This version of the form is not currently in use and is provided for reference only. Download this version of

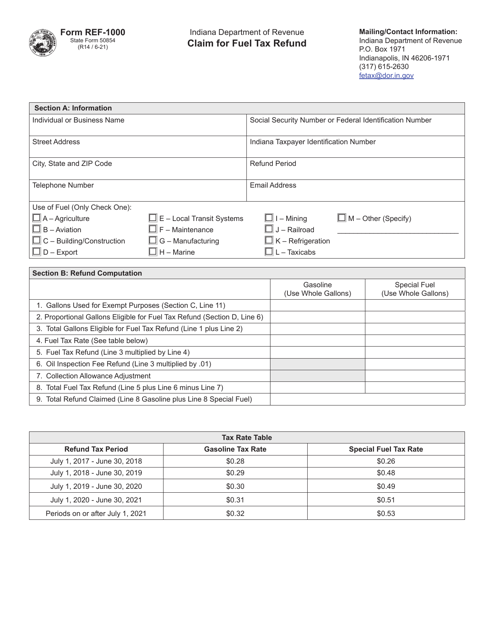

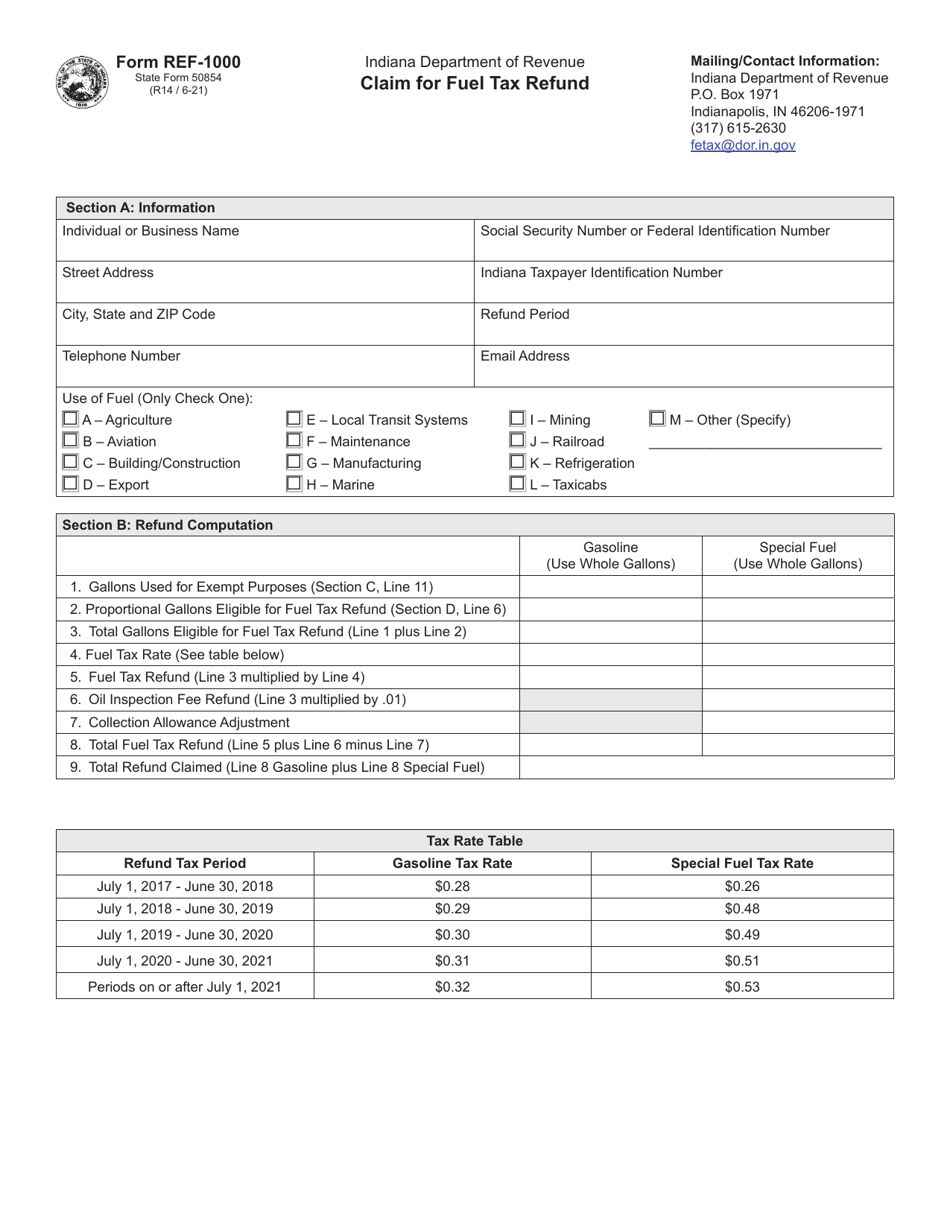

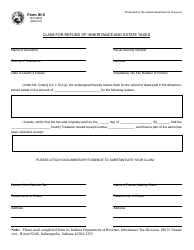

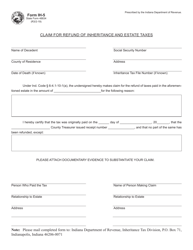

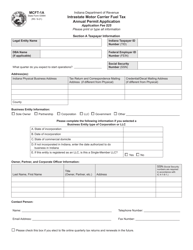

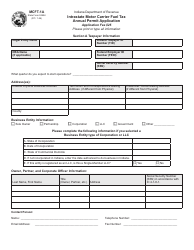

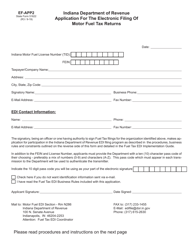

Form REF-1000 (State Form 50854)

for the current year.

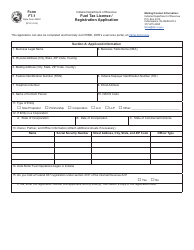

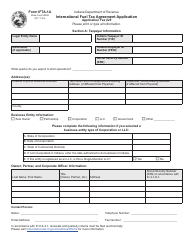

Form REF-1000 (State Form 50854) Claim for Fuel Tax Refund - Indiana

What Is Form REF-1000 (State Form 50854)?

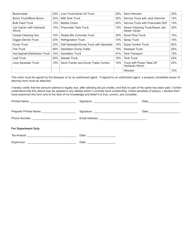

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

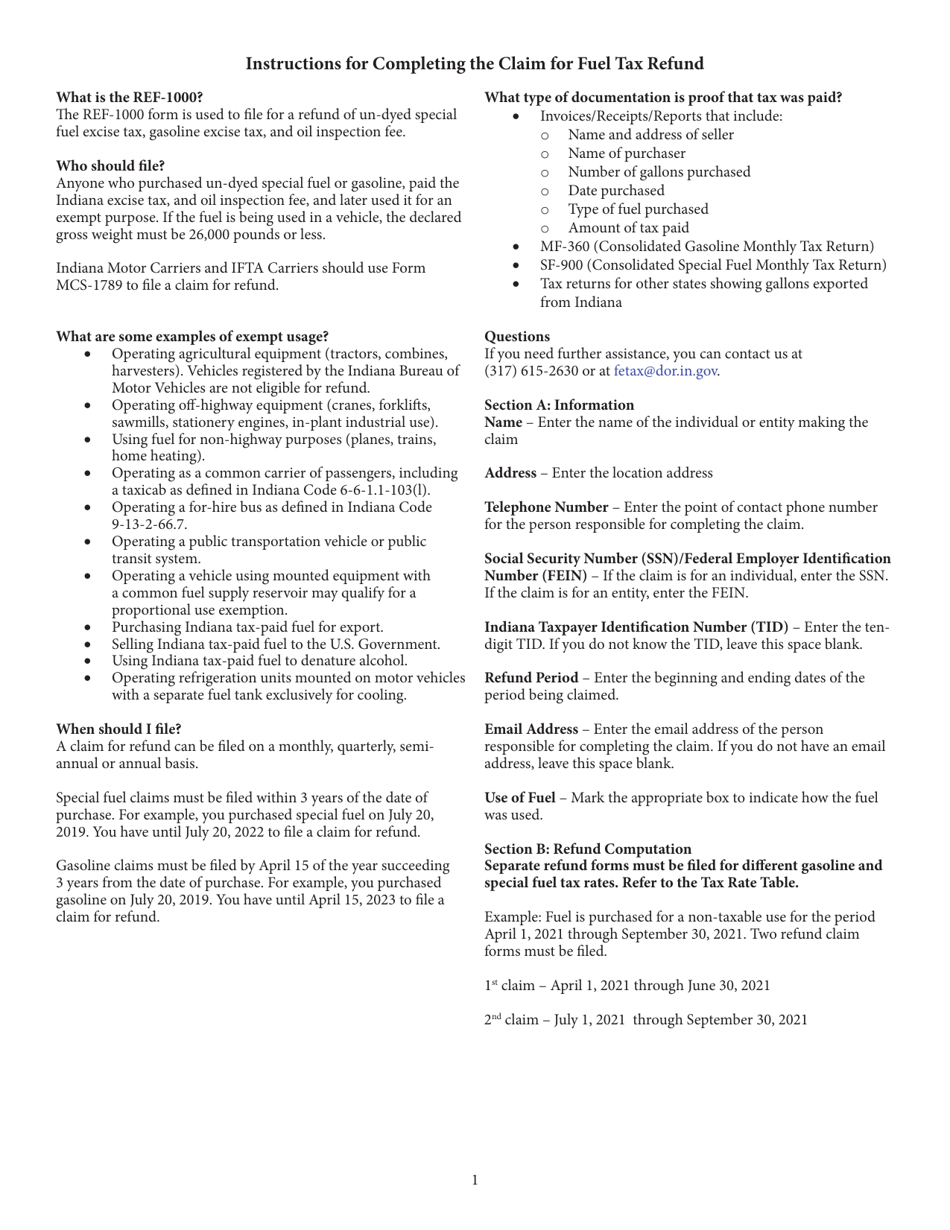

Q: What is Form REF-1000?

A: Form REF-1000 is a claim for fuel tax refund in Indiana.

Q: What is the purpose of Form REF-1000?

A: The purpose of Form REF-1000 is to claim a refund for fuel tax paid in Indiana.

Q: Who can use Form REF-1000?

A: Anyone who has paid fuel tax in Indiana can use Form REF-1000 to claim a refund.

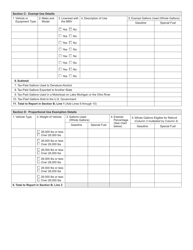

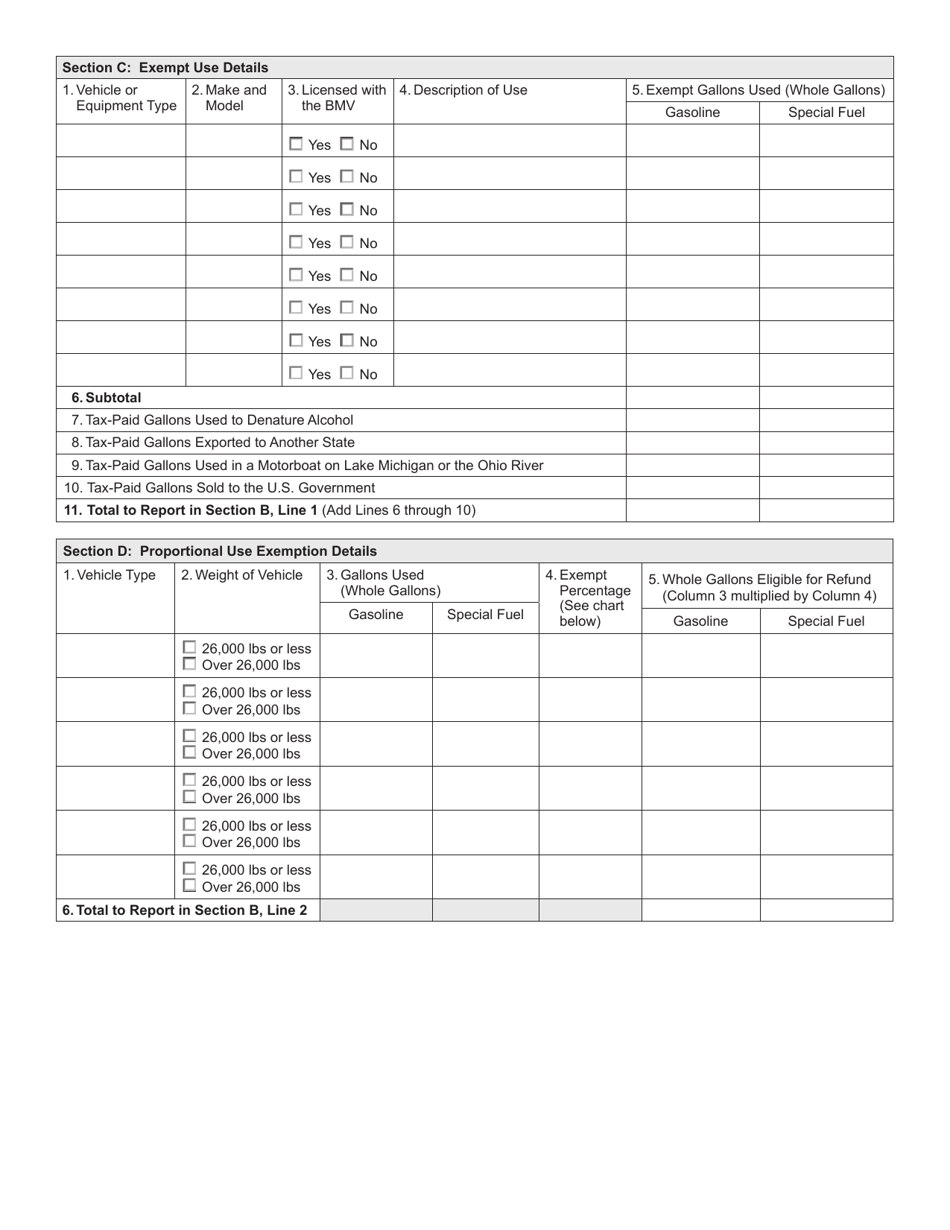

Q: What information do I need to fill out Form REF-1000?

A: You will need to provide details about the fuel purchases, including dates, quantities, and amounts paid.

Q: Is there a deadline to submit Form REF-1000?

A: Yes, the deadline to submit Form REF-1000 is typically within three years from the date of the fuel purchase.

Q: How long does it take to receive a refund after filing Form REF-1000?

A: It usually takes about 8 to 12 weeks to process and receive a refund after filing Form REF-1000.

Q: What should I do if I have questions about Form REF-1000?

A: If you have questions about Form REF-1000, you can contact the Indiana Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REF-1000 (State Form 50854) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.