This version of the form is not currently in use and is provided for reference only. Download this version of

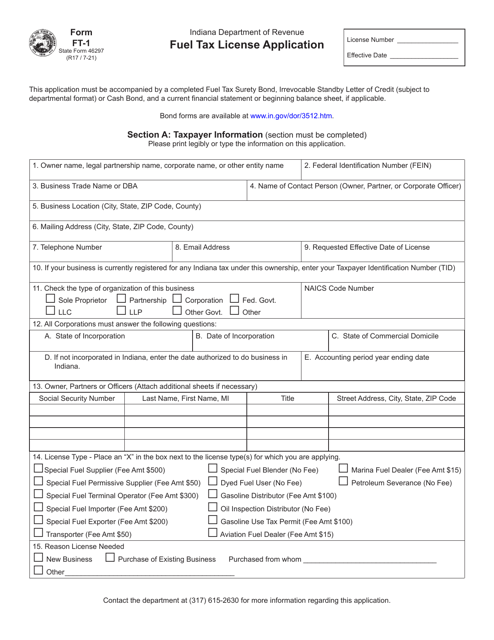

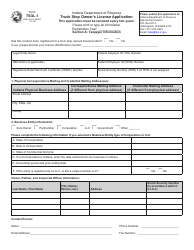

Form FT-1 (State Form 46297)

for the current year.

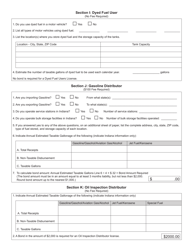

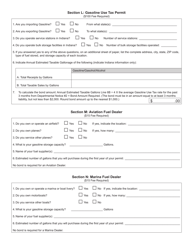

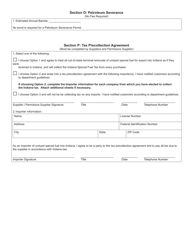

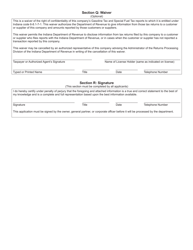

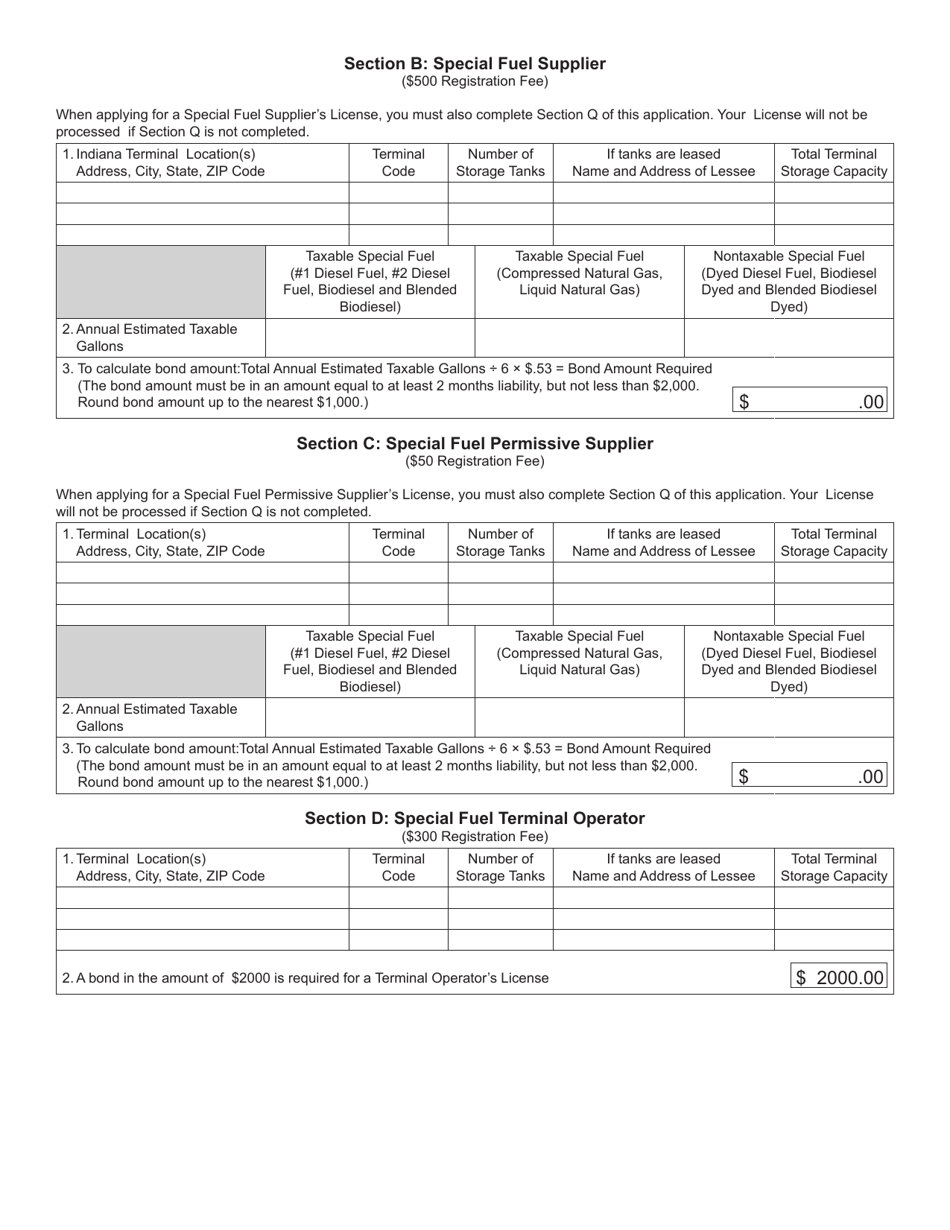

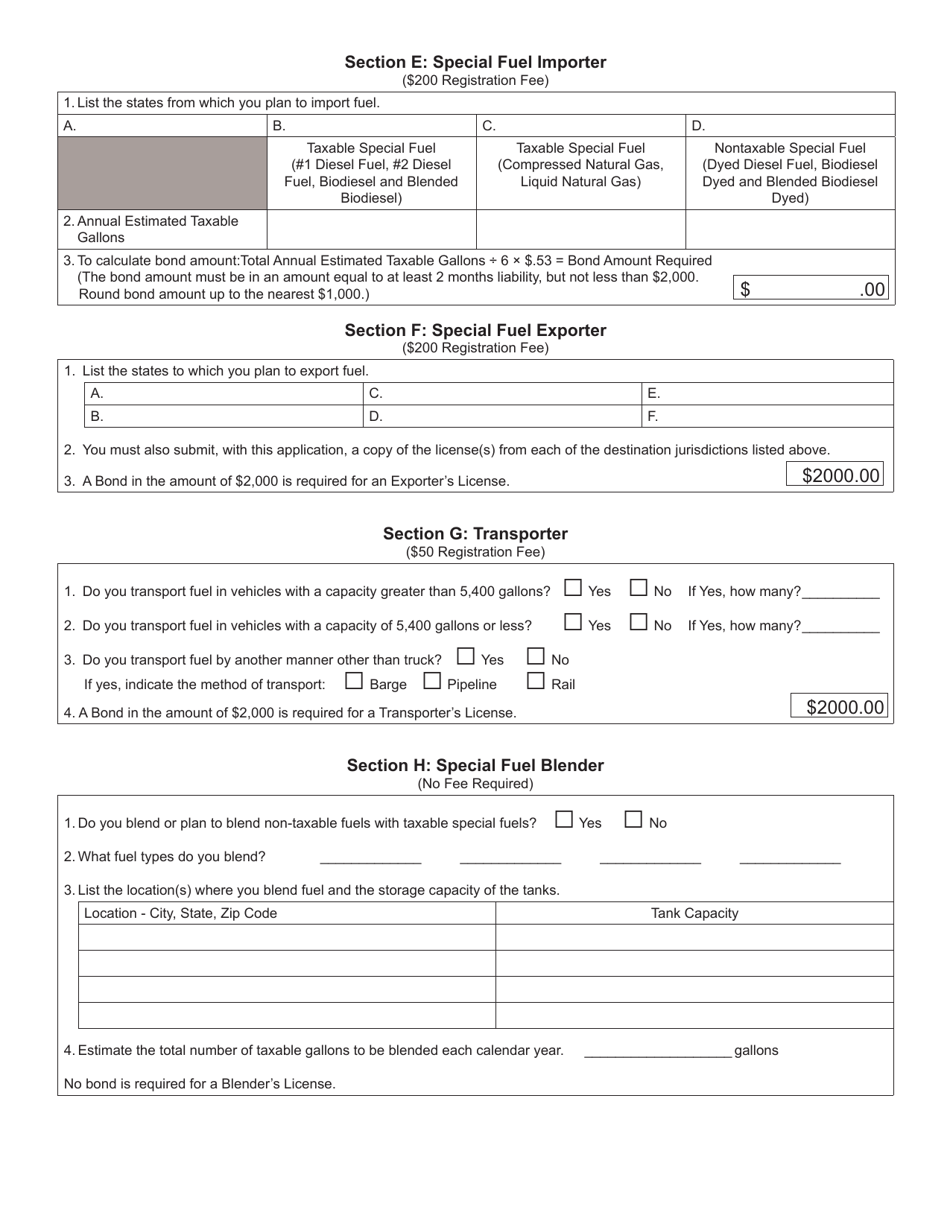

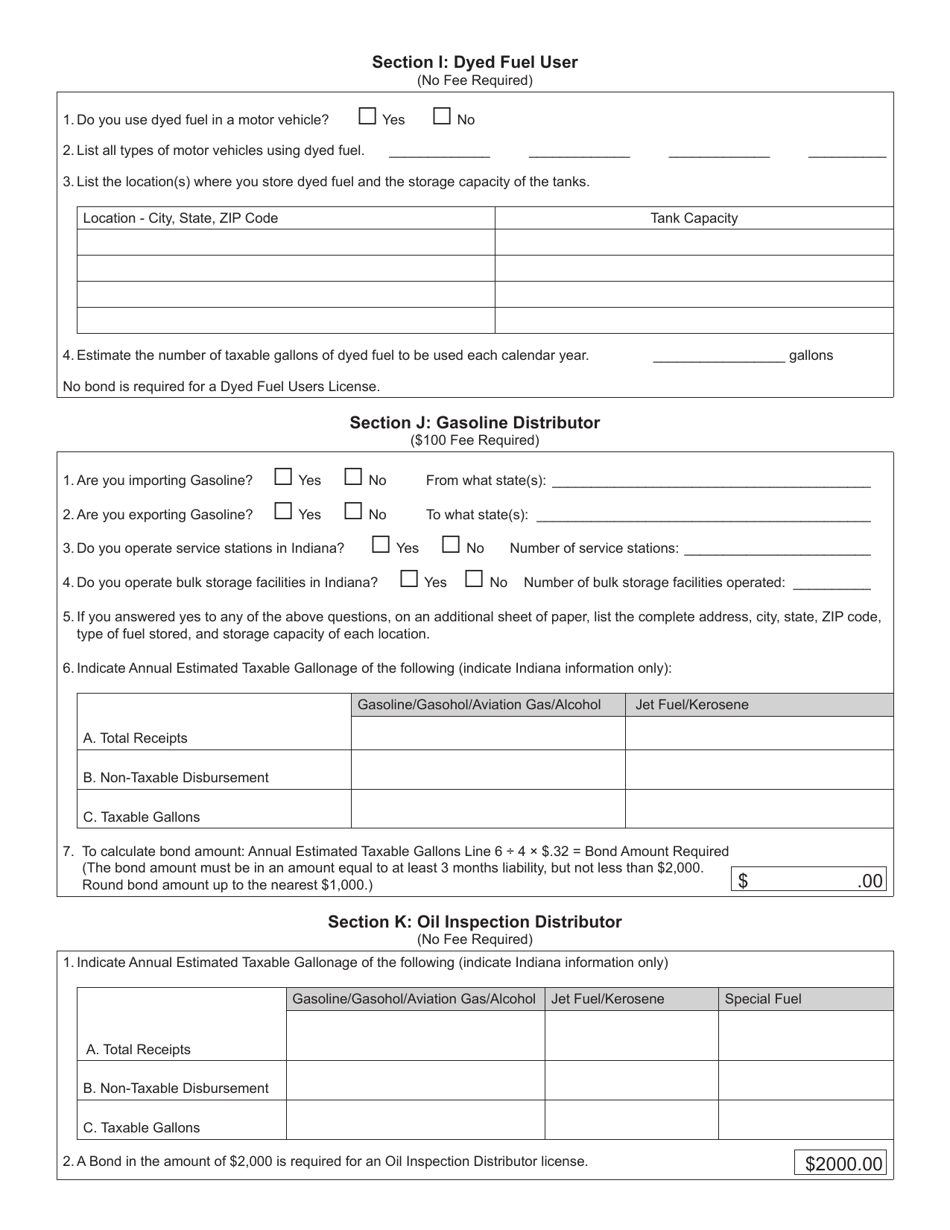

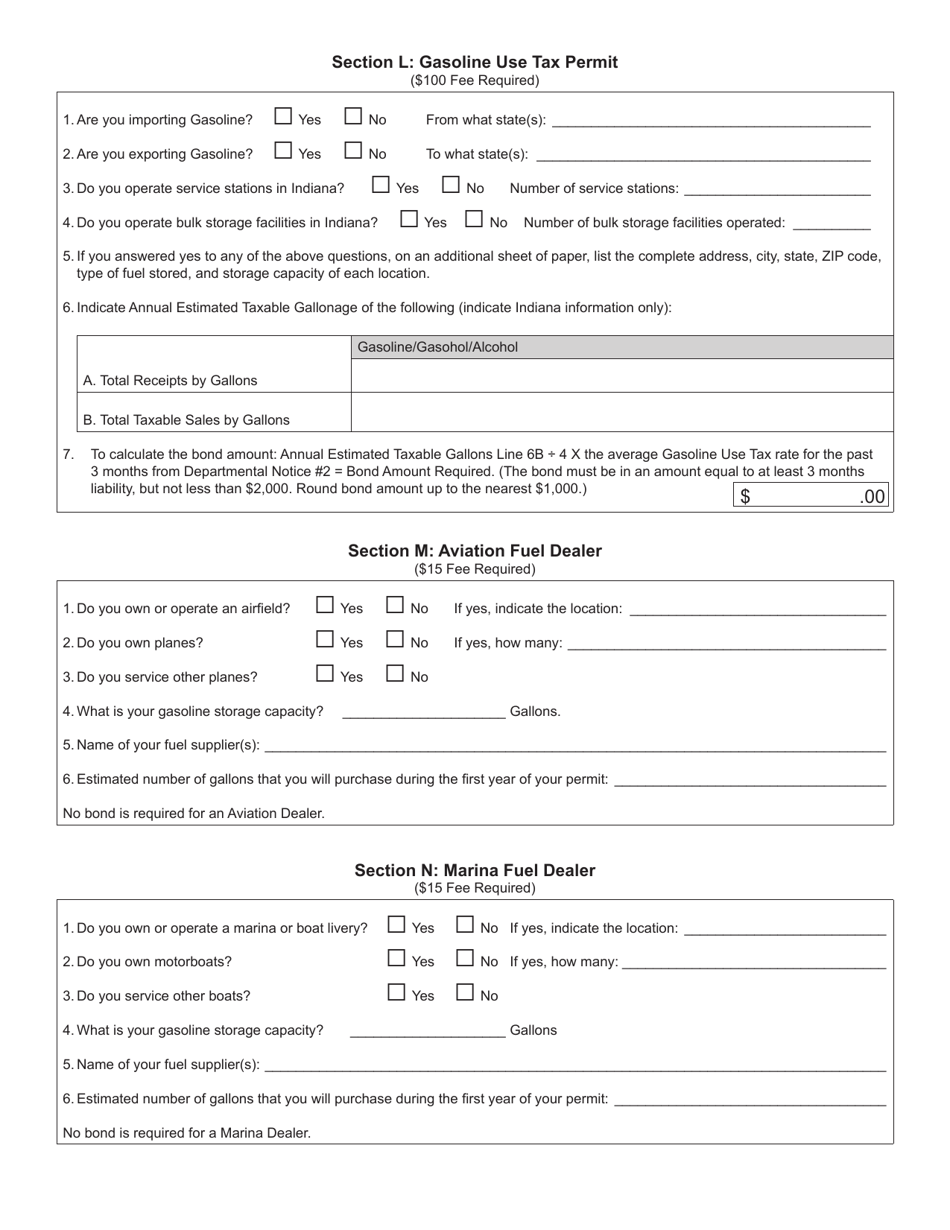

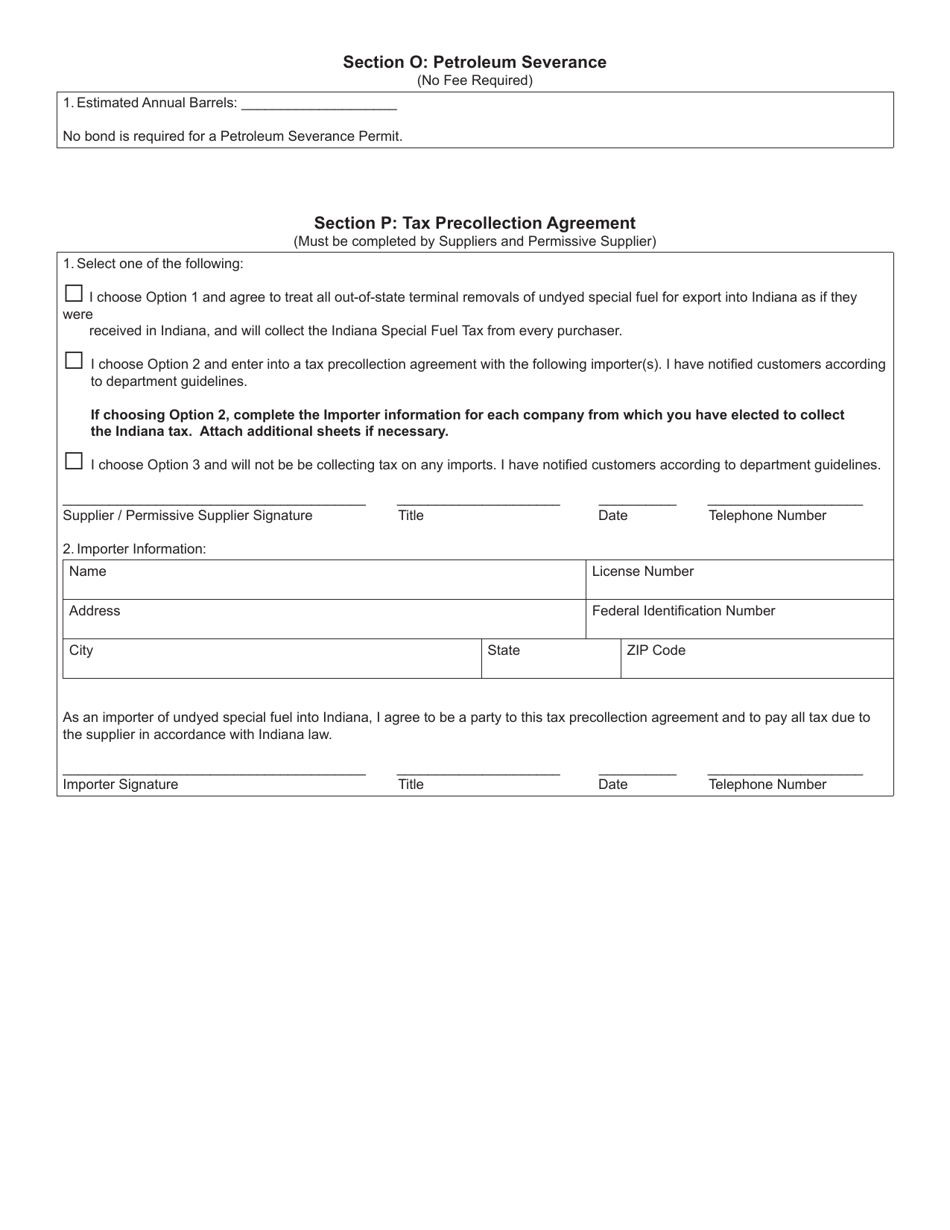

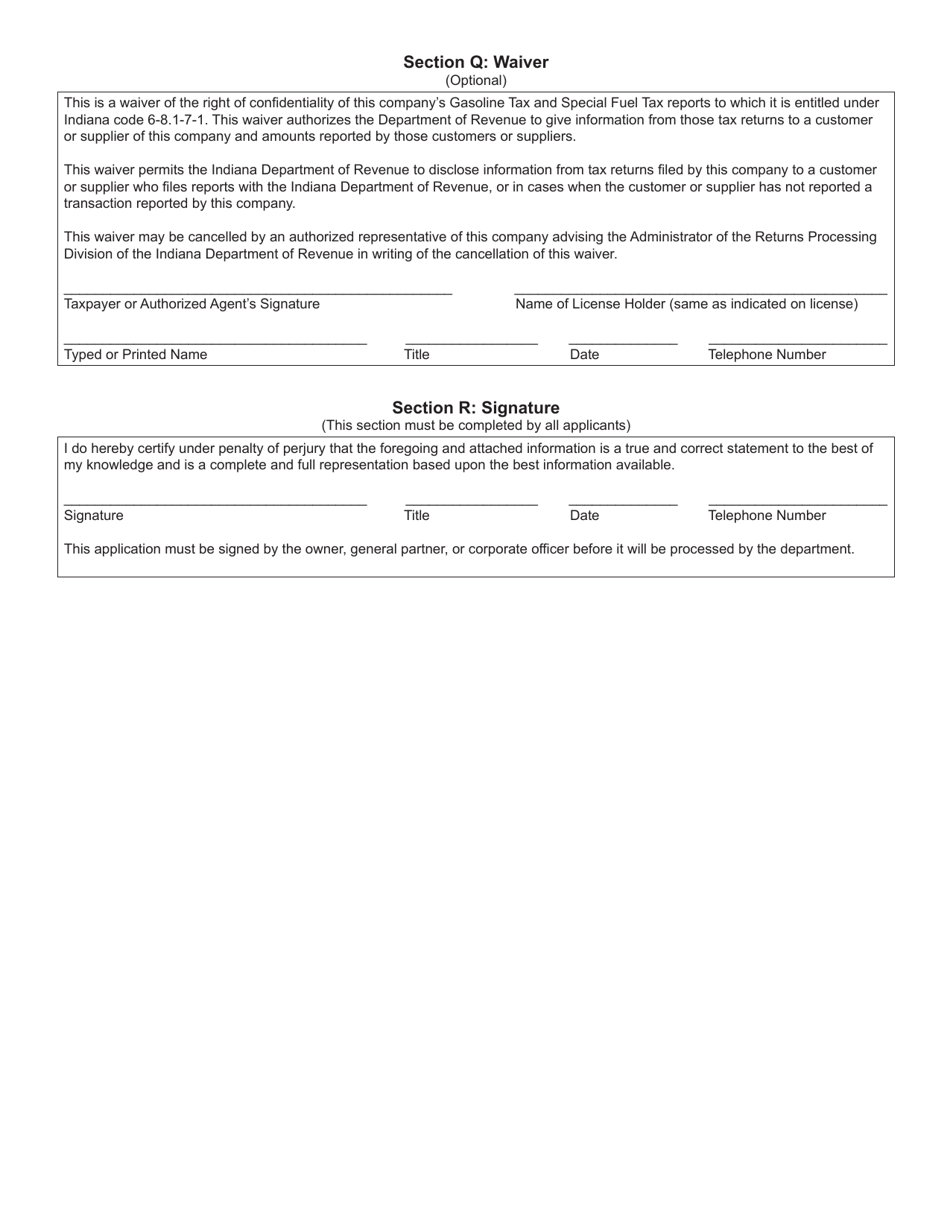

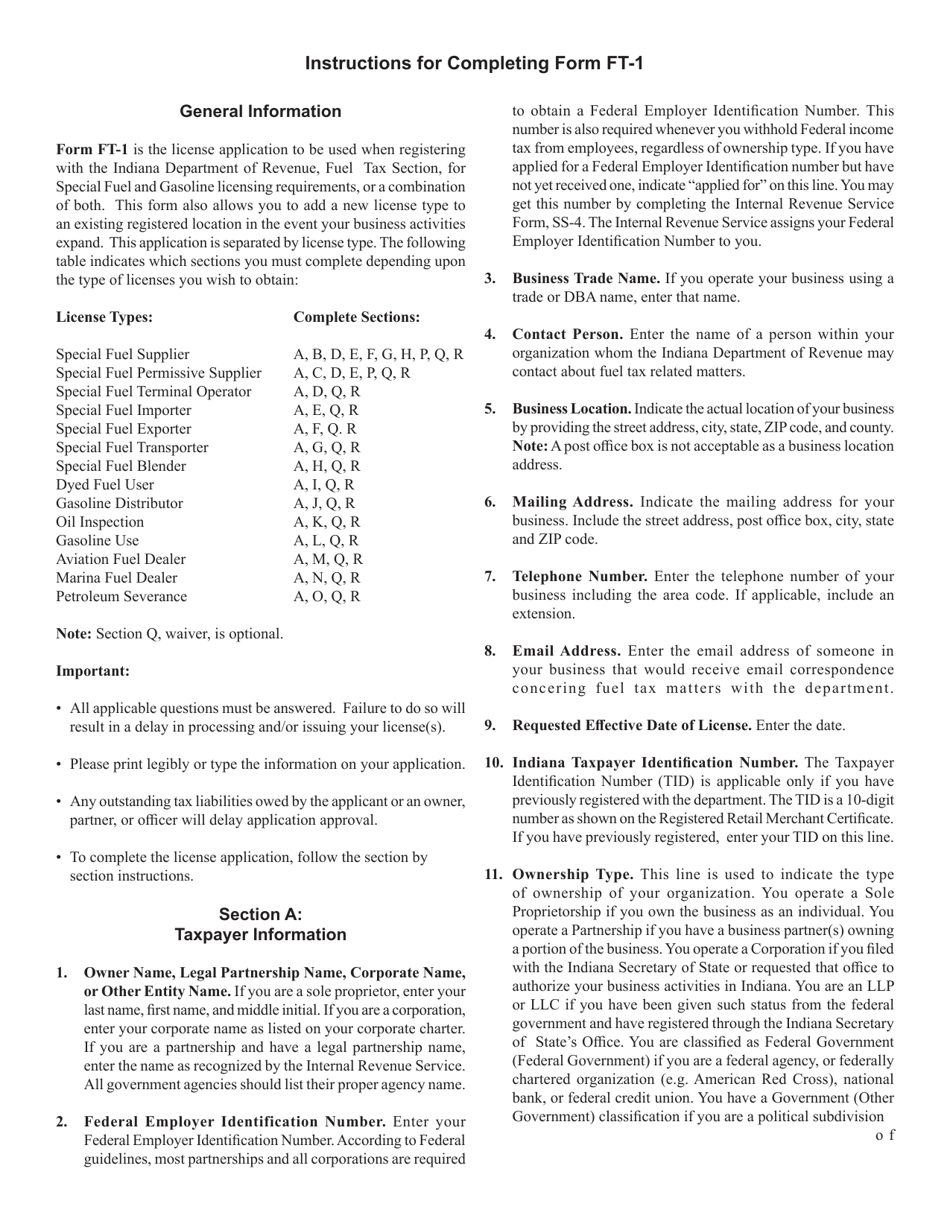

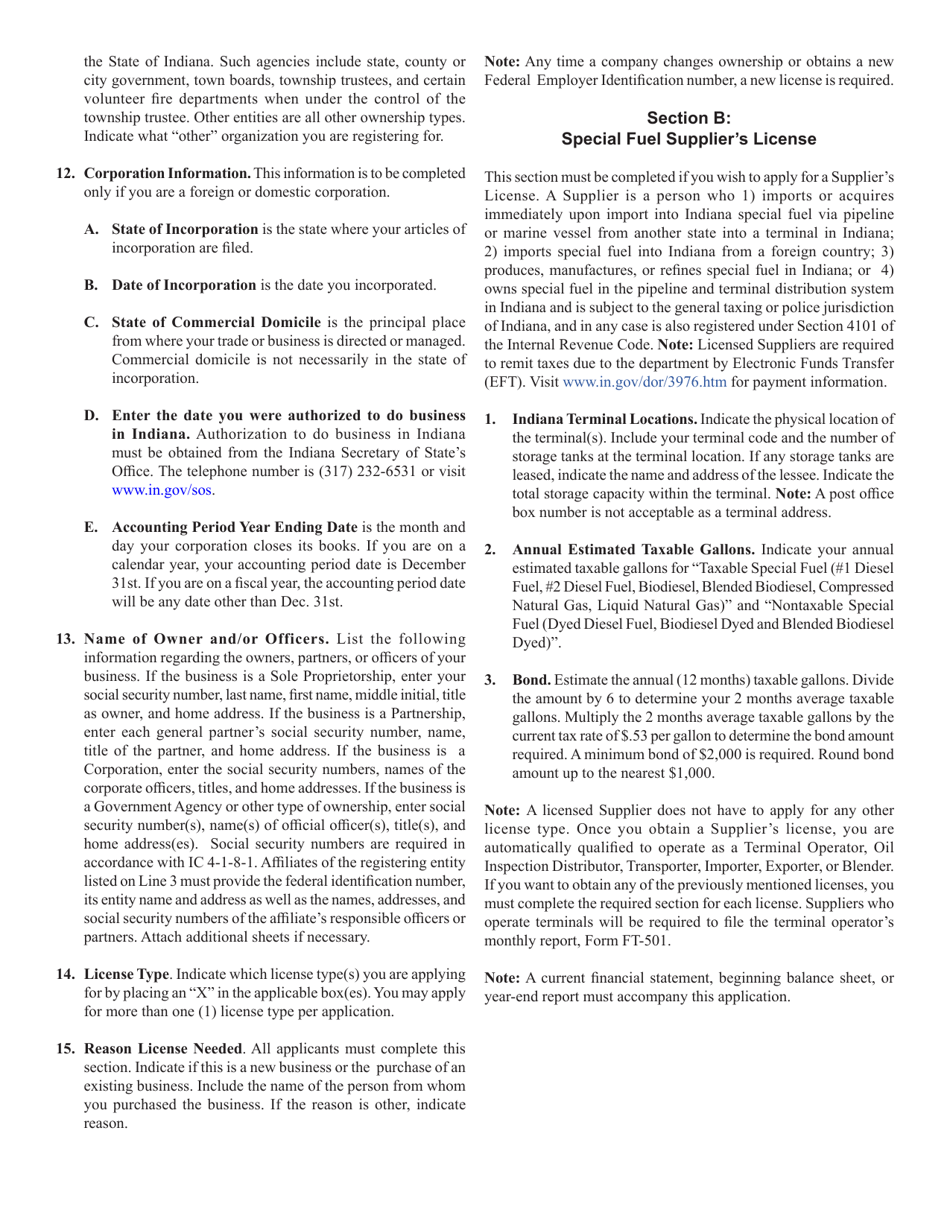

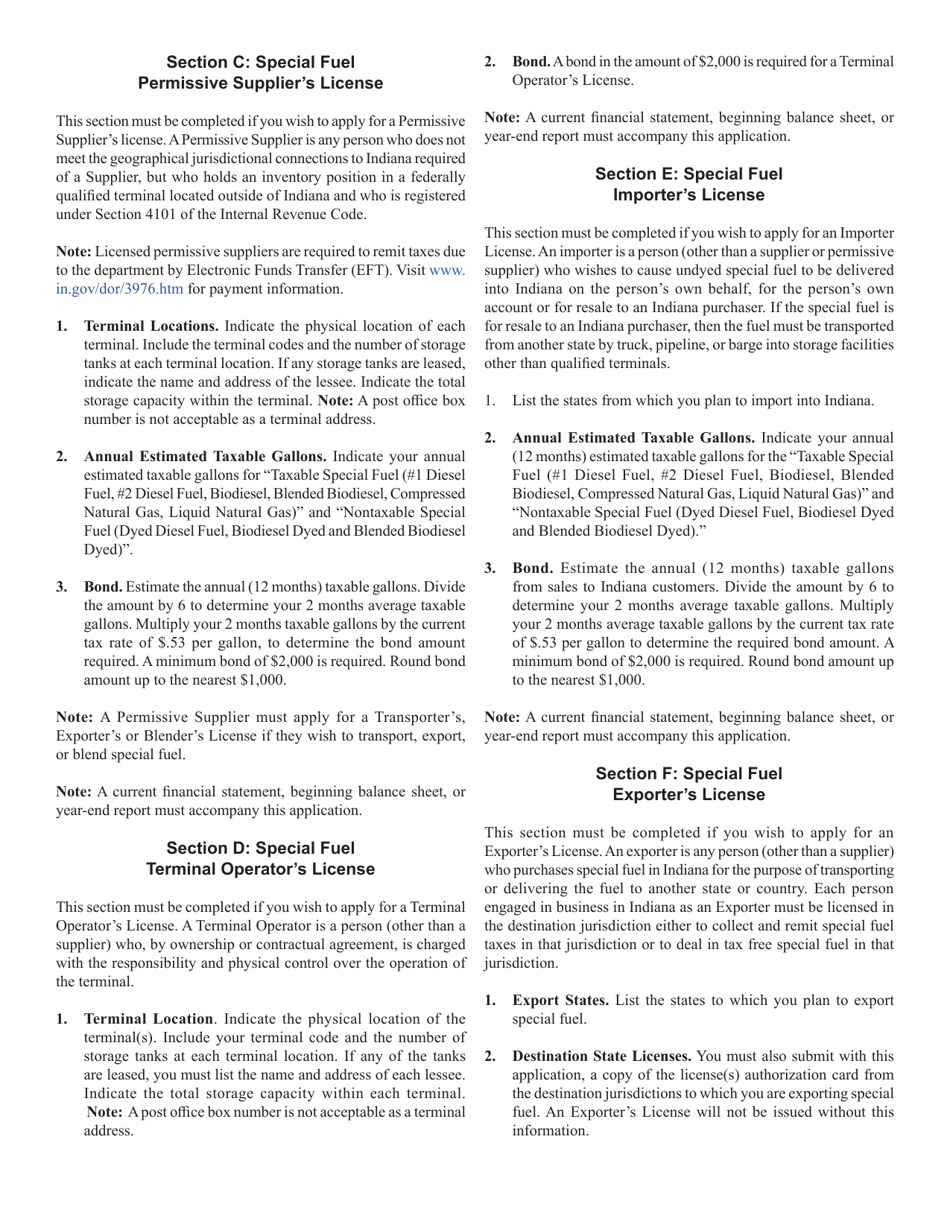

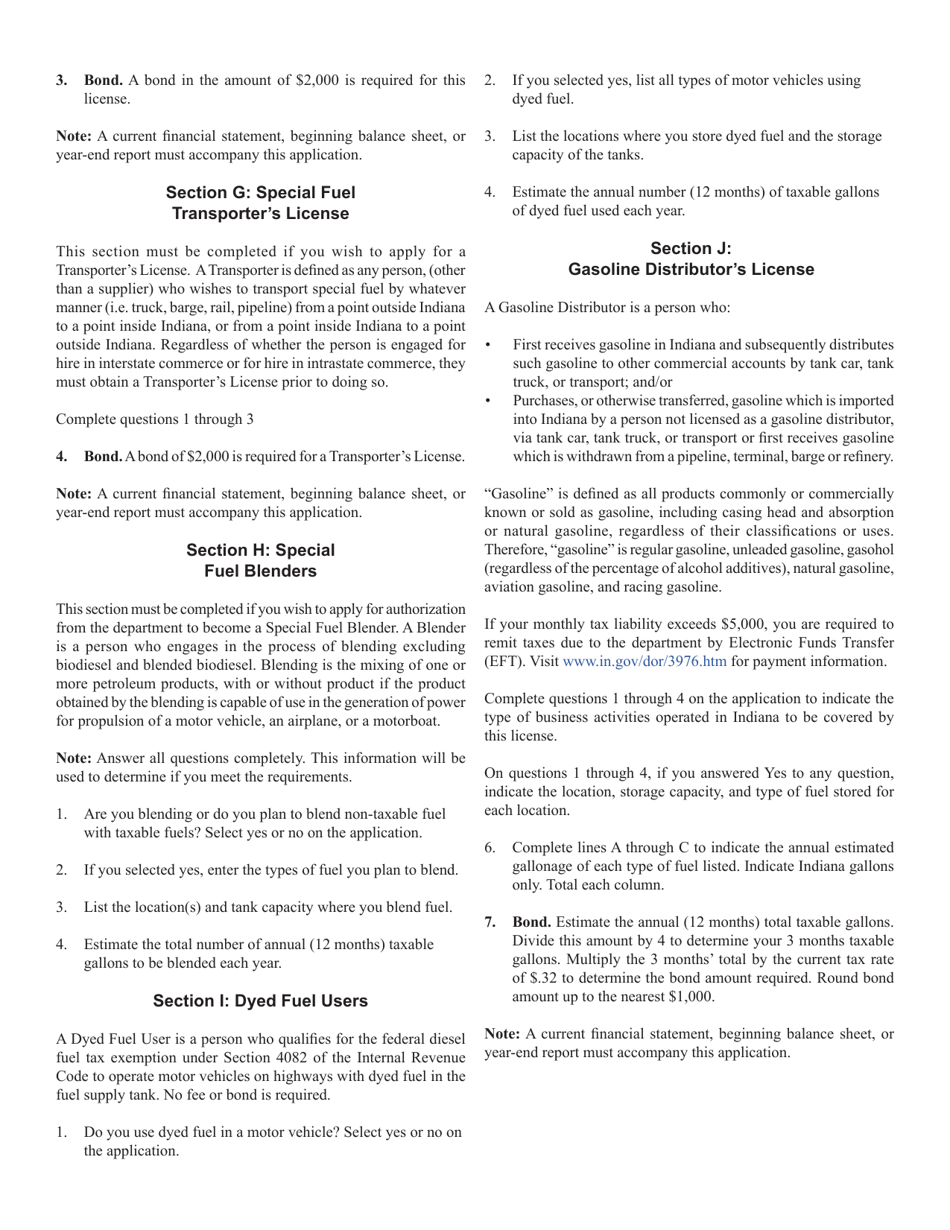

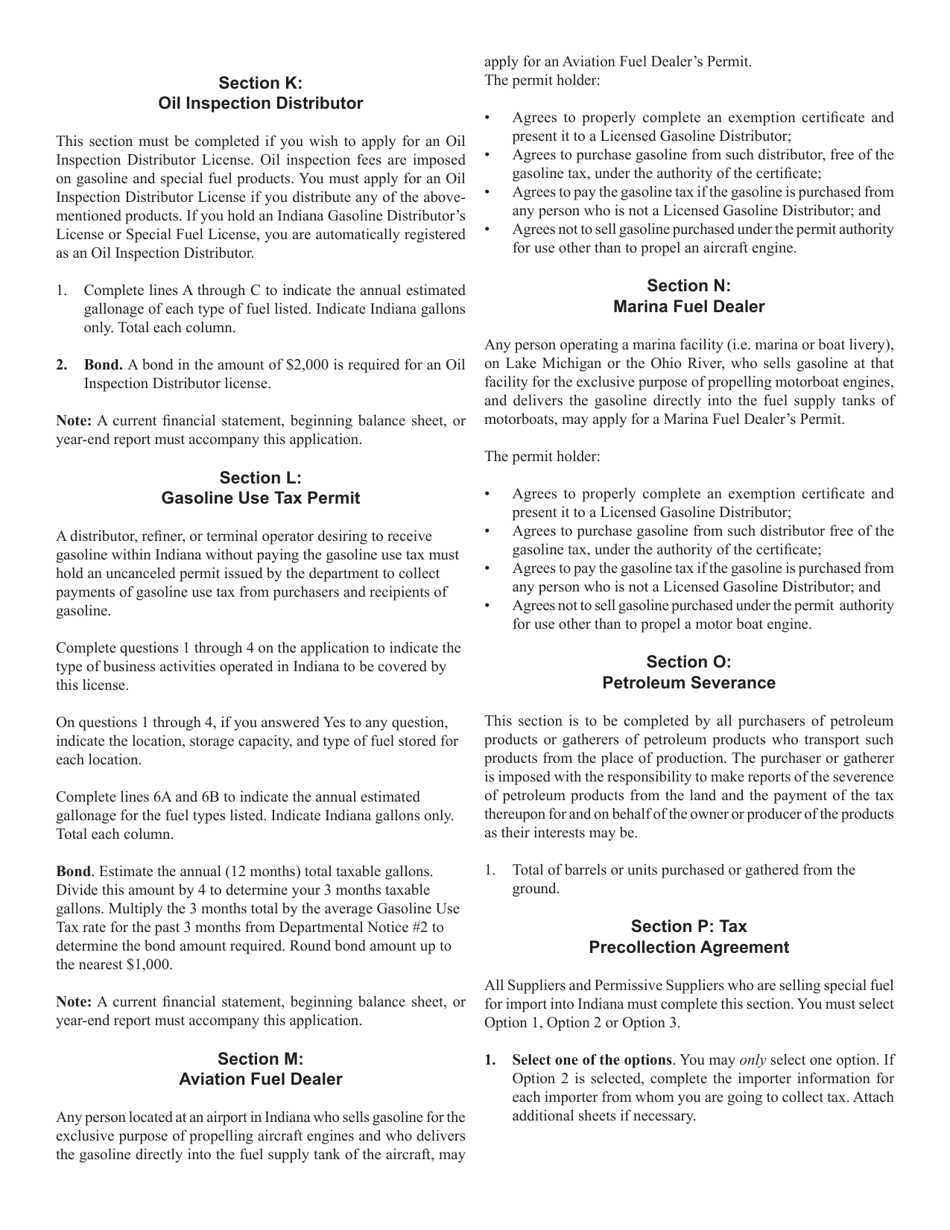

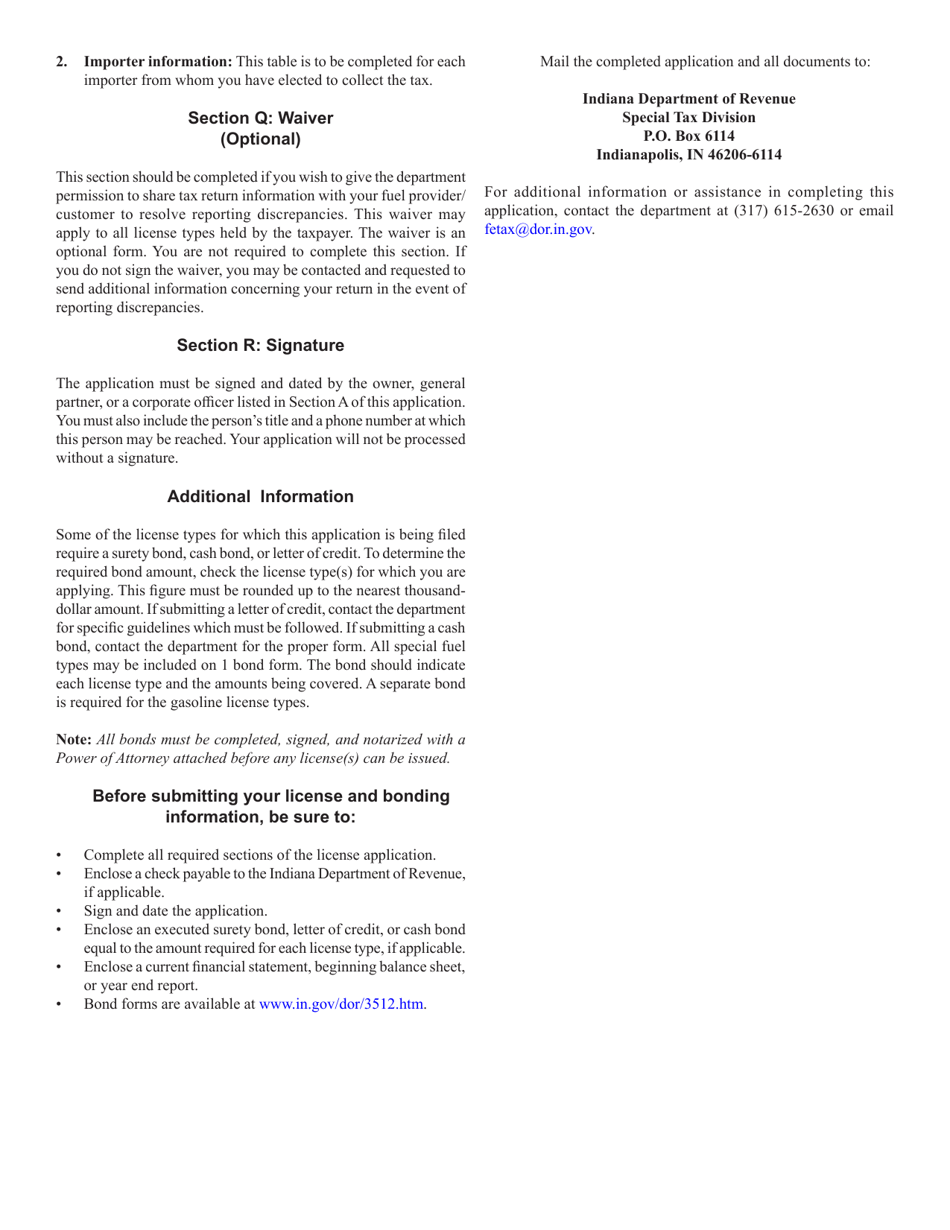

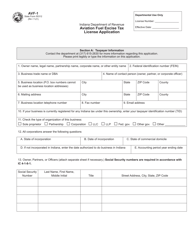

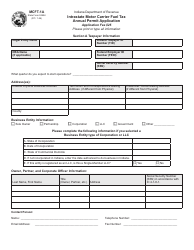

Form FT-1 (State Form 46297) Fuel Tax License Application - Indiana

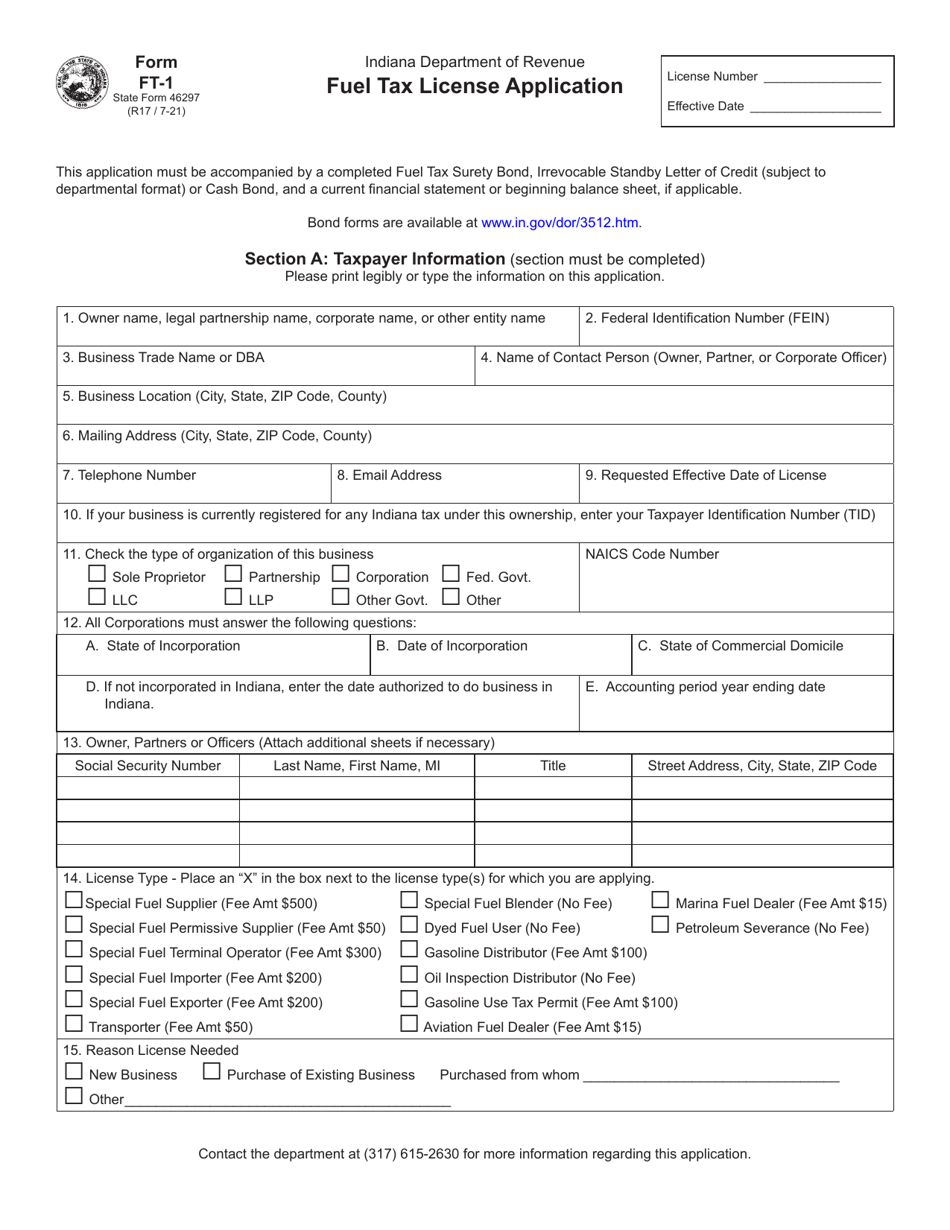

What Is Form FT-1 (State Form 46297)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-1?

A: Form FT-1 is the Fuel Tax License Application for Indiana.

Q: What is State Form 46297?

A: State Form 46297 is the specific form number for Form FT-1.

Q: What is the purpose of Form FT-1?

A: The purpose of Form FT-1 is to apply for a fuel tax license in Indiana.

Q: Who needs to fill out Form FT-1?

A: Anyone who wants to obtain a fuel tax license in Indiana needs to fill out Form FT-1.

Q: Is there a fee to submit Form FT-1?

A: Yes, there is a fee associated with submitting Form FT-1. The fee amount can be found on the form or by contacting the Indiana Department of Revenue.

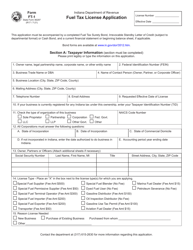

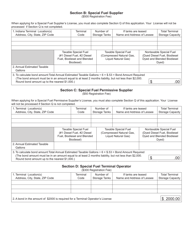

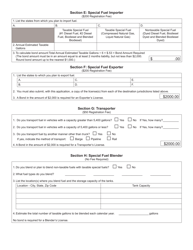

Q: What information is required on Form FT-1?

A: Form FT-1 requires information such as business details, fuel types handled, and estimated monthly gallons of fuel use.

Q: When should Form FT-1 be submitted?

A: Form FT-1 should be submitted at least 21 days before engaging in the fuel business or operating a motor vehicle using fuel in Indiana.

Q: Are there any additional requirements for obtaining a fuel tax license?

A: Yes, additional requirements may include posting a bond or providing proof of financial responsibility.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-1 (State Form 46297) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.