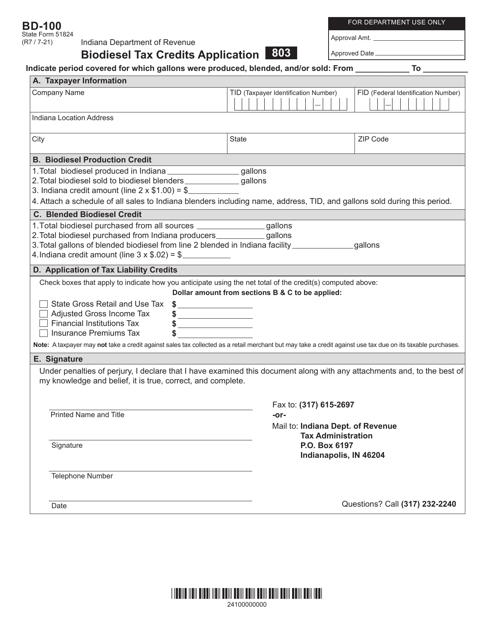

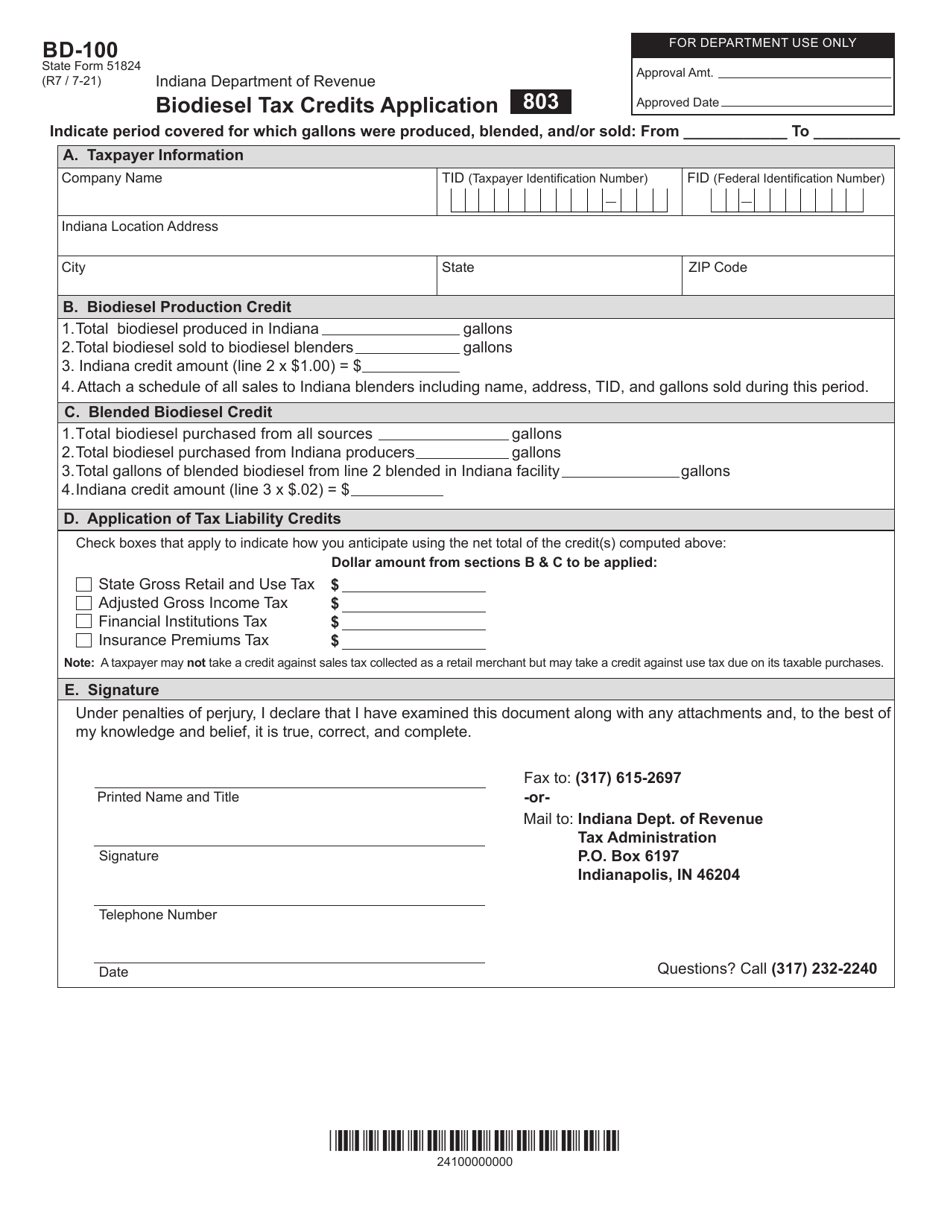

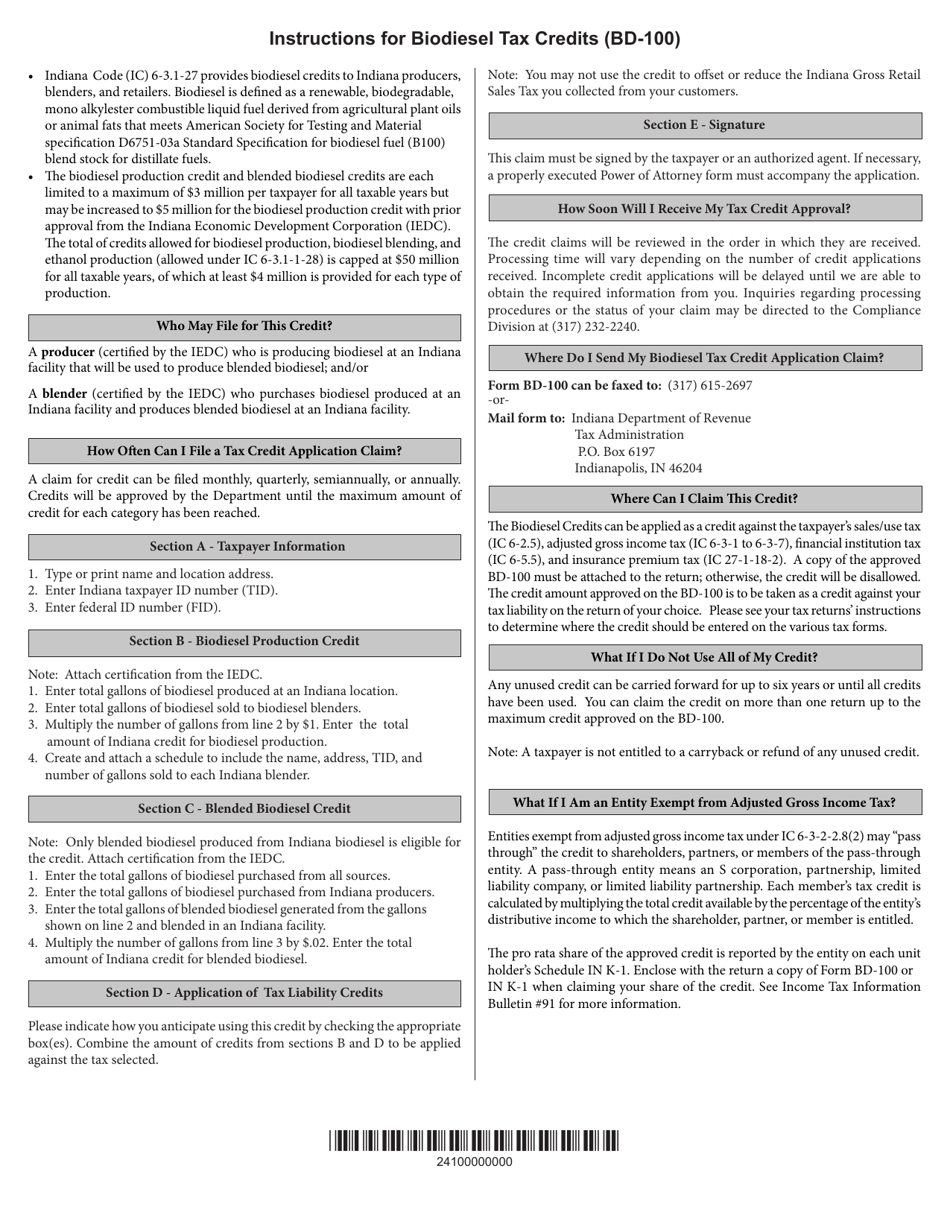

Form BD-100 (State Form 51824) Biodiesel Tax Credits Application - Indiana

What Is Form BD-100 (State Form 51824)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BD-100?

A: Form BD-100 is the Biodiesel Tax Credits Application for the state of Indiana.

Q: What is the purpose of Form BD-100?

A: The purpose of Form BD-100 is to apply for tax credits related to the production and use of biodiesel in Indiana.

Q: Who is eligible to use Form BD-100?

A: Any individual or business engaged in the production or use of biodiesel in Indiana may be eligible to use Form BD-100.

Q: What information is required on Form BD-100?

A: Form BD-100 requires information such as the taxpayer's name, business information, biodiesel production or use details, and supporting documentation.

Q: Are there any deadlines for submitting Form BD-100?

A: Yes, the deadlines for submitting Form BD-100 vary depending on the tax year and are specified by the Indiana Department of Revenue.

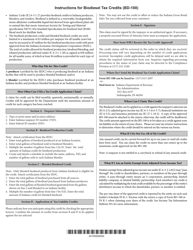

Q: Are there any specific instructions for filling out Form BD-100?

A: Yes, the Indiana Department of Revenue provides instructions on how to complete Form BD-100, which should be followed carefully to ensure accurate and timely submission.

Q: Are there any fees associated with submitting Form BD-100?

A: There are no fees associated with submitting Form BD-100.

Q: What happens after submitting Form BD-100?

A: After submitting Form BD-100, the Indiana Department of Revenue will review the application and determine eligibility for biodiesel tax credits.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BD-100 (State Form 51824) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.