This version of the form is not currently in use and is provided for reference only. Download this version of

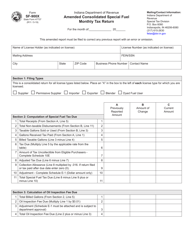

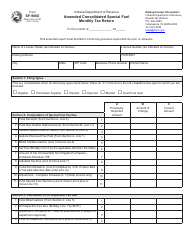

Form MF-360 (State Form 49276)

for the current year.

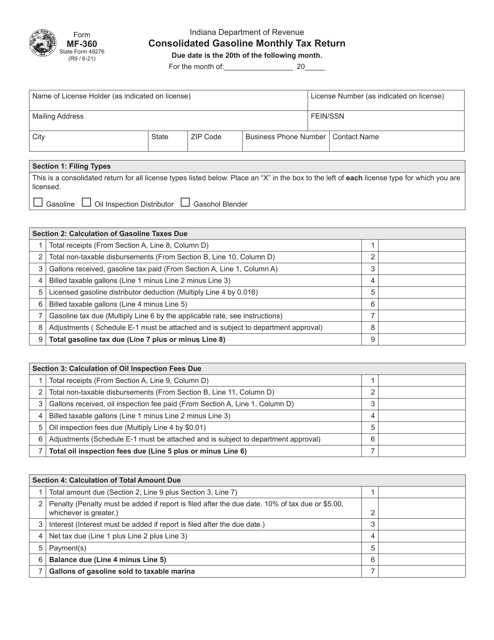

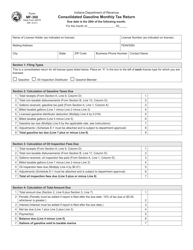

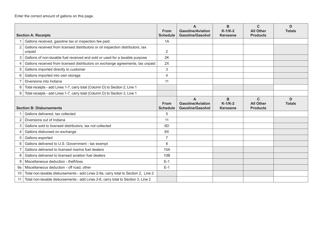

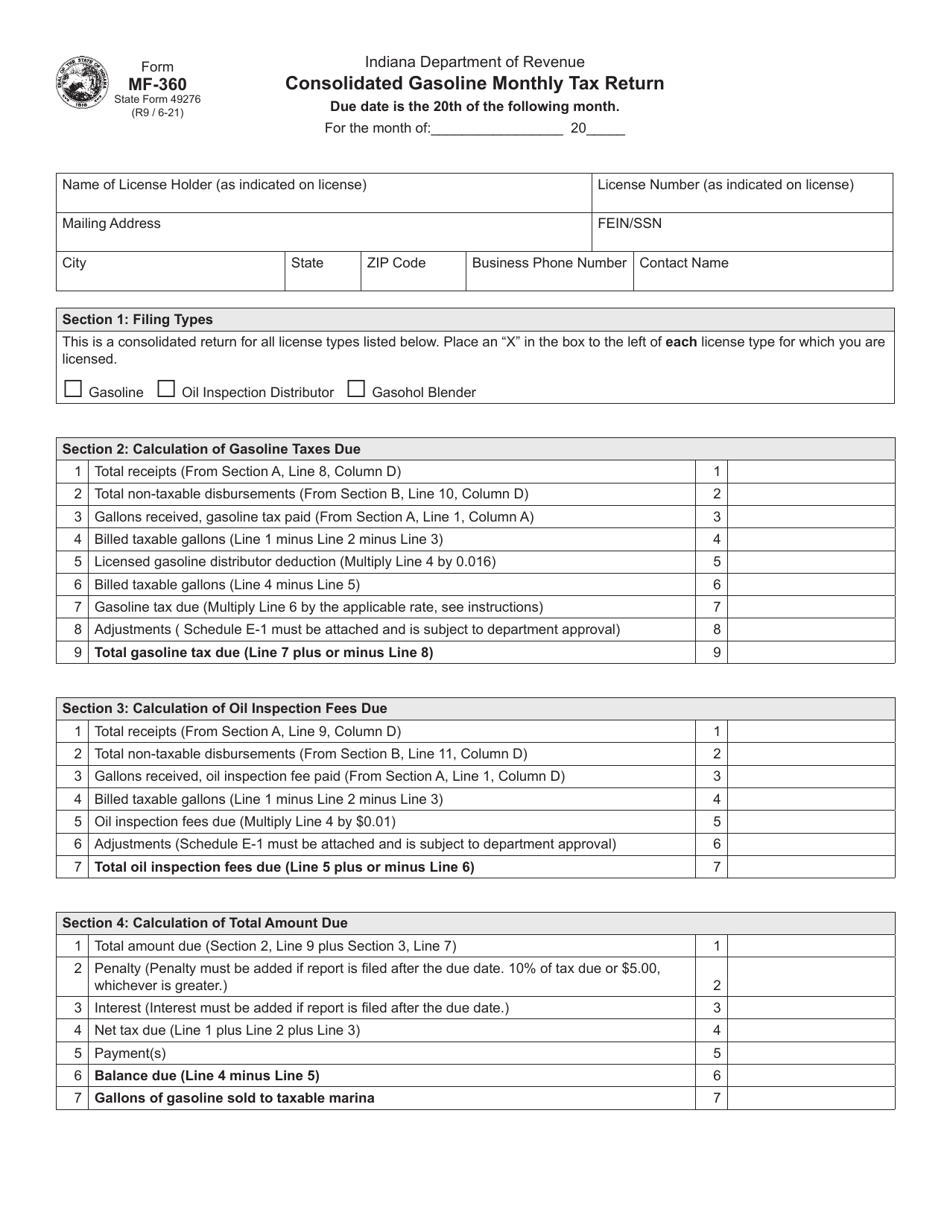

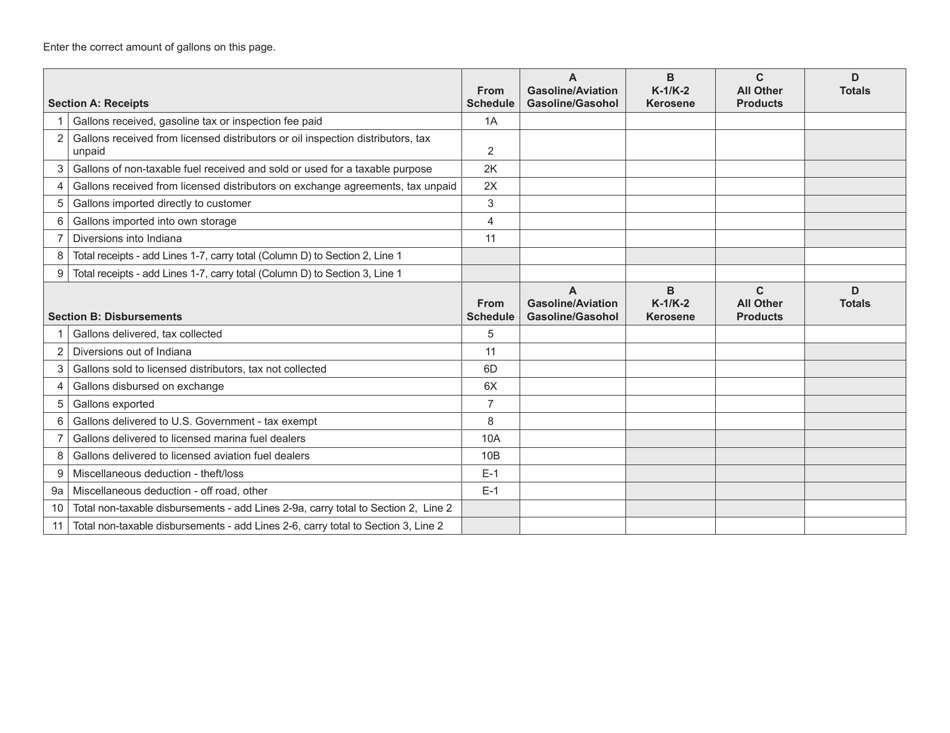

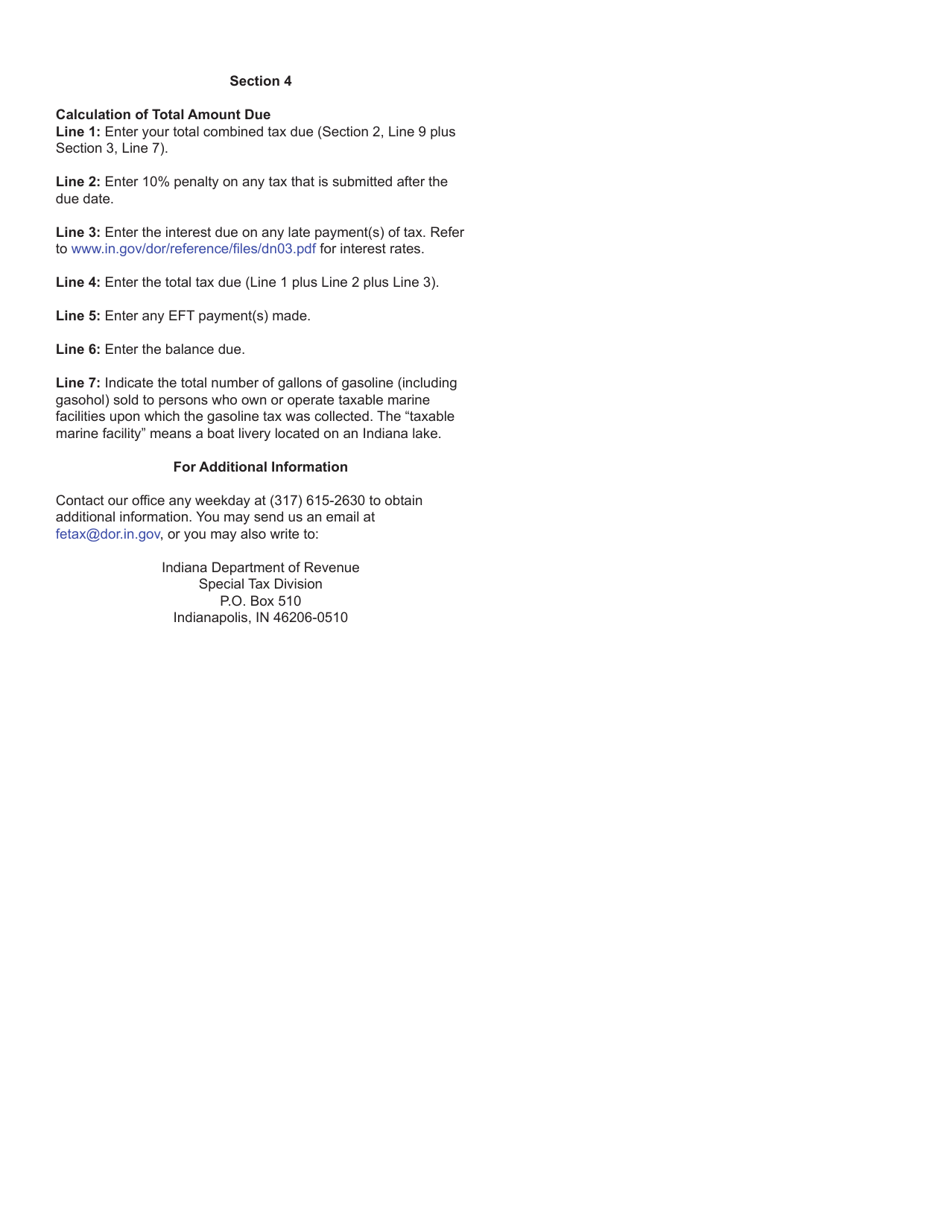

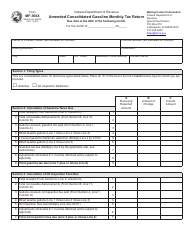

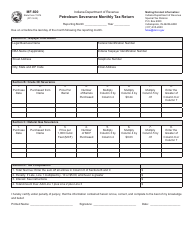

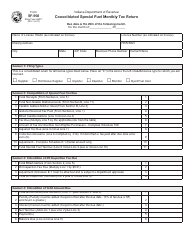

Form MF-360 (State Form 49276) Consolidated Gasoline Monthly Tax Return - Indiana

What Is Form MF-360 (State Form 49276)?

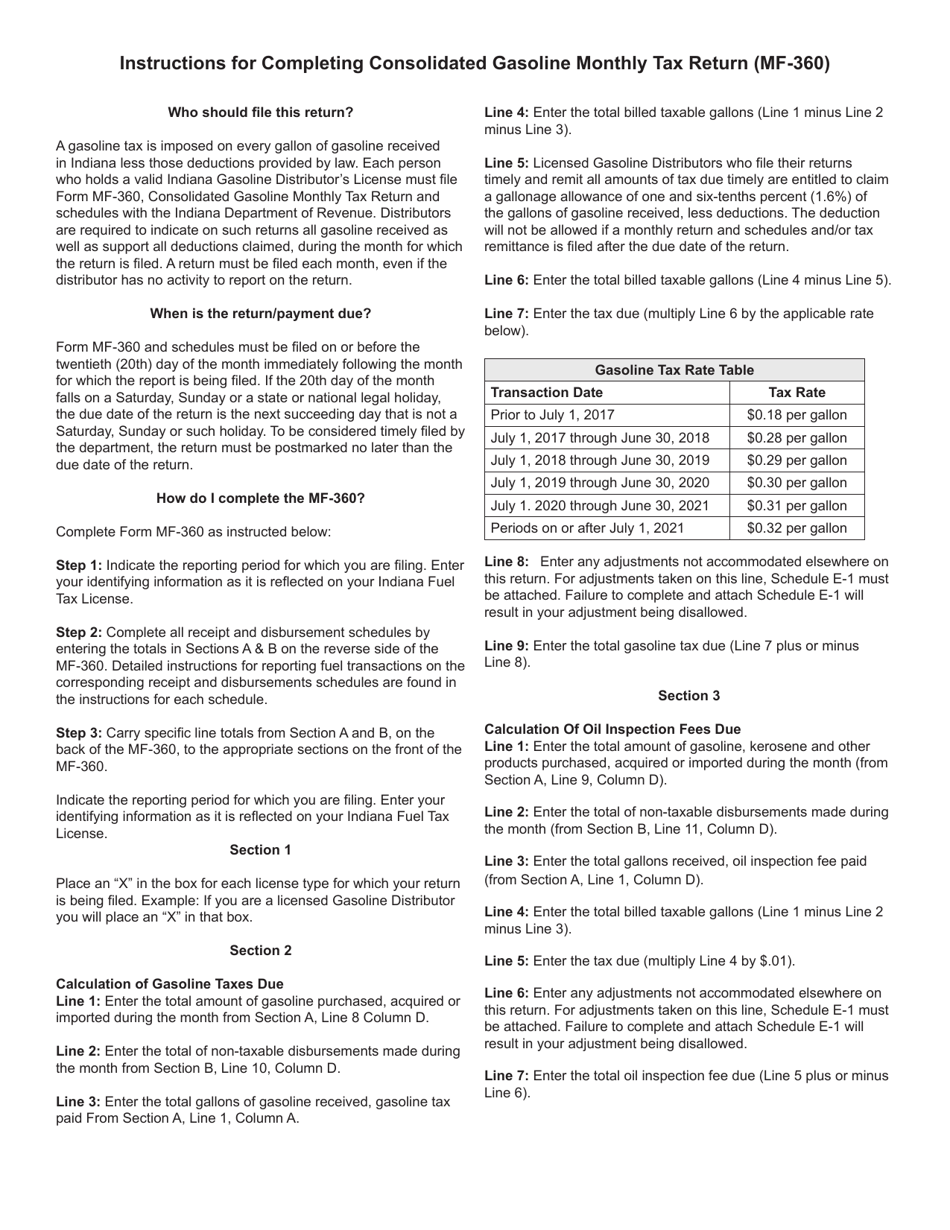

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MF-360?

A: Form MF-360 is the Consolidated Gasoline Monthly Tax Return for Indiana.

Q: What is State Form 49276?

A: State Form 49276 is the specific form number assigned to Form MF-360.

Q: Who needs to file Form MF-360?

A: Businesses or individuals who sell gasoline in Indiana need to file Form MF-360.

Q: What is the purpose of Form MF-360?

A: Form MF-360 is used to report and pay the gasoline tax owed to the state of Indiana.

Q: How often should Form MF-360 be filed?

A: Form MF-360 should be filed monthly.

Q: Are there any penalties for late or incorrect filing of Form MF-360?

A: Yes, there can be penalties for late or incorrect filing of Form MF-360. It's important to file on time and provide accurate information.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MF-360 (State Form 49276) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.