This version of the form is not currently in use and is provided for reference only. Download this version of

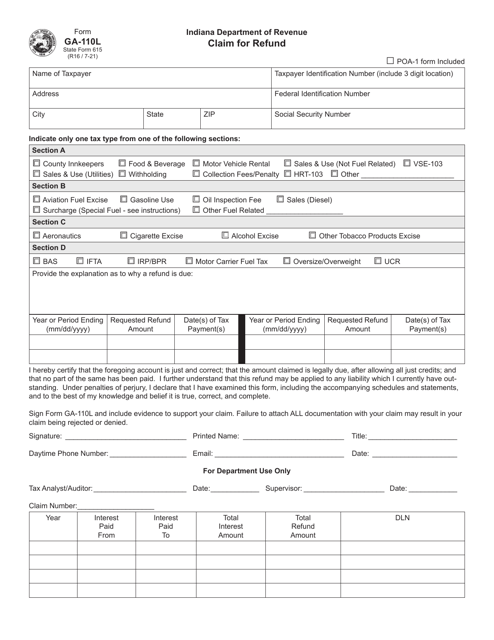

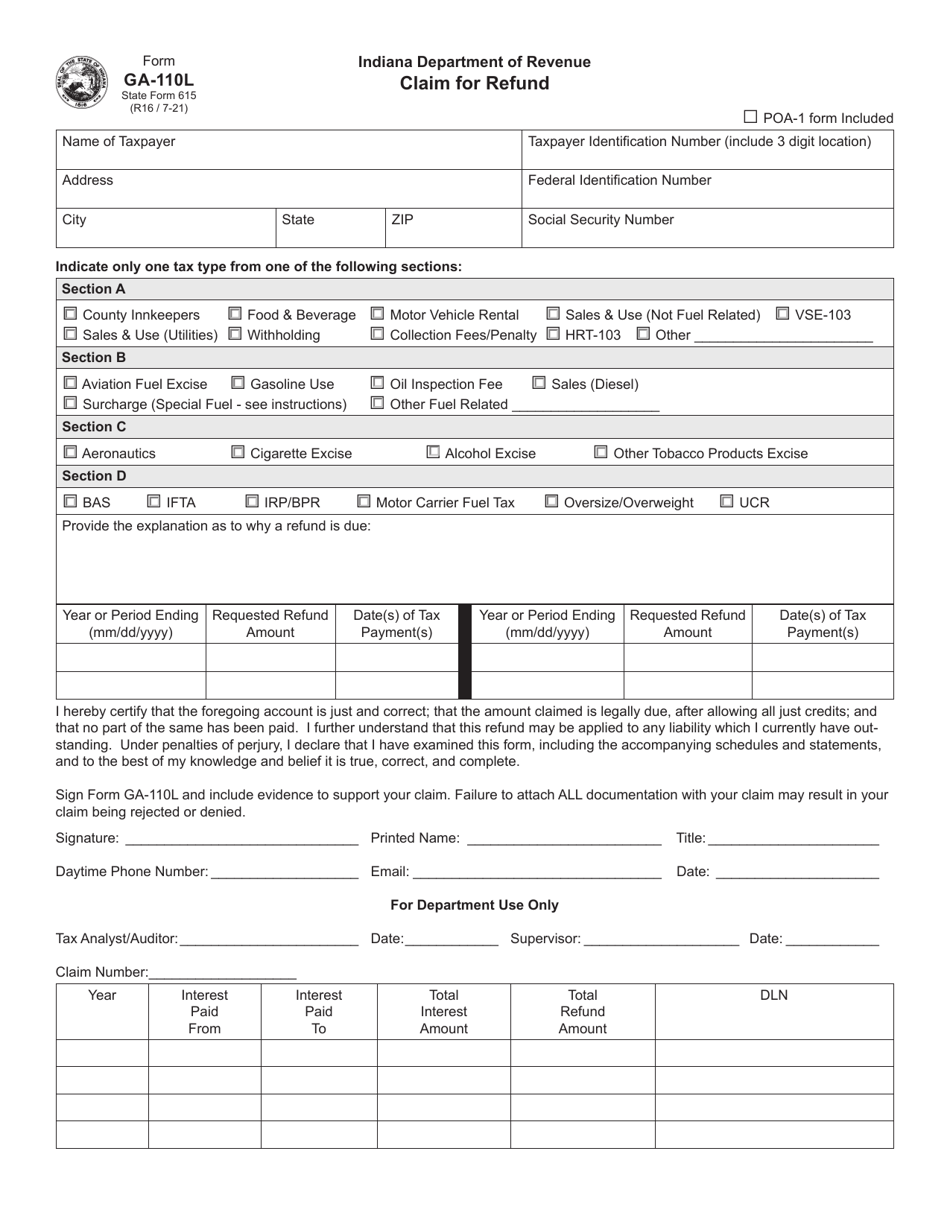

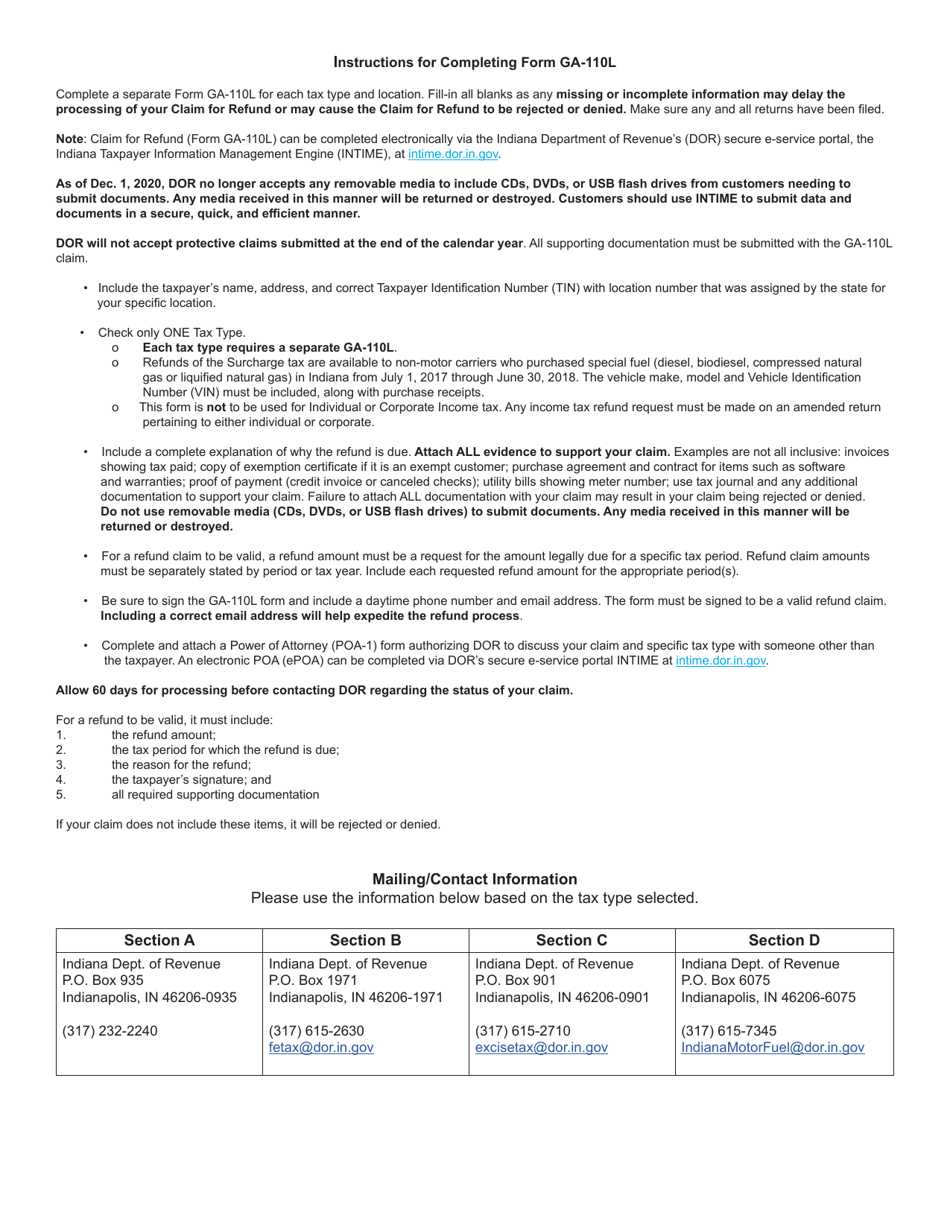

Form GA-110L (State Form 615)

for the current year.

Form GA-110L (State Form 615) Claim for Refund - Indiana

What Is Form GA-110L (State Form 615)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-110L?

A: Form GA-110L is also known as State Form 615 and is used for claiming a refund in Indiana.

Q: Who can use Form GA-110L?

A: Any individual or business entity who wants to claim a refund in Indiana can use Form GA-110L.

Q: What is the purpose of Form GA-110L?

A: The purpose of Form GA-110L is to request a refund of overpaid taxes or credits in Indiana.

Q: What information is required on Form GA-110L?

A: Form GA-110L requires you to provide your personal information, details of the overpayment, and any supporting documentation.

Q: Can I file Form GA-110L electronically?

A: Yes, Indiana allows electronic filing of Form GA-110L if you meet the eligibility criteria.

Q: Is there a deadline to file Form GA-110L?

A: Yes, Form GA-110L must be filed within three years from the due date of the original tax return or within one year from the date the tax was paid, whichever is later.

Q: What should I do after filing Form GA-110L?

A: After filing Form GA-110L, you should keep a copy for your records and allow some time for the Indiana Department of Revenue to process your refund claim.

Q: What if my Form GA-110L is denied or rejected?

A: If your Form GA-110L is denied or rejected, you have the option to appeal the decision by following the instructions provided by the Indiana Department of Revenue.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-110L (State Form 615) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.