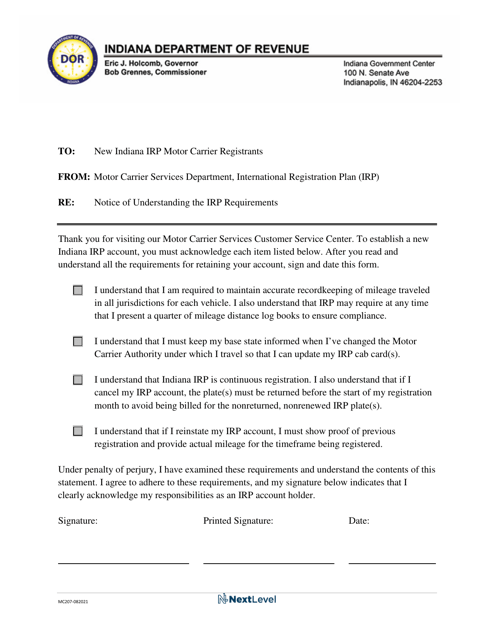

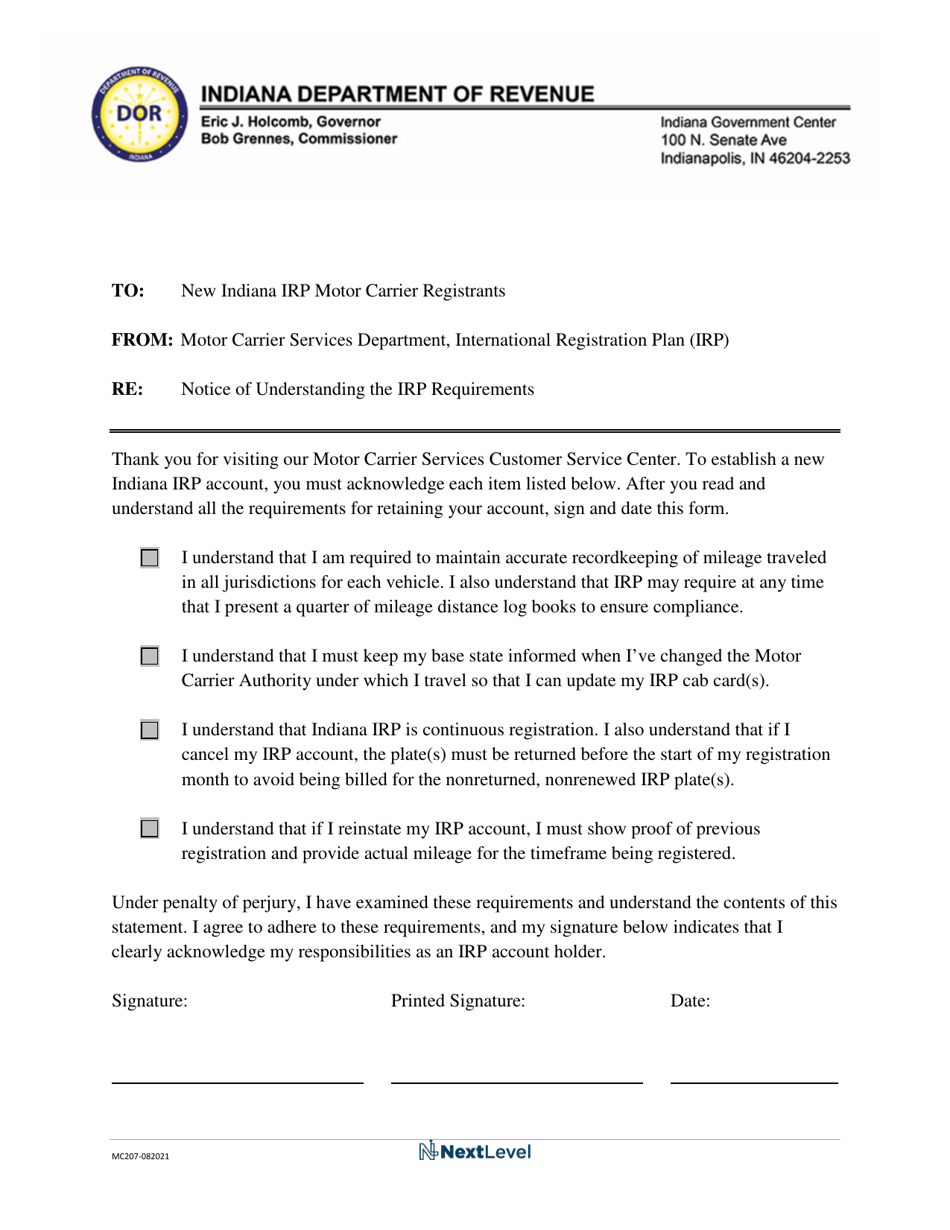

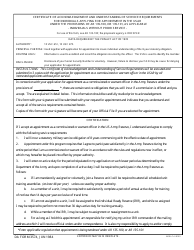

Form MC207 Notice of Understanding the Irp Requirements - Indiana

What Is Form MC207?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MC207 Notice of Understanding?

A: The MC207 Notice of Understanding is a document used in Indiana to demonstrate that the driver understands the requirements of the International Registration Plan (IRP).

Q: What is the purpose of the MC207 Notice of Understanding?

A: The purpose of the MC207 Notice of Understanding is to certify that the driver understands and agrees to comply with the IRP requirements for operating a commercial vehicle across multiple states.

Q: Who needs to complete the MC207 Notice of Understanding?

A: Commercial vehicle drivers operating under the IRP in Indiana are required to complete the MC207 Notice of Understanding.

Q: What information is required on the MC207 Notice of Understanding?

A: The MC207 Notice of Understanding requires the driver's name, address, signature, and a declaration stating that the driver understands the IRP requirements.

Q: Is there a fee for submitting the MC207 Notice of Understanding?

A: No, there is no fee for submitting the MC207 Notice of Understanding.

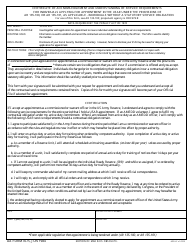

Q: What should I do after completing the MC207 Notice of Understanding?

A: After completing the MC207 Notice of Understanding, you should keep a copy for your records and submit the original document to the Indiana Bureau of Motor Vehicles.

Q: What happens if I don't submit the MC207 Notice of Understanding?

A: Failure to submit the MC207 Notice of Understanding can result in penalties, such as fines or the suspension of your commercial driver's license.

Q: How often do I need to complete the MC207 Notice of Understanding?

A: The MC207 Notice of Understanding must be completed and submitted to the Indiana Bureau of Motor Vehicles annually or whenever there are changes to your IRP account information.

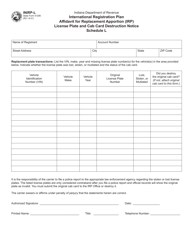

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MC207 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.