This version of the form is not currently in use and is provided for reference only. Download this version of

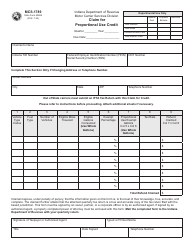

Form MCS-CNG-101 (State Form 55598)

for the current year.

Form MCS-CNG-101 (State Form 55598) Quarterly Cng Claim for Refund - Indiana

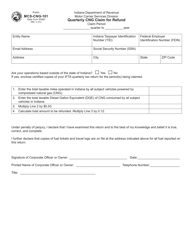

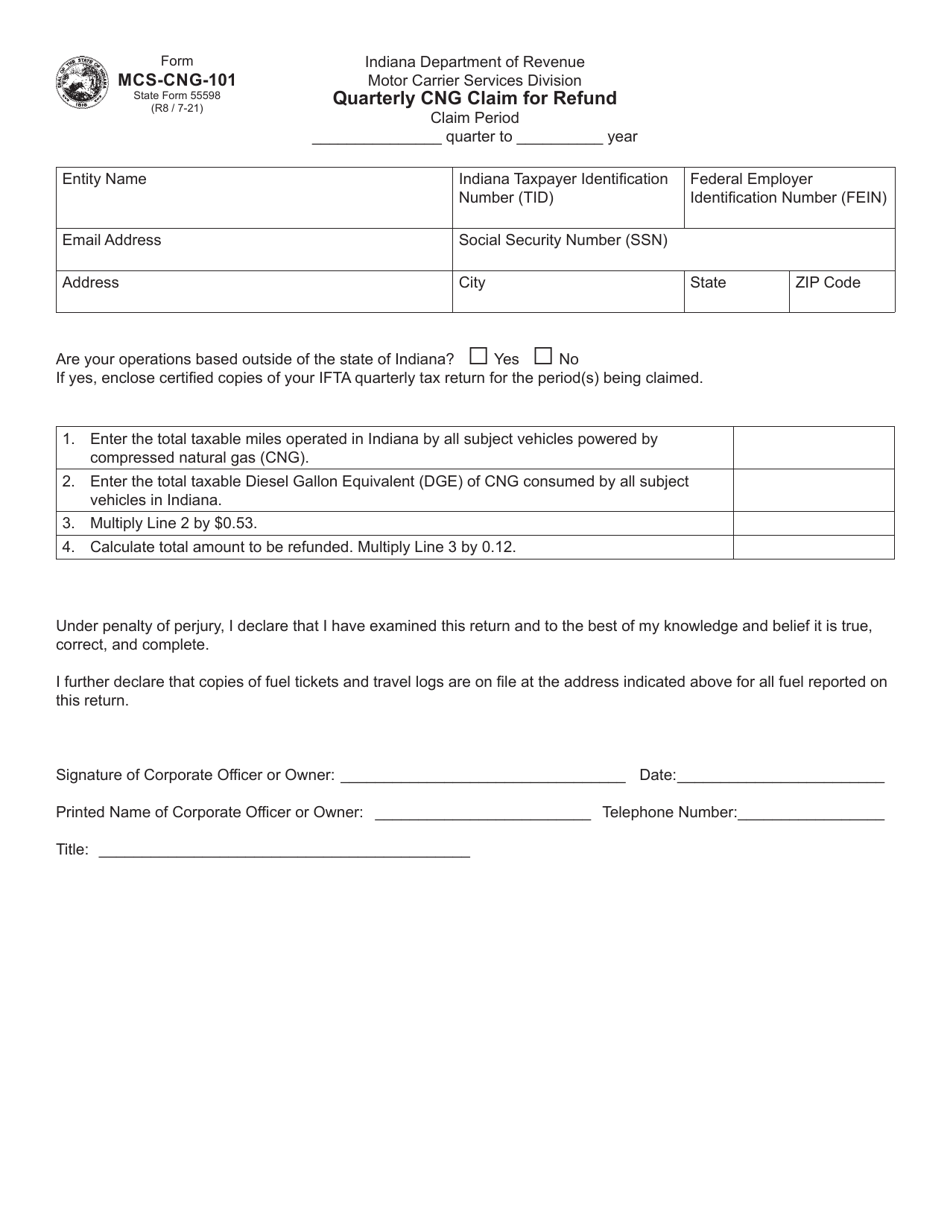

What Is Form MCS-CNG-101 (State Form 55598)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MCS-CNG-101?

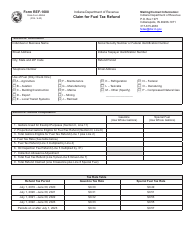

A: Form MCS-CNG-101 is a quarterly claim for a refund for compressed natural gas (CNG) in Indiana.

Q: What is the purpose of form MCS-CNG-101?

A: The purpose of form MCS-CNG-101 is to request a refund for the state excise tax paid on compressed natural gas (CNG) in Indiana.

Q: Who needs to fill out form MCS-CNG-101?

A: Anyone who has paid the state excise tax on compressed natural gas (CNG) in Indiana and wants to request a refund can fill out form MCS-CNG-101.

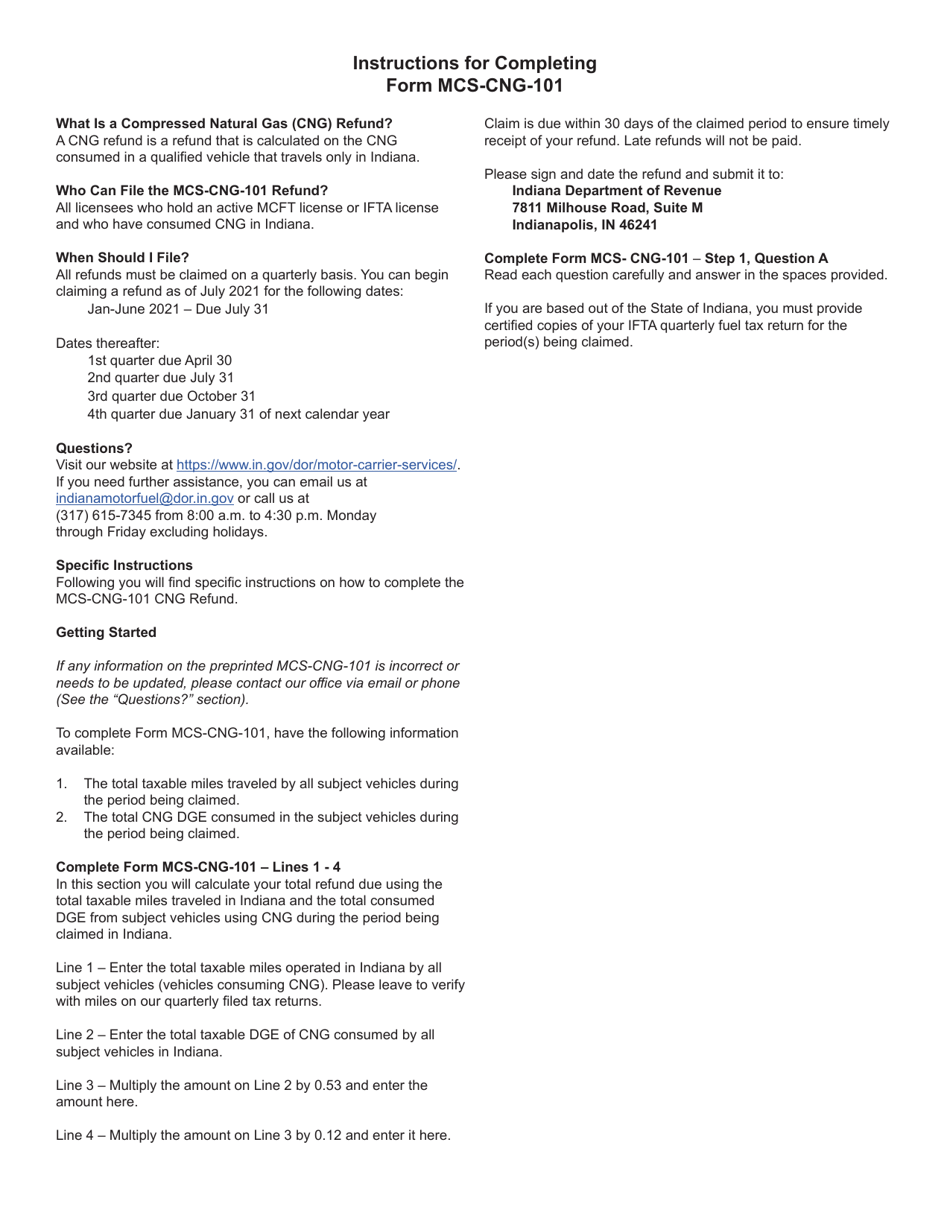

Q: When should form MCS-CNG-101 be filed?

A: Form MCS-CNG-101 should be filed quarterly, no later than the last day of the month following the end of the quarter for which the refund is being claimed.

Q: What supporting documentation is required with form MCS-CNG-101?

A: Supporting documentation such as fuel receipts, invoices, and mileage records should be included with form MCS-CNG-101 to substantiate the refund claim.

Q: How long does it take to process form MCS-CNG-101?

A: The processing time for form MCS-CNG-101 varies, but the Indiana Department of Revenue strives to process refund claims within 30 to 60 days.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MCS-CNG-101 (State Form 55598) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.