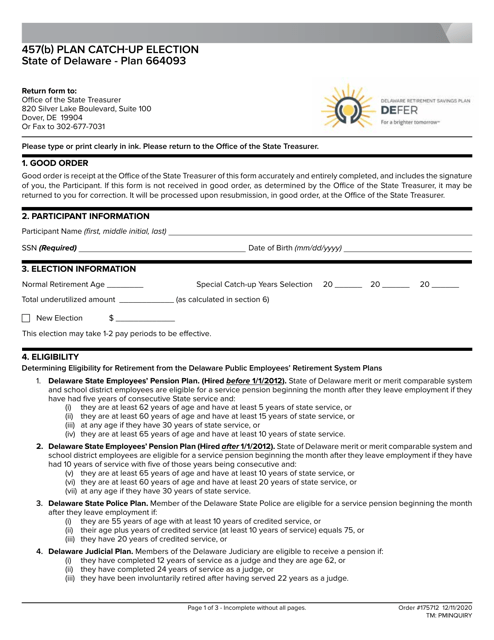

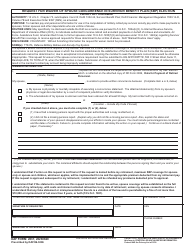

457(B) Plan Catch-Up Election - Delaware

457(B) Plan Catch-Up Election is a legal document that was released by the Delaware Office of the State Treasurer - a government authority operating within Delaware.

FAQ

Q: What is a 457(B) plan?

A: A 457(B) plan is a type of retirement savings plan available to employees of state and local governments, as well as certain tax-exempt organizations.

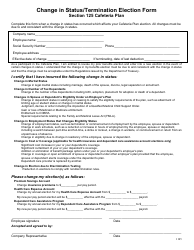

Q: What is a catch-up election for a 457(B) plan?

A: A catch-up election allows participants who are age 50 or older to contribute additional amounts to their 457(B) plan to catch up on any missed contributions.

Q: Is a catch-up election available to all participants in a 457(B) plan?

A: No, catch-up elections are only available to participants who are age 50 or older.

Q: Can catch-up contributions be made in addition to the regular contribution limit for a 457(B) plan?

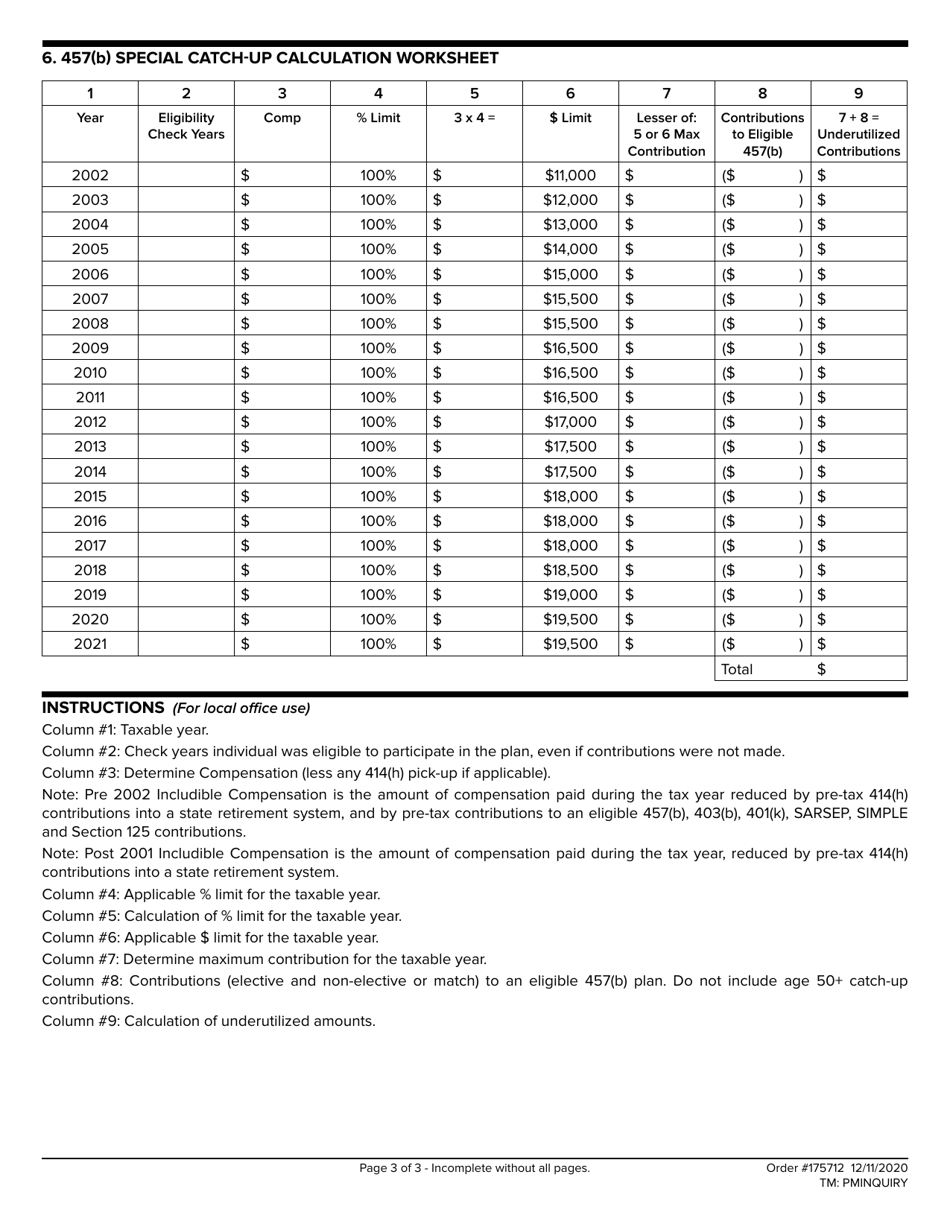

A: Yes, catch-up contributions can be made in addition to the regular contribution limit for a 457(B) plan, which is $19,500 in 2021.

Q: Are catch-up contributions for a 457(B) plan tax-deductible?

A: Yes, catch-up contributions to a 457(B) plan are tax-deductible, which means they can lower your taxable income for the year.

Q: How much can someone contribute as a catch-up election to a 457(B) plan in 2021?

A: In 2021, the catch-up contribution limit for a 457(B) plan is an additional $6,500, for a total of $26,000 if you are age 50 or older.

Q: Can someone make catch-up contributions to a 457(B) plan if they are already maximizing their regular contributions?

A: Yes, even if you are already contributing the maximum amount to your 457(B) plan, you can still make catch-up contributions if you are age 50 or older.

Q: Are catch-up contributions for a 457(B) plan subject to income limits?

A: No, catch-up contributions for a 457(B) plan are not subject to income limits.

Q: Are catch-up contributions to a 457(B) plan employer-matched?

A: It depends on the specific 457(B) plan. Some plans may offer employer matching on catch-up contributions, while others may not.

Q: Do catch-up contributions to a 457(B) plan affect the amount someone can contribute to other retirement accounts?

A: No, catch-up contributions to a 457(B) plan do not affect the amount someone can contribute to other retirement accounts, such as an IRA or a 401(k).

Form Details:

- Released on December 11, 2020;

- The latest edition currently provided by the Delaware Office of the State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Office of the State Treasurer.