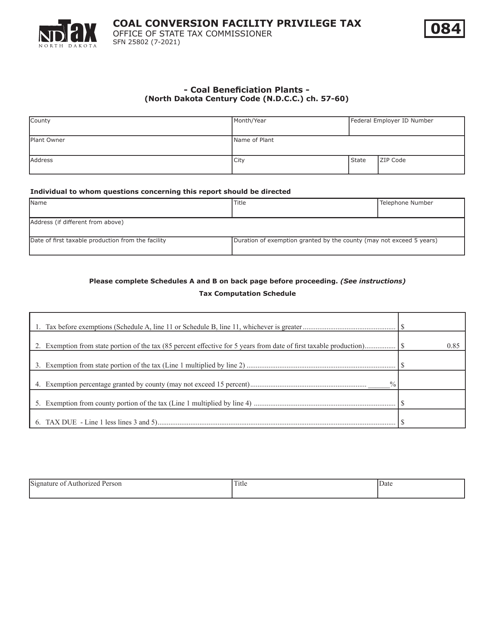

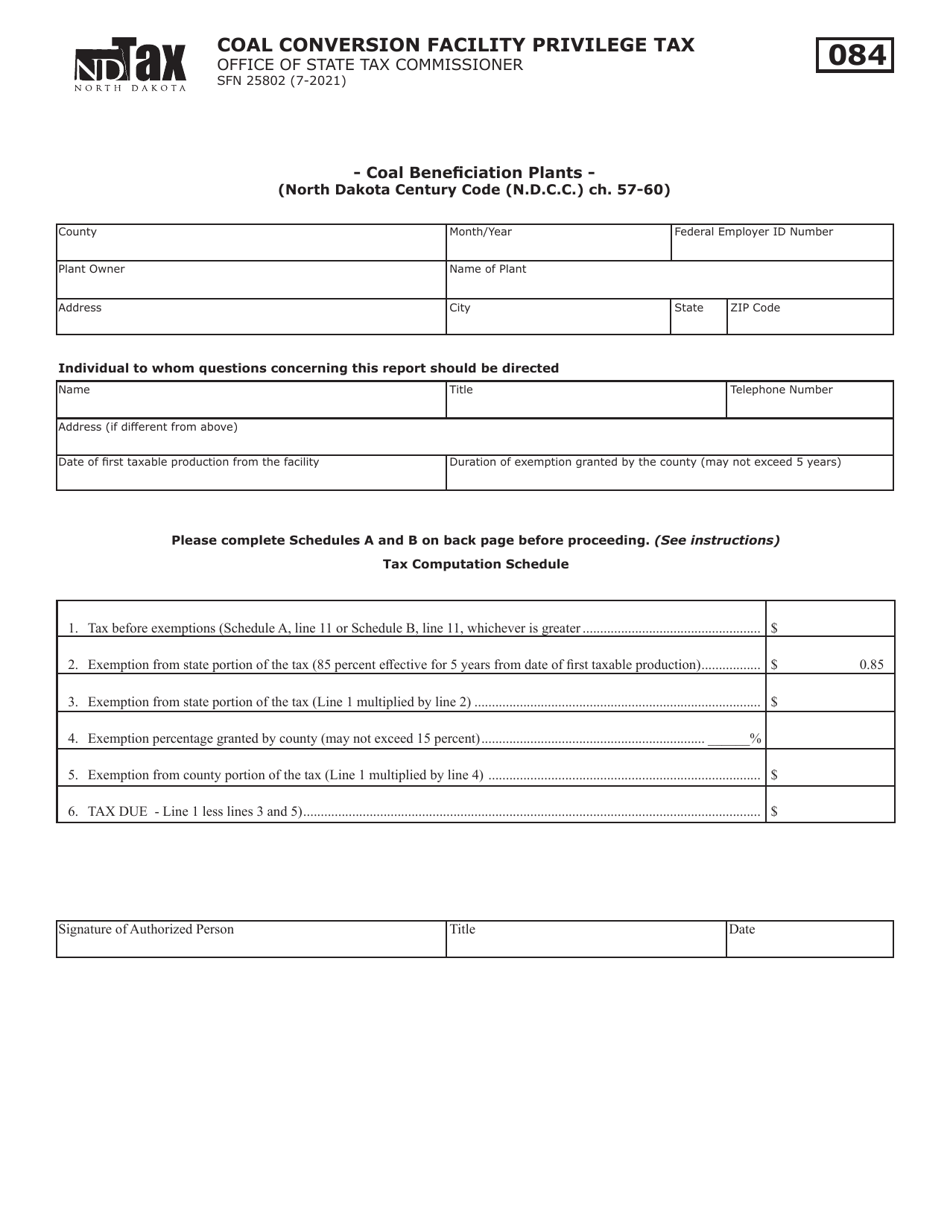

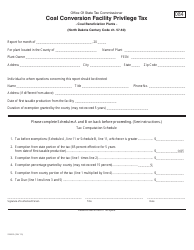

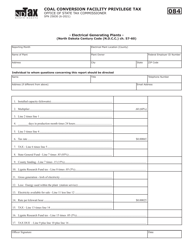

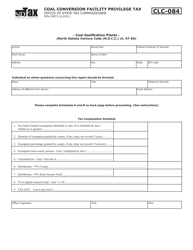

Form SFN25802 Coal Conversion Facility Privilege Tax - Coal Beneficiation Plants - North Dakota

What Is Form SFN25802?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN25802?

A: Form SFN25802 is a tax form related to coal conversion facility privilege tax in North Dakota.

Q: What is coal beneficiation?

A: Coal beneficiation is the process of improving the quality of coal by removing impurities.

Q: What are coal beneficiation plants?

A: Coal beneficiation plants are facilities that process coal to remove impurities and enhance its value as a fuel.

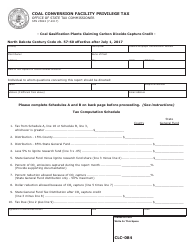

Q: What is coal conversion facility privilege tax?

A: Coal conversion facility privilege tax is a tax imposed on the operation of coal beneficiation plants in North Dakota.

Q: Who is required to file Form SFN25802?

A: Owners or operators of coal beneficiation plants in North Dakota are required to file Form SFN25802.

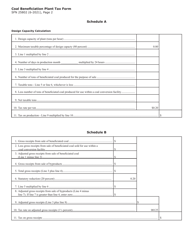

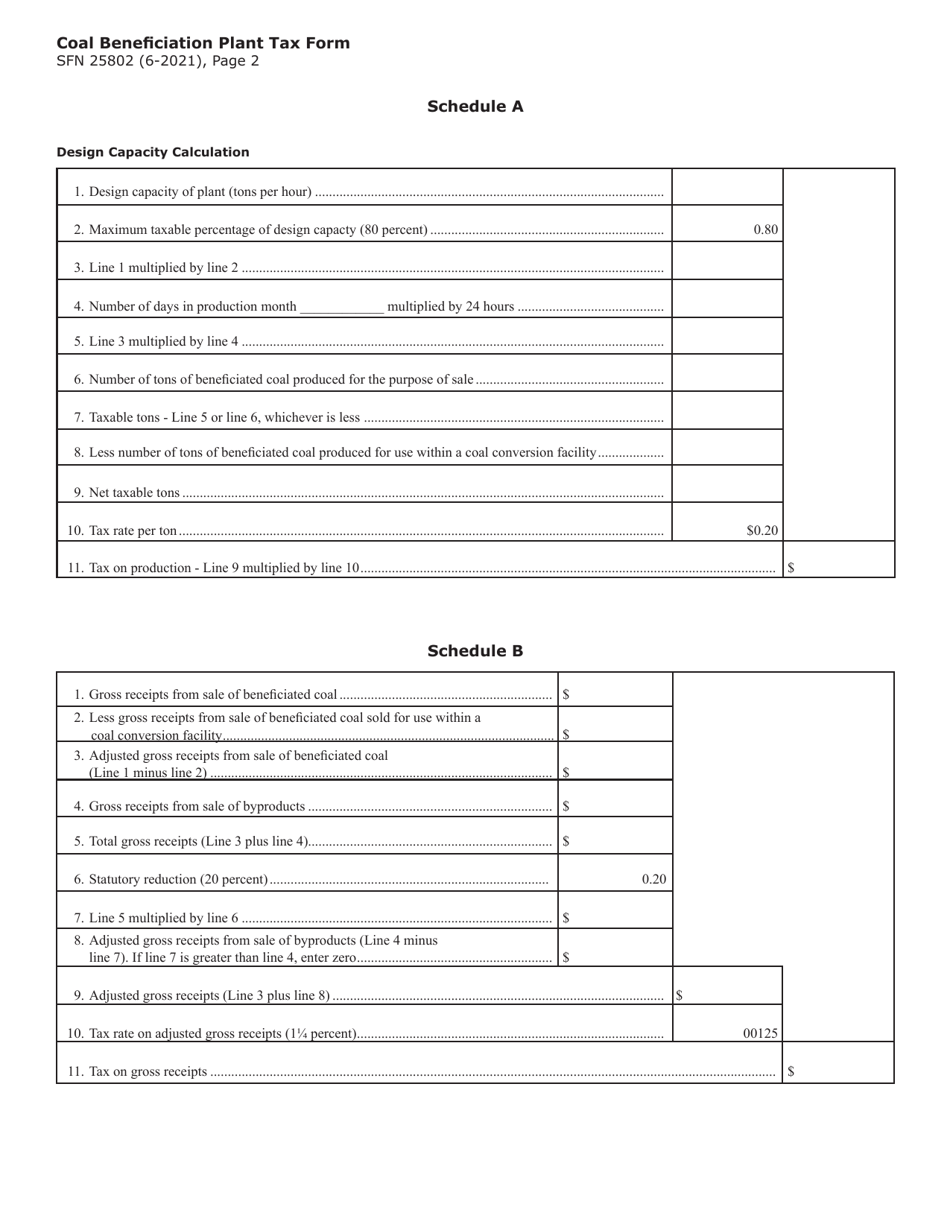

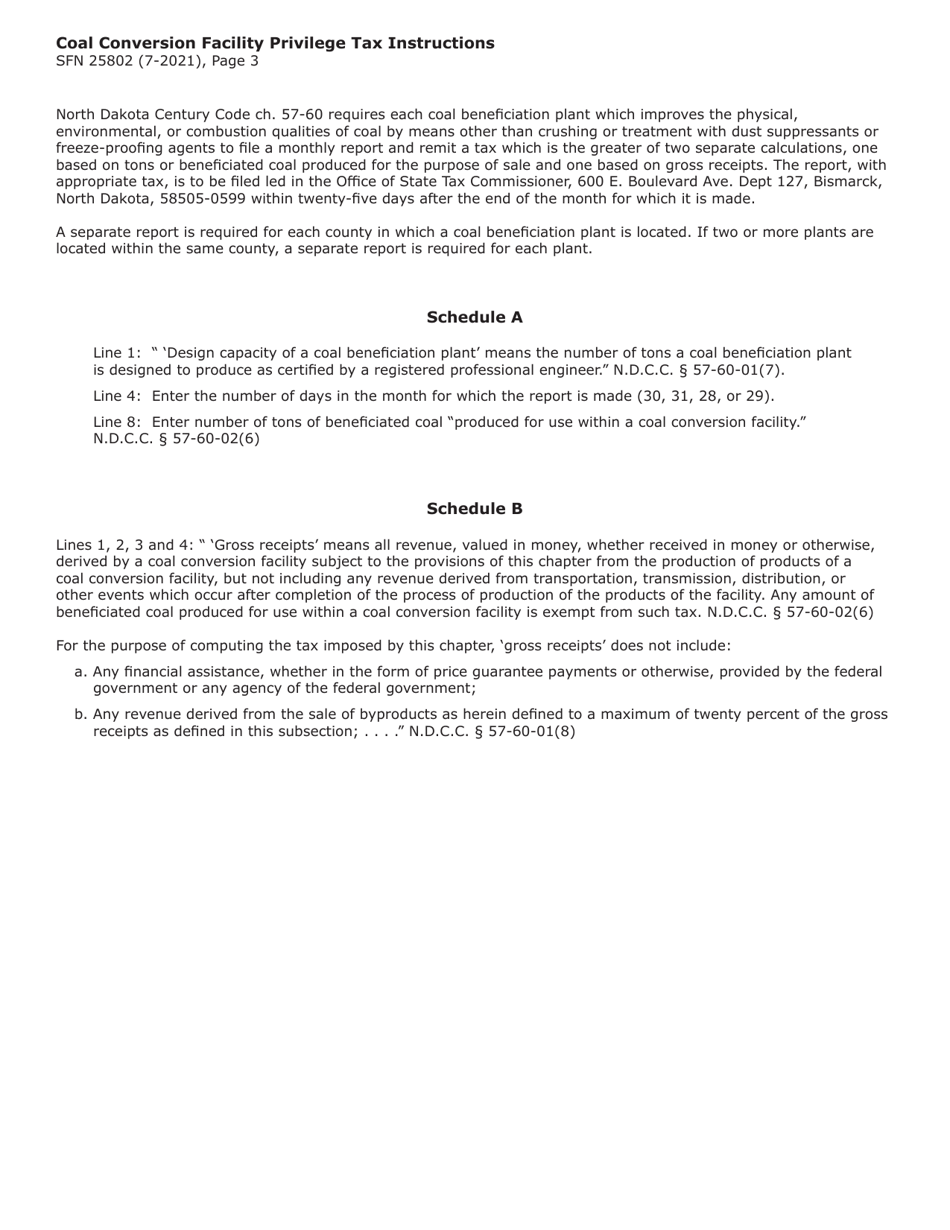

Q: What information is required to complete Form SFN25802?

A: Form SFN25802 requires the reporting of various information, such as production data, sales data, and tax liability calculations.

Q: When is Form SFN25802 due?

A: Form SFN25802 is due on or before the 15th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form SFN25802?

A: Yes, late filing of Form SFN25802 may result in penalties and interest.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN25802 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.