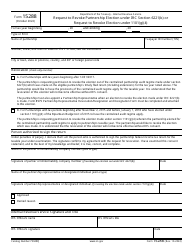

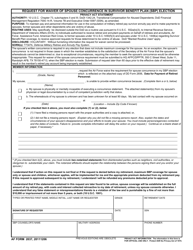

Instructions for IRS Form 8857 Request for Innocent Spouse Relief

This document contains official instructions for IRS Form 8857 , Request for Innocent Spouse Relief - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8857 is available for download through this link.

FAQ

Q: What is IRS Form 8857?

A: IRS Form 8857 is the Request for Innocent Spouse Relief.

Q: Who can use IRS Form 8857?

A: Individuals who believe they qualify for innocent spouse relief can use IRS Form 8857.

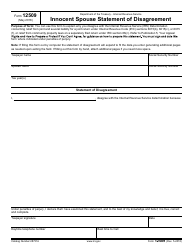

Q: What is innocent spouse relief?

A: Innocent spouse relief is a tax provision that allows certain individuals to be relieved of joint tax liability.

Q: How do I file IRS Form 8857?

A: You can file IRS Form 8857 by mail or electronically, depending on your eligibility.

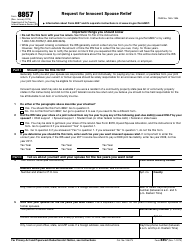

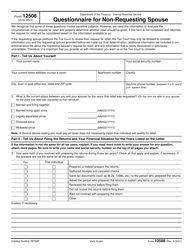

Q: What information is required for IRS Form 8857?

A: IRS Form 8857 requires information about your personal background, the tax liability in question, and supporting documentation.

Q: What is the deadline for filing IRS Form 8857?

A: The deadline for filing IRS Form 8857 is generally within 2 years from the date the IRS first attempts to collect the tax.

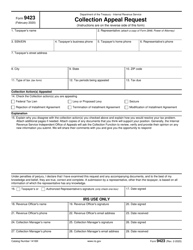

Q: Can I appeal if my request for innocent spouse relief is denied?

A: Yes, you can appeal the denial of innocent spouse relief by following the instructions provided on the denial letter.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.