This version of the form is not currently in use and is provided for reference only. Download this version of

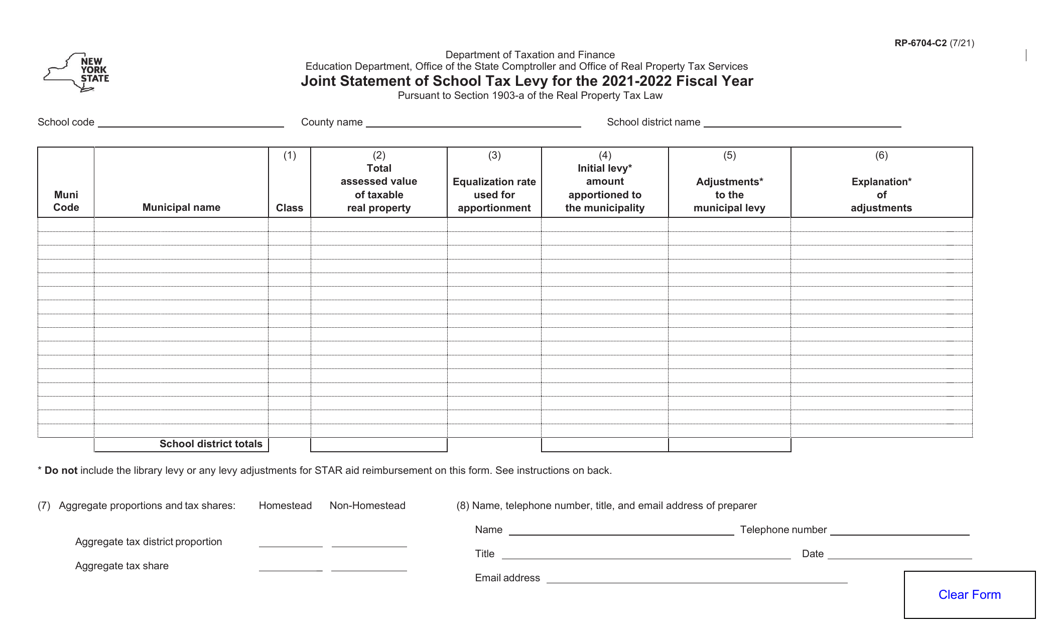

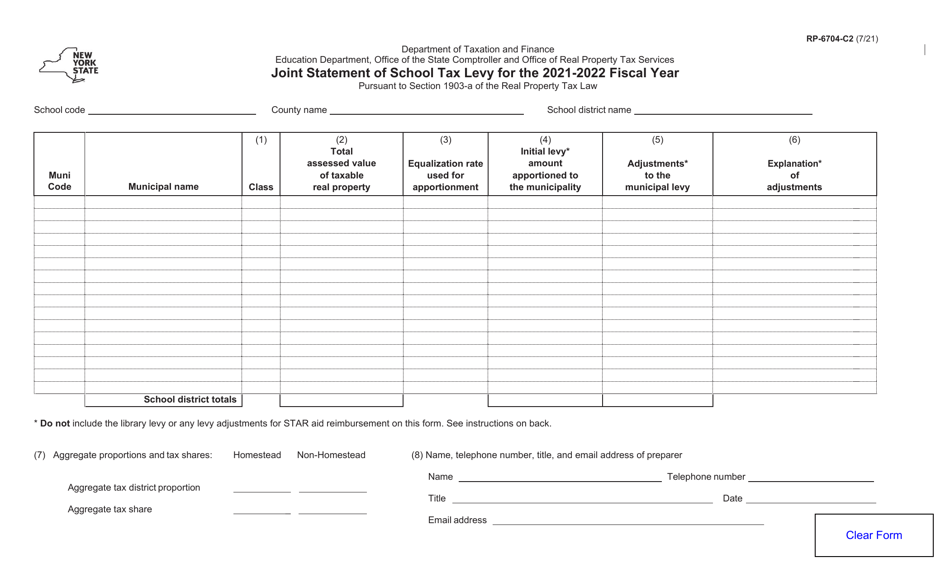

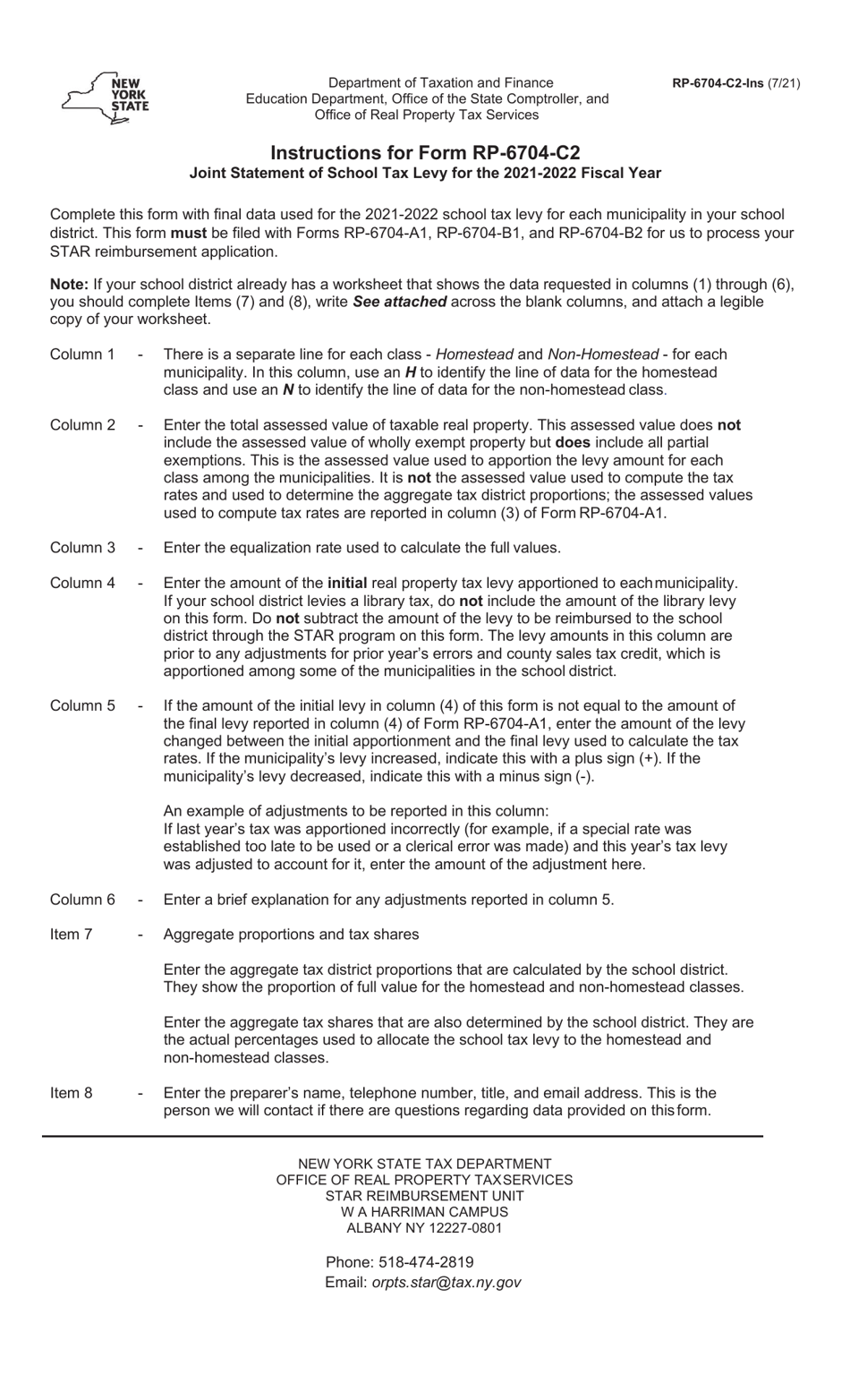

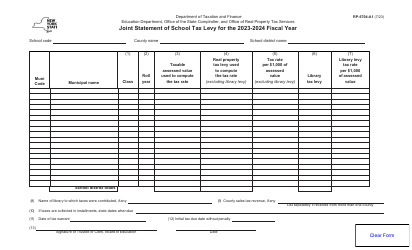

Form RP-6704-C2

for the current year.

Form RP-6704-C2 Joint Statement of School Tax Levy - New York

What Is Form RP-6704-C2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

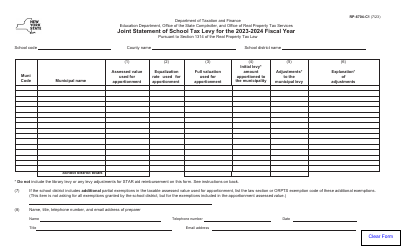

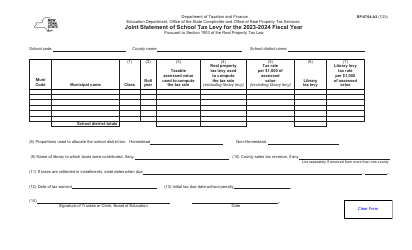

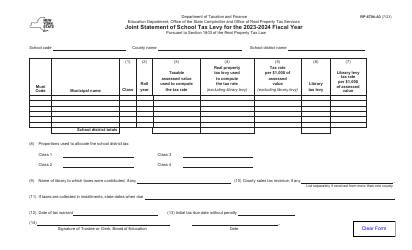

Q: What is form RP-6704-C2?

A: Form RP-6704-C2 is the Joint Statement of School Tax Levy for the state of New York.

Q: Who needs to fill out form RP-6704-C2?

A: The form should be completed by school district officials or their authorized representatives.

Q: What is the purpose of form RP-6704-C2?

A: The form is used to report the school tax levy for each tax district within a school district.

Q: How often is form RP-6704-C2 filed?

A: The form is filed annually.

Q: Are there any filing fees associated with form RP-6704-C2?

A: No, there are no filing fees for this form.

Q: What are the consequences of not filing form RP-6704-C2?

A: Failure to file the form may result in penalties or interest being assessed by the taxing authority.

Q: Is form RP-6704-C2 the same as a property tax bill?

A: No, form RP-6704-C2 is not a property tax bill. It is a statement used for reporting the school tax levy.

Q: What is the deadline for filing form RP-6704-C2?

A: The deadline for filing the form varies each year and is typically specified by the New York State Department of Taxation and Finance.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6704-C2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.