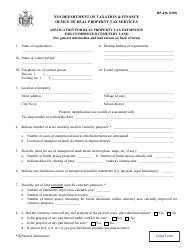

This version of the form is not currently in use and is provided for reference only. Download this version of

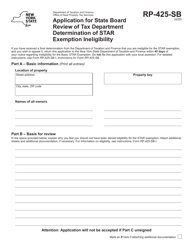

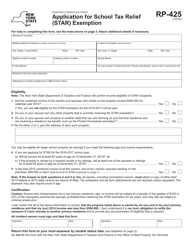

Form RP-425-B

for the current year.

Form RP-425-B Application for Basic Star Exemption - New York

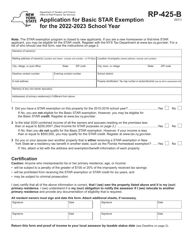

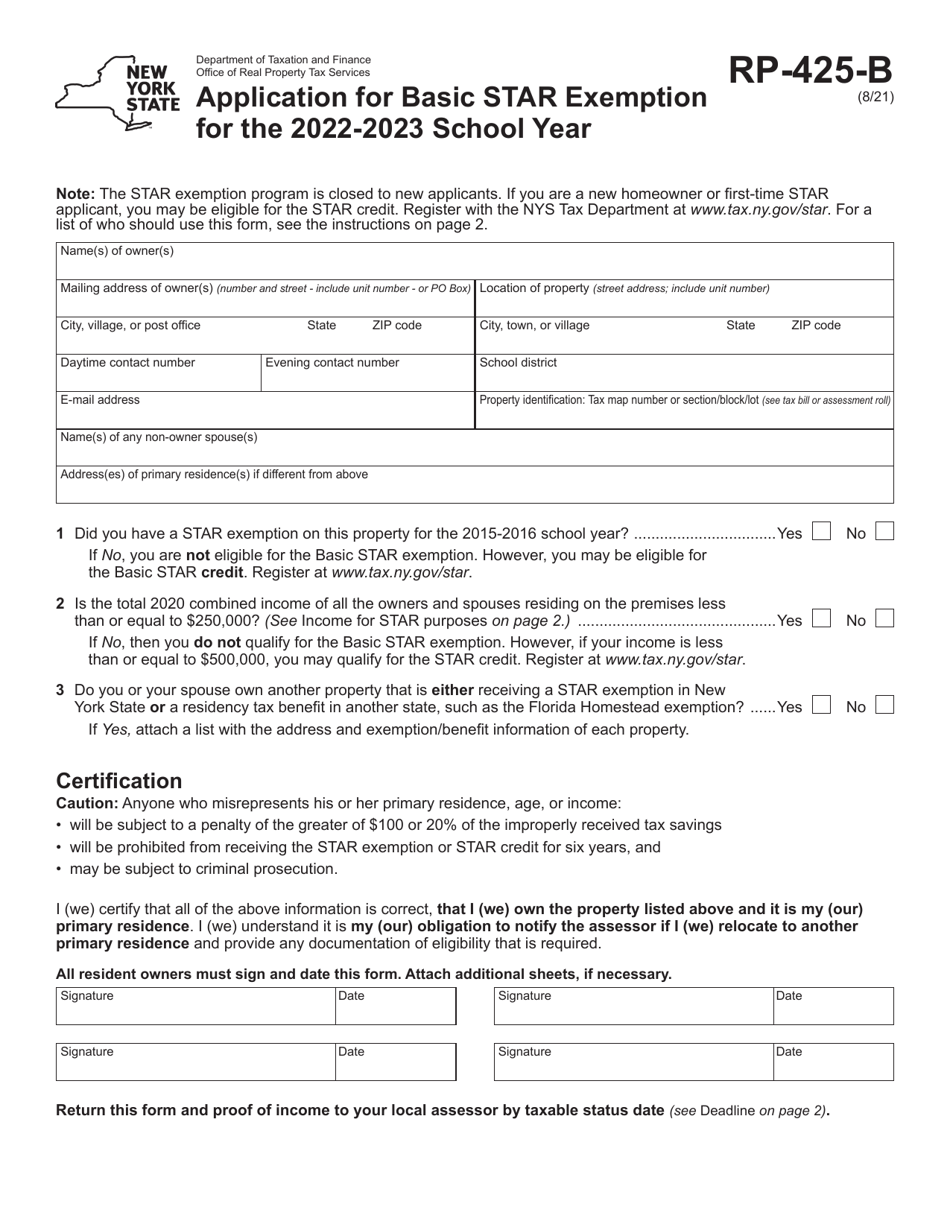

What Is Form RP-425-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-B?

A: Form RP-425-B is an application for the Basic STAR exemption in New York.

Q: What is the Basic STAR exemption?

A: The Basic STAR exemption is a property tax exemption available to eligible homeowners in New York.

Q: Who is eligible for the Basic STAR exemption?

A: To be eligible for the Basic STAR exemption, you must be the owner of the property and use it as your primary residence.

Q: How do I apply for the Basic STAR exemption?

A: You can apply for the Basic STAR exemption by submitting Form RP-425-B to your local assessor's office.

Q: What documents do I need to include with the application?

A: You may need to include a copy of your federal or state income tax return, a copy of your deed, or other proof of eligibility.

Q: When is the deadline to apply for the Basic STAR exemption?

A: The deadline to apply for the Basic STAR exemption varies by county, so it's best to check with your local assessor's office.

Q: Is the Basic STAR exemption available in all counties in New York?

A: No, some counties in New York have opted out of the Basic STAR program, so it's important to check if it is available in your county.

Q: What is the benefit of the Basic STAR exemption?

A: The Basic STAR exemption provides a reduction in your property taxes, resulting in potential savings for eligible homeowners.

Q: Can I receive both the Basic STAR exemption and the Enhanced STAR exemption?

A: No, you can only receive either the Basic STAR exemption or the Enhanced STAR exemption, depending on your age and income.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.