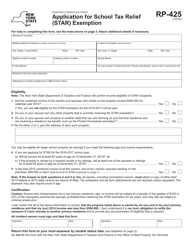

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-425-E

for the current year.

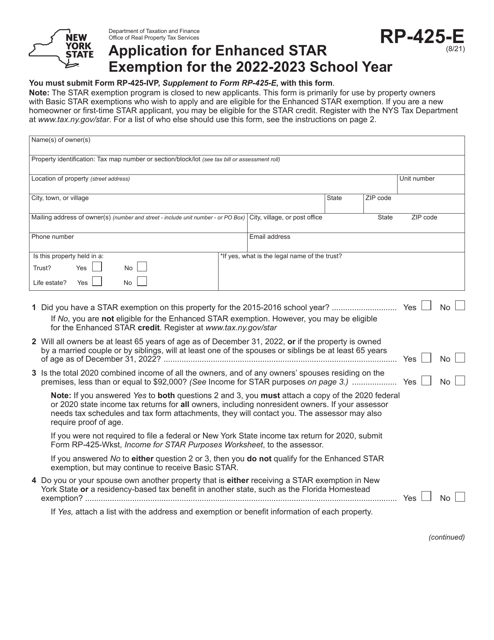

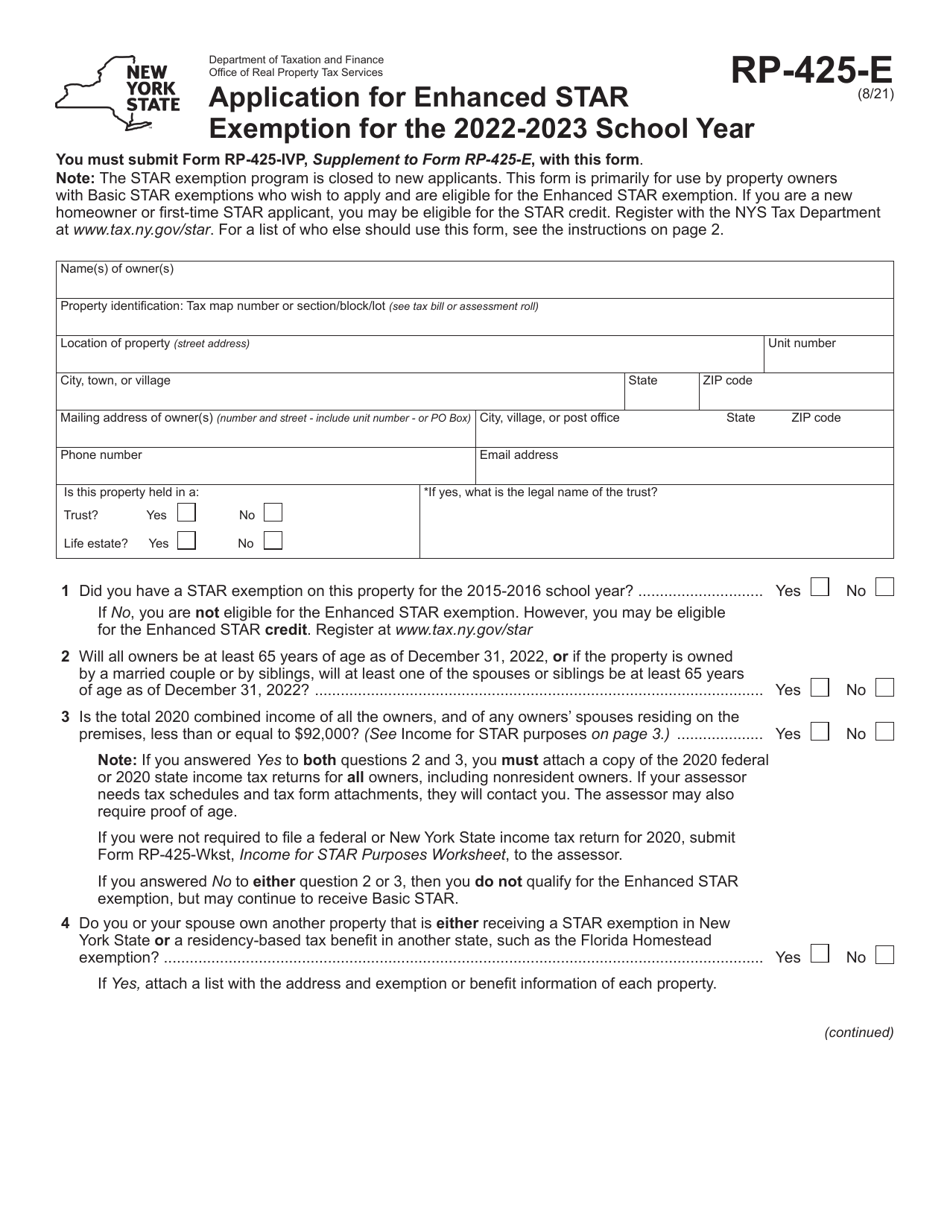

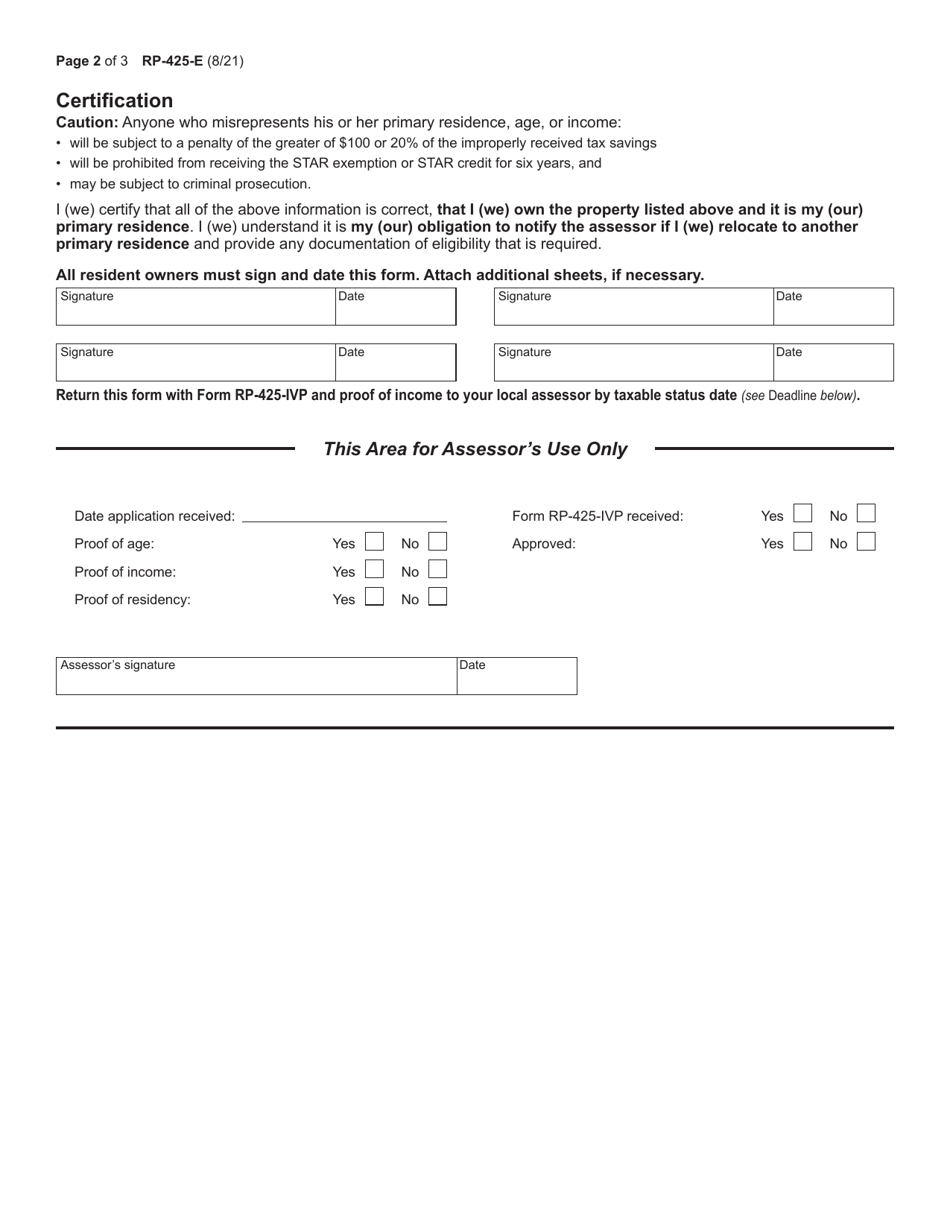

Form RP-425-E Application for Enhanced Star Exemption - New York

What Is Form RP-425-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-E?

A: Form RP-425-E is the application for Enhanced Star Exemption in New York.

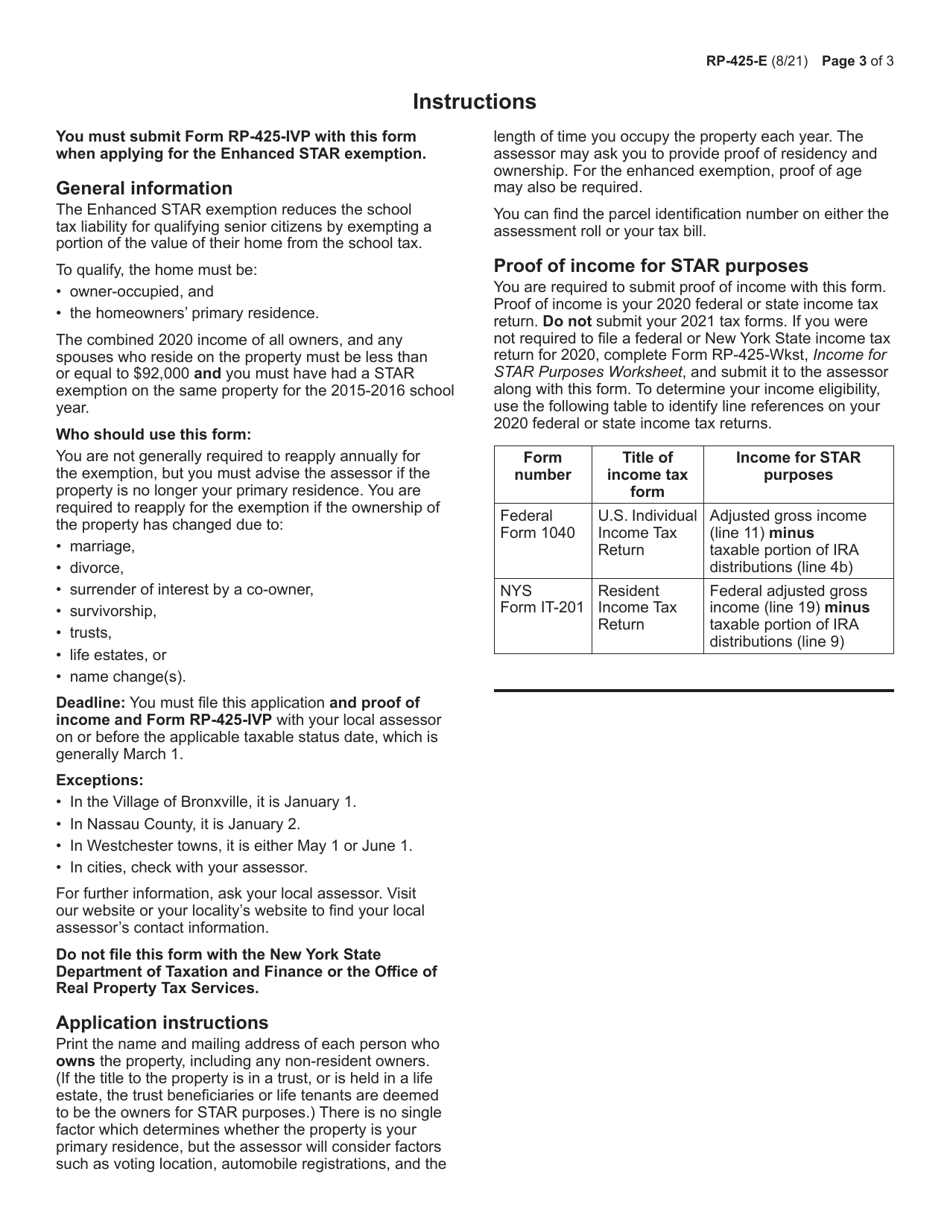

Q: What is the Enhanced Star Exemption?

A: The Enhanced Star Exemption is a property tax exemption for senior citizens in New York.

Q: Who is eligible for the Enhanced Star Exemption?

A: To be eligible for the Enhanced Star Exemption, you must be 65 years or older and have a household income below a certain threshold.

Q: How do I apply for the Enhanced Star Exemption?

A: You can apply for the Enhanced Star Exemption by completing Form RP-425-E and submitting it to your local assessor's office.

Q: What documents do I need to include with the application?

A: You will need to include proof of age and proof of income with your application for the Enhanced Star Exemption.

Q: When is the deadline to apply for the Enhanced Star Exemption?

A: The deadline to apply for the Enhanced Star Exemption in New York is generally March 1st of each year, but it may vary by municipality.

Q: What are the benefits of the Enhanced Star Exemption?

A: The Enhanced Star Exemption provides a reduction in property taxes for eligible senior citizens in New York.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.