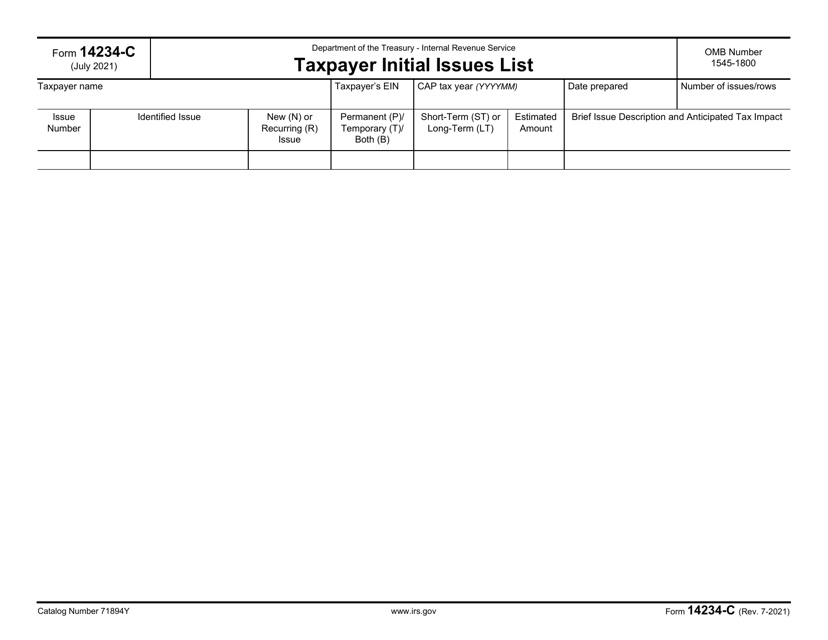

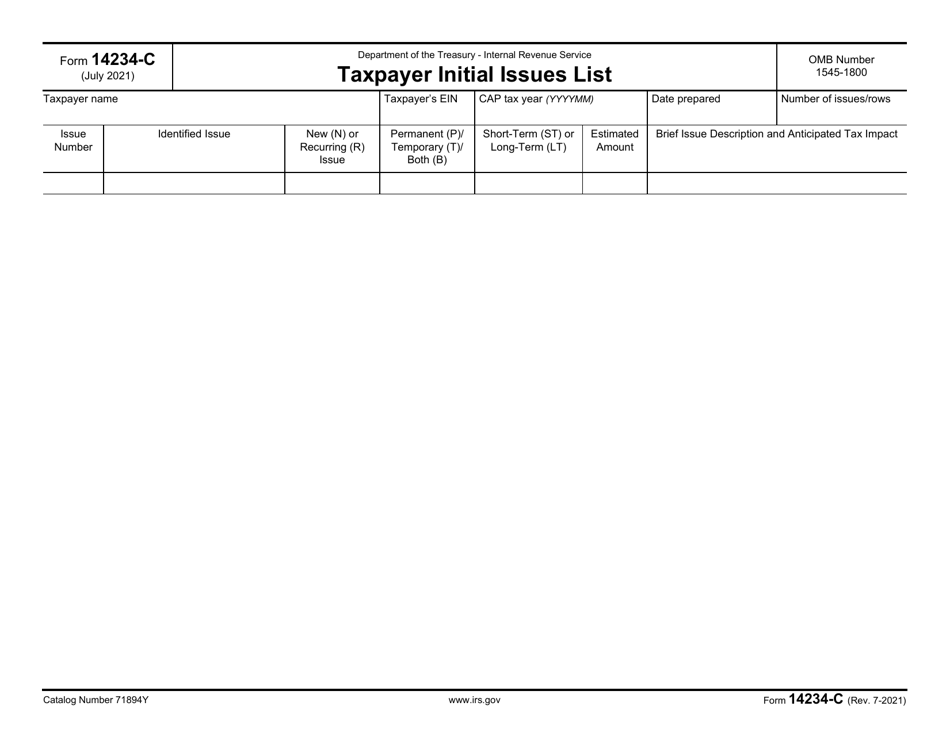

This version of the form is not currently in use and is provided for reference only. Download this version of

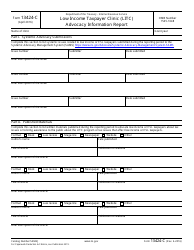

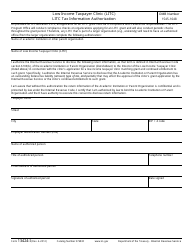

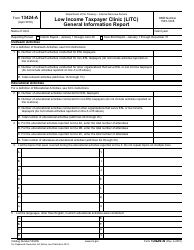

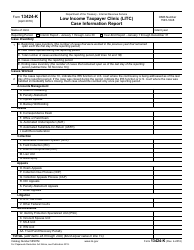

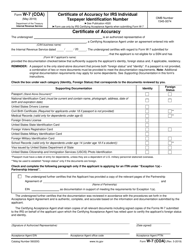

IRS Form 14234-C

for the current year.

IRS Form 14234-C Taxpayer Initial Issues List

What Is IRS Form 14234-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14234-C?

A: IRS Form 14234-C is the Taxpayer Initial Issues List.

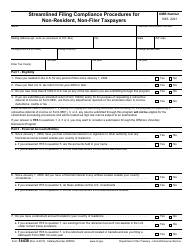

Q: Who needs to fill out IRS Form 14234-C?

A: Taxpayers who have tax issues and are working with the IRS need to fill out this form.

Q: What is the purpose of IRS Form 14234-C?

A: The form is used to help taxpayers identify and prioritize the issues they are facing with the IRS.

Q: Do I need to submit IRS Form 14234-C with my tax return?

A: No, this form is not required to be submitted with your tax return. It is only used in specific situations when working with the IRS.

Q: What should I do if I have questions about IRS Form 14234-C?

A: If you have questions or need assistance with this form, it is best to contact the IRS directly for guidance.

Form Details:

- A 1-page form available for download in PDF;

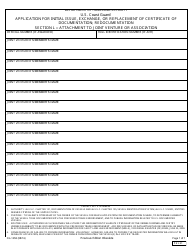

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14234-C through the link below or browse more documents in our library of IRS Forms.