IRS Penalty Abatement Request Letter Template

An IRS Penalty Abatement Request Letter is a formal statement composed by a taxpayer and sent to the Internal Revenue Service (IRS) to ask the latter to waive a penalty imposed for not filing the required tax return on time or not paying taxes. If you are a taxpayer with a clean history of compliance, you may be allowed to make one mistake when filing a tax return.

Alternate Name:

- IRS Penalty Abatement Letter.

Make sure you qualify for the relief from the IRS penalty and are allowed to draft an IRS Letter to Request First-Time Penalty Abatement:

- This is your first tax return or you had no penalties for three years before the current tax year;

- You submitted all the returns for this year on time or requested an extension for submission;

- You have paid the tax you owe or you have precise arrangements to do so.

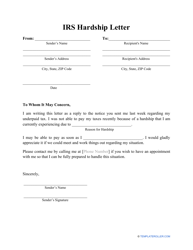

An IRS Penalty Abatement Letter template can be downloaded below.

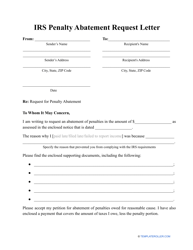

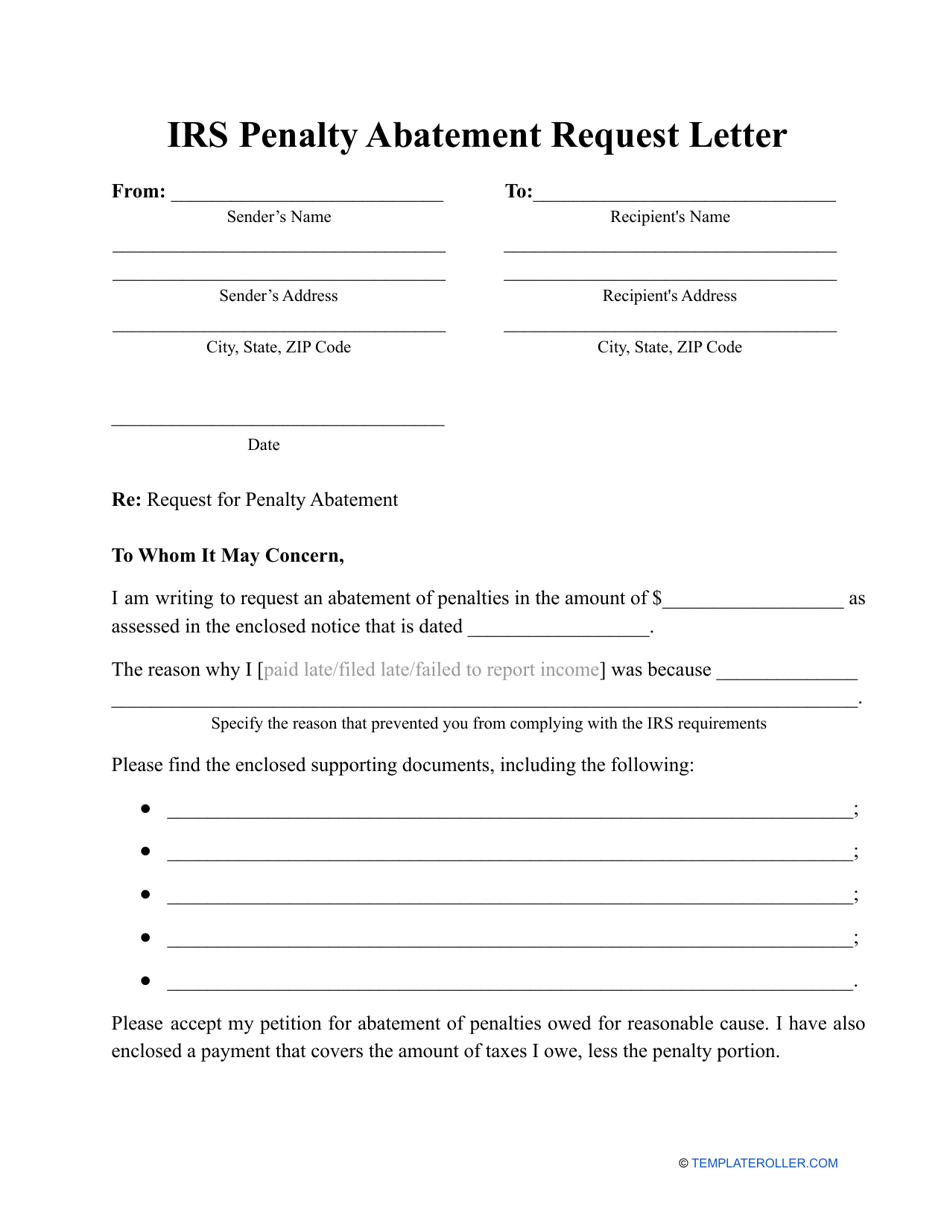

How to Write an IRS Penalty Abatement Letter?

Here is how you should prepare a Letter to the IRS for Penalty Abatement:

- Title the document correctly to let the recipient know what you are looking for - write down "Request for penalty abatement" at the top of the page. Then, enter the address of the IRS service center and introduce yourself. To facilitate identification, you can refer to the latest notice you have received from the IRS or add your taxpayer identification number.

- Confirm your wish to ask for the abatement of penalties . Depending on the circumstances, you can ask the IRS to waive the full penalty or its portion.

- Describe the reasons for failing to pay on time, submitting the return late, or not filing the documentation at all . The IRS will be prepared to consider any situation that prevented you from fulfilling your obligations as a taxpayer. For instance, you or your immediate family member was ill, you had to deal with the impact of a natural disaster or fire, you were unable to access records to report to the IRS on time. You can write two or three paragraphs outlining the extenuating circumstances and explaining why you could not comply with your responsibility to file taxes on time. Note that a simple description will not be enough and the request will likely be denied - your claims must be supported by the documents you attach to the letter such as court records, medical records, a letter from your doctor, and documentation that proves a natural disaster or fire has occurred.

- List the documents you are enclosing with the letter and do not forget to send them in your package.

- Once again, reiterate your request for the penalty abatement . If you are attaching a check or money order to cover the taxes you currently owe, indicate it in the letter.

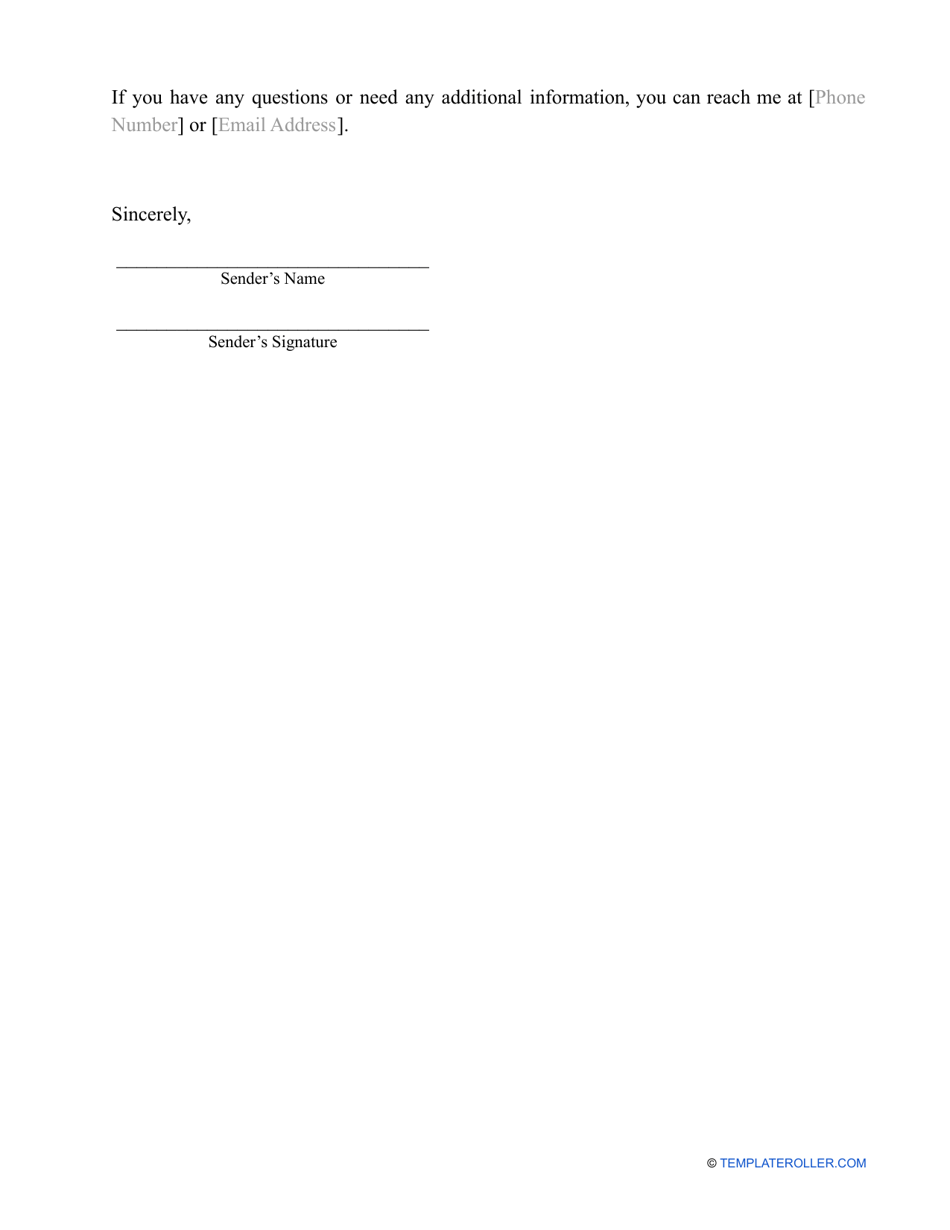

- Add your contact details and ask the IRS to reach out to you in case they need more information or have any concerns about the documents you send.

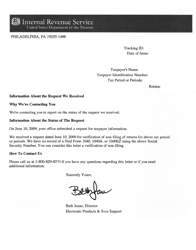

Where to Mail IRS Penalty Abatement Letter?

The IRS Penalty Abatement Letter mailing address depends on your location - send it to the IRS service center you usually submit your paper returns. In case you file your returns electronically, you can ask for the abatement online via your account on the official IRS website. However, if you received a formal notice from the IRS with the demand to pay taxes and it indicates a different address for future correspondence, make sure you mail the letter with the supporting documentation at this address.

Still looking for a particular template? Take a look at the related templates and samples below: