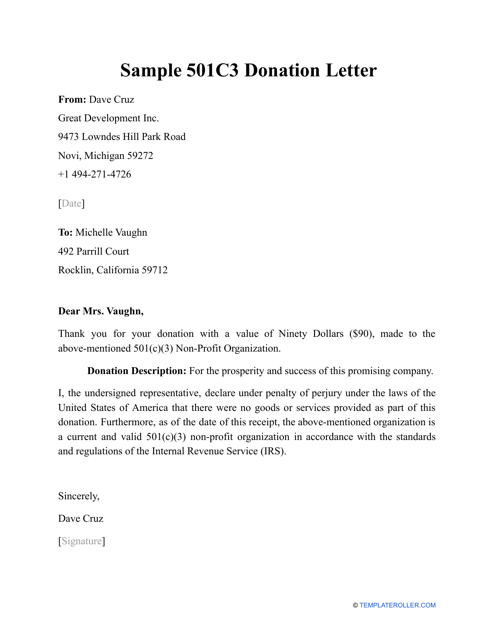

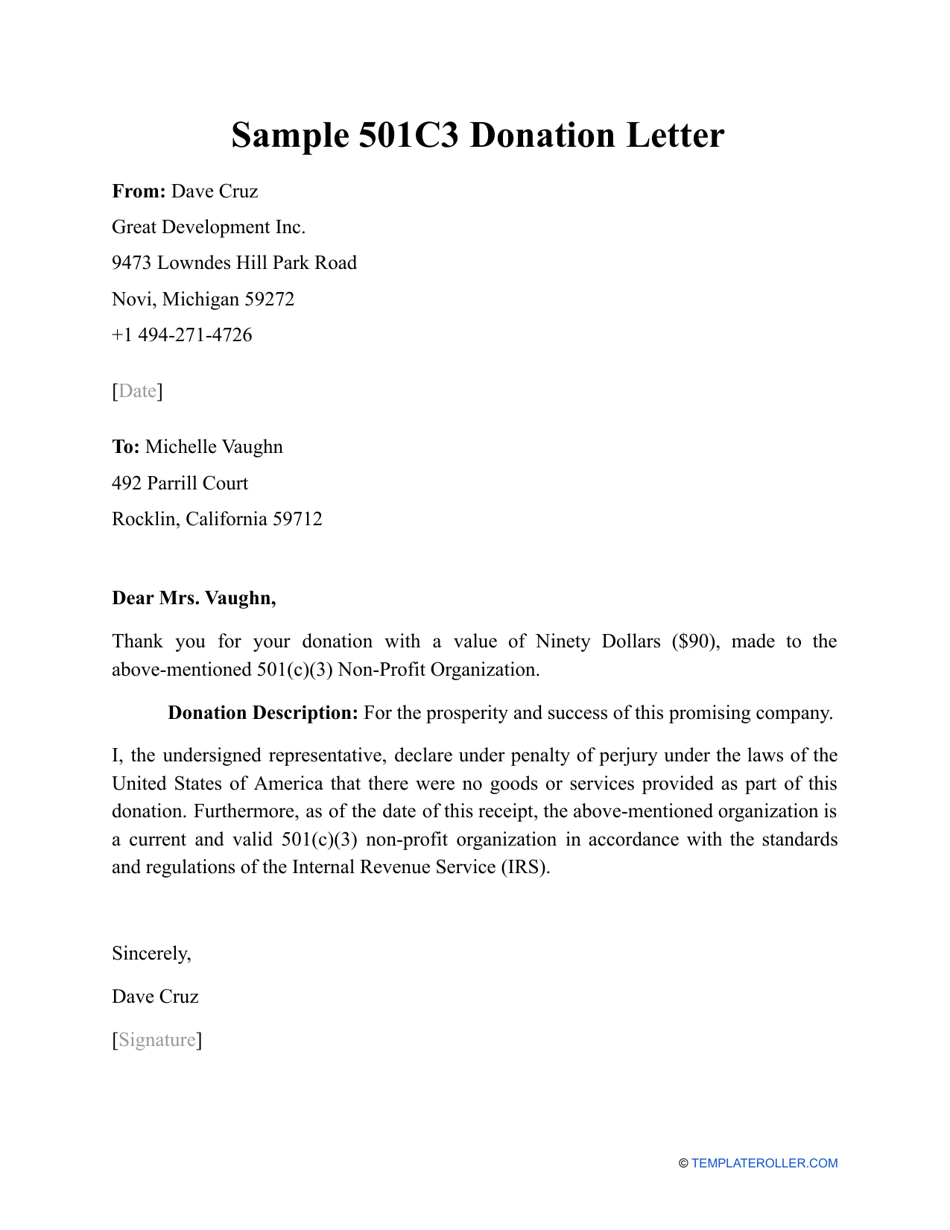

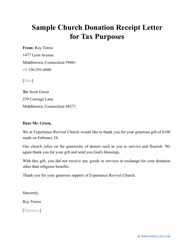

Sample 501c3 Donation Letter

A 501c3 Donation Letter is a formal document prepared by a non-profit organization to acknowledge the contribution of a donor to let the latter claim this sum of money as a tax deduction when they file their annual tax return. If the gift from the individual donor was $250 or more, they may ask you for a statement that verifies the act of giving and later attach this document to their tax paperwork.

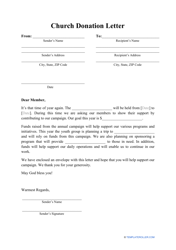

Download a sample 501c3 Donation Letter through the link below. The 501c3 Donation Letter requirements are as follows:

- Confirm the non-profit organization's tax-exempt status. Indicate the name of your entity and record its Employer Identification Number.

- Include the name of the person or company that contributed to the cause . To facilitate identification, you can also add their driver's license number or business address.

- Enter the date the donation was received.

- Describe the donation or valuable gift . As long as you state the monetary value of the contribution, the letter can be accepted as sufficient proof of donation required to qualify for a tax deduction.

- Certify the donor has not received any goods or services from the organization in exchange for their financial assistance.

Once the letter is prepared, consider enclosing a note of gratitude before you send it to the donor - a short message that tells them about the importance of the contribution may motivate them to help you in the future.

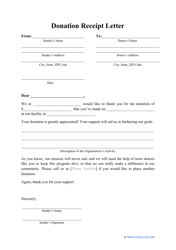

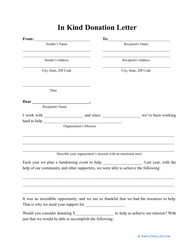

Haven't found the sample you're looking for? Take a look at the related samples and templates below: