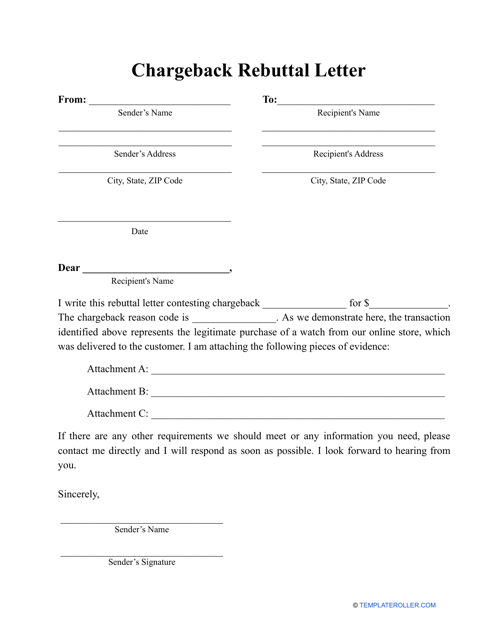

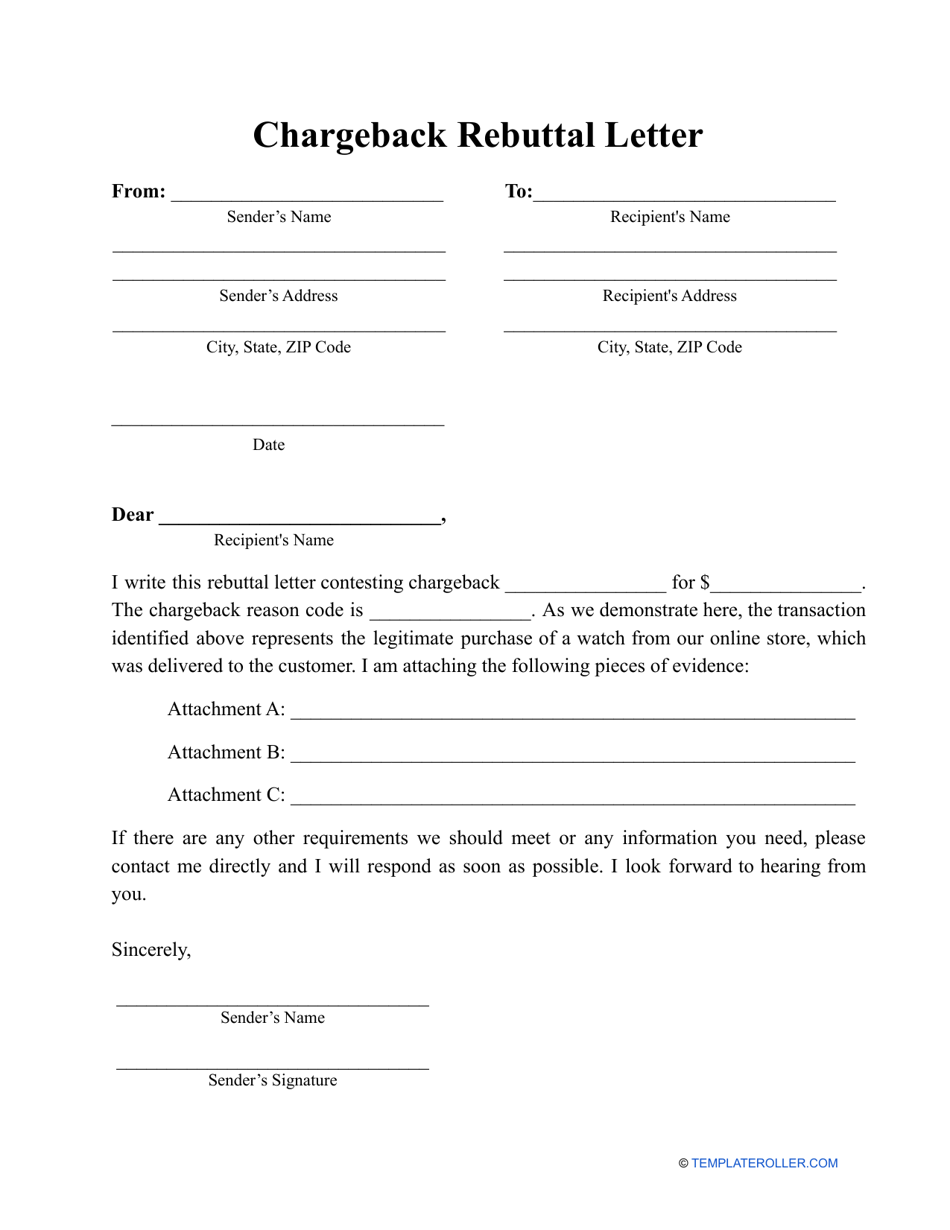

Chargeback Rebuttal Letter Template

A Chargeback Rebuttal Letter is a formal document that informs a financial institution that the refund issued to a customer after they asked to cancel the transaction had no foundation.

Alternate Name:

- Merchant Chargeback Letter.

If the cardholder questioned the transaction and requested their bank to reverse it yet the merchant in question believes the business did not make a mistake and the transaction was authorized by the cardholder, it is possible to contest the decision using this short statement to provide the description of the chargeback and challenge it to get your money back. You may download a Chargeback Rebuttal Letter template through the link below.

How to Write a Chargeback Rebuttal Letter?

Follow these steps to compose a Merchant Chargeback Letter:

- Greet the payment processor - generally, it is a financial institution like the bank.

- Introduce yourself - write down the name of your company and add your identification code - a unique number the payment processing provider has given you to be able to identify your business whenever customers make purchases with their credit and debit cards. Since you already have information about the chargeback, you should also have a specific code from the issuing bank - this code will indicate whether it is alleged fraud, authorization issues, processing errors, or a customer dispute.

- Outline the particulars of the cardholder's original request and certify the amount of funds involved . You need to briefly describe what product or service was sold and purchased.

- Object to the arguments of the other party . Refer to the reason code you have at your disposal - for example, you can confirm the customer has a sales receipt that proves the purchase, show the goods were delivered, list documents or reviews that demonstrate the client was happy about the finalized transaction, or verify the cardholder's relative was properly authorized to go through with the purchase. Attach the documentation you refer to in your statement - the copies should be enough.

- Ask the letter recipient for action - even though the purpose of the rebuttal may seem obvious, it is important to state your wishes clearly in writing.

- Sign the letter and send it to the payment processor before the deadline . Since all banks set their own timelines for inquiries of this nature, you have to act quickly, within days or weeks, and do not wait until the last day. This way, the bank will be able to ask you additional questions, demand supplementary documentation to support the case, and contact the customer to hear their point of view to resolve the issue at hand.

Haven't found the template you're looking for? Take a look at the related templates and samples below: