Mortgage Pre-approval Letter Template

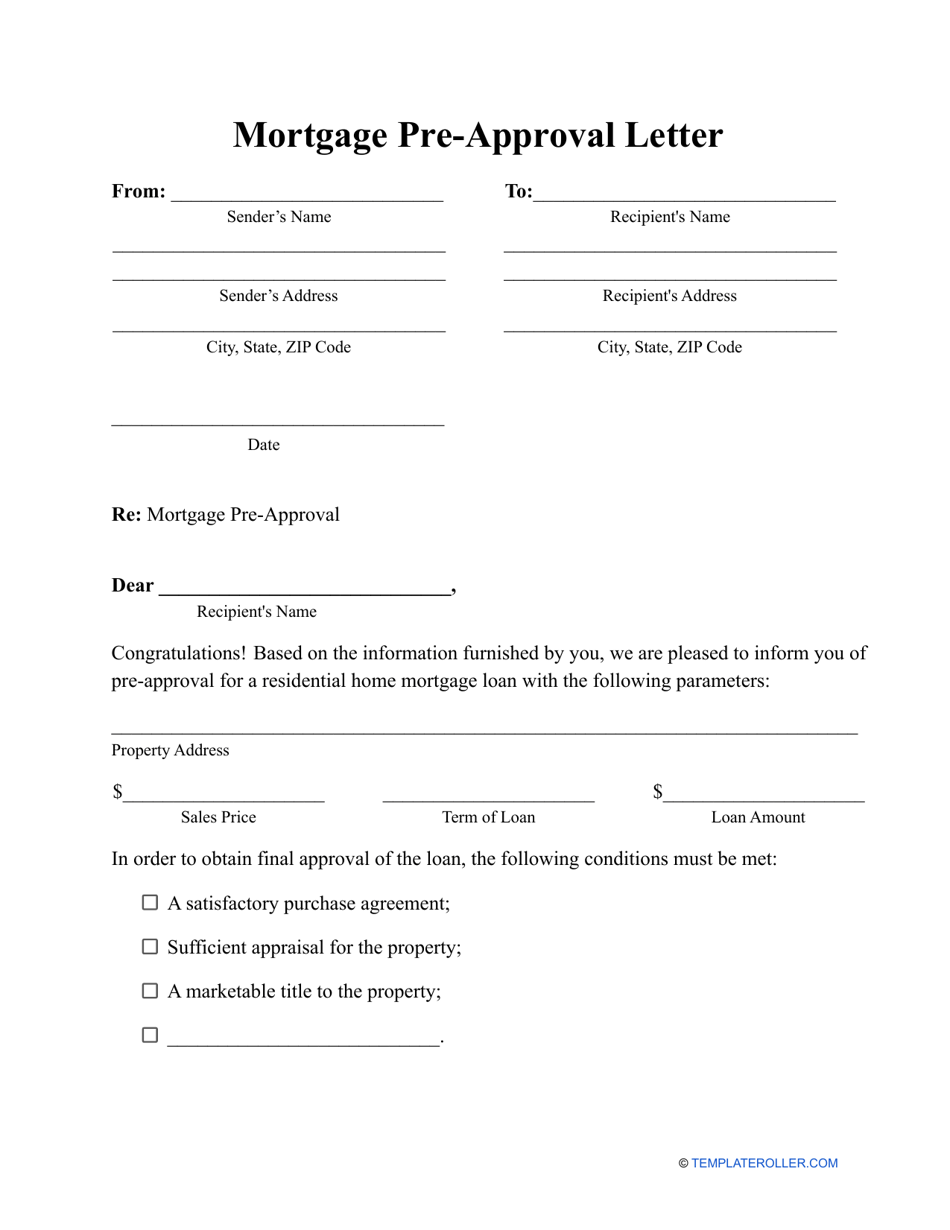

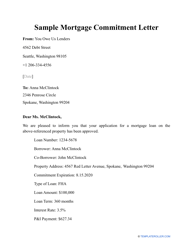

A Mortgage Pre-Approval Letter is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to, inform the applicant about the type and amount of loan they have qualified for, and offer them a chance to sign a mortgage agreement in the nearest future.

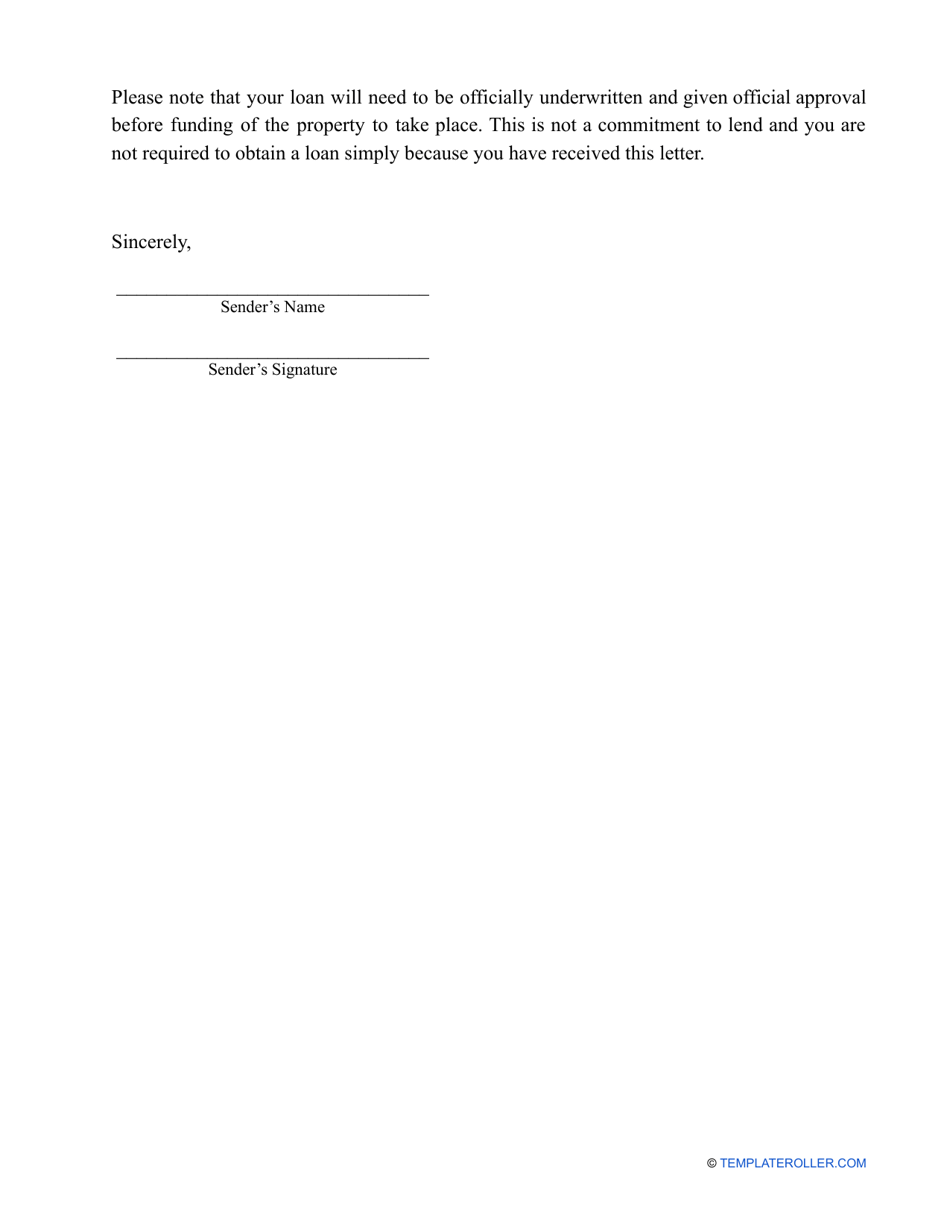

A potential borrower should be aware the pre-approval does not mean the lender is committed to a formalized deal - especially if they include strict conditions for you to follow to be able to get the definitive approval. You can download a Mortgage Pre-Approval Letter template through the link below.

How to Get a Mortgage Pre-Approval Letter?

To be pre-approved for a mortgage, you have to research the future lender, talk to their representative on the phone or in person, and file a mortgage application. This one document will not be enough, however - you must identify yourself, provide proof of income (pay stubs, tax returns, bank statements, gift letters), proof of sale and purchase of the real property, and inform the lender about any issues that may negatively affect your financial standing.

A Pre-Approval Letter for a Mortgage will contain the following sections:

- Identification of the lender and the borrower - it is enough to write down the names and addresses of the parties. The contract to be signed later will indicate more details that will help avoid confusion in case the borrower's name is common or they move out of the old place.

- Unambiguous declaration of the lender to sign the deal . Make sure the letter includes the word "pre-approved" to prevent disputes or disagreements - the borrower may incorrectly assume their loan is already secured.

- State the property address if the borrower has already notified you about their residence of choice.

- Briefly indicate the main terms of the mortgage agreement - the total price of the real estate, the duration of the loan, the mortgage amount, the interest rate, penalties, and amortization. Since the letter is not considered legally binding, the parties may still change the conditions that will be part of the mortgage agreement - mention the provisions are up for discussion.

- List the requirements for the borrower to meet to obtain the mortgage . Typically, you can request them to send you a copy of the sale and purchase agreement, the appraisal statement prepared by the certified expert that determined the market value of the home, and a property title free from defects and claims.

- Add your contact details and ask the borrower to reach out to start the last stage of negotiations.

How Long Does It Take to Get a Mortgage Pre-Approval Letter?

Once you have submitted the mortgage application, wait for two weeks for the lender to process your documentation and respond. If you do not hear from them, you can reach out by calling and then visiting the office to learn whether there are any issues you were not informed about. However, if you are filing the paperwork when interest rates are lower or a public health emergency disrupts the usual workflow, you may have to wait for one or two weeks more - ask the mortgage provider how many days they will take to review your application and proceed accordingly. Additionally, do not wait until you find the perfect house or apartment for yourself and your family and apply for a mortgage straight away - you can look for your new residence while the documentation is under review.

Still looking for a particular template? Take a look at the related templates and samples below: