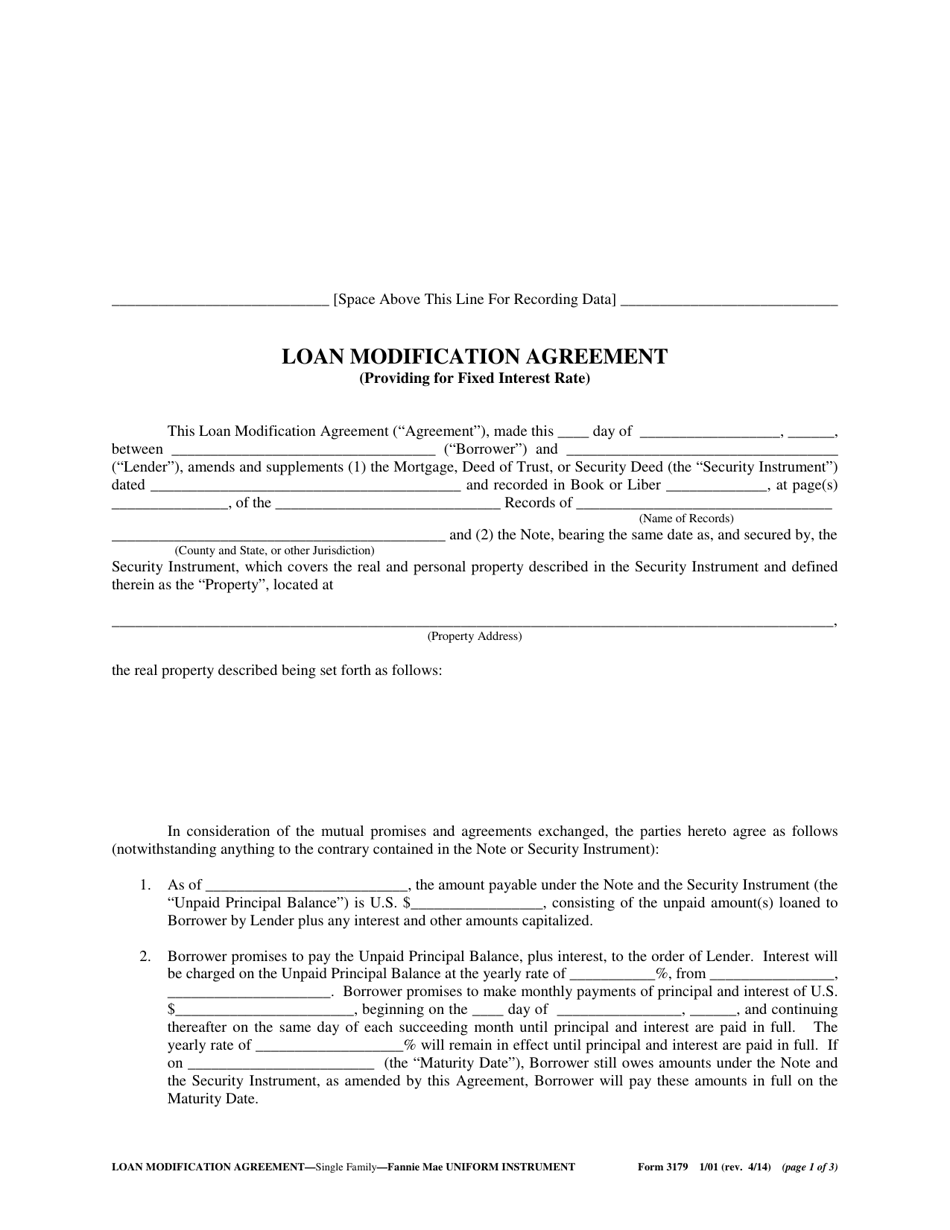

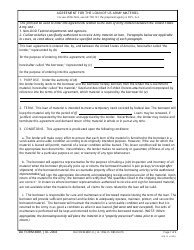

Form 3179 Loan Modification Agreement (Providing for Fixed Interest Rate)

What Is Form 3179?

This is a legal form that was released by the Federal National Mortgage Association (Fannie Mae) on April 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3179 Loan Modification Agreement?

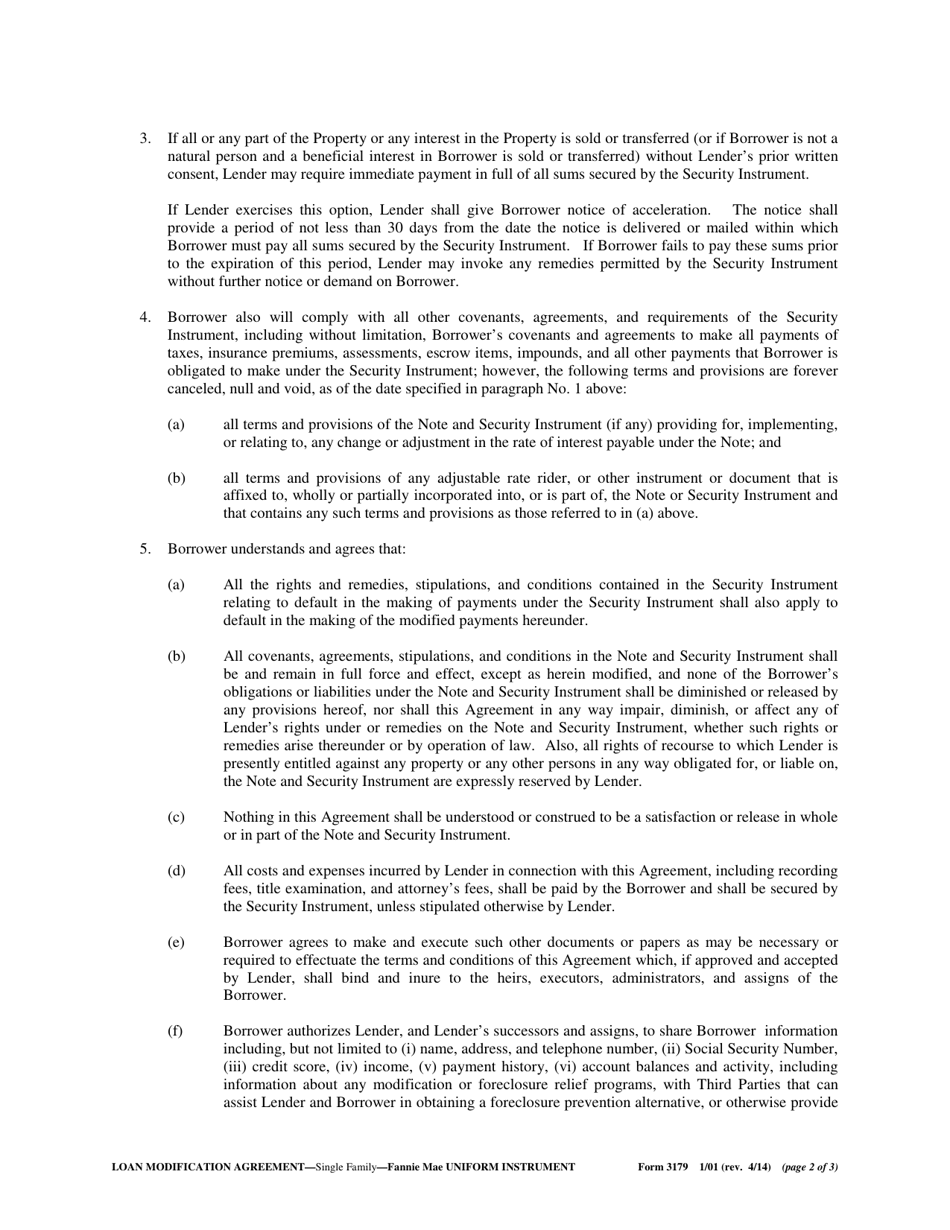

A: Form 3179 Loan Modification Agreement is a legal document used to change the terms of a loan, specifically to create a fixed interest rate.

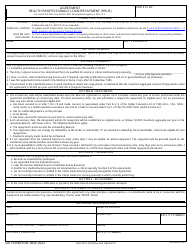

Q: When is Form 3179 Loan Modification Agreement used?

A: Form 3179 Loan Modification Agreement is used when a borrower and lender have agreed to modify the terms of a loan to include a fixed interest rate.

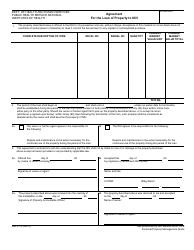

Q: What does Form 3179 Loan Modification Agreement provide for?

A: Form 3179 Loan Modification Agreement provides for a fixed interest rate on a loan that was originally adjustable or variable.

Q: What is the purpose of Form 3179 Loan Modification Agreement?

A: The purpose of Form 3179 Loan Modification Agreement is to establish a fixed interest rate on a loan, providing more stability and predictability for the borrower.

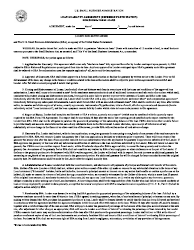

Q: Who needs to sign Form 3179 Loan Modification Agreement?

A: Both the borrower and the lender need to sign Form 3179 Loan Modification Agreement in order for it to be legally binding.

Q: Is Form 3179 Loan Modification Agreement binding?

A: Yes, Form 3179 Loan Modification Agreement is legally binding once both the borrower and lender have signed it.

Q: Can I modify other terms of my loan with Form 3179 Loan Modification Agreement?

A: While the primary purpose of Form 3179 Loan Modification Agreement is to establish a fixed interest rate, it may also be possible to modify other terms of the loan through additional agreements.

Form Details:

- Released on April 1, 2014;

- The latest available edition released by the Federal National Mortgage Association (Fannie Mae);

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3179 by clicking the link below or browse more documents and templates provided by the Federal National Mortgage Association (Fannie Mae).