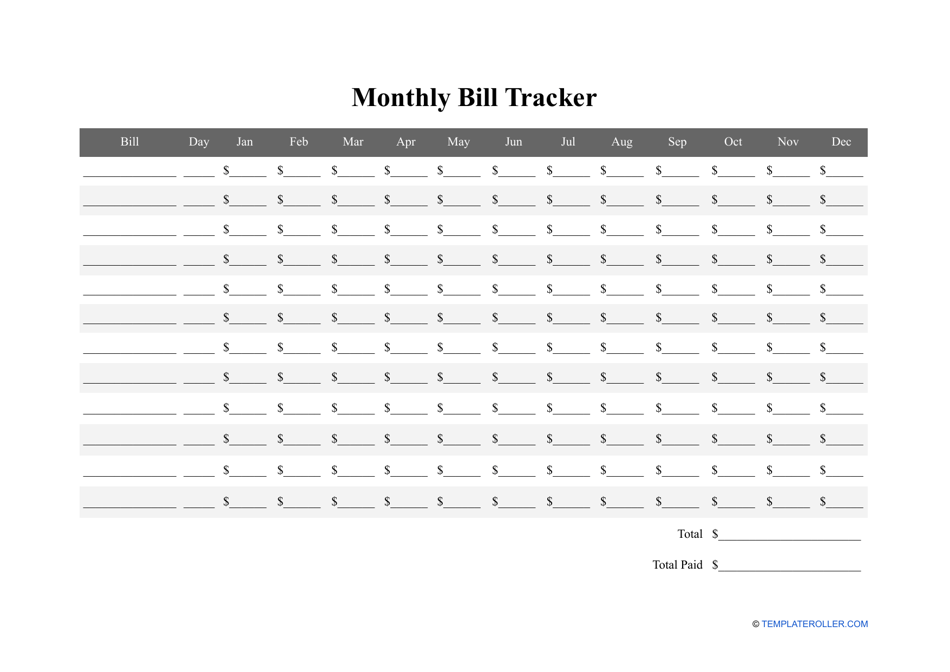

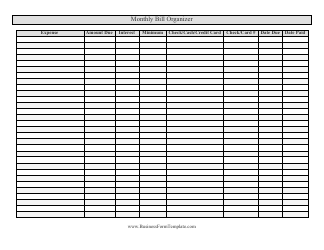

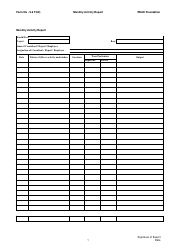

Monthly Bill Tracker Template

A Monthly Bill Tracker is a structured document that organizes the bills and helps the person who drafted it to pay the bills on time and avoid penalties or fines. Whether you only deal with your own money or are responsible for the entire household of people with various bills, it is necessary to have a good system in place to monitor all the fixed expenses since most bills require monthly payments. You can download a Monthly Bill Tracker template via the link below.

Alternate Name:

- Monthly Bill Tracking Sheet.

If you create a Bill Tracker, you will be able to prevent unnecessary spending and ensure you always have the extra money in your account, learn how much money you require every month, and discover budget discrepancies - bills you may not need or payments that should have been cut off a long time ago.

How Do I Keep Track of My Monthly Bills?

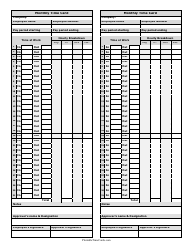

Follow these steps to draft a Monthly Bill Tracker Spreadsheet:

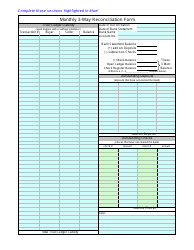

- You can draw a table using a pen and a sheet of paper or create an Excel file . An electronic version of the Bill Tracker may be preferable if you are not sure how many bills you need to take care of. Additionally, it will allow you to correct mistakes you find along the way and quickly address disparities. If you are an advanced Excel user, you may embed formulas to calculate your monthly expenses. However, do not be in a hurry to get rid of all the paper bills unless you are sure you will not need them anymore.

- Add several columns to the table - the name of the bill, the amount of money you have to pay, the payment due date, and twelve months of the year . You may add a column that indicates the proper time to deal with the bill instead of leaving it until the very last moment.

- List bills in appropriate order - you can sort them by the payment deadline or simply write them down while you go through paper bills and electronic statements you have received. Alternatively, you can group the bills by categories - taxes, insurance, mortgage, utility bills (water, electricity, and gas), phone, Internet, and TV bills.

- If you live with neighbors or friends and you share the financial burden of maintaining the residence, regroup the bills to reflect the amount of money every individual should contribute every month.

- Leave some space at the bottom of the tracker to insert reminders of bills you were unable to deal with at the right time . Keep track of all the unpaid bills and add the appropriate amounts to the figures you have computed for the upcoming months.

Still looking for a particular template? Take a look at the related templates below: