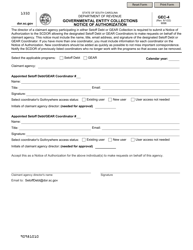

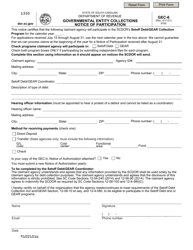

This version of the form is not currently in use and is provided for reference only. Download this version of

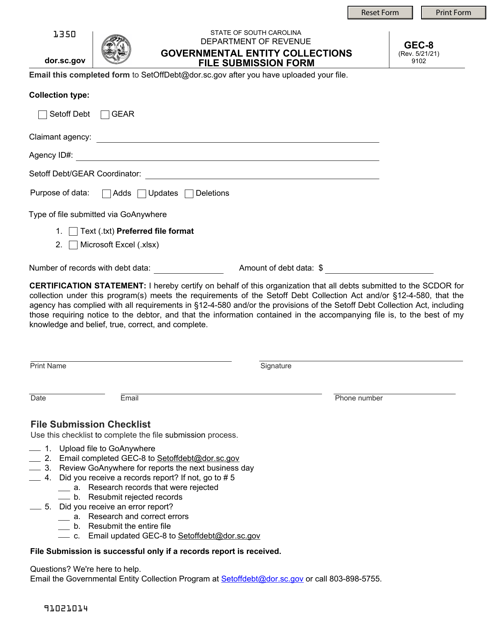

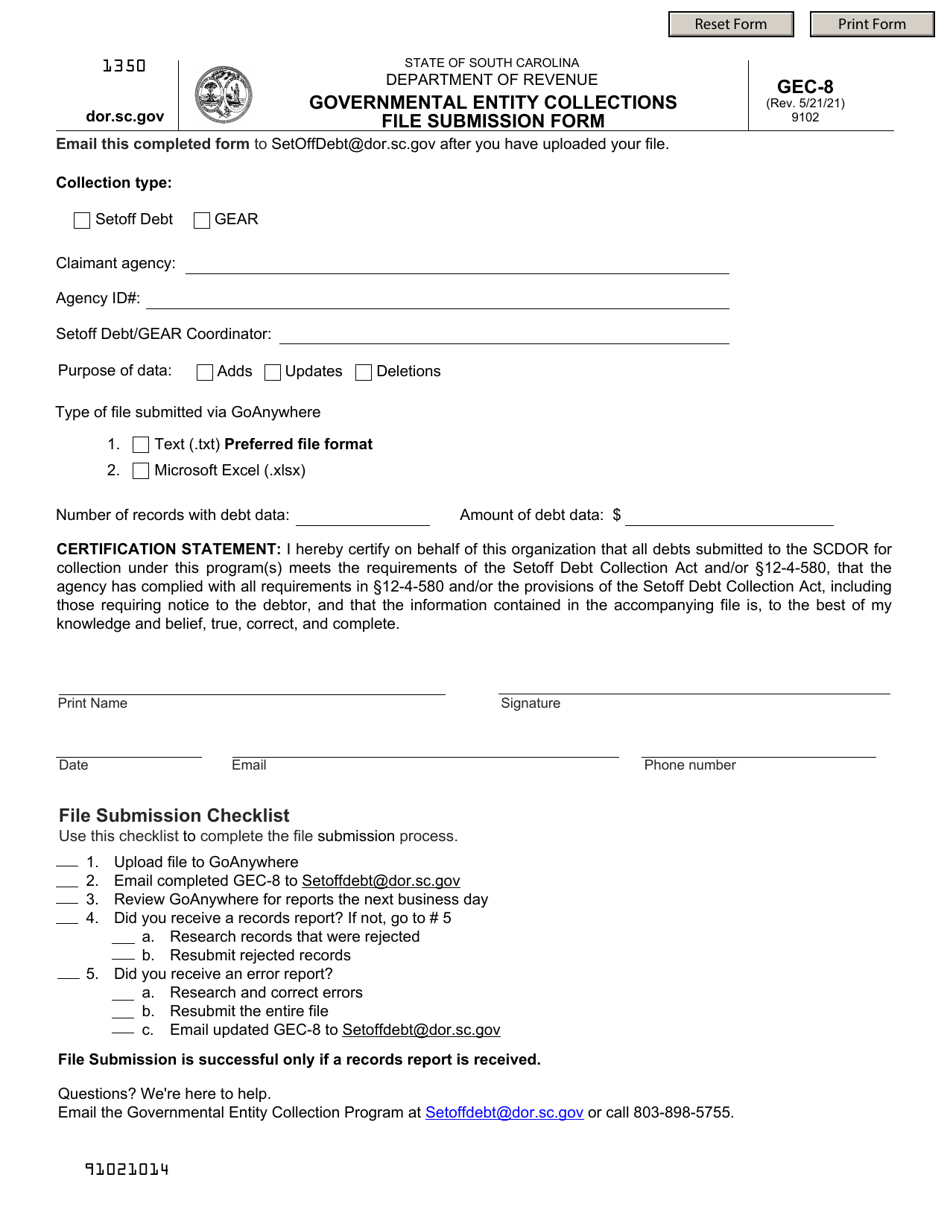

Form GEC-8

for the current year.

Form GEC-8 Governmental Entity Collections File Submission Form - South Carolina

What Is Form GEC-8?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GEC-8?

A: Form GEC-8 is the Governmental Entity Collections File Submission Form.

Q: What is the purpose of Form GEC-8?

A: The purpose of Form GEC-8 is to submit collection files for governmental entities in South Carolina.

Q: Who needs to fill out Form GEC-8?

A: Governmental entities in South Carolina that are collecting debts need to fill out Form GEC-8.

Q: What information is required on Form GEC-8?

A: Form GEC-8 requires information such as the name of the governmental entity, contact information, collection agency information, and details about the debts collected.

Q: Are there any fees associated with Form GEC-8?

A: No, there are no fees associated with Form GEC-8.

Q: What is the deadline for submitting Form GEC-8?

A: The deadline for submitting Form GEC-8 is specified on the form and may vary.

Q: Is Form GEC-8 applicable for individual debt collections?

A: No, Form GEC-8 is only applicable for governmental entity debt collections.

Q: Is Form GEC-8 required for out-of-state collections?

A: Yes, Form GEC-8 is required for out-of-state collections if the governmental entity is located in South Carolina.

Form Details:

- Released on May 21, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GEC-8 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.