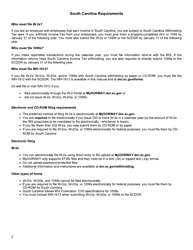

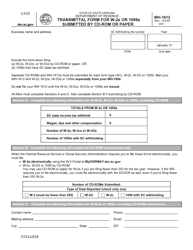

Form RS-1 Instructions and Specifications for Filing W-2s - South Carolina

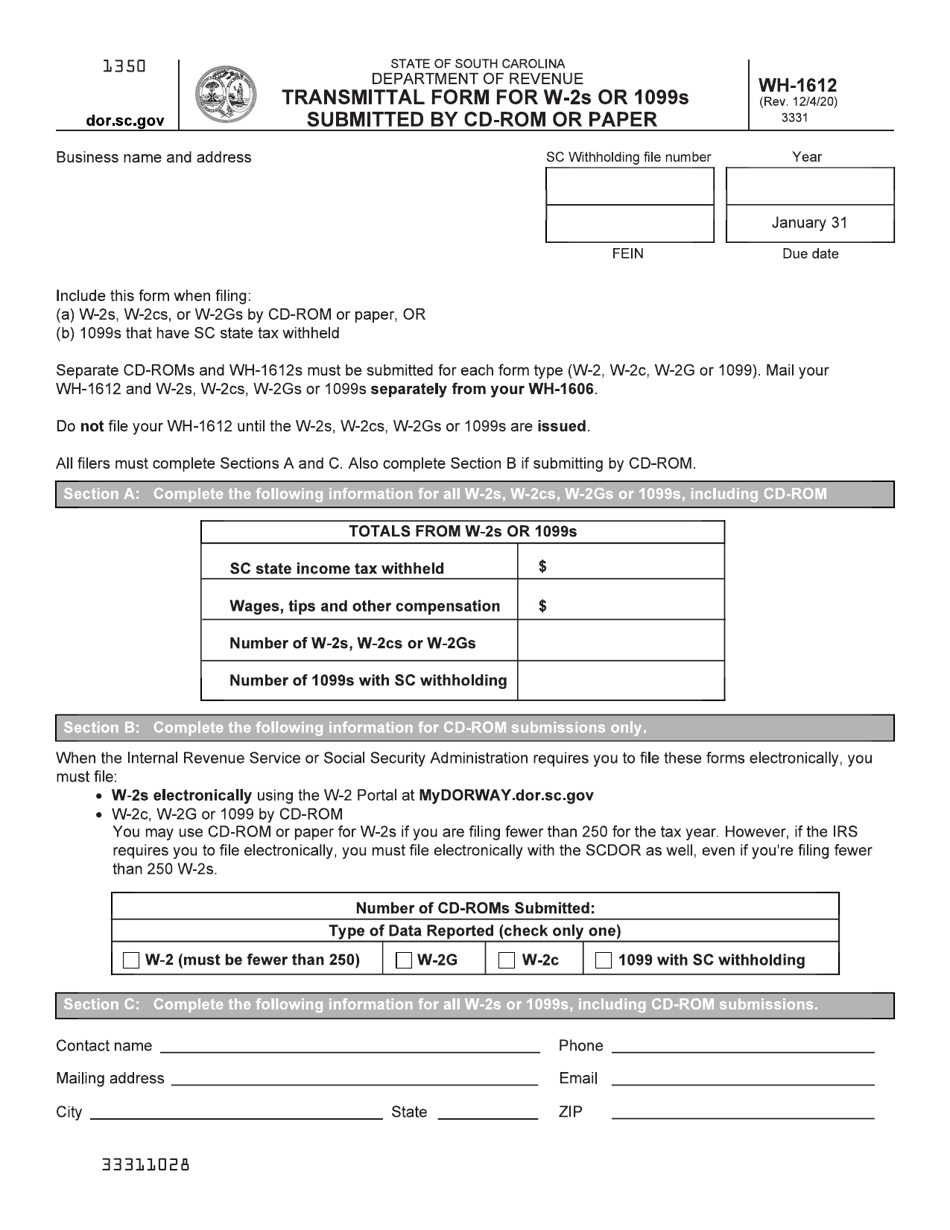

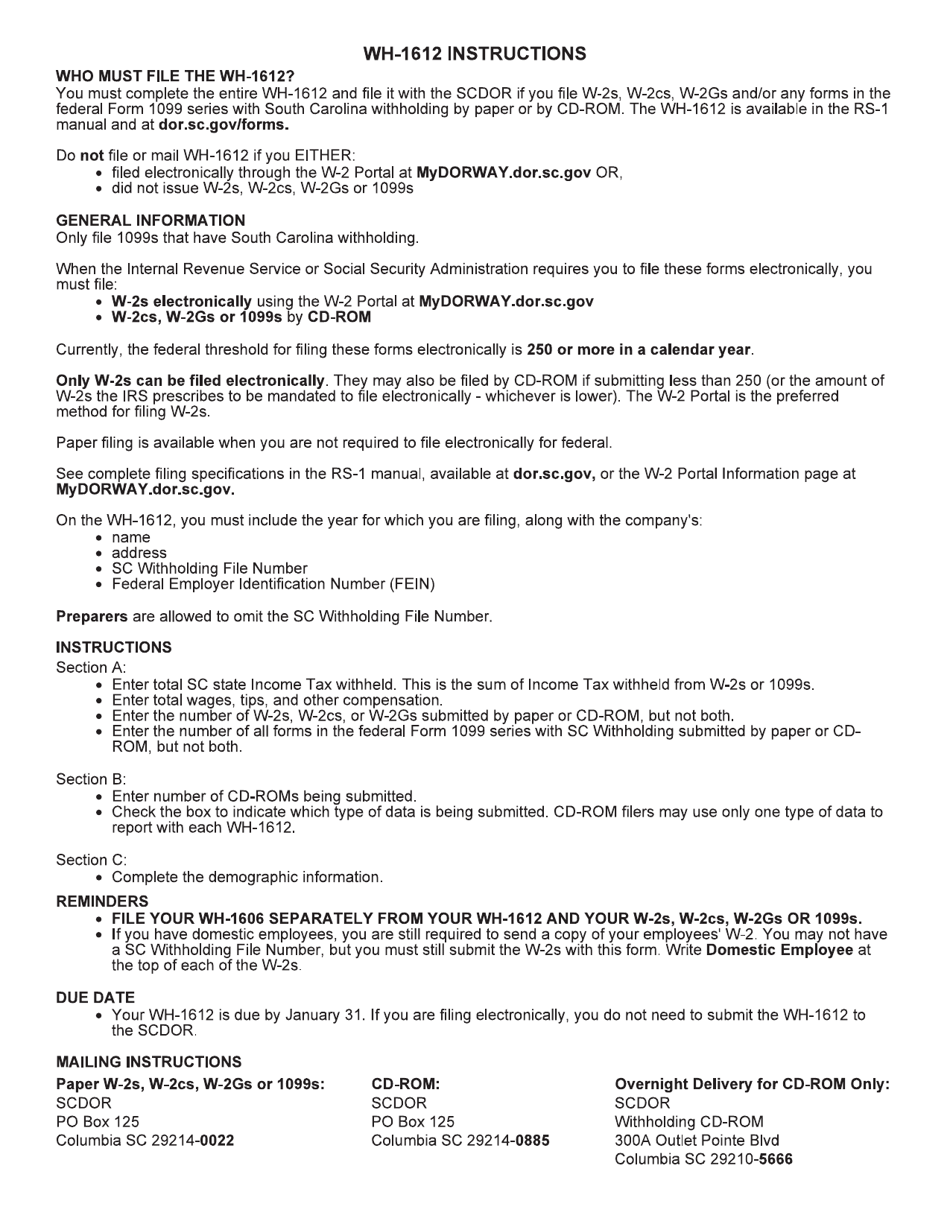

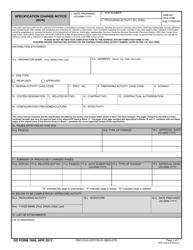

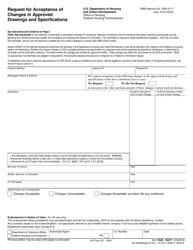

What Is Form RS-1?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

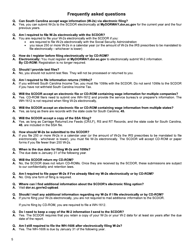

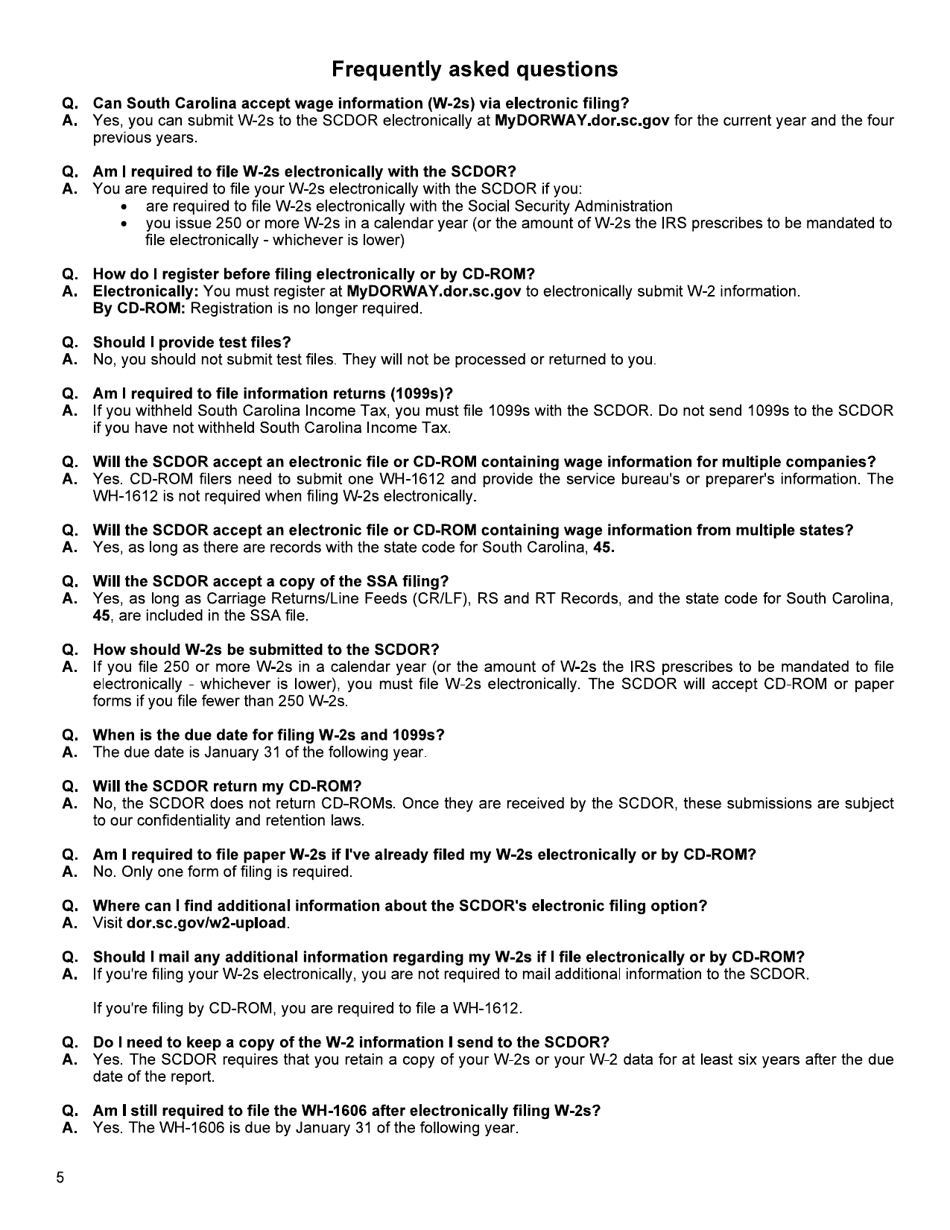

Q: What is Form RS-1?

A: Form RS-1 is the form used to file W-2s in South Carolina.

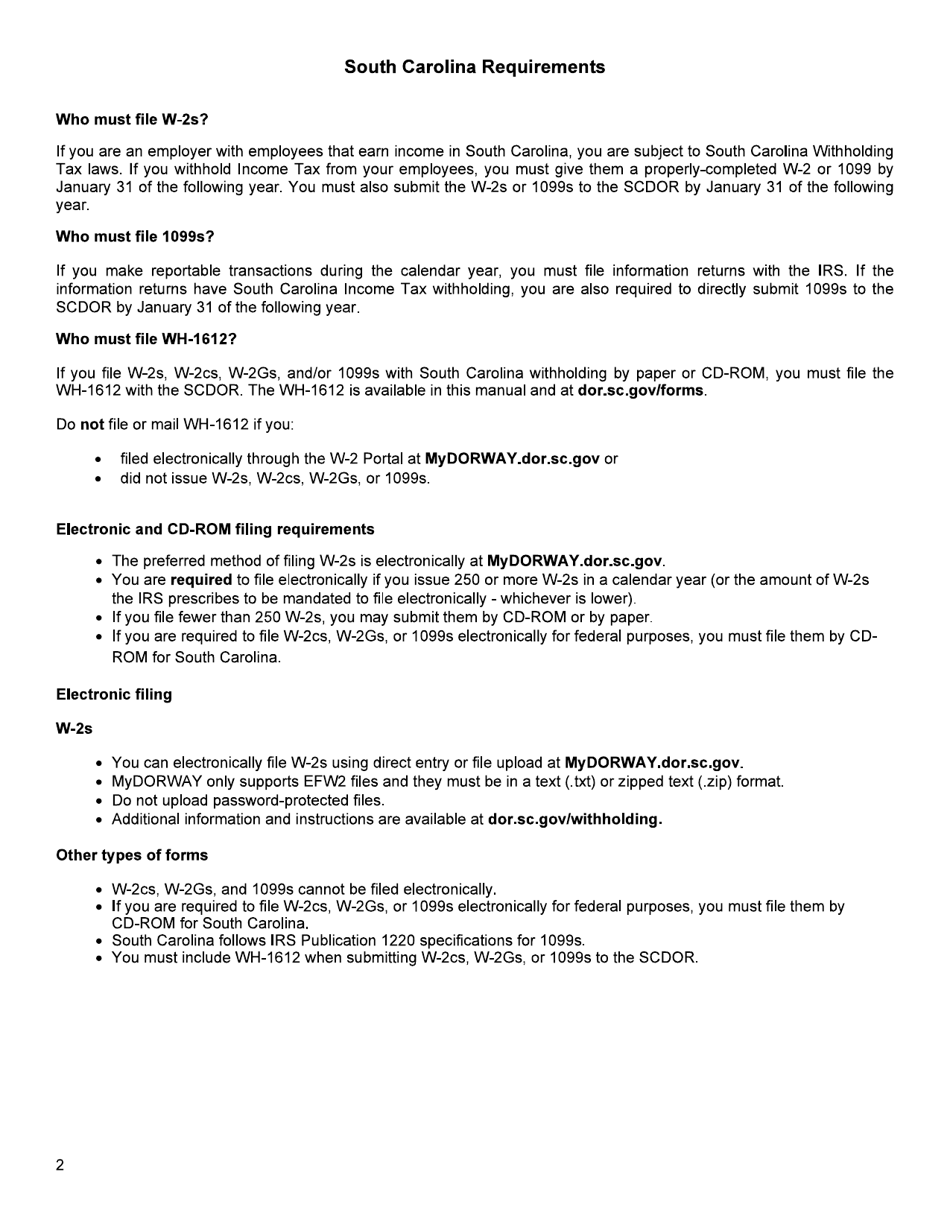

Q: Who should file Form RS-1?

A: Employers in South Carolina who have employees to whom they paid wages during the year should file Form RS-1.

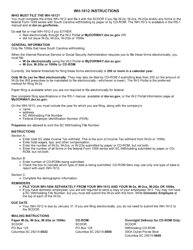

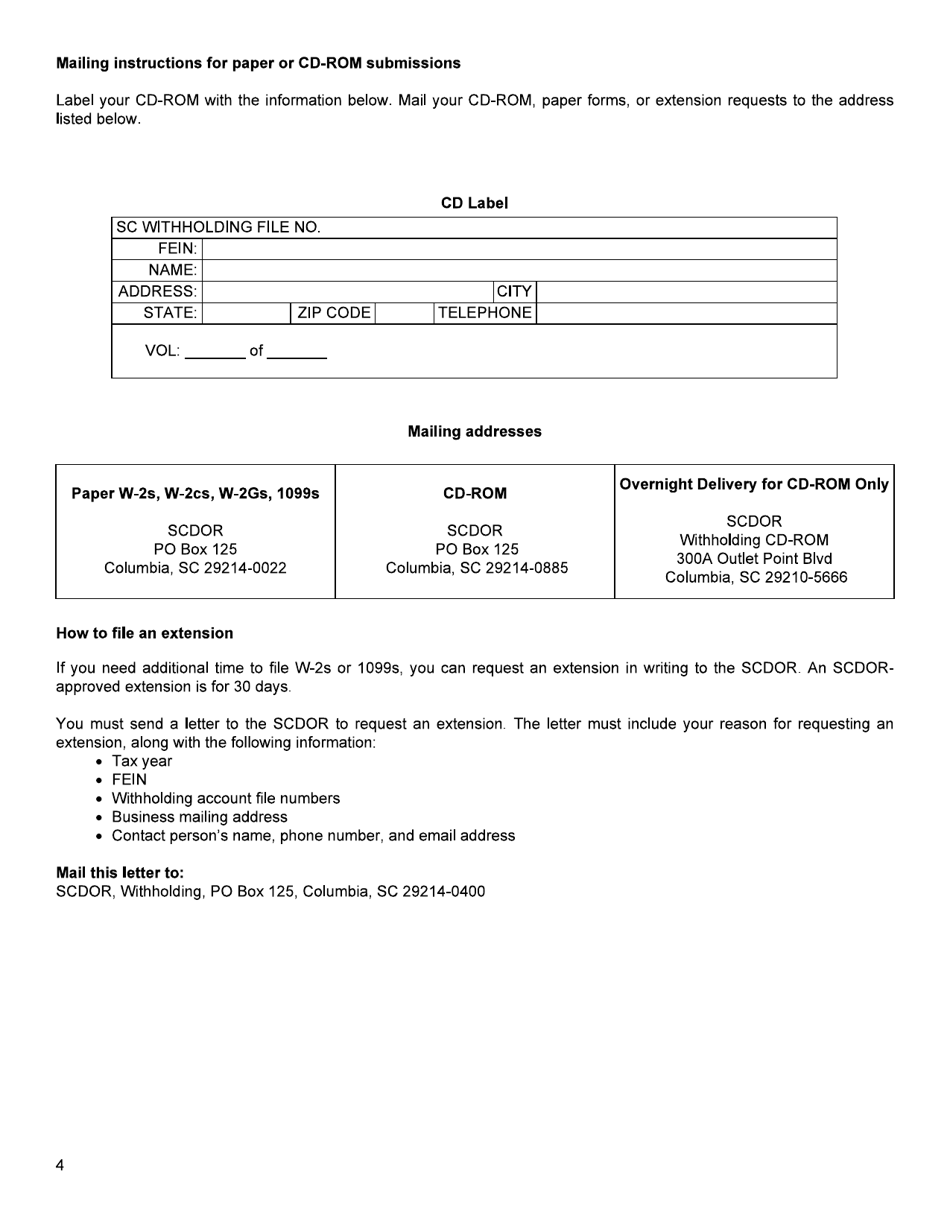

Q: How do I file Form RS-1?

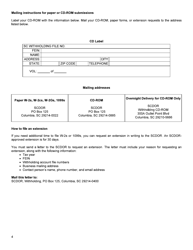

A: Form RS-1 can be filed electronically or by mail. Electronic filing is encouraged.

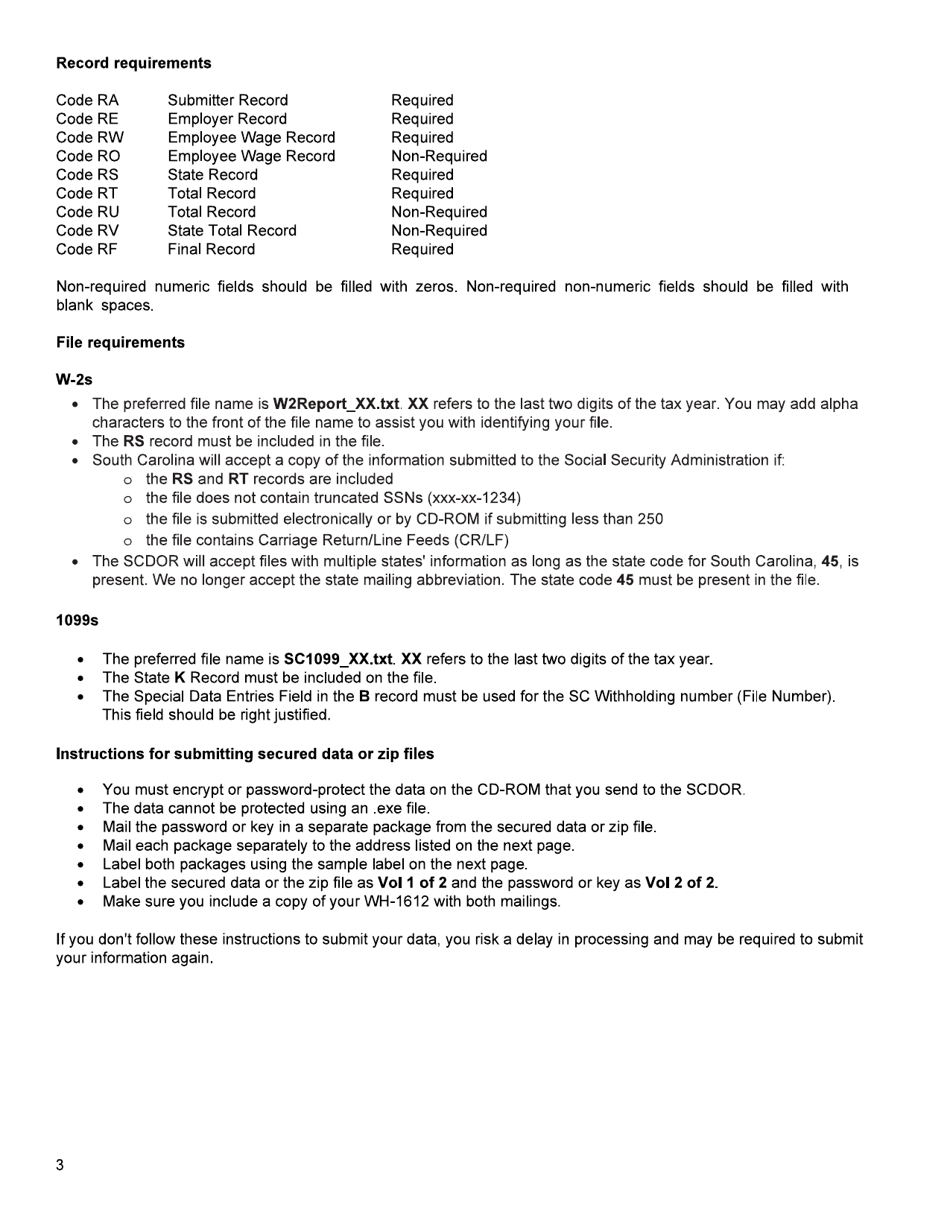

Q: What information do I need to file Form RS-1?

A: You will need the employer's name, address, EIN, and total amounts of wages, tips, and other compensation paid to employees.

Q: When is the deadline for filing Form RS-1?

A: Form RS-1 must be filed by the last day of January following the close of the calendar year.

Q: What happens if I file Form RS-1 late?

A: Late filings may be subject to penalties and interest.

Form Details:

- Released on June 18, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RS-1 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.