This version of the form is not currently in use and is provided for reference only. Download this version of

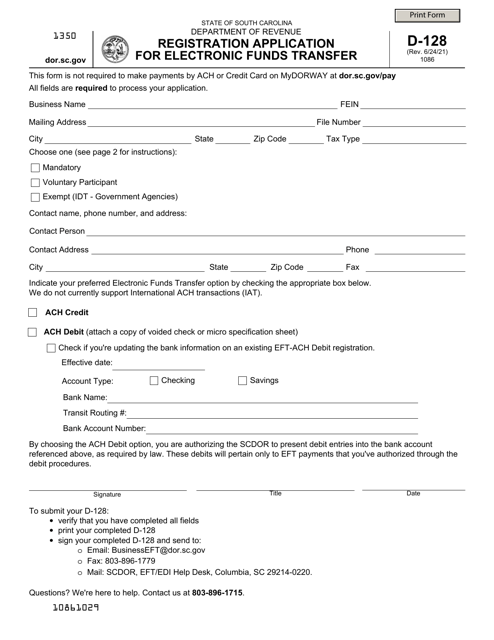

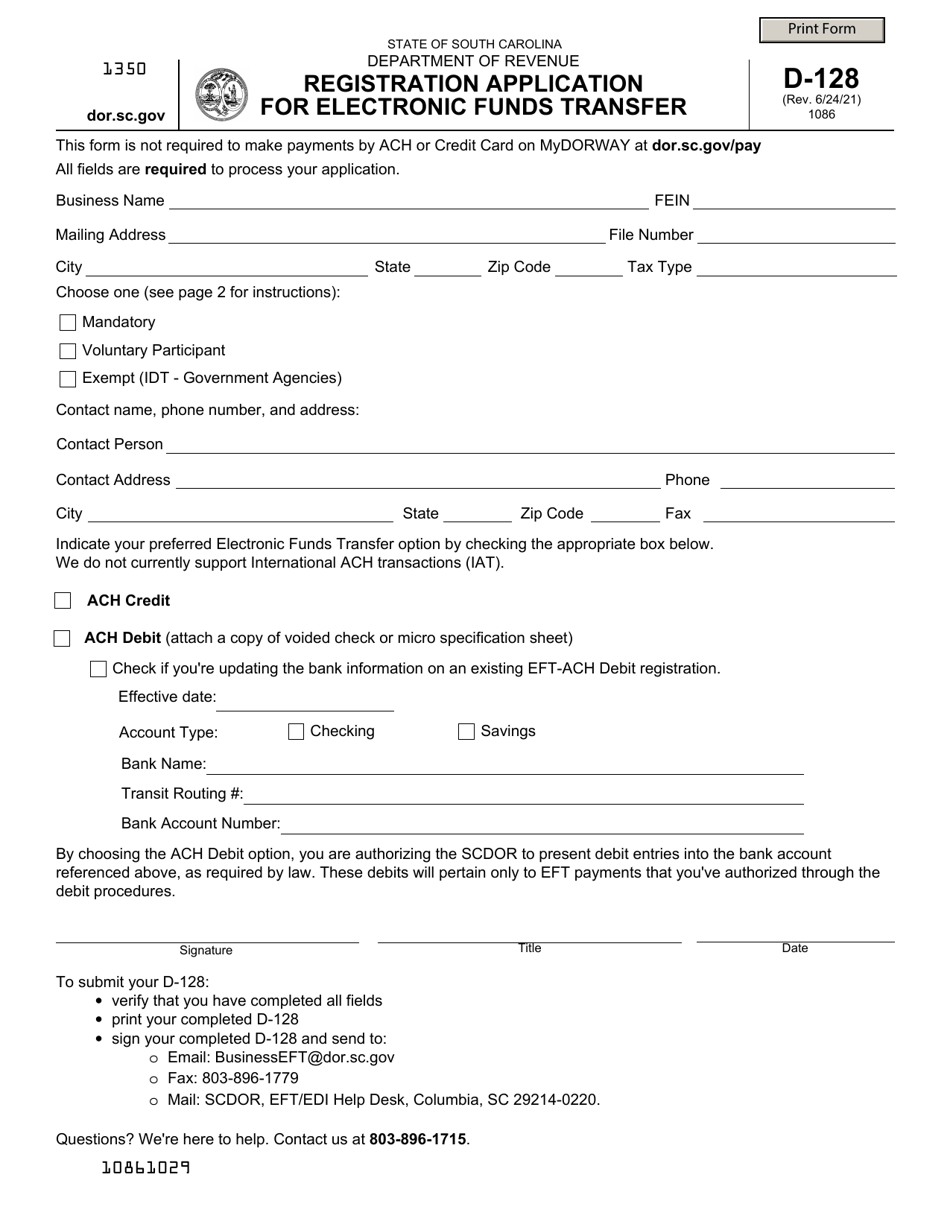

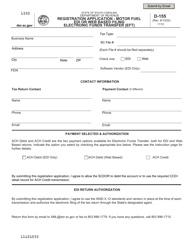

Form D-128

for the current year.

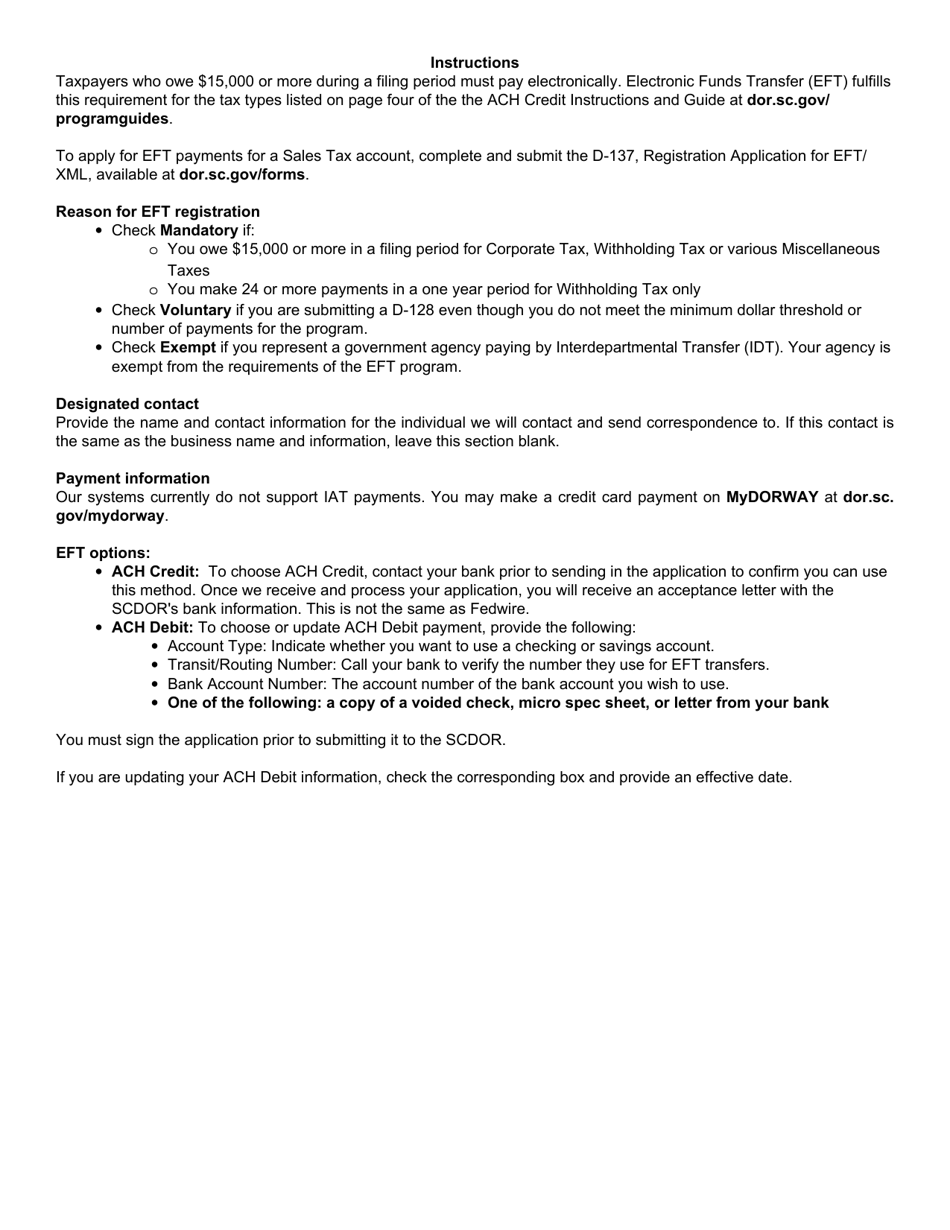

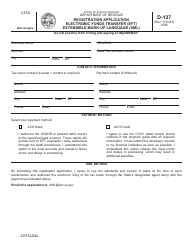

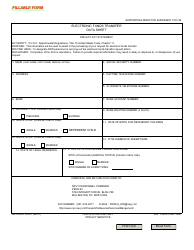

Form D-128 Registration Application for Electronic Funds Transfer - South Carolina

What Is Form D-128?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-128?

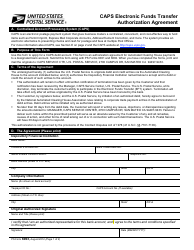

A: Form D-128 is the Registration Application for Electronic Funds Transfer in South Carolina.

Q: What is the purpose of Form D-128?

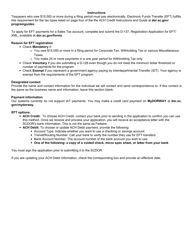

A: The purpose of Form D-128 is to register for electronic funds transfer for tax payments in South Carolina.

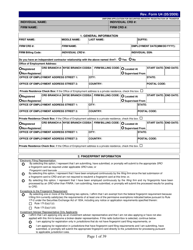

Q: Who needs to fill out Form D-128?

A: Anyone who wants to make tax payments through electronic funds transfer in South Carolina needs to fill out Form D-128.

Q: Is Form D-128 only for residents of South Carolina?

A: No, Form D-128 can be used by both residents and non-residents of South Carolina who need to make tax payments in the state.

Q: Are there any fees for using electronic funds transfer?

A: There may be fees associated with electronic funds transfer. It is best to check with your financial institution for any applicable fees.

Q: Is Form D-128 mandatory?

A: No, filling out Form D-128 is not mandatory. It is an option for those who prefer to make tax payments through electronic funds transfer.

Q: What information is required on Form D-128?

A: Form D-128 requires information such as the taxpayer's name, address, contact information, banking information, and the types of taxes they will be paying.

Q: How long does it take to process Form D-128?

A: The processing time for Form D-128 may vary. It is recommended to submit the form well in advance of the tax payment deadline to ensure timely processing.

Form Details:

- Released on June 24, 2021;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-128 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.