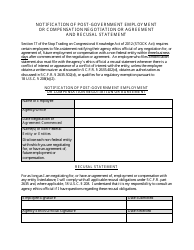

State of Montana 457(B) Deferred Compensation Plan Adoption Agreement - Sample - Montana

State of Montana 457(B) Deferred Adoption Agreement - Sample is a legal document that was released by the Montana Public Employee Retirement Administration - a government authority operating within Montana.

FAQ

Q: What is a 457(b) Deferred Compensation Plan?

A: A 457(b) Deferred Compensation Plan is a retirement plan available to employees of state and local governments and certain tax-exempt organizations.

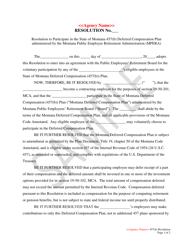

Q: Who can participate in the Montana 457(b) Deferred Compensation Plan?

A: Employees of the State of Montana, local governments, and certain tax-exempt organizations can participate in the Montana 457(b) Deferred Compensation Plan.

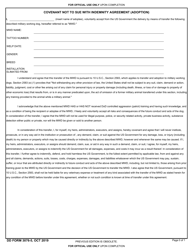

Q: What is the purpose of the Adoption Agreement?

A: The Adoption Agreement is a legal document that establishes the terms and conditions under which the employer will contribute to the employee's 457(b) Deferred Compensation Plan.

Q: What are the benefits of participating in the Montana 457(b) Plan?

A: Participating in the Montana 457(b) Plan allows employees to save for retirement on a tax-advantaged basis, with contributions made before taxes are deducted.

Q: Can employees contribute to the Montana 457(b) Plan?

A: Yes, employees can make pre-tax contributions to the Montana 457(b) Plan, up to the annual contribution limit set by the IRS.

Q: Is there a minimum contribution requirement for the Montana 457(b) Plan?

A: No, there is no minimum contribution requirement for the Montana 457(b) Plan.

Q: Can employees make catch-up contributions to the Montana 457(b) Plan?

A: Yes, employees who are age 50 or older can make additional catch-up contributions to the Montana 457(b) Plan, up to a certain limit set by the IRS.

Q: Are there any fees associated with the Montana 457(b) Plan?

A: Yes, there may be administrative fees associated with the Montana 457(b) Plan. It is important to review the plan documents for details.

Q: Can employees change their contribution amount or investment options?

A: Yes, employees can change their contribution amount and investment options in the Montana 457(b) Plan, subject to any restrictions set by the plan administrator.

Q: What happens to the funds in the Montana 457(b) Plan if an employee leaves their job?

A: If an employee leaves their job, they can generally roll over the funds in the Montana 457(b) Plan to another eligible retirement plan or take a distribution, subject to IRS rules and potential taxes and penalties.

Form Details:

- The latest edition currently provided by the Montana Public Employee Retirement Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Montana Public Employee Retirement Administration.