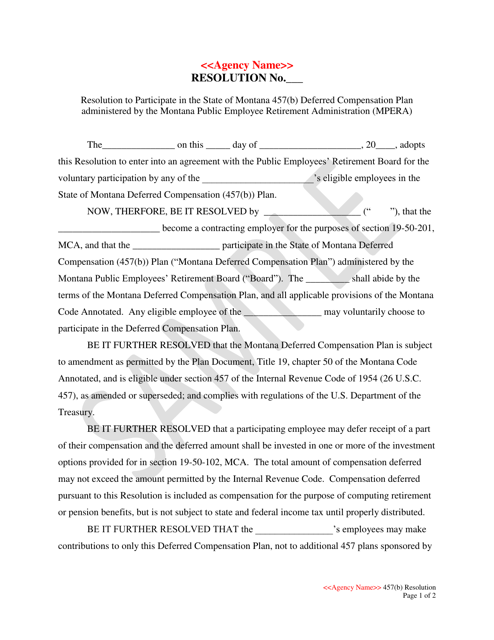

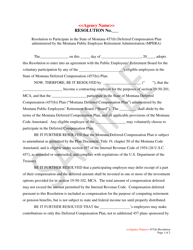

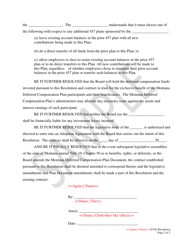

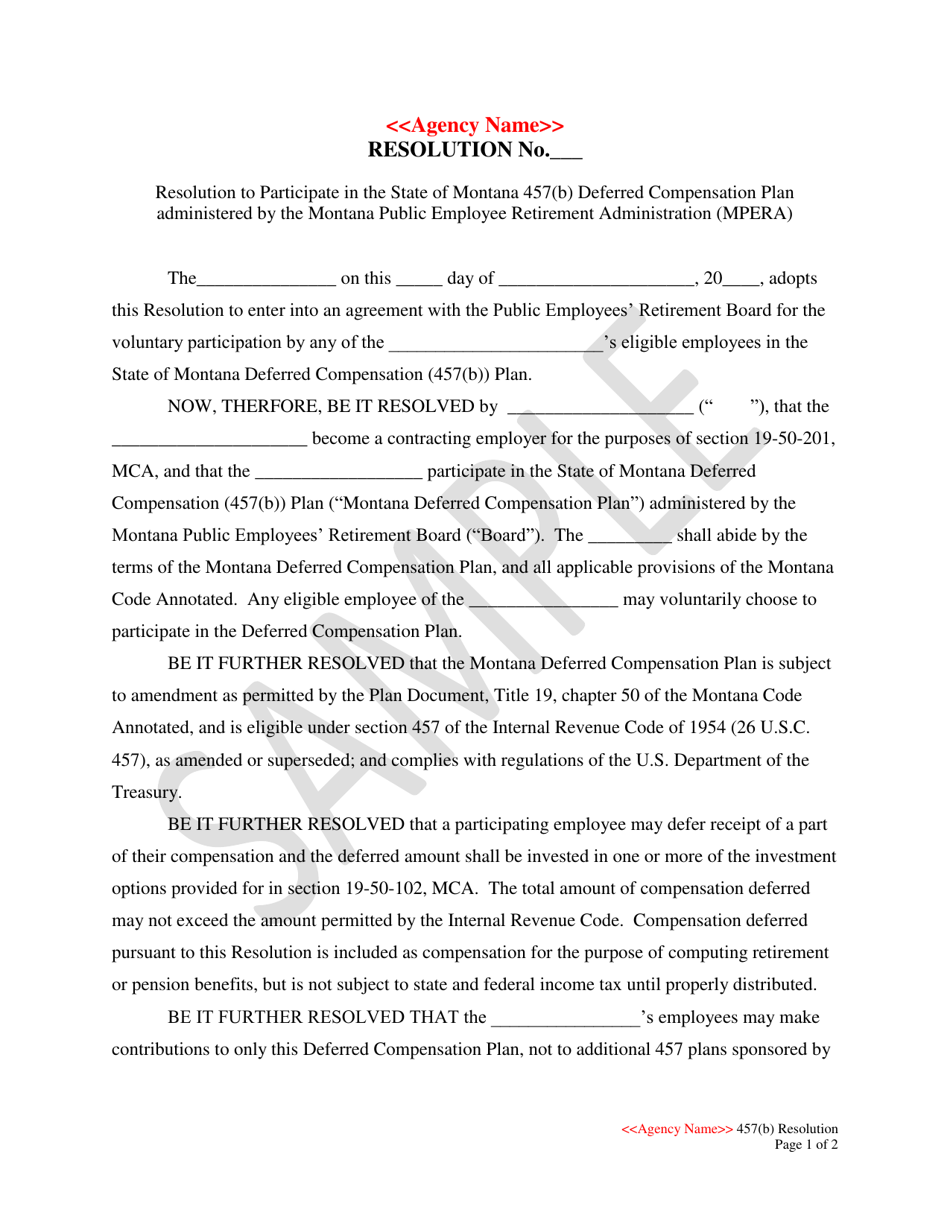

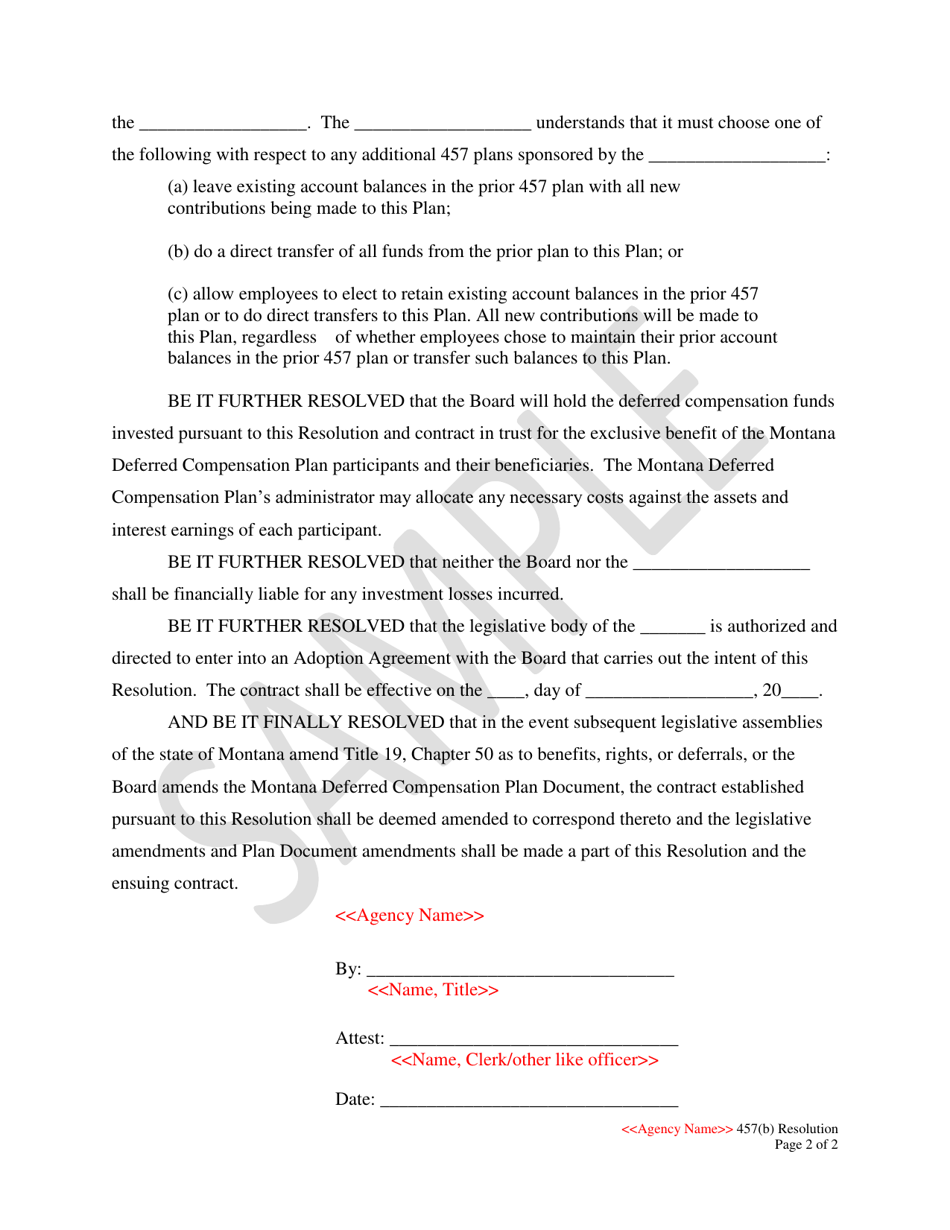

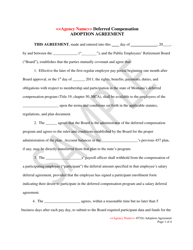

Resolution to Participate in the State of Montana 457(B) Deferred Compensation Plan - Sample - Montana

Resolution to Participate in the State of Montana 457(B) Deferred Compensation Plan - Sample is a legal document that was released by the Montana Public Employee Retirement Administration - a government authority operating within Montana.

FAQ

Q: What is the State of Montana 457(B) Deferred Compensation Plan?

A: The State of Montana 457(B) Deferred Compensation Plan is a retirement savings plan for employees of the state of Montana.

Q: Who can participate in the State of Montana 457(B) Deferred Compensation Plan?

A: Employees of the state of Montana can participate in the plan.

Q: What is the purpose of the State of Montana 457(B) Deferred Compensation Plan?

A: The purpose of the plan is to provide employees with a way to save for retirement through pre-tax contributions.

Q: How does the State of Montana 457(B) Deferred Compensation Plan work?

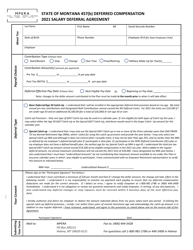

A: Employees can contribute a portion of their salary to the plan on a pre-tax basis, and the contributions are invested to grow over time. Withdrawals are allowed after retirement.

Q: Are there any tax advantages to participating in the State of Montana 457(B) Deferred Compensation Plan?

A: Yes, participating in the plan offers tax advantages, as contributions are made with pre-tax dollars and grow tax-deferred until withdrawal.

Q: Can employees change their contribution amount to the State of Montana 457(B) Deferred Compensation Plan?

A: Yes, employees can change their contribution amount at any time within the limits set by the plan.

Q: What happens if an employee leaves their job before retirement?

A: If an employee leaves their job, they have options such as rolling over the plan balance to an IRA or another eligible retirement plan.

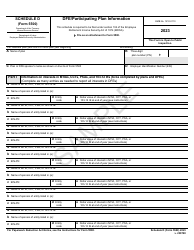

Q: What is the maximum contribution limit for the State of Montana 457(B) Deferred Compensation Plan?

A: The maximum contribution limit for the plan is set by the IRS and may change each year.

Form Details:

- The latest edition currently provided by the Montana Public Employee Retirement Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Montana Public Employee Retirement Administration.