This version of the form is not currently in use and is provided for reference only. Download this version of

Form SFN24770

for the current year.

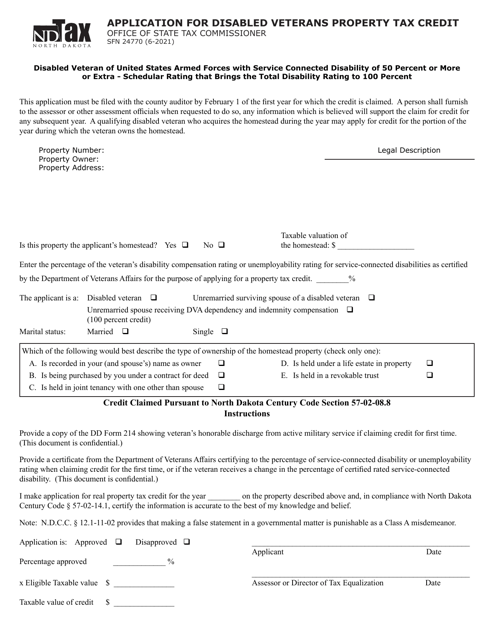

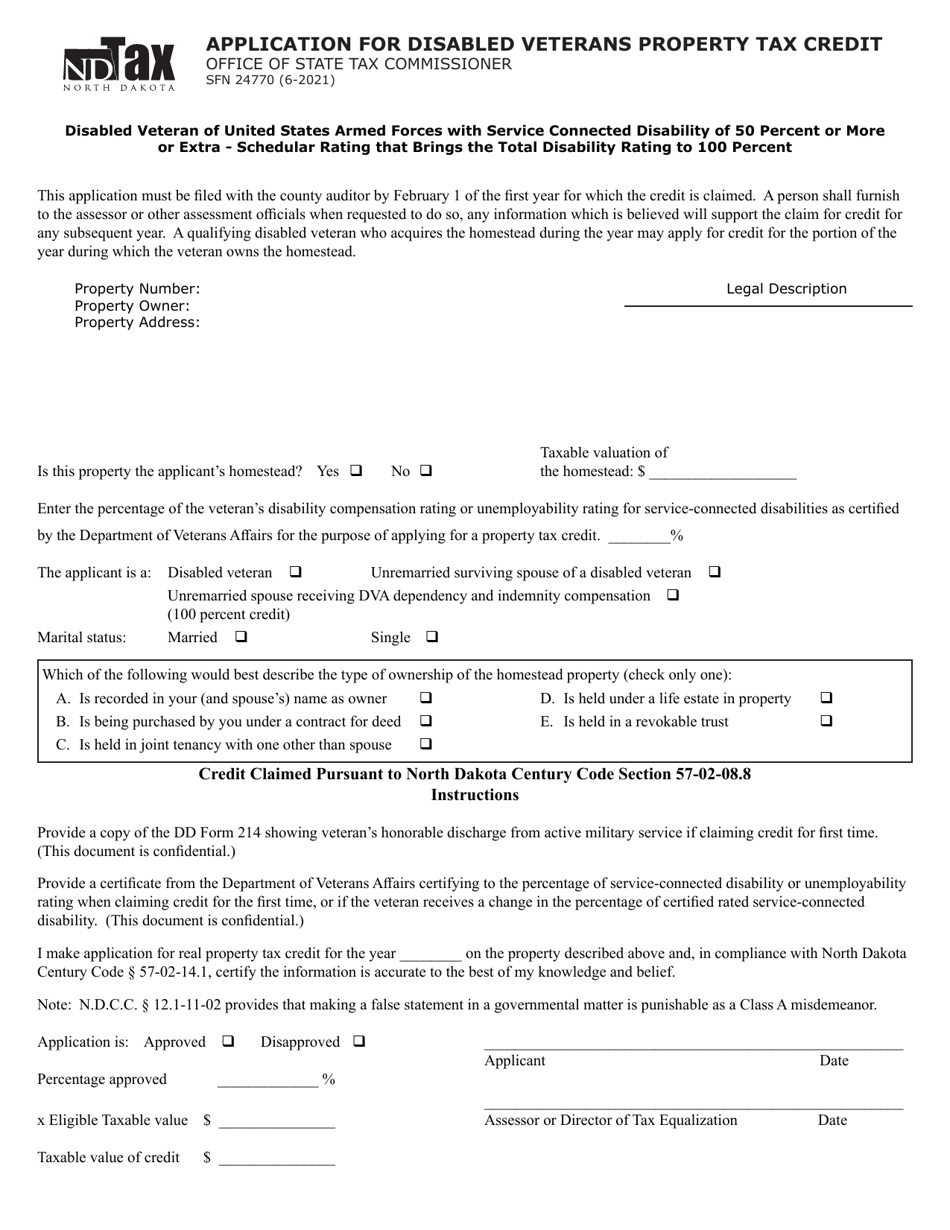

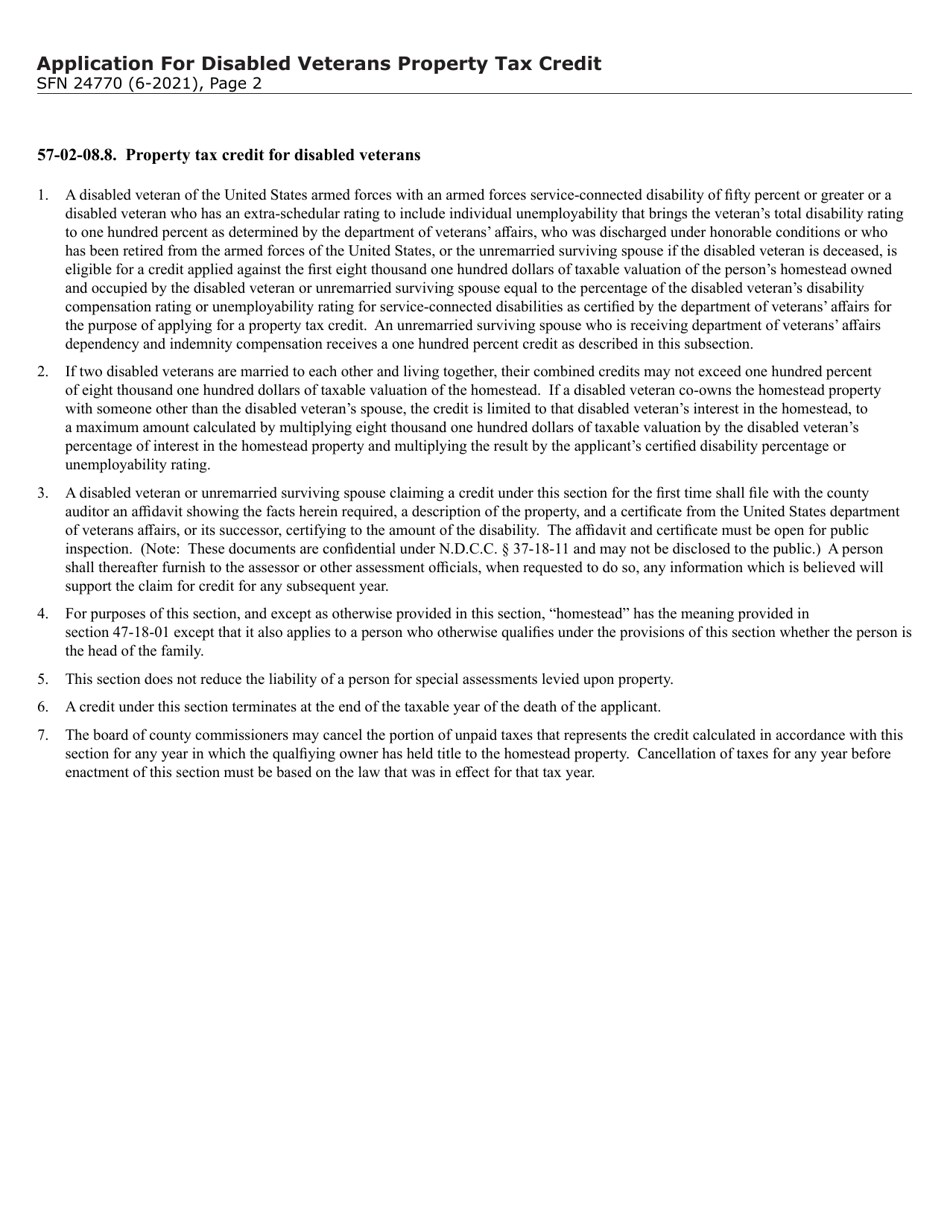

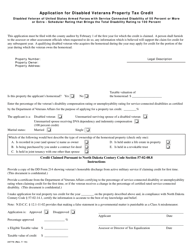

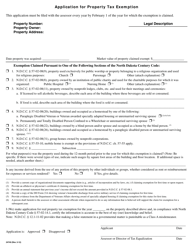

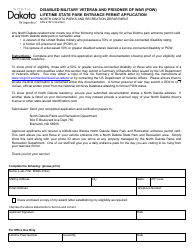

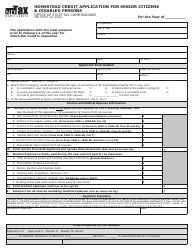

Form SFN24770 Application for Disabled Veterans Property Tax Credit - North Dakota

What Is Form SFN24770?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN24770?

A: Form SFN24770 is the application for the Disabled Veterans Property Tax Credit in North Dakota.

Q: Who is eligible for the Disabled Veterans Property Tax Credit?

A: Disabled veterans who meet certain criteria are eligible for the property tax credit.

Q: What criteria must a disabled veteran meet to be eligible for the tax credit?

A: To be eligible for the tax credit, a disabled veteran must have a service-connected disability rating of at least 50%.

Q: How does the Disabled Veterans Property Tax Credit work?

A: The tax credit reduces the property tax liability for eligible disabled veterans.

Q: Are there any deadlines for submitting Form SFN24770?

A: Yes, the application must be submitted by February 1st of each year to be considered for the tax credit.

Q: Is additional documentation required when submitting Form SFN24770?

A: Yes, disabled veterans must include a copy of their VA Rating Decision Letter as supporting documentation with the application.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN24770 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.