This version of the form is not currently in use and is provided for reference only. Download this version of

Form ARB-M5

for the current year.

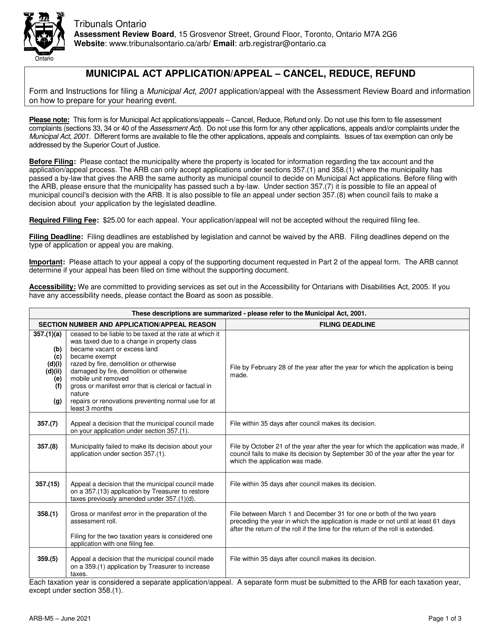

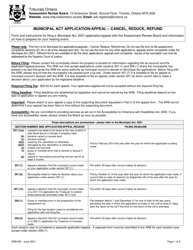

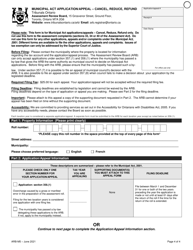

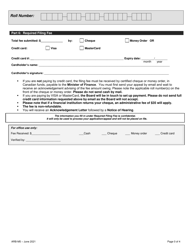

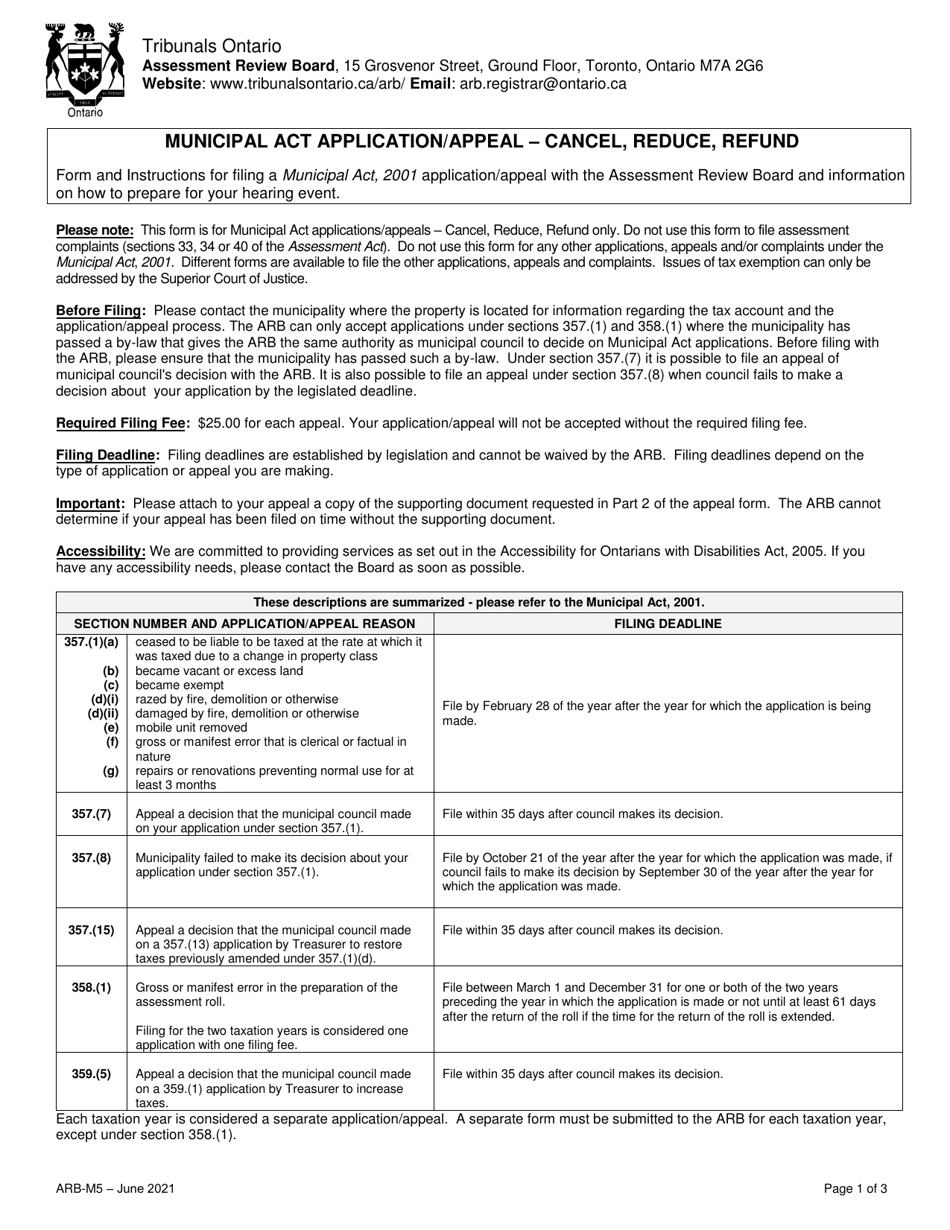

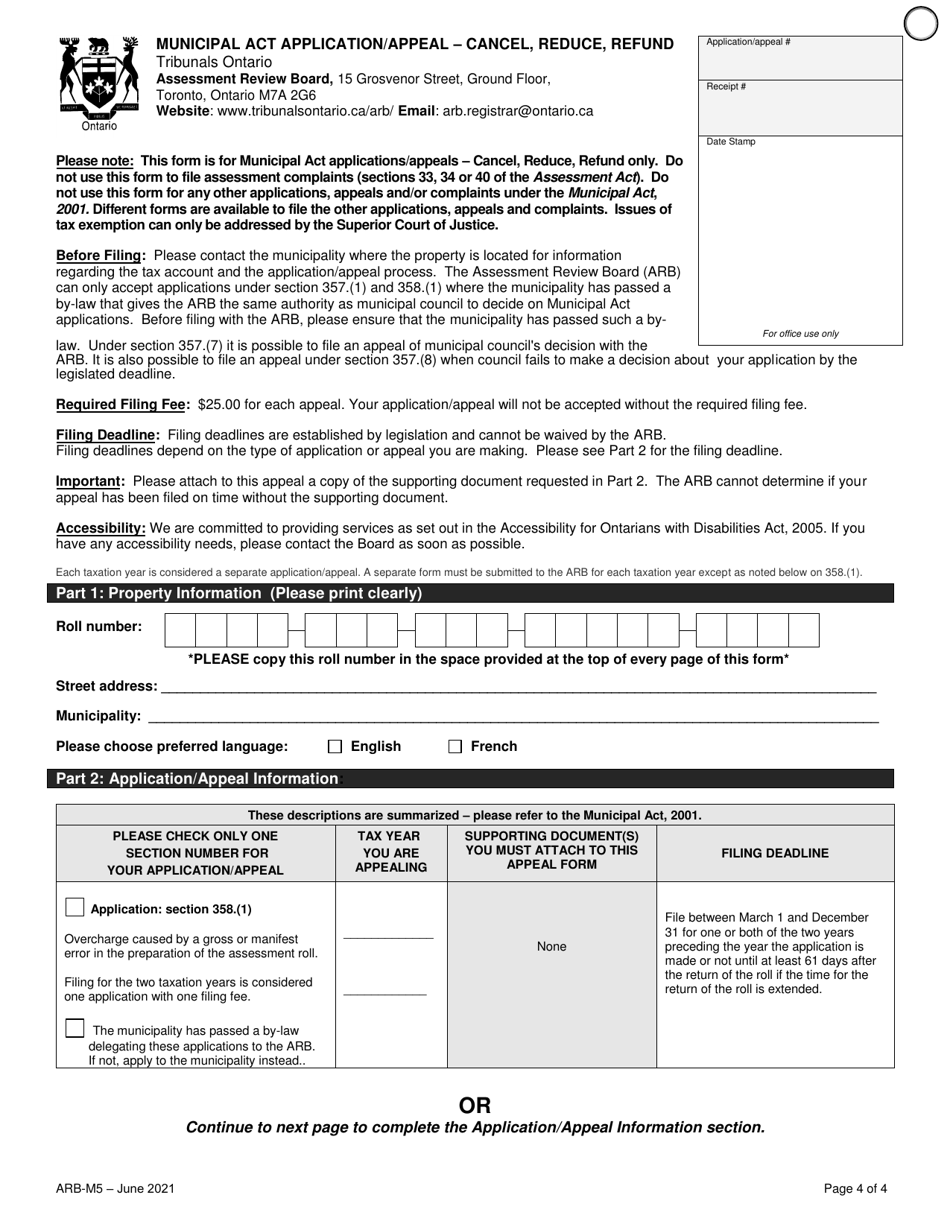

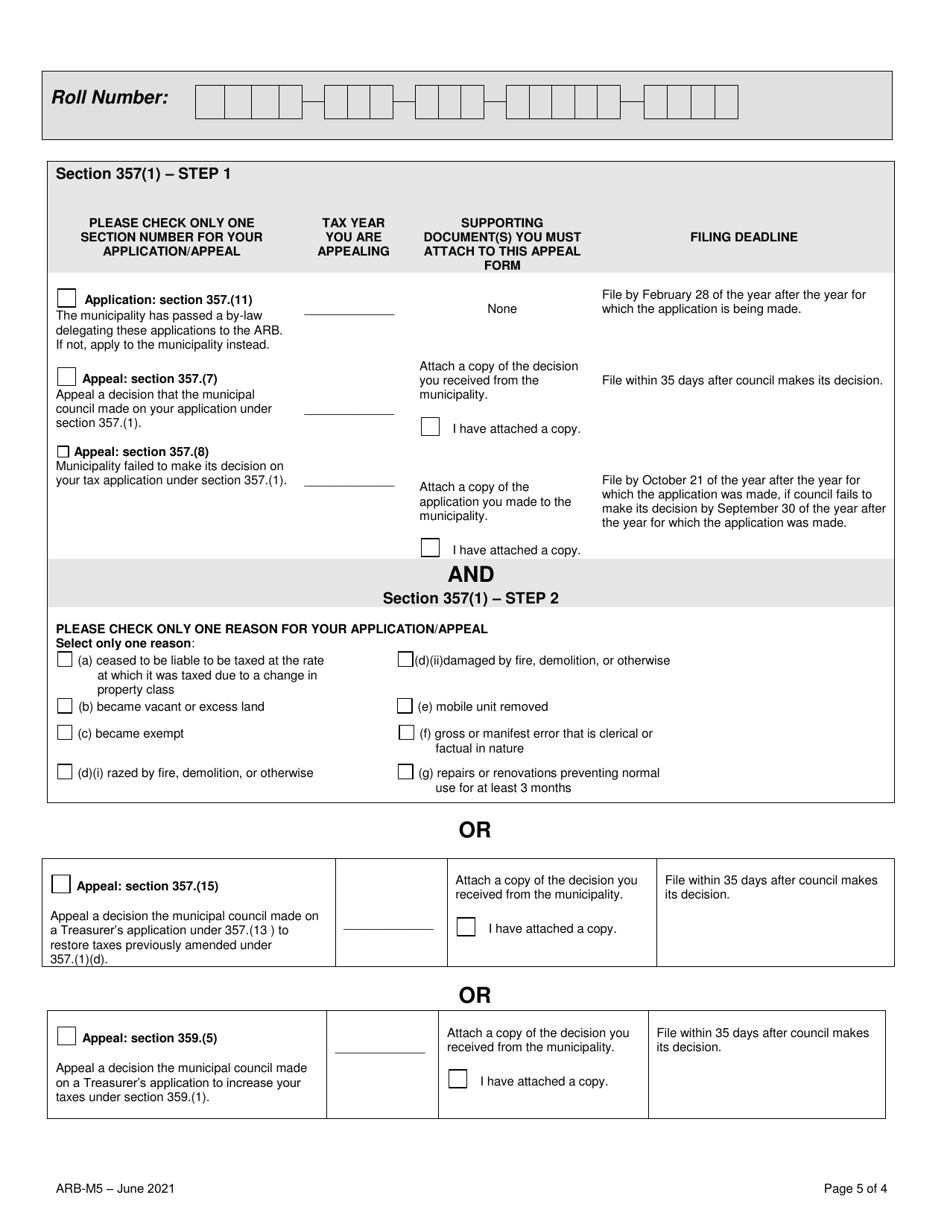

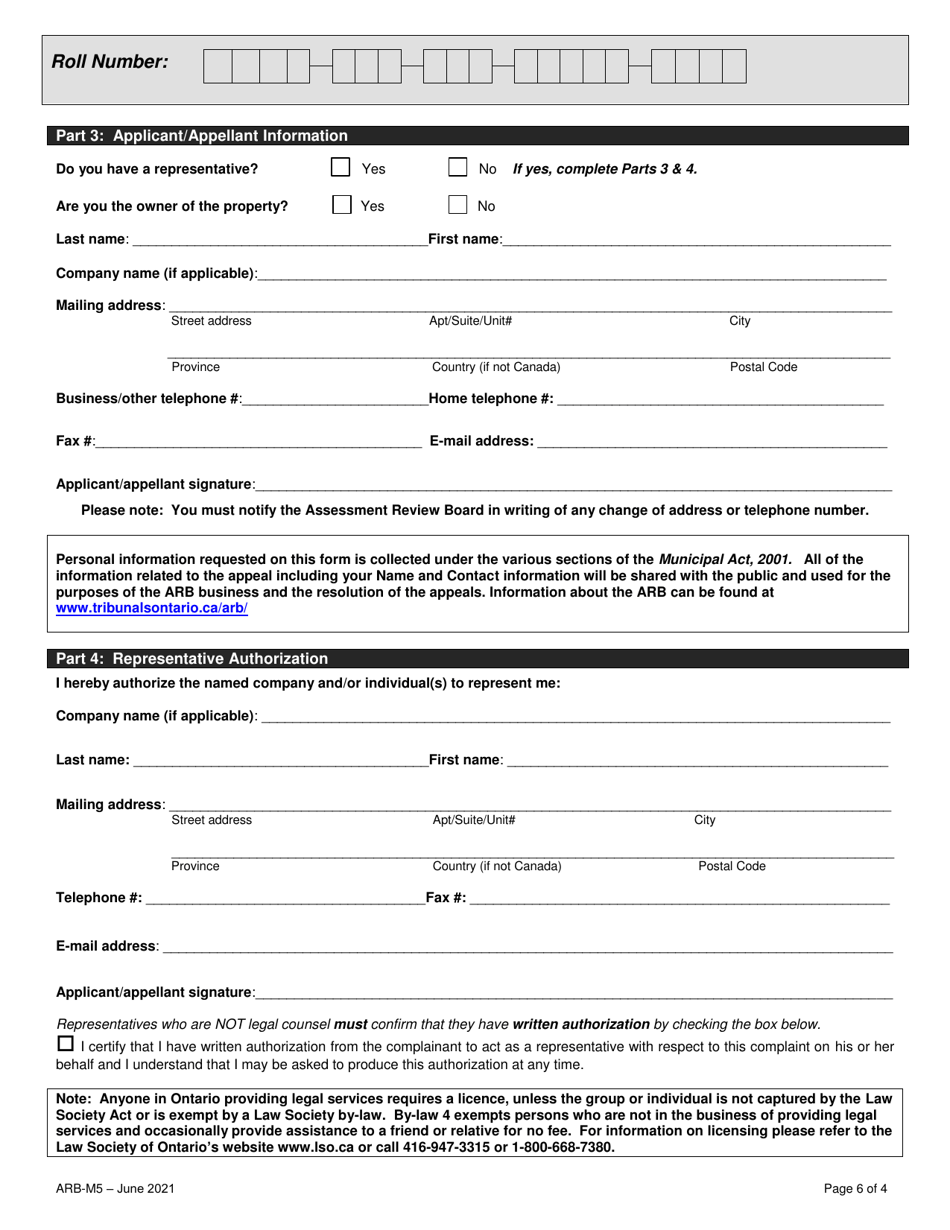

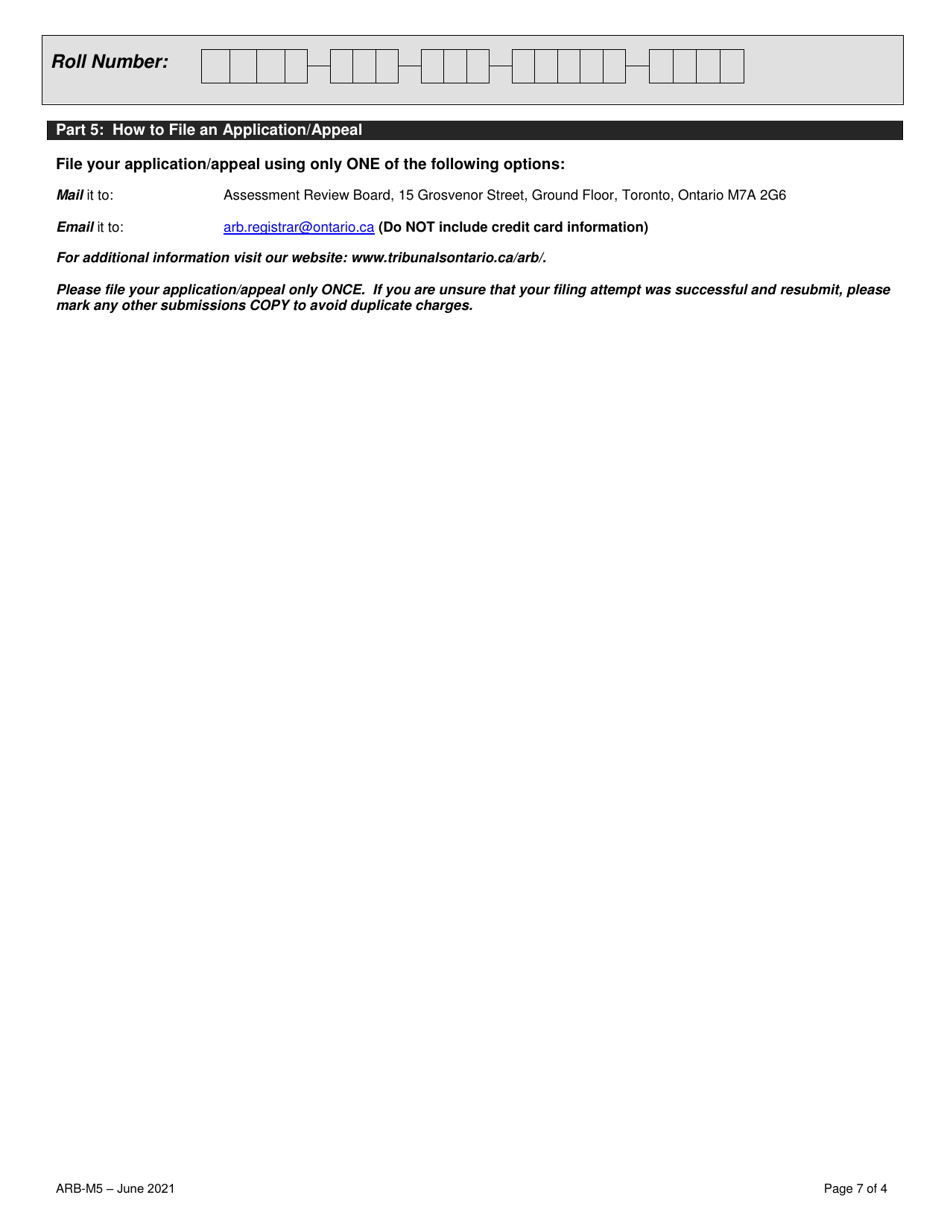

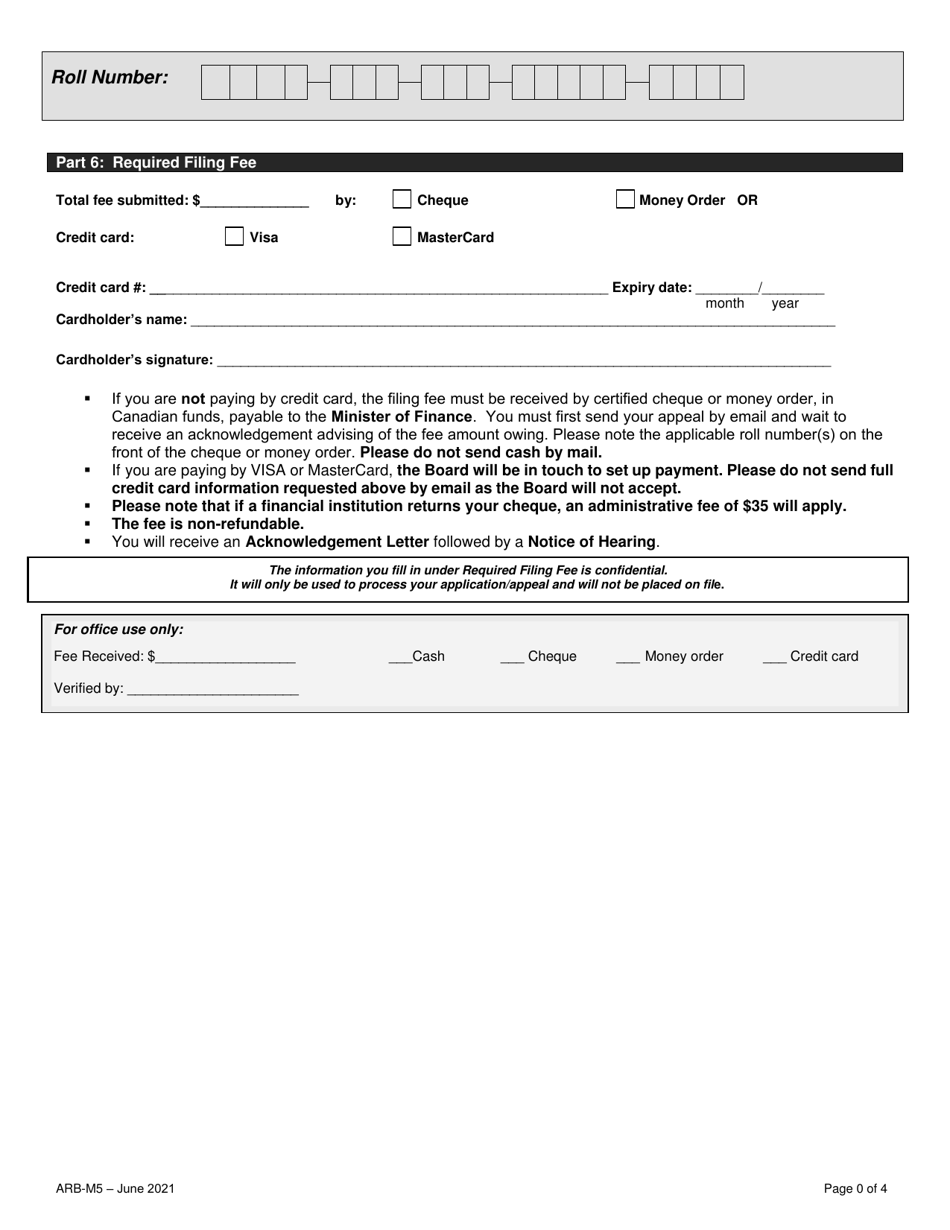

Form ARB-M5 Municipal Act Application / Appeal - Cancel, Reduce, Refund - Ontario, Canada

Form ARB-M5 Municipal Act Application/Appeal is for individuals in Ontario, Canada who want to apply or appeal a decision to cancel, reduce, or refund their municipal property taxes. It is used to request a review of their property assessment and tax liability.

The Form ARB-M5 Municipal Act Application/Appeal - Cancel, Reduce, Refund in Ontario, Canada is filed by individuals or organizations who wish to appeal a property tax assessment or request a cancellation, reduction, or refund related to municipal taxes.

FAQ

Q: What is the ARB-M5 Municipal Act Application/Appeal form?

A: The ARB-M5 form is used in Ontario, Canada for applying for or appealing a cancellation, reduction, or refund related to the Municipal Act.

Q: Who can use the ARB-M5 Municipal Act Application/Appeal form?

A: Any individual or organization in Ontario, Canada can use the ARB-M5 form to apply for or appeal a cancellation, reduction, or refund related to the Municipal Act.

Q: What can the ARB-M5 form be used for?

A: The ARB-M5 form can be used to apply for or appeal a cancellation, reduction, or refund related to the Municipal Act in Ontario, Canada.

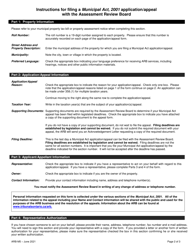

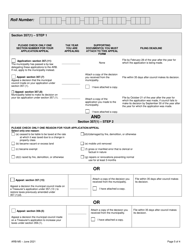

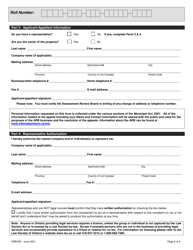

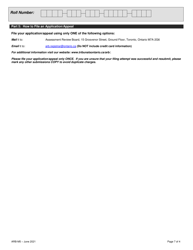

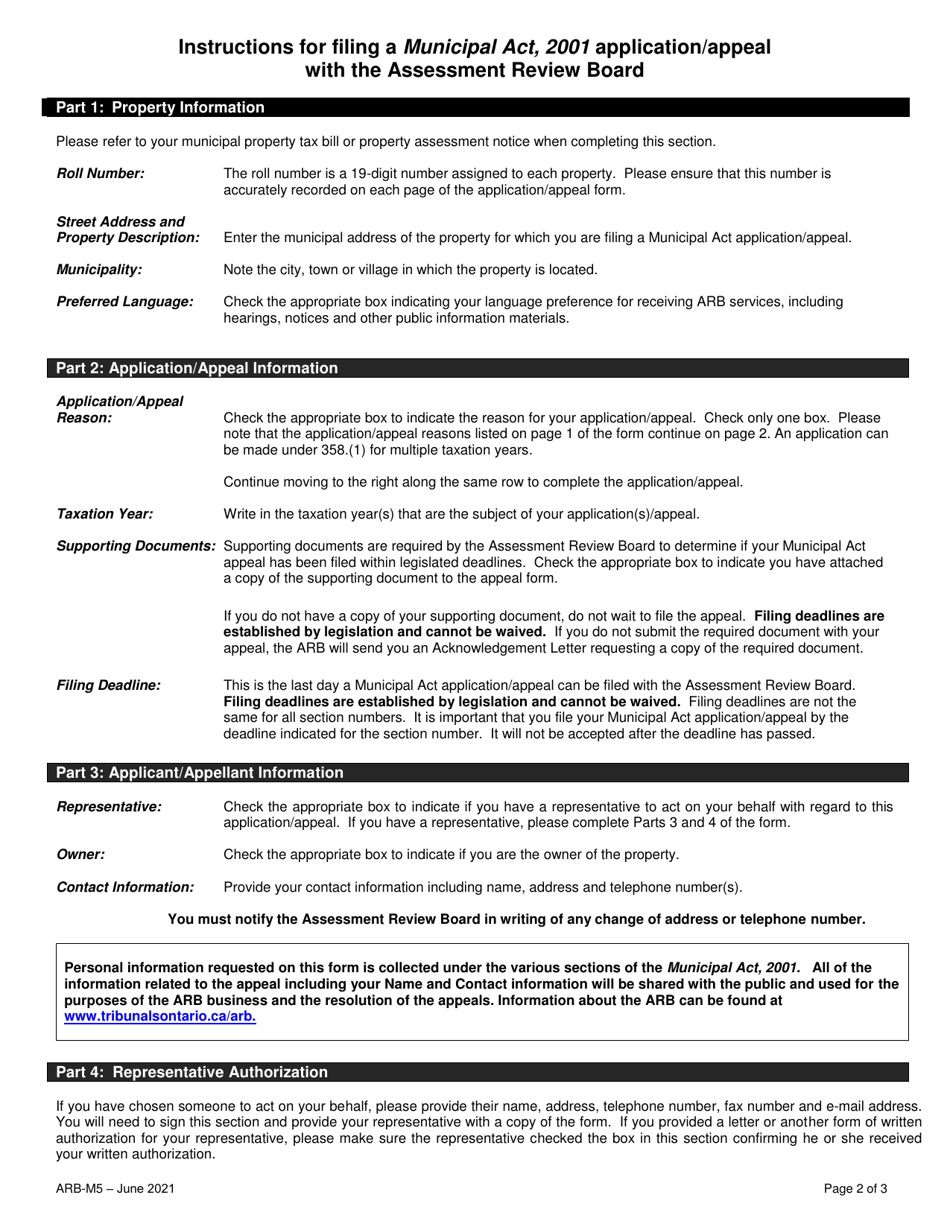

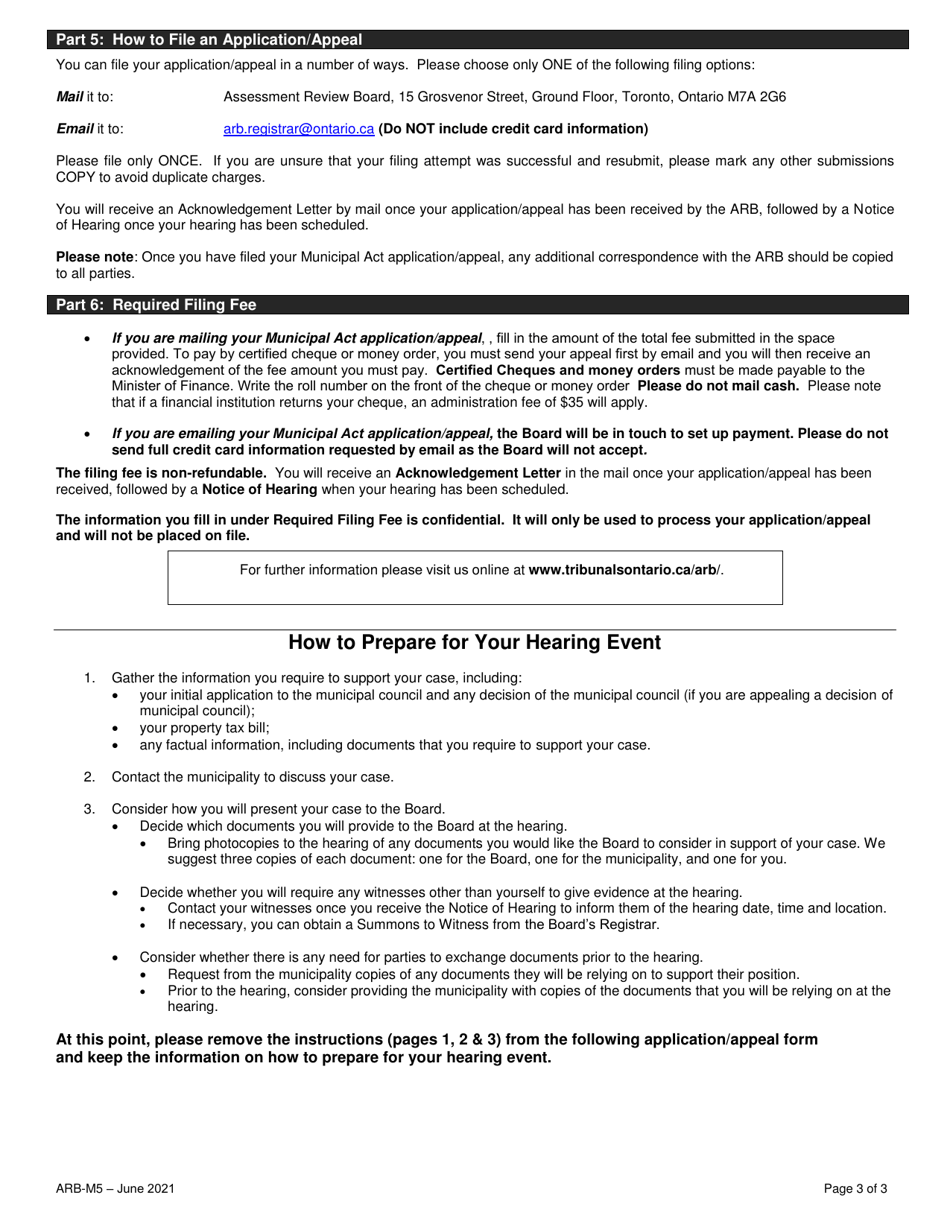

Q: How do I fill out the ARB-M5 Municipal Act Application/Appeal form?

A: The ARB-M5 form requires you to provide information about your application or appeal, including the reasons for cancellation, reduction, or refund, as well as any supporting documents.

Q: How long does it take to process the ARB-M5 form?

A: The processing time for the ARB-M5 form can vary. It is best to contact the Assessment Review Board directly for information on current processing times.

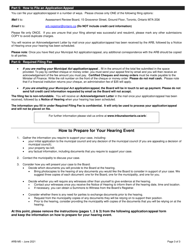

Q: What happens after I submit the ARB-M5 form?

A: After submitting the ARB-M5 form, the Assessment Review Board will review your application or appeal and make a decision based on the provided information and supporting documents.

Q: Can I appeal the decision made by the Assessment Review Board?

A: Yes, if you are not satisfied with the decision made by the Assessment Review Board, you have the right to appeal to the Ontario Superior Court of Justice within a specified timeframe.