This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

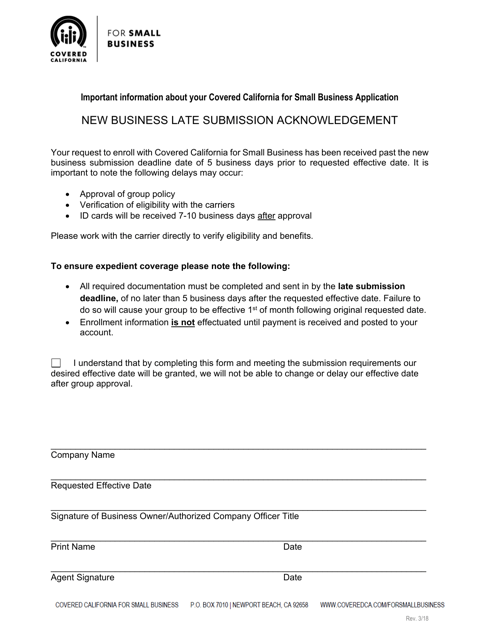

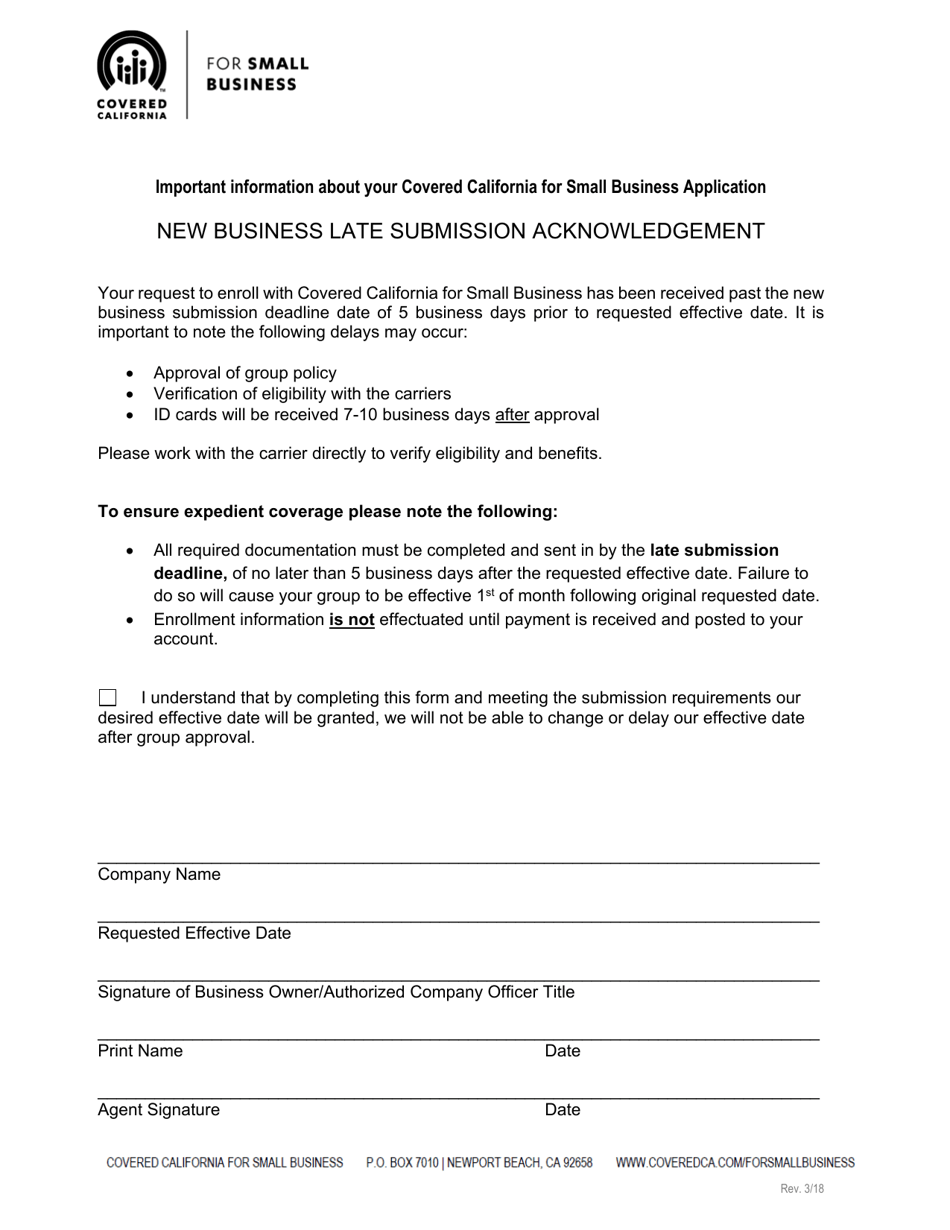

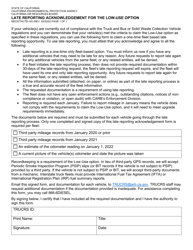

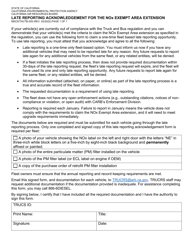

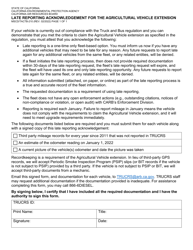

New Business Late Submission Acknowledgement - California

New Business Late Submission Acknowledgement is a legal document that was released by the Covered California - a government authority operating within California.

FAQ

Q: What is the New Business Late Submission Acknowledgement?

A: The New Business Late Submission Acknowledgement is a process in California for acknowledging late submission of business filings.

Q: What is considered a late submission of business filings in California?

A: In California, a late submission of business filings refers to any filing that is submitted after the legally required deadline.

Q: Why is it important to acknowledge late submission of business filings?

A: Acknowledging late submission of business filings helps maintain transparency and record-keeping accuracy.

Q: How does the New Business Late Submission Acknowledgement process work?

A: The process involves acknowledging the late submission, documenting the reason for the delay, and updating the business records accordingly.

Q: Who is responsible for completing the New Business Late Submission Acknowledgement?

A: The responsible party for completing the New Business Late Submission Acknowledgement is typically the business owner or authorized representative.

Q: Are there any penalties for late submission of business filings in California?

A: Yes, there may be penalties for late submission of business filings in California. It is important to comply with the required deadlines to avoid such penalties.

Form Details:

- Released on March 1, 2018;

- The latest edition currently provided by the Covered California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Covered California.