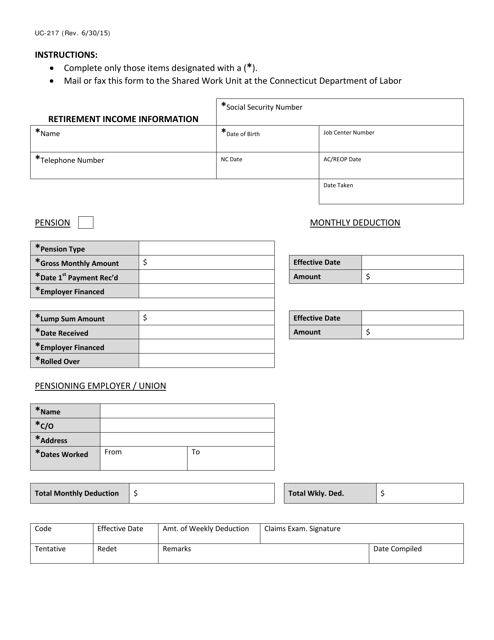

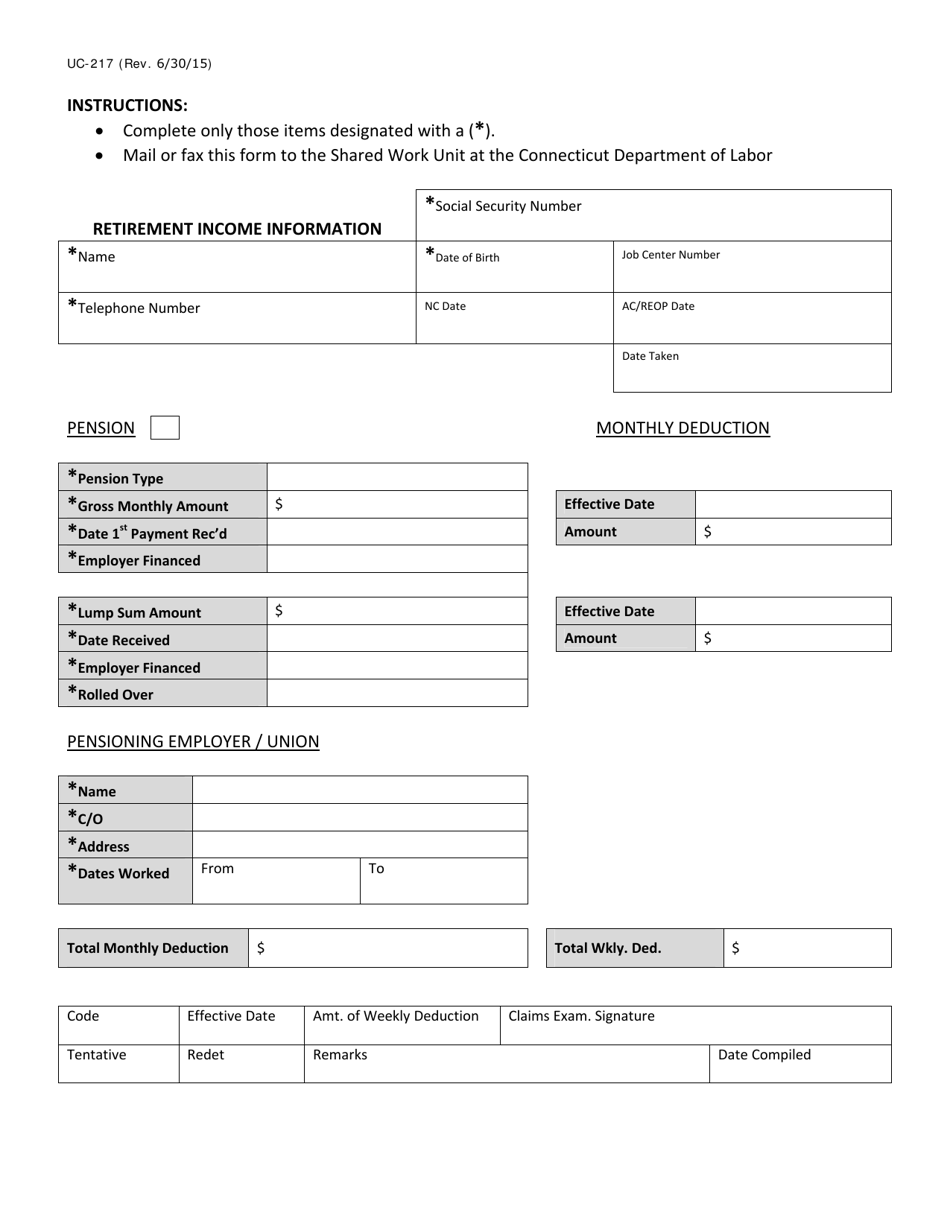

Form UC-217 Retirement Income Information - Connecticut

What Is Form UC-217?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-217?

A: Form UC-217 is the Retirement Income Information form in Connecticut.

Q: What is the purpose of Form UC-217?

A: The purpose of Form UC-217 is to report retirement income in Connecticut.

Q: Who needs to file Form UC-217?

A: Individuals who receive retirement income in Connecticut need to file Form UC-217.

Q: What types of retirement income should be reported on Form UC-217?

A: Any type of retirement income, such as pensions, annuities, IRA distributions, and Social Security benefits, should be reported on Form UC-217.

Q: When is the deadline to file Form UC-217?

A: The deadline to file Form UC-217 is usually April 15th, the same as the federal tax deadline.

Q: Is Form UC-217 similar to the federal tax return?

A: No, Form UC-217 is specific to reporting retirement income in Connecticut and is separate from the federal tax return.

Q: What happens if I don't file Form UC-217?

A: If you don't file Form UC-217, you may face penalties or interest charges imposed by the Connecticut Department of Labor.

Form Details:

- Released on June 30, 2015;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UC-217 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.