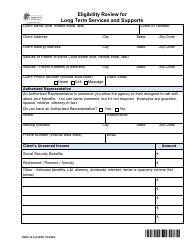

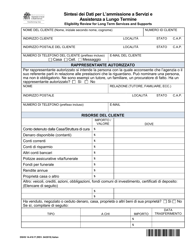

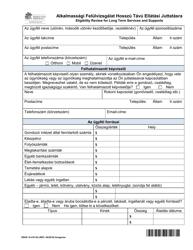

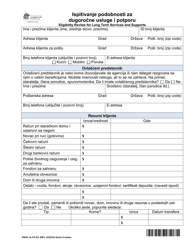

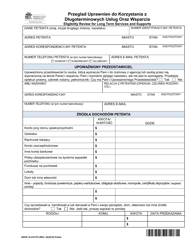

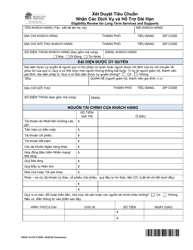

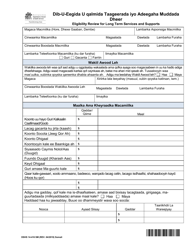

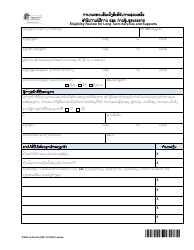

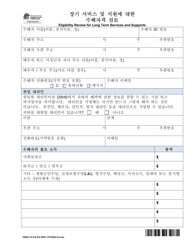

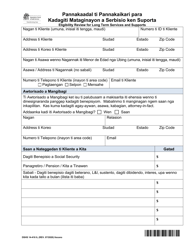

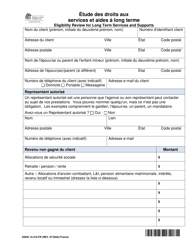

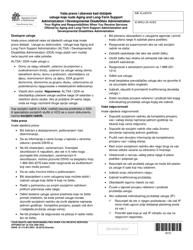

DSHS Form 14-454 Estate Recovery: Repaying the State for Medical and Long Term Services and Supports - Washington (Mandinka)

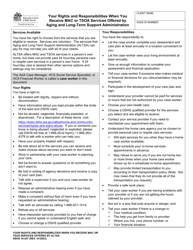

This is a legal form that was released by the Washington State Department of Social and Health Services - a government authority operating within Washington.

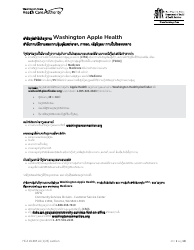

The document is provided in Mandinka. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DSHS Form 14-454?

A: DSHS Form 14-454 is a form used for estate recovery in Washington state.

Q: What is estate recovery?

A: Estate recovery is the process of repaying the state for medical and long-term services and supports provided to individuals.

Q: Who is responsible for repaying the state?

A: The estate of the individual who received the services is responsible for repaying the state.

Q: What types of services are subject to estate recovery?

A: Medical and long-term services and supports, such as nursing home care, are subject to estate recovery.

Q: Is estate recovery mandatory?

A: Yes, estate recovery is mandatory in Washington state.

Q: What happens if the estate does not have enough funds to repay?

A: If the estate does not have enough funds to repay, the state may place a lien on the property or file a claim against the estate.

Q: Are certain assets exempt from estate recovery?

A: Yes, certain assets, such as a primary residence, may be exempt from estate recovery.

Q: Is there a time limit for estate recovery?

A: Yes, estate recovery must be initiated within 10 years from the date of death.

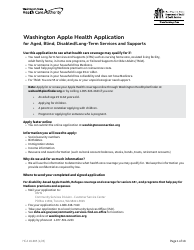

Q: Is the form available in different languages?

A: Yes, DSHS Form 14-454 is available in multiple languages, including Mandinka.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Washington State Department of Social and Health Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of DSHS Form 14-454 by clicking the link below or browse more documents and templates provided by the Washington State Department of Social and Health Services.