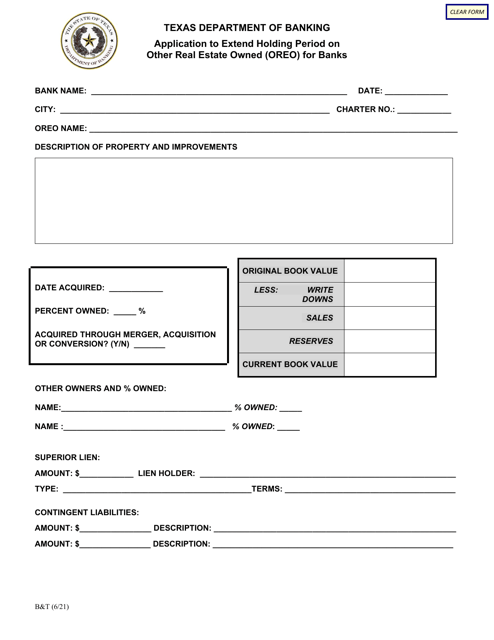

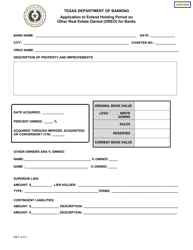

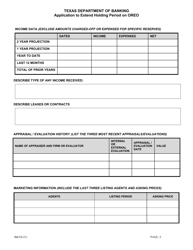

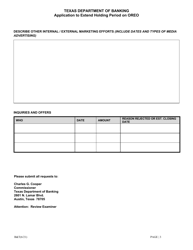

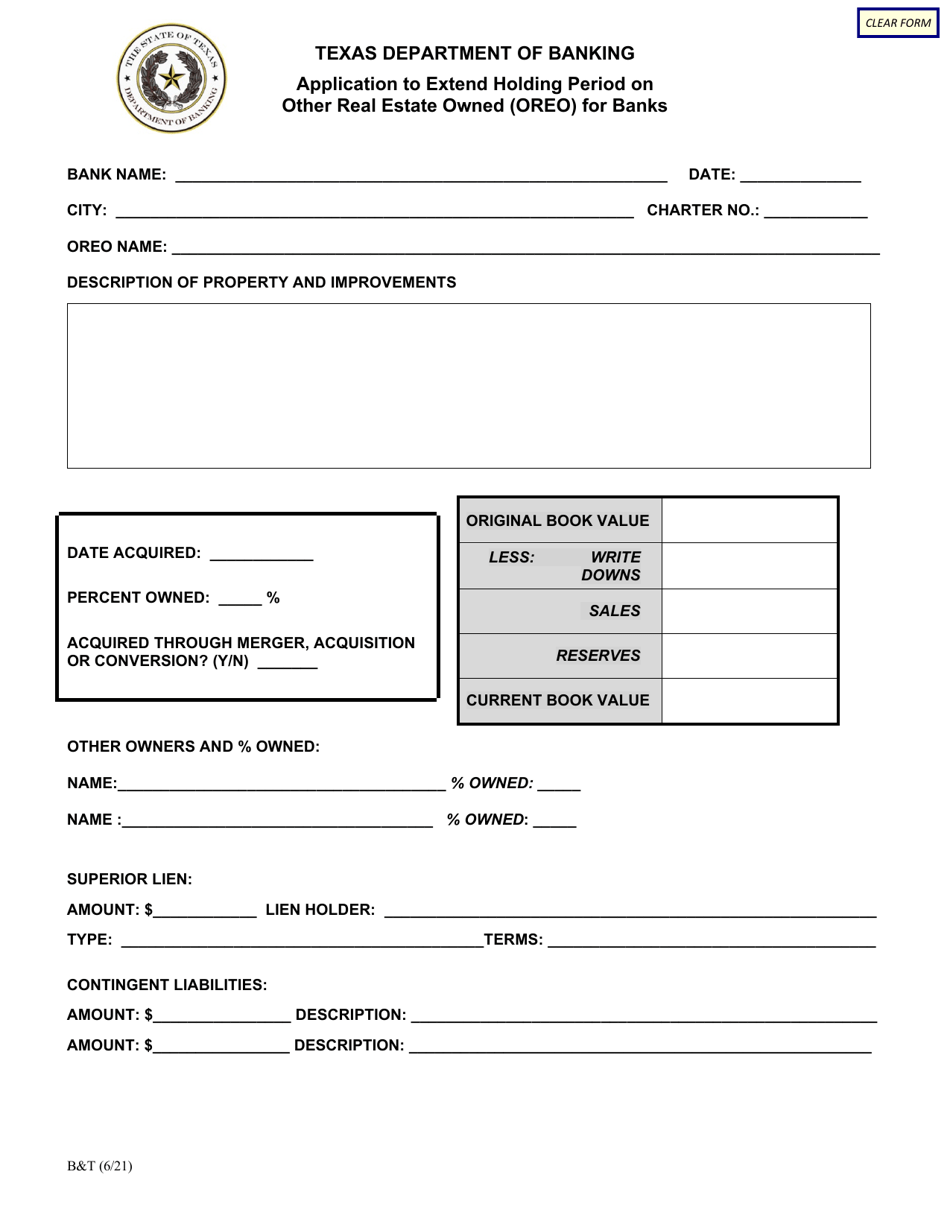

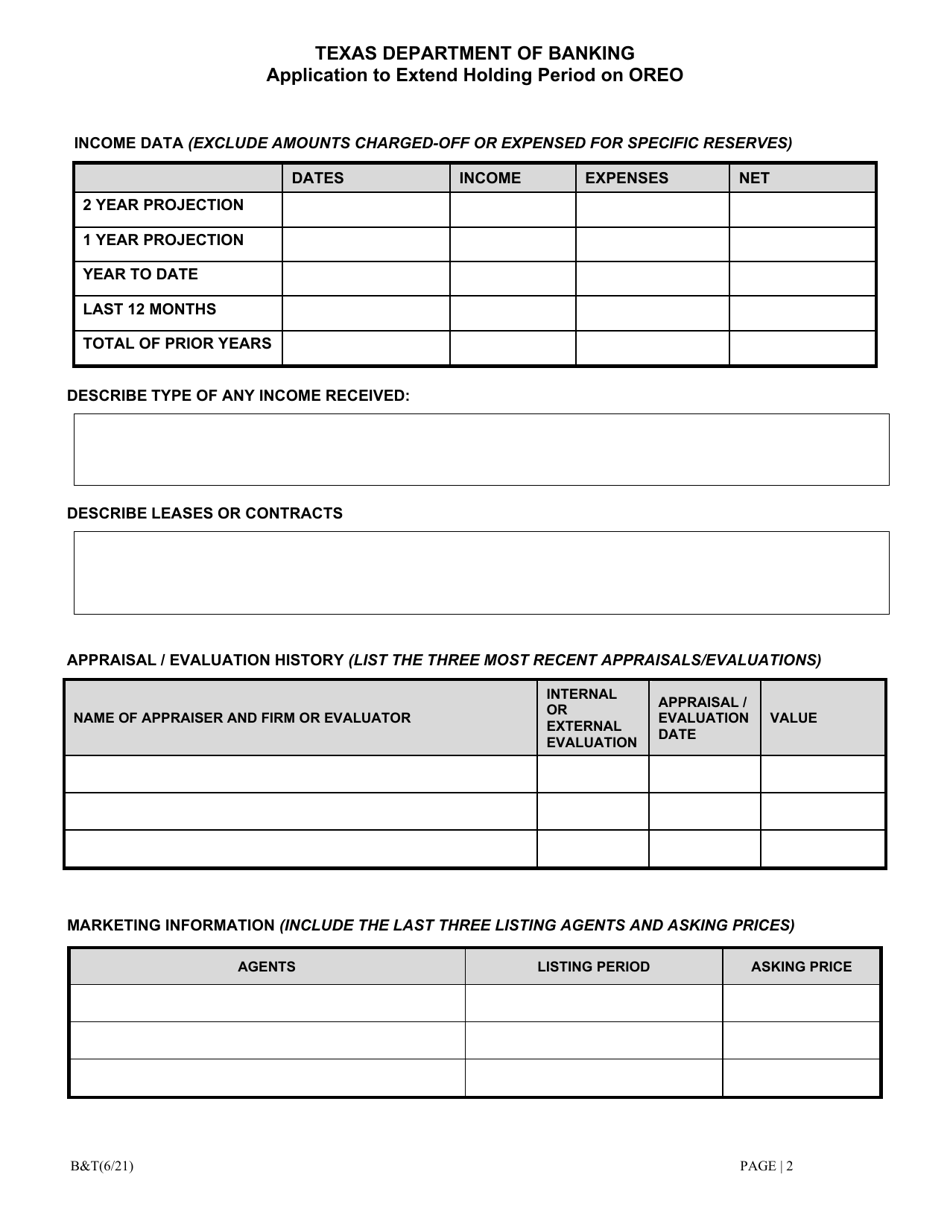

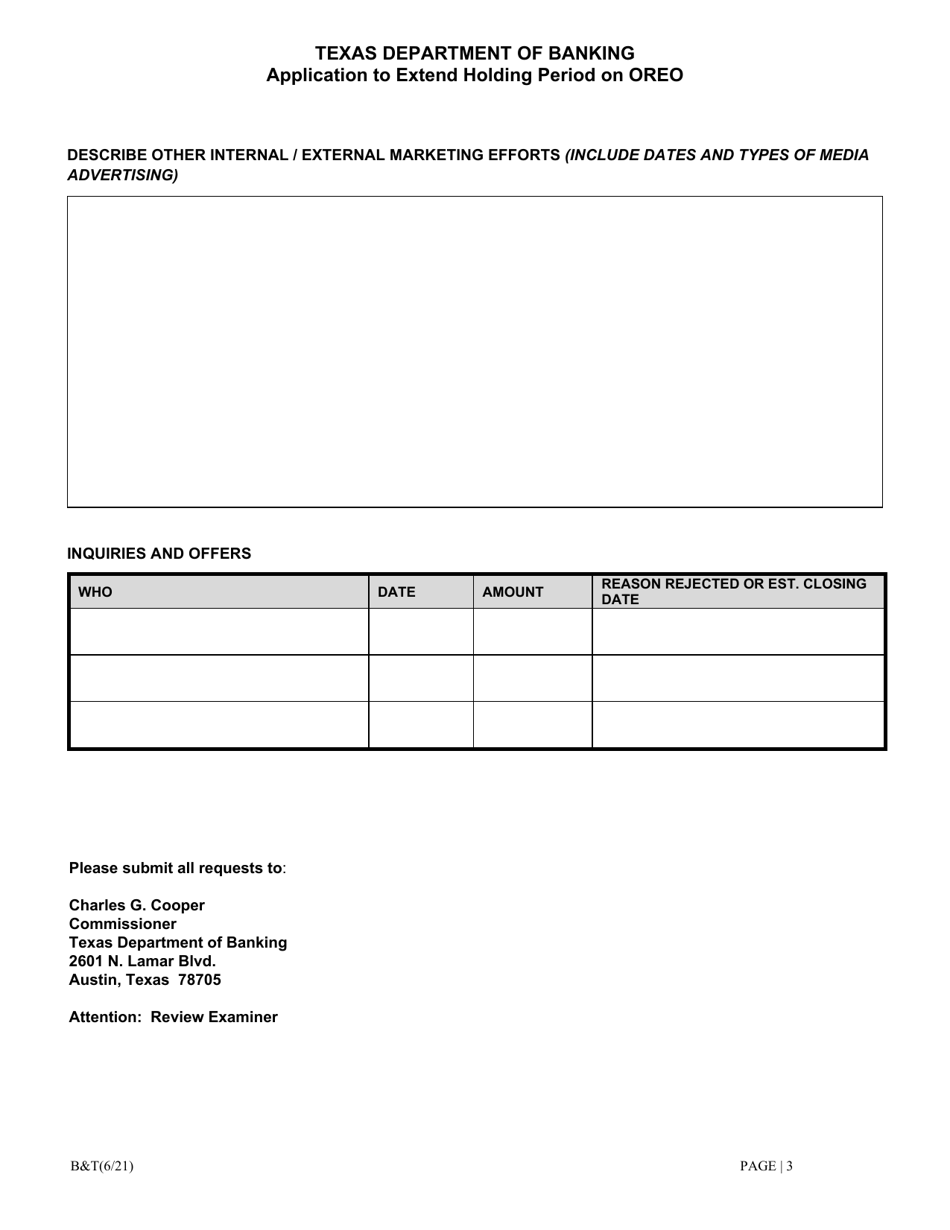

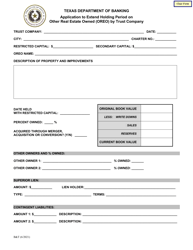

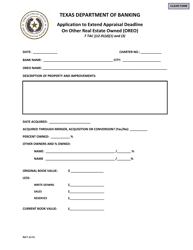

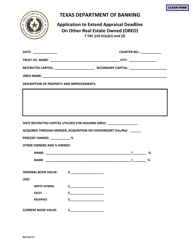

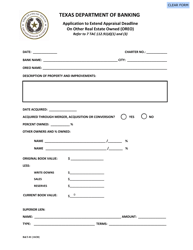

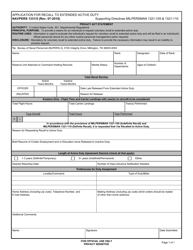

Application to Extend Holding Period on Other Real Estate Owned (Oreo) for Banks - Texas

Application to Extend Holding Period on Other Real Estate Owned (Oreo) for Banks is a legal document that was released by the Texas Department of Banking - a government authority operating within Texas.

FAQ

Q: What is an Other Real Estate Owned (OREO) property?

A: An Other Real Estate Owned (OREO) property refers to properties that are owned by banks and financial institutions as a result of foreclosure.

Q: Why would a bank apply to extend the holding period on OREO?

A: A bank may apply to extend the holding period on OREO if they need more time to sell the property and recover their investment.

Q: What is the purpose of extending the holding period on OREO?

A: Extending the holding period allows banks to have more flexibility in managing OREO properties and maximizing their potential value.

Q: Who is eligible to apply for an extension on the holding period for OREO?

A: Banks and financial institutions that own OREO properties in Texas are generally eligible to apply for an extension on the holding period.

Q: How long is the typical holding period for OREO properties?

A: The holding period for OREO properties can vary, but typically it is around 5 years.

Q: What is the process for applying to extend the holding period on OREO?

A: The specific process may vary, but generally, banks will need to submit an application to the appropriate regulatory authority in Texas.

Q: Are there any fees associated with applying to extend the holding period?

A: There may be fees associated with the application process for extending the holding period, which vary depending on the regulatory authority and the specific circumstances.

Q: Can the holding period on OREO be extended multiple times?

A: In some cases, the holding period on OREO can be extended multiple times, but this depends on the regulatory authority and the specific circumstances.

Q: What happens if the holding period on OREO expires?

A: If the holding period on OREO expires, the bank may be required to take certain actions, such as listing the property for sale or transferring it to another category of assets.

Q: Are there any restrictions on selling OREO properties?

A: There may be certain restrictions on selling OREO properties, such as required disclosures or limitations on the selling price, depending on the regulatory authority and the specific circumstances.

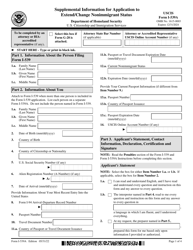

Form Details:

- Released on June 1, 2021;

- The latest edition currently provided by the Texas Department of Banking;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Banking.