This version of the form is not currently in use and is provided for reference only. Download this version of

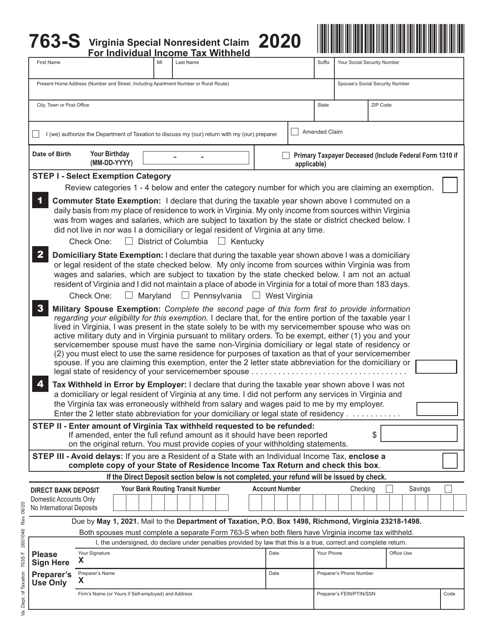

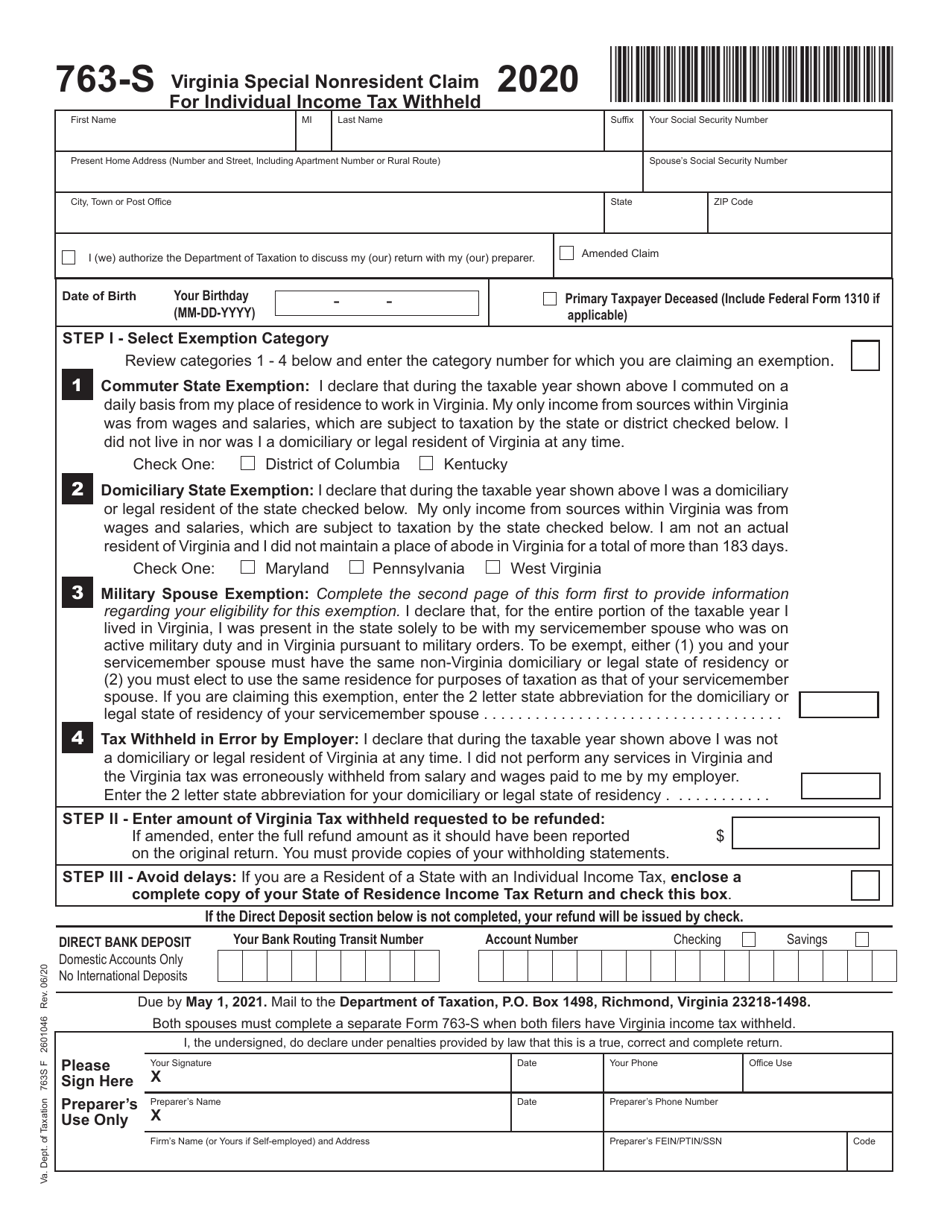

Form 763-S

for the current year.

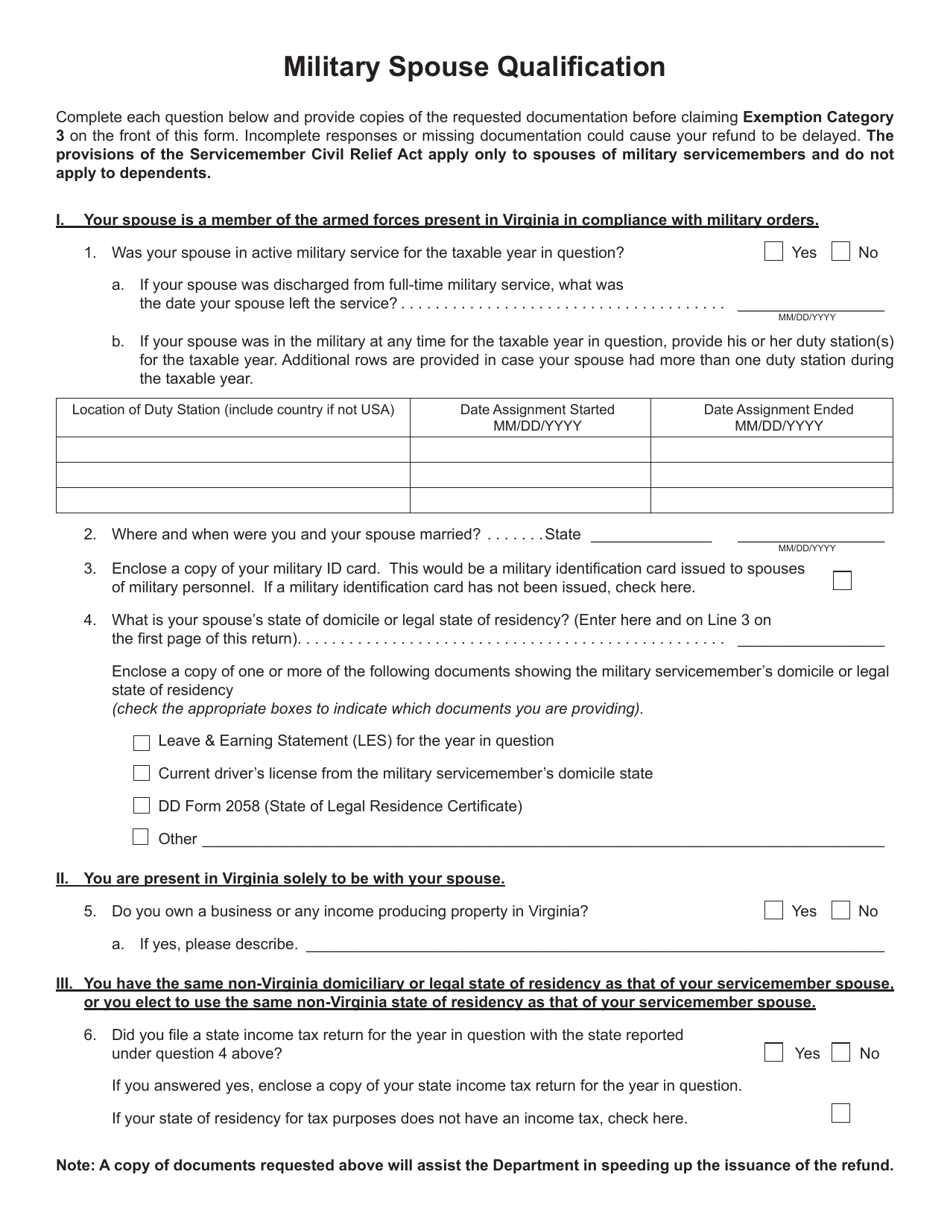

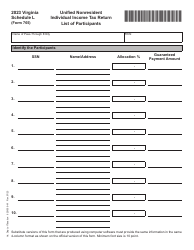

Form 763-S Virginia Special Nonresident Claim for Individual Income Tax Withheld - Virginia

What Is Form 763-S?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 763-S?

A: Form 763-S is a tax form used by nonresidents of Virginia to claim a refund of income tax withheld in the state.

Q: Who should use Form 763-S?

A: Nonresidents of Virginia who had income tax withheld from their earnings in the state may use Form 763-S to claim a refund.

Q: When is the deadline to file Form 763-S?

A: The deadline to file Form 763-S is the same as the regular tax return filing deadline, which is typically April 15th.

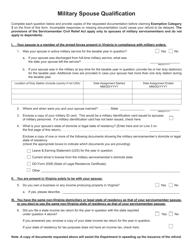

Q: What information do I need to complete Form 763-S?

A: You will need to provide information about your income, deductions, and tax withheld in Virginia. You may also need to attach supporting documents.

Q: How long does it take to process a Form 763-S refund?

A: It can take several weeks to process a Form 763-S refund, depending on the volume of requests received by the Virginia Department of Taxation.

Q: Are there any restrictions or limitations to filing Form 763-S?

A: Yes, there may be restrictions or limitations based on your residency status, income, and other factors. Consult the instructions for Form 763-S for more information.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 763-S by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.