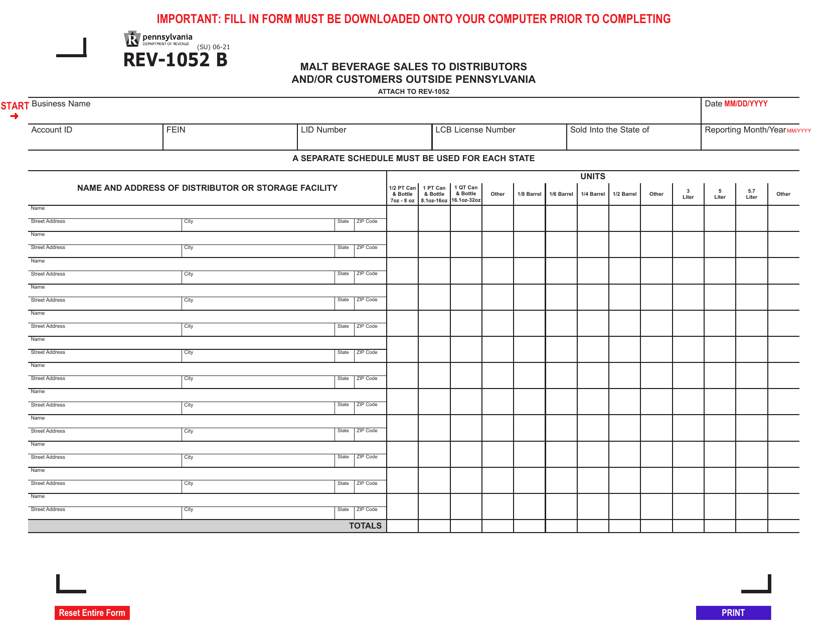

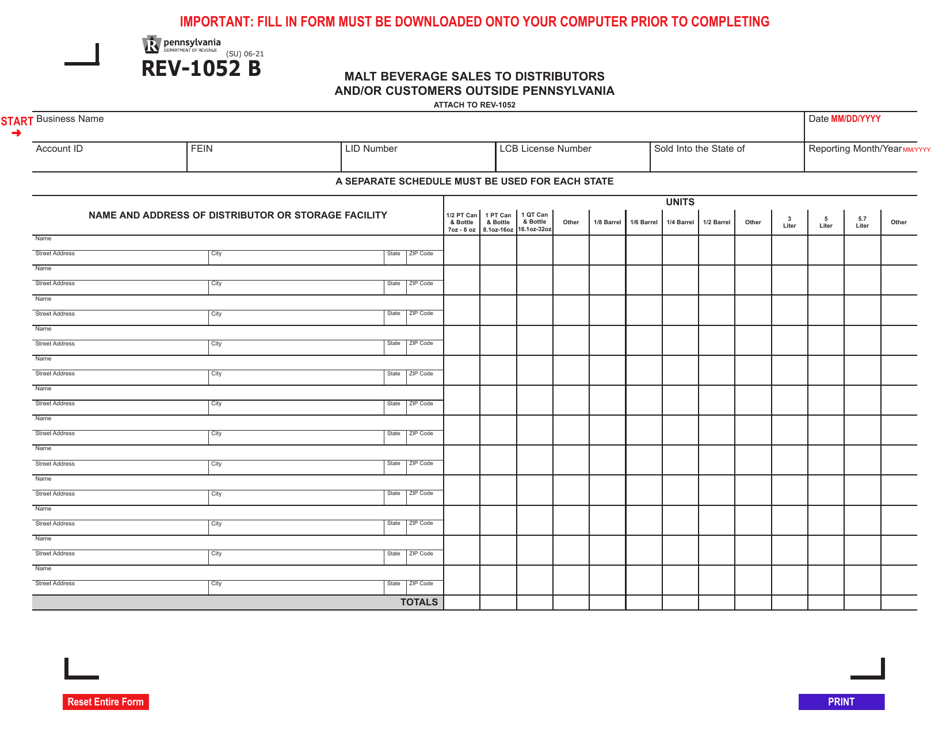

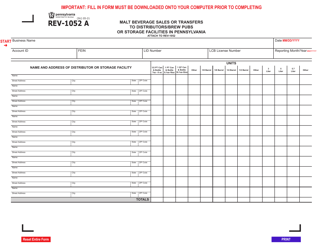

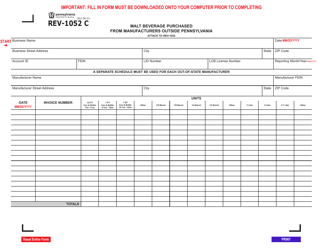

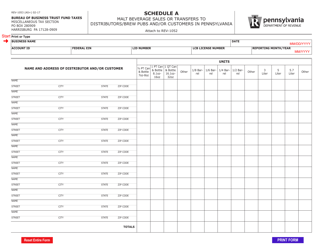

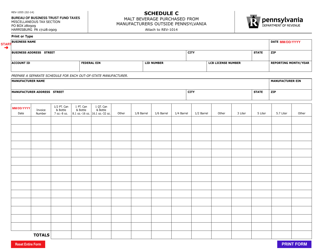

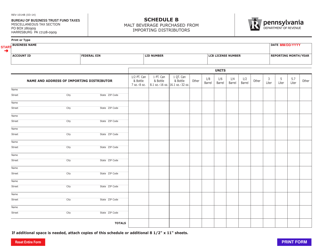

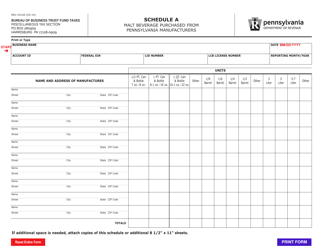

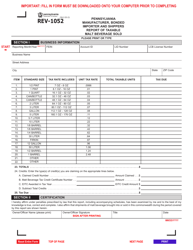

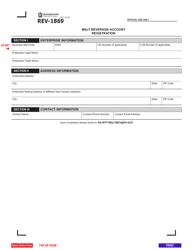

Form REV-1052 B Malt Beverage Sales to Distributors and / or Customers Outside Pennsylvania - Pennsylvania

What Is Form REV-1052 B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1052 B?

A: Form REV-1052 B is a tax form used for reporting malt beverage sales to distributors and/or customers outside of Pennsylvania.

Q: Who needs to file Form REV-1052 B?

A: Any person or business that sells malt beverages to distributors and/or customers outside of Pennsylvania needs to file Form REV-1052 B.

Q: What information is required on Form REV-1052 B?

A: Form REV-1052 B requires information such as the seller's name and address, the buyer's name and address, the quantity and type of malt beverages sold, and the amount of tax due.

Q: How often should Form REV-1052 B be filed?

A: Form REV-1052 B should be filed on a monthly basis, with the tax payment due on or before the 25th day of the following month.

Q: Are there any penalties for not filing Form REV-1052 B?

A: Yes, there are penalties for failing to file Form REV-1052 B, including late filing penalties and interest charges on any unpaid taxes.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1052 B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.