This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC65

for the current year.

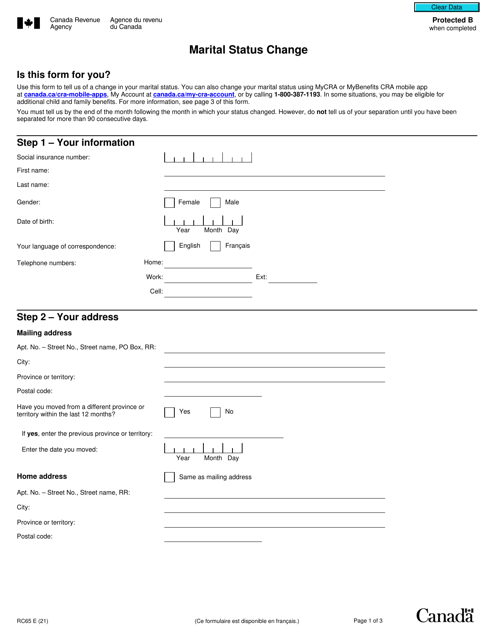

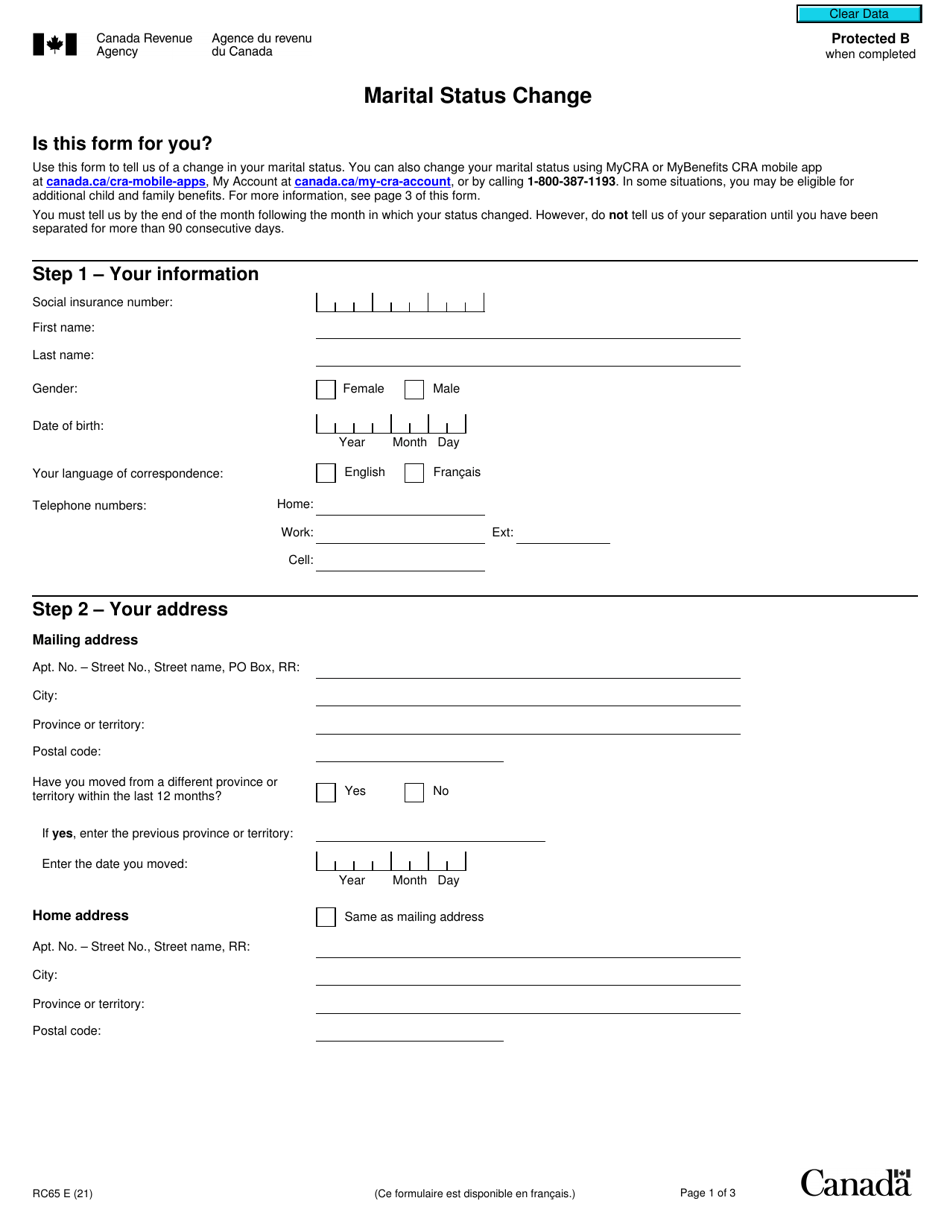

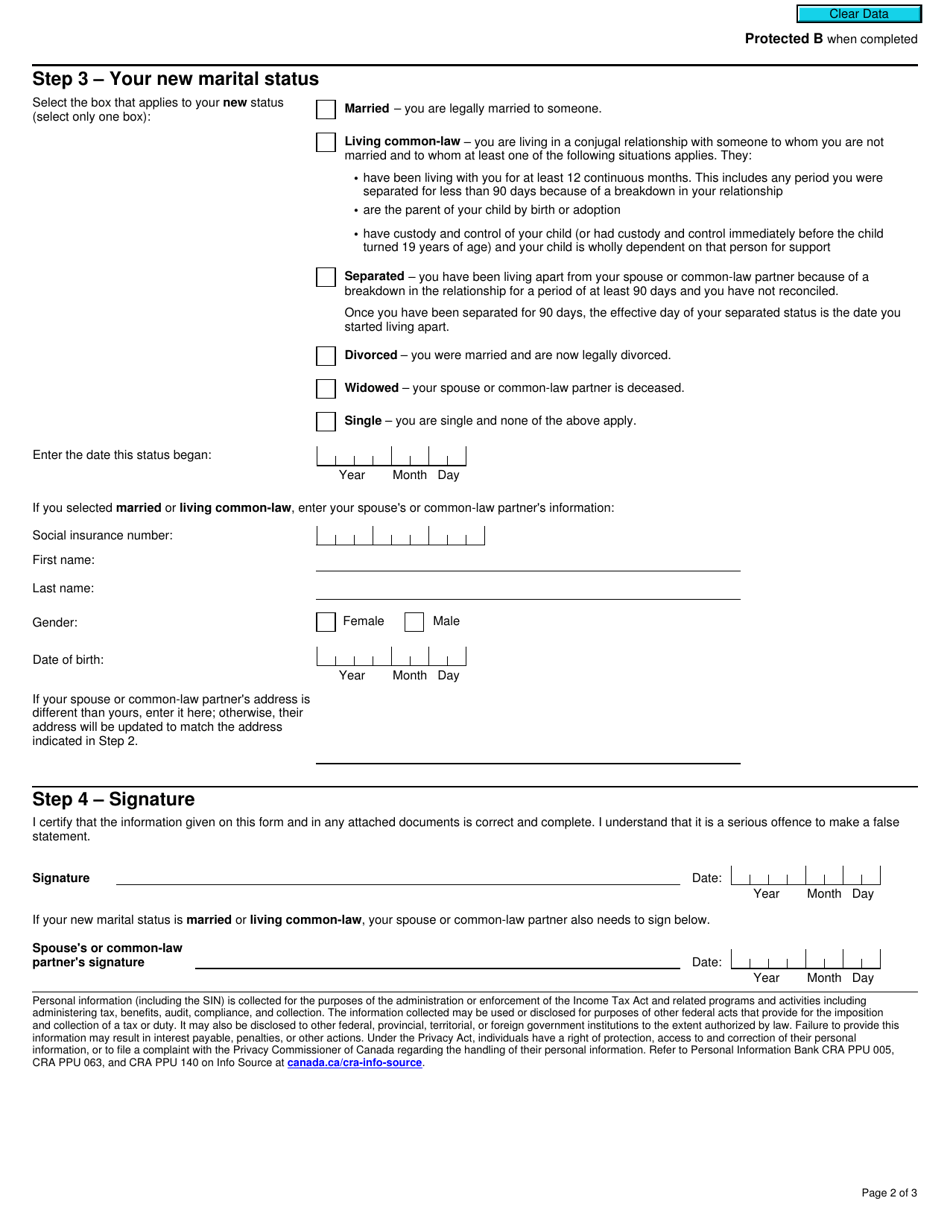

Form RC65 Marital Status Change - Canada

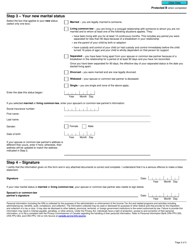

Form RC65 Marital Status Change - Canada is used to inform the Canada Revenue Agency (CRA) about a change in your marital status. This form is used to update your marital status for tax purposes.

The Form RC65 Marital Status Change in Canada is typically filed by an individual who wants to update their marital status with the Canada Revenue Agency (CRA). It is used to inform the CRA about a change in marital status, such as getting married or separated.

FAQ

Q: What is Form RC65?

A: Form RC65 is a form used in Canada to update your marital status with the Canada Revenue Agency (CRA).

Q: Why would I need to fill out Form RC65?

A: You would need to fill out Form RC65 if your marital status has changed and you want to inform the CRA.

Q: What information is required on Form RC65?

A: On Form RC65, you will need to provide your personal information, such as your name, social insurance number, and your new marital status.

Q: Is there a deadline for submitting Form RC65?

A: There is no specific deadline for submitting Form RC65, but it is recommended to update your marital status with the CRA as soon as possible after your status changes.

Q: What happens after I submit Form RC65?

A: After you submit Form RC65, the CRA will update your marital status in their records, which may affect your tax obligations and benefits.

Q: Do I need to provide supporting documents with Form RC65?

A: In most cases, you do not need to provide supporting documents with Form RC65. However, the CRA may request additional documentation if necessary.