This version of the form is not currently in use and is provided for reference only. Download this version of

Form E414

for the current year.

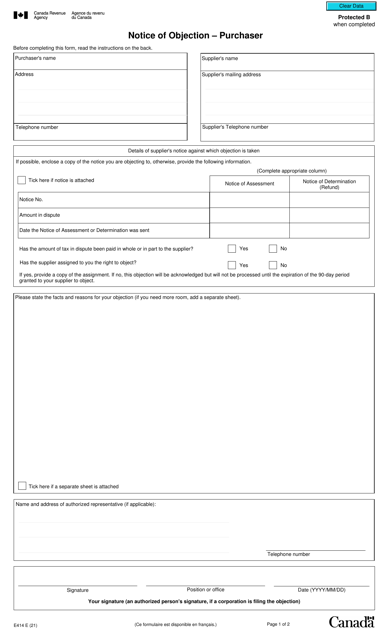

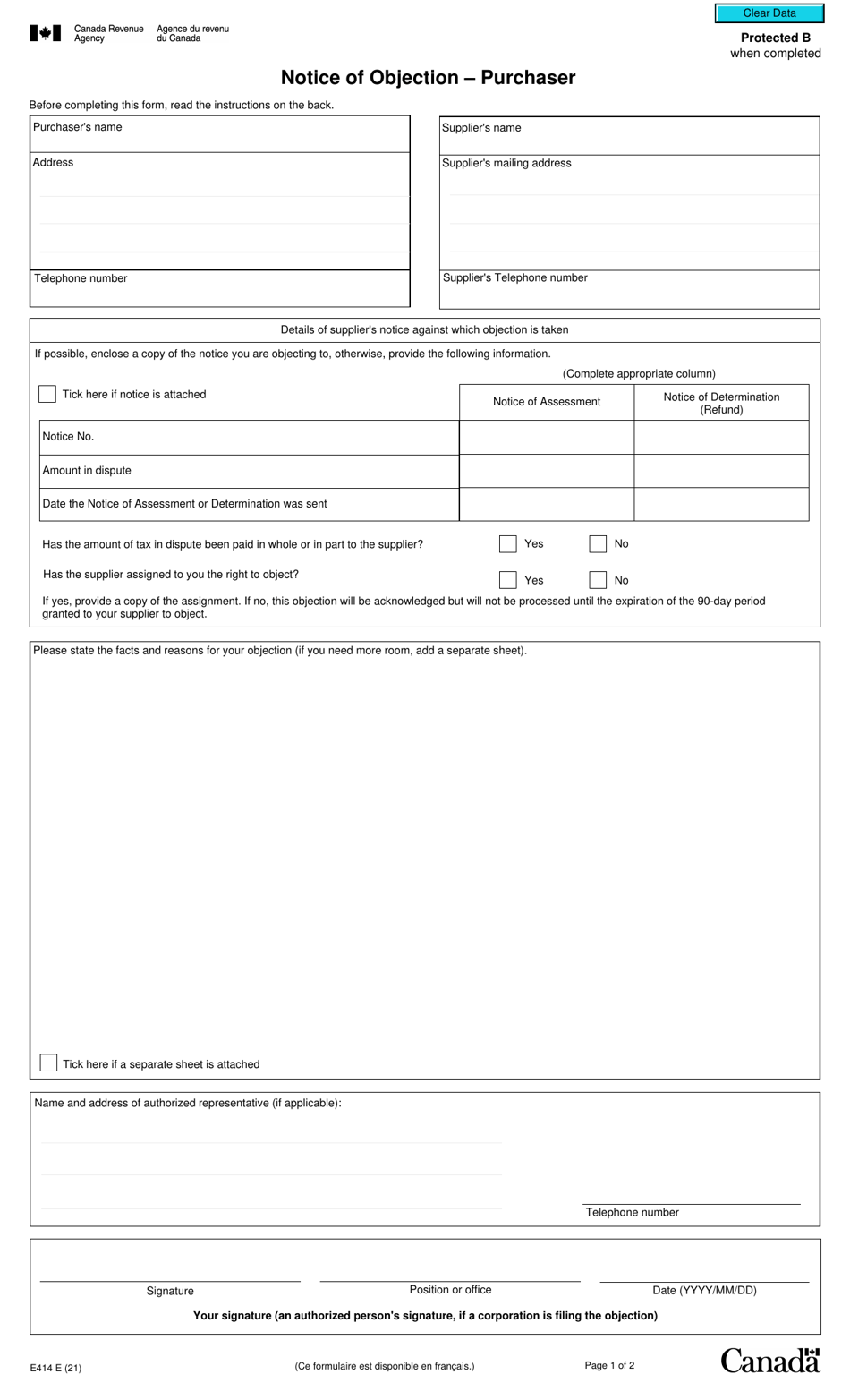

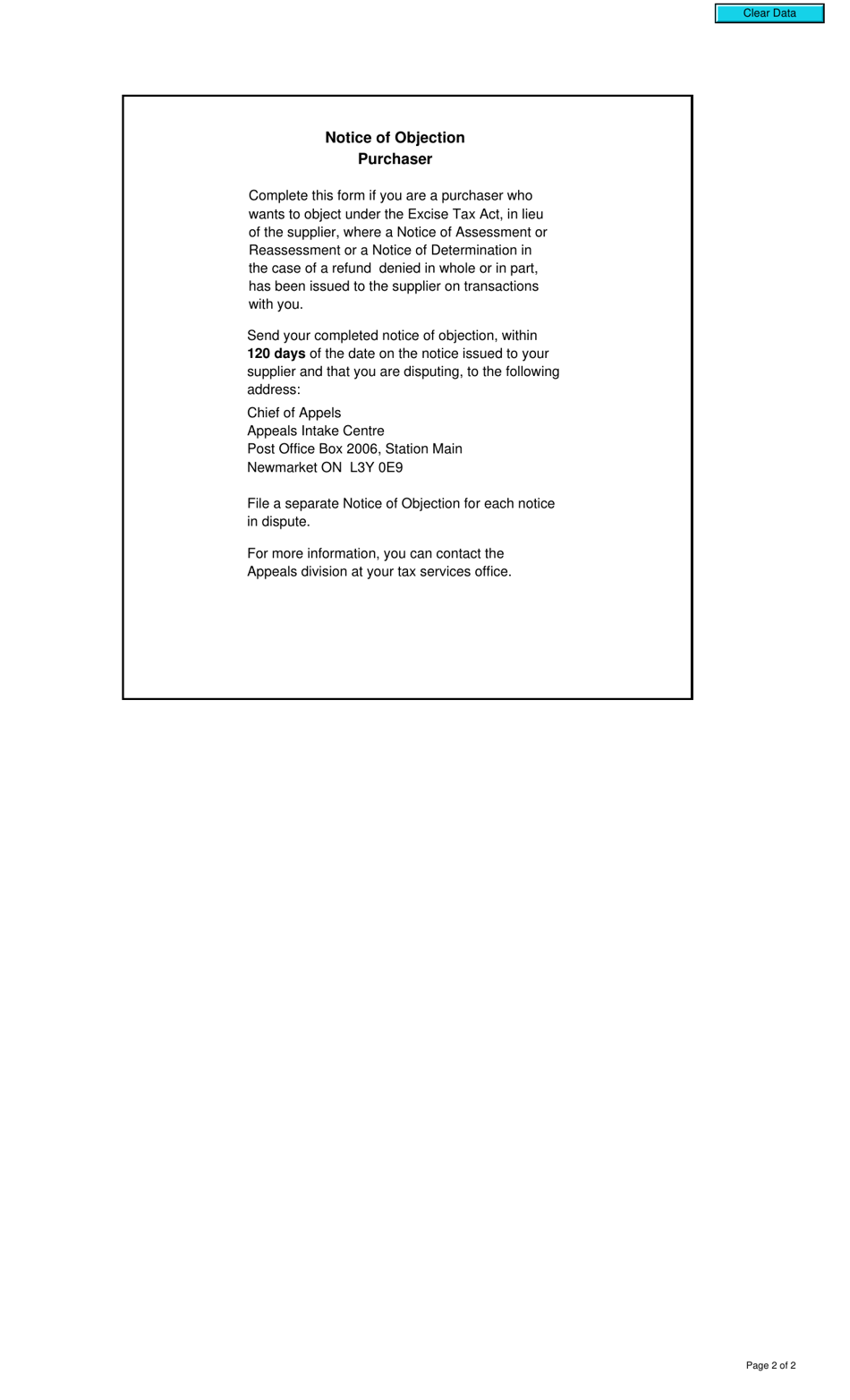

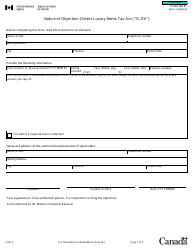

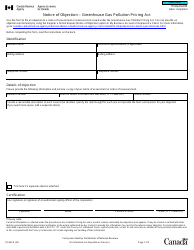

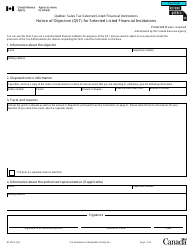

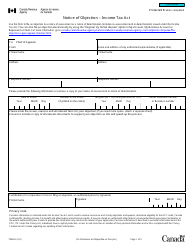

Form E414 Notice of Objection - Purchaser - Canada

Form E414 Notice of Objection - Purchaser in Canada is used for lodging a formal objection to the purchase of a property. It is typically used when a purchaser wishes to dispute the transaction or raise a concern regarding the sale. The form allows the buyer to provide detailed information about the objection and present their case for review. It is an important document for buyers in Canada who want to formally challenge a property purchase.

The Form E414 Notice of Objection in Canada is typically filed by the purchaser.

FAQ

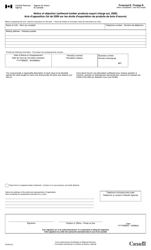

Q: What is Form E414 Notice of Objection - Purchaser?

A: Form E414 Notice of Objection - Purchaser is a form used in Canada to file an objection when a person disagrees with the amount of tax withheld by a purchaser.

Q: Who can use Form E414 Notice of Objection - Purchaser?

A: Any individual in Canada who disagrees with the amount of tax withheld by a purchaser can use Form E414 to file an objection.

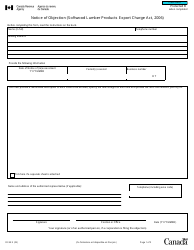

Q: What information is required in Form E414 Notice of Objection - Purchaser?

A: The form requires information such as the individual's name, address, social insurance number, the purchaser's name, address, and business number, and details of the objection.

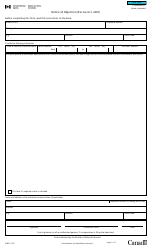

Q: How should I submit Form E414 Notice of Objection - Purchaser?

A: Completed Form E414 can be submitted to the CRA by mail or fax. The address and fax number are provided on the form.