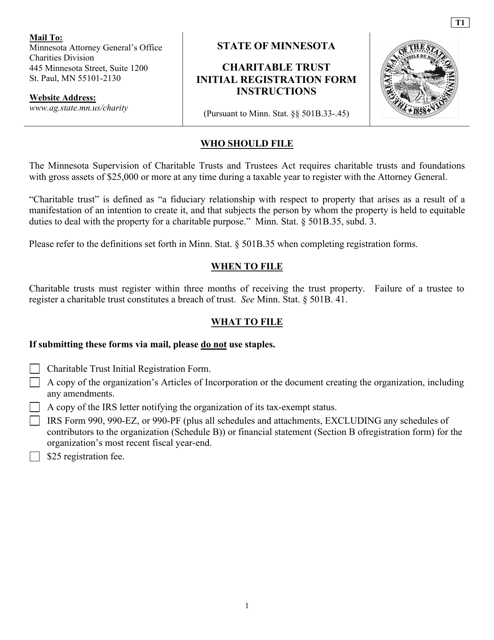

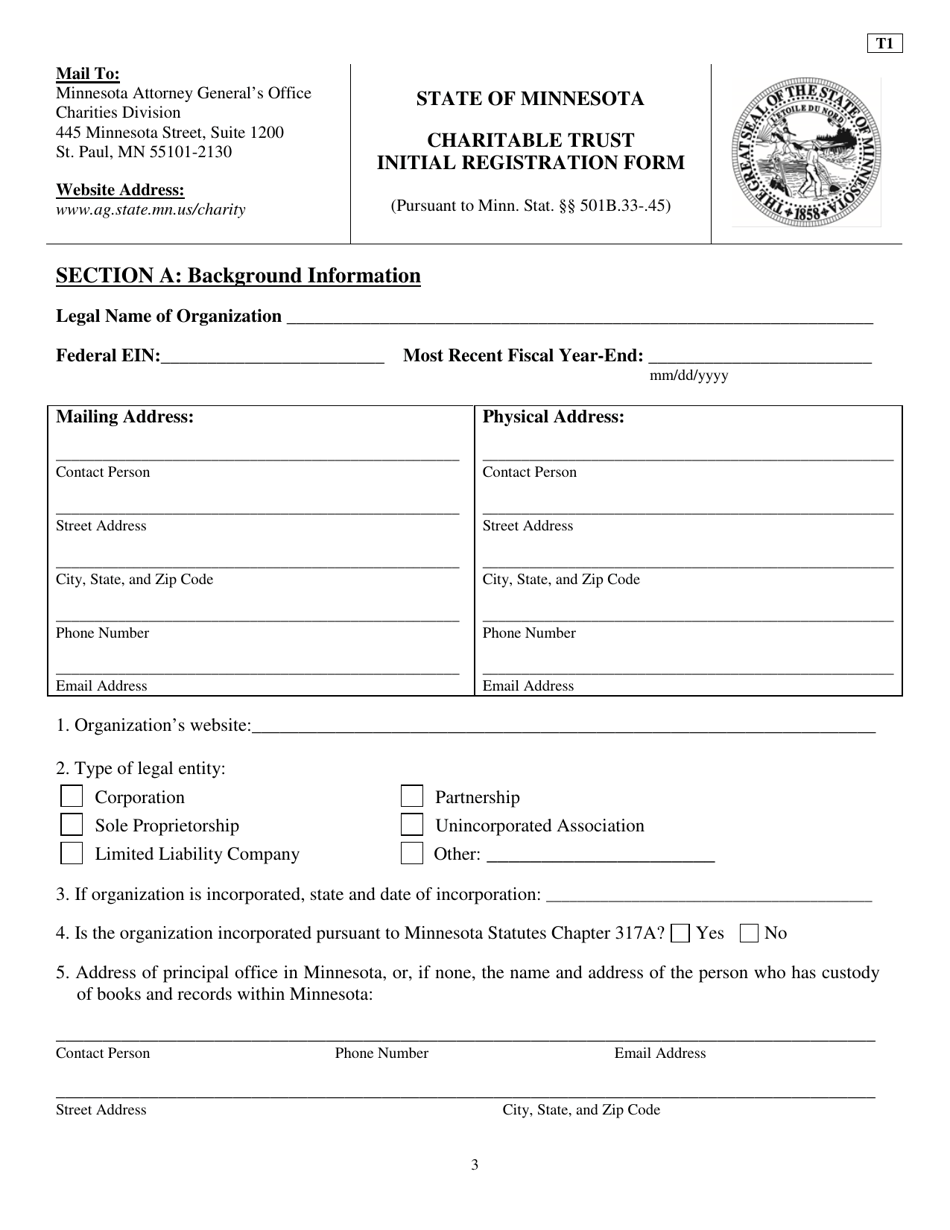

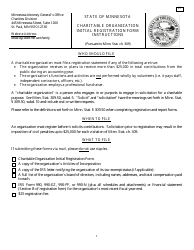

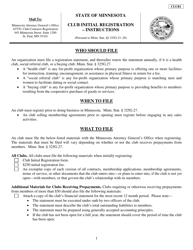

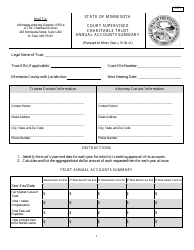

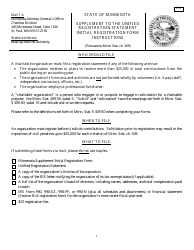

Form T1 Charitable Trust Initial Registration Form - Minnesota

What Is Form T1?

This is a legal form that was released by the Office of the Minnesota Attorney General - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form T1?

A: The Form T1 is the Charitable Trust Initial Registration Form in Minnesota.

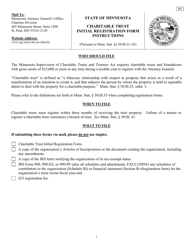

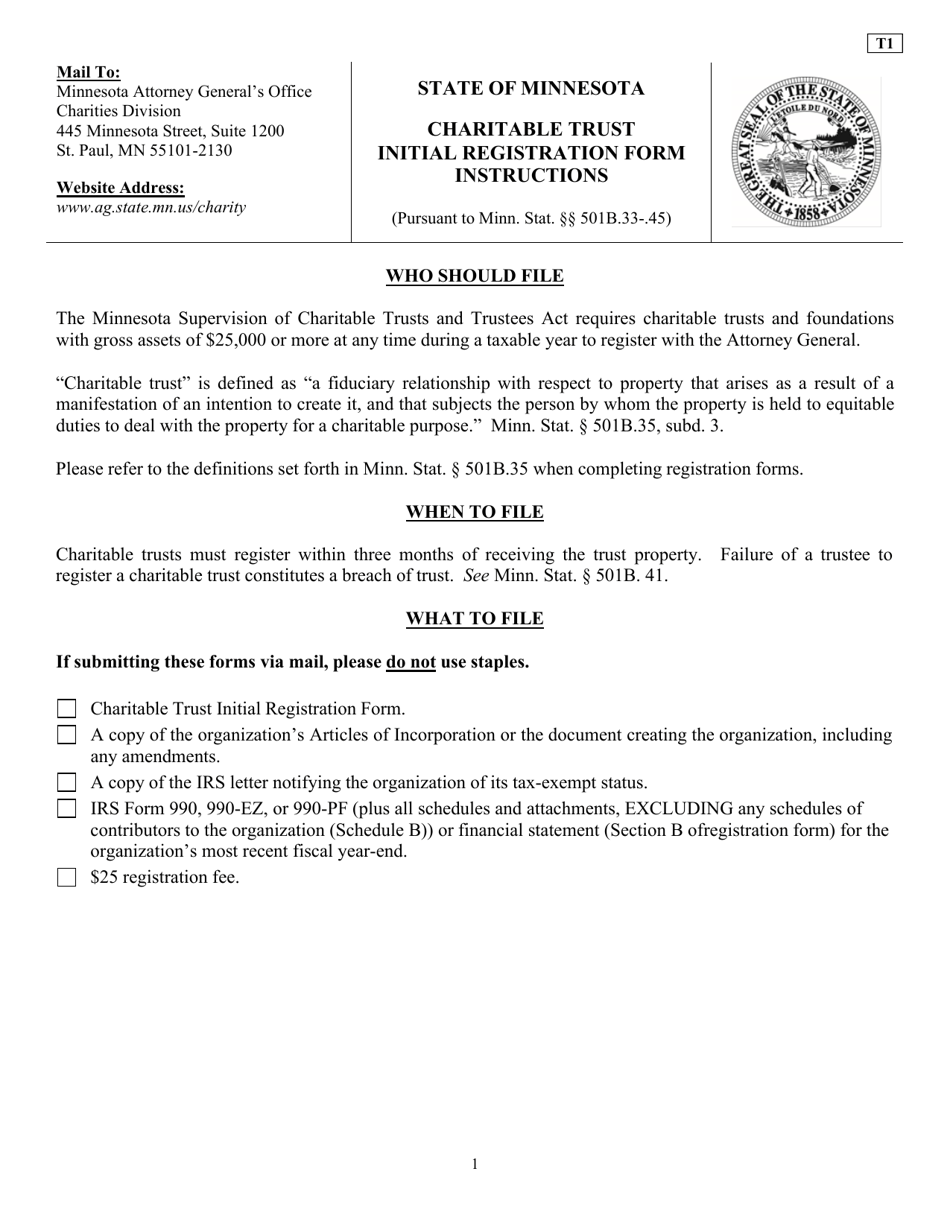

Q: Who needs to file Form T1?

A: Any charitable trust operating in Minnesota needs to file Form T1.

Q: What is the purpose of Form T1?

A: The purpose of Form T1 is to register a charitable trust with the state of Minnesota.

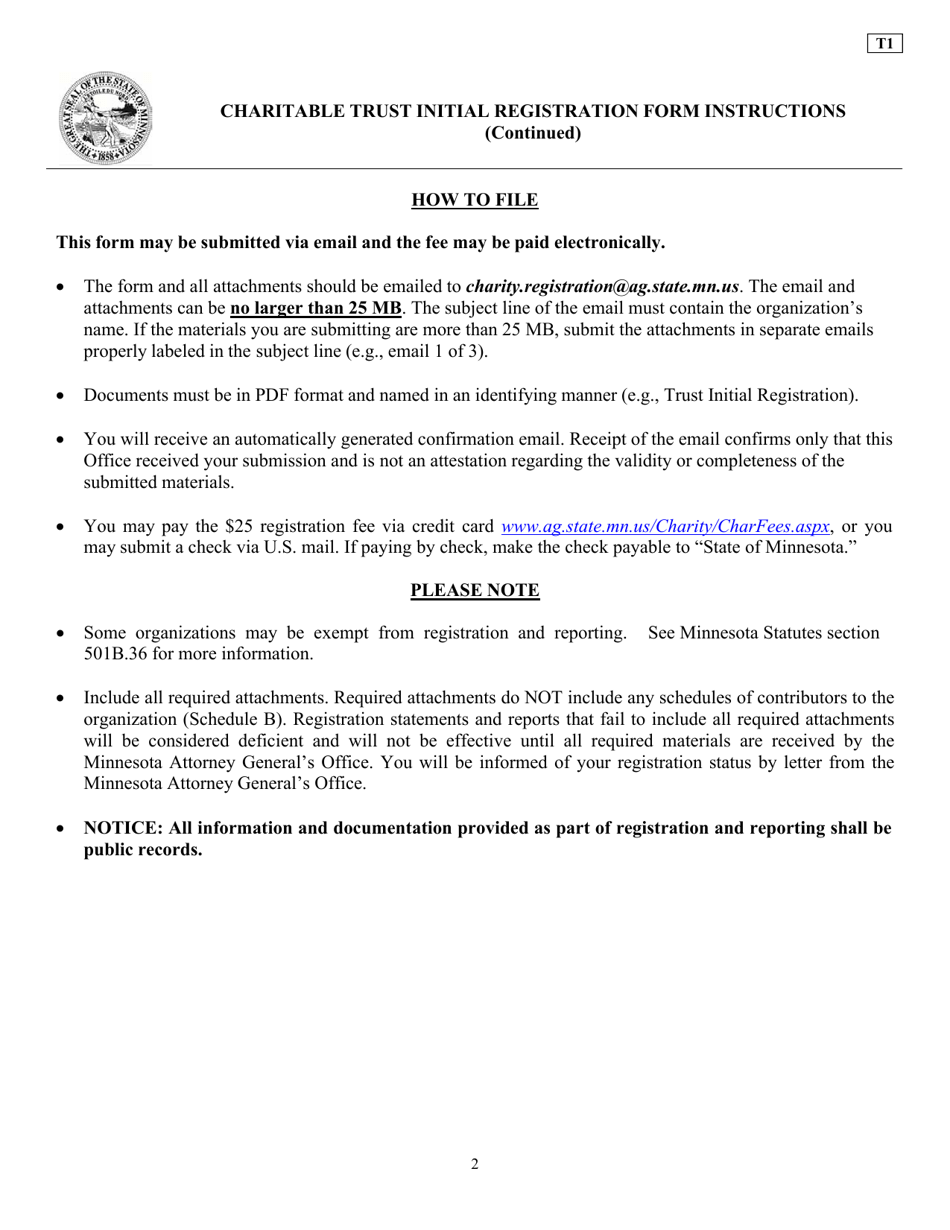

Q: How do I obtain Form T1?

A: You can obtain Form T1 from the Minnesota Department of Revenue.

Q: Is there a fee for filing Form T1?

A: Yes, there is a fee associated with filing Form T1. The fee amount may vary.

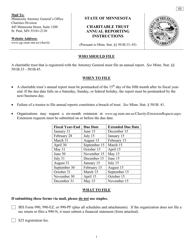

Q: Are there any deadlines for filing Form T1?

A: Yes, Form T1 must be filed within 60 days of the charitable trust's formation or first solicitation of charitable contributions in Minnesota.

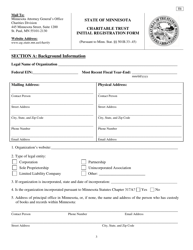

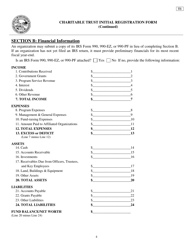

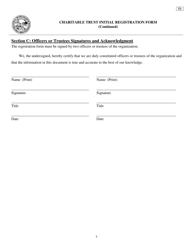

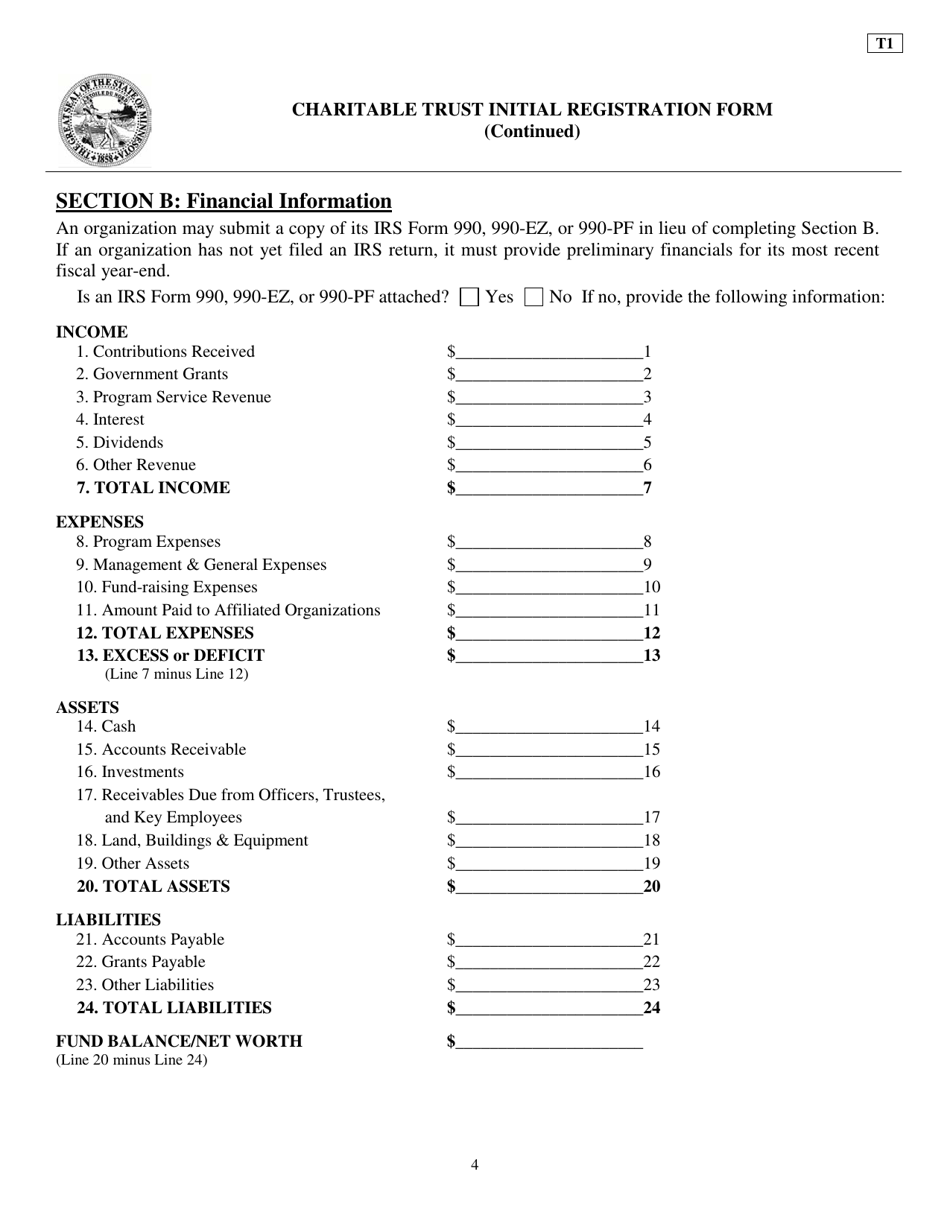

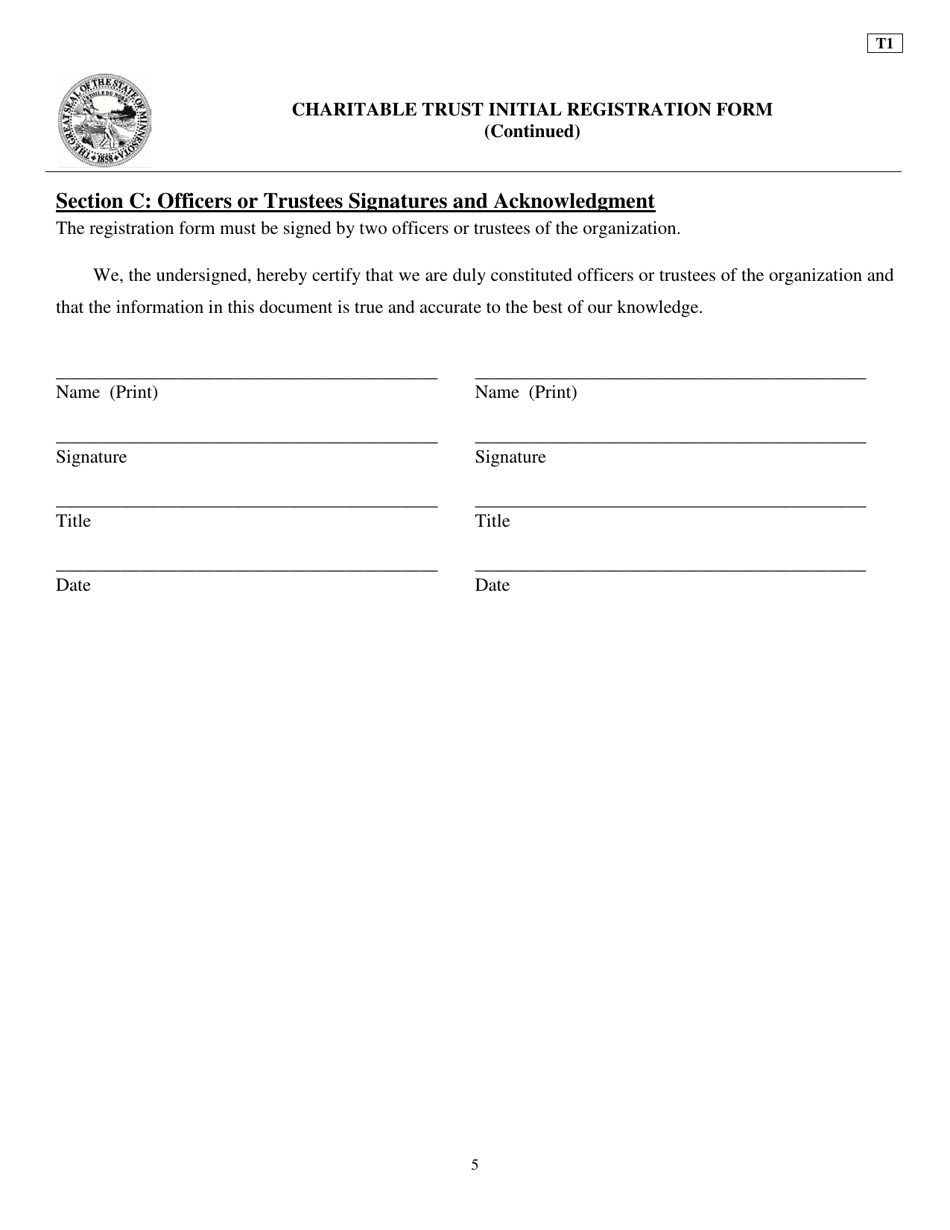

Q: What information is required on Form T1?

A: Form T1 requires information such as the charitable trust's name, purpose, assets, and contact information.

Q: Are there any penalties for not filing Form T1?

A: Yes, failure to file Form T1 or filing it late may result in penalties and interest.

Form Details:

- The latest edition provided by the Office of the Minnesota Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T1 by clicking the link below or browse more documents and templates provided by the Office of the Minnesota Attorney General.