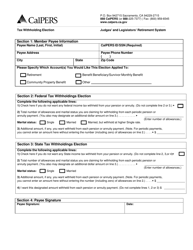

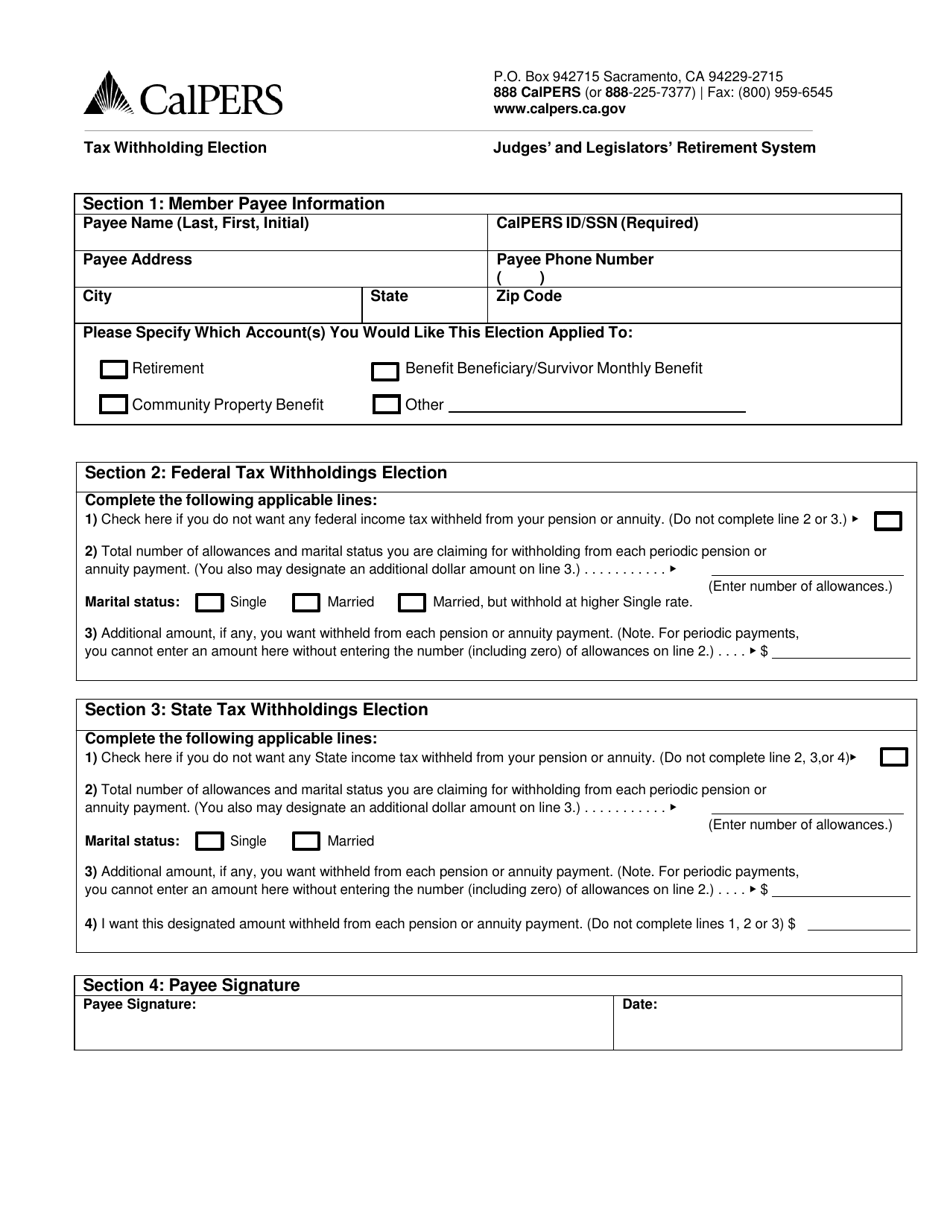

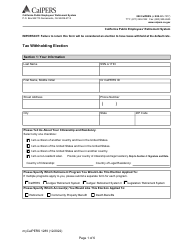

Form PERS-PRS-W-4P / DE-4P Tax Withholding Election - Judges' and Legislators' Retirement System - California

What Is Form PERS-PRS-W-4P/DE-4P?

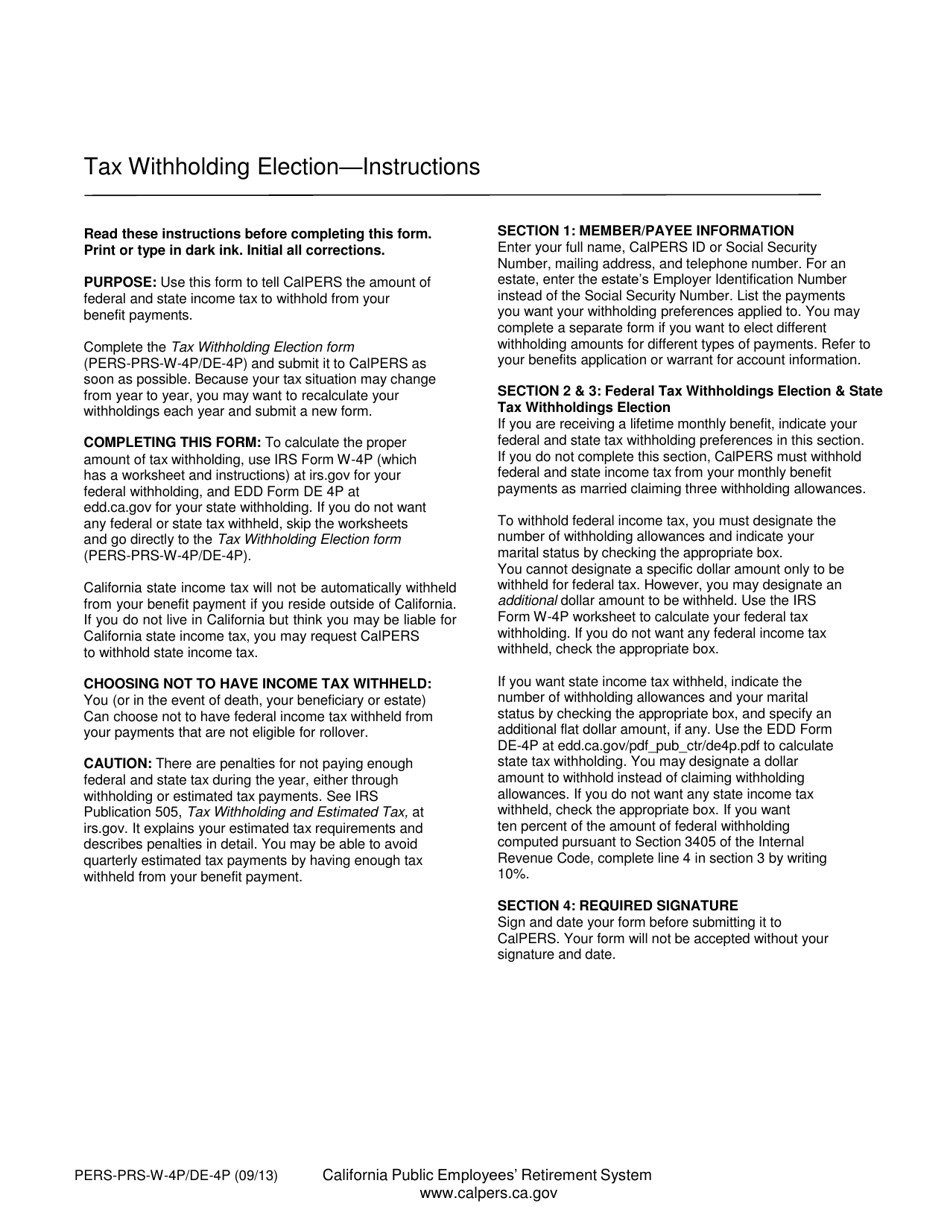

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PERS-PRS-W-4P/DE-4P?

A: Form PERS-PRS-W-4P/DE-4P is a tax withholding election form specifically for the Judges' and Legislators' Retirement System in California.

Q: Who is required to use this form?

A: This form is for judges and legislators who are members of the retirement system.

Q: What is the purpose of this form?

A: The purpose of this form is to instruct your employer on the amount of tax to withhold from your retirement system benefit payments.

Q: Is this form mandatory?

A: Yes, if you are a member of the Judges' and Legislators' Retirement System in California, you must complete this form and submit it to CalPERS.

Q: Can I change my tax withholding election?

A: Yes, you can update your tax withholding election by completing a new Form PERS-PRS-W-4P/DE-4P and submitting it to CalPERS.

Q: How often should I review my tax withholding?

A: It is recommended that you review your tax withholding election annually or whenever there is a change in your financial circumstances to ensure that the correct amount of tax is being withheld.

Q: What happens if I do not submit this form?

A: If you do not submit Form PERS-PRS-W-4P/DE-4P, CalPERS will withhold taxes based on the default withholding rate, which may not accurately reflect your tax liability.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PERS-PRS-W-4P/DE-4P by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.