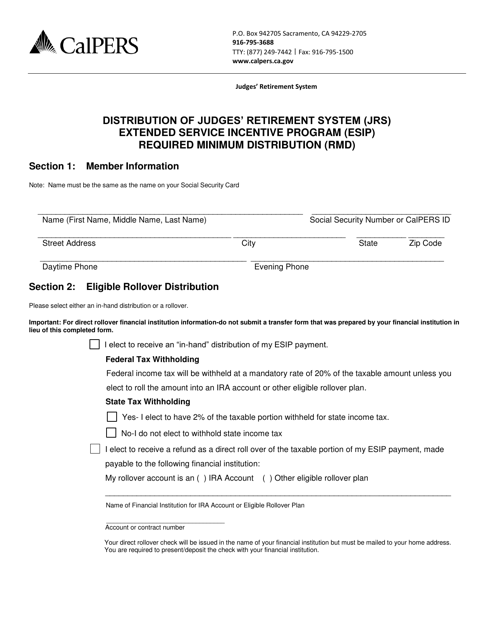

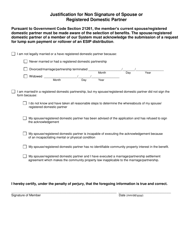

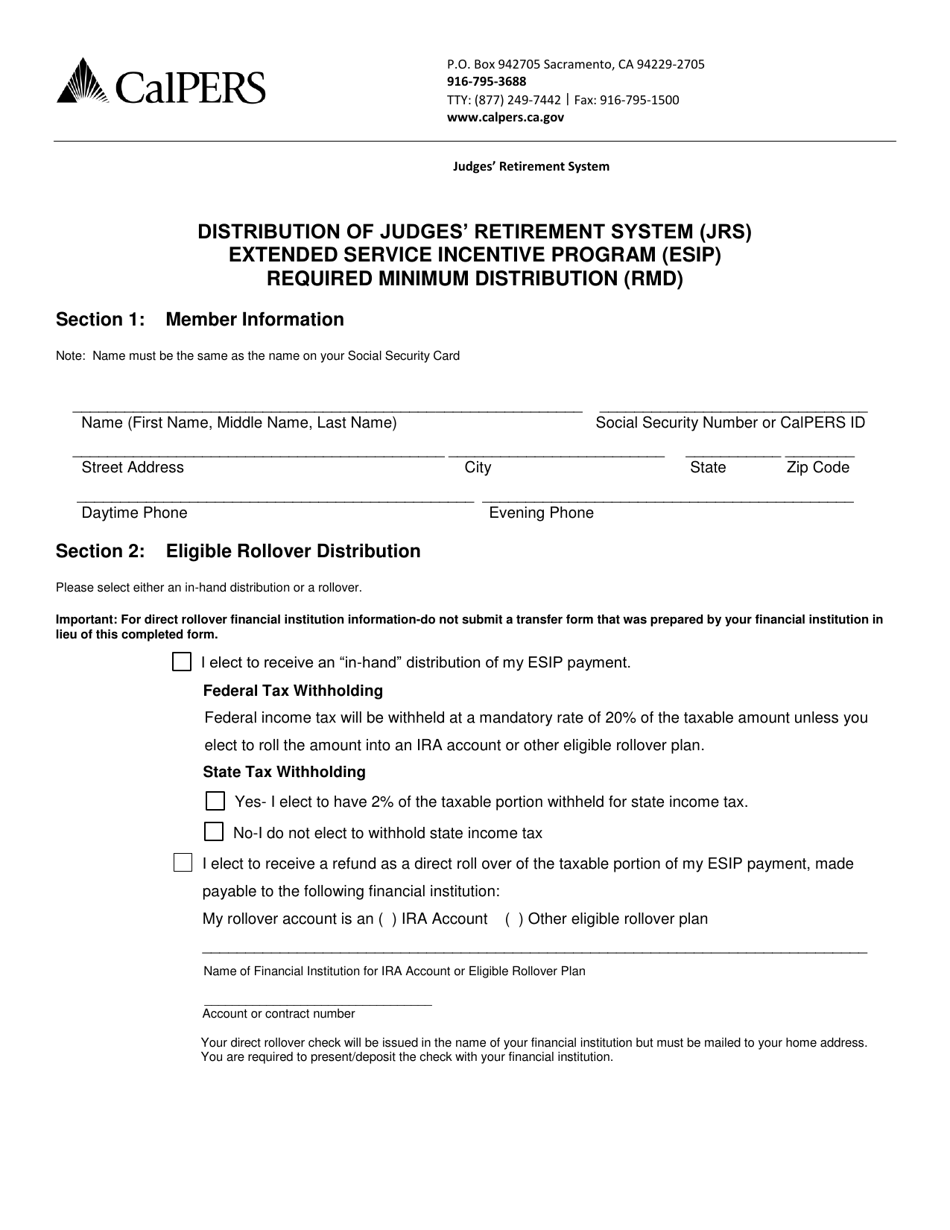

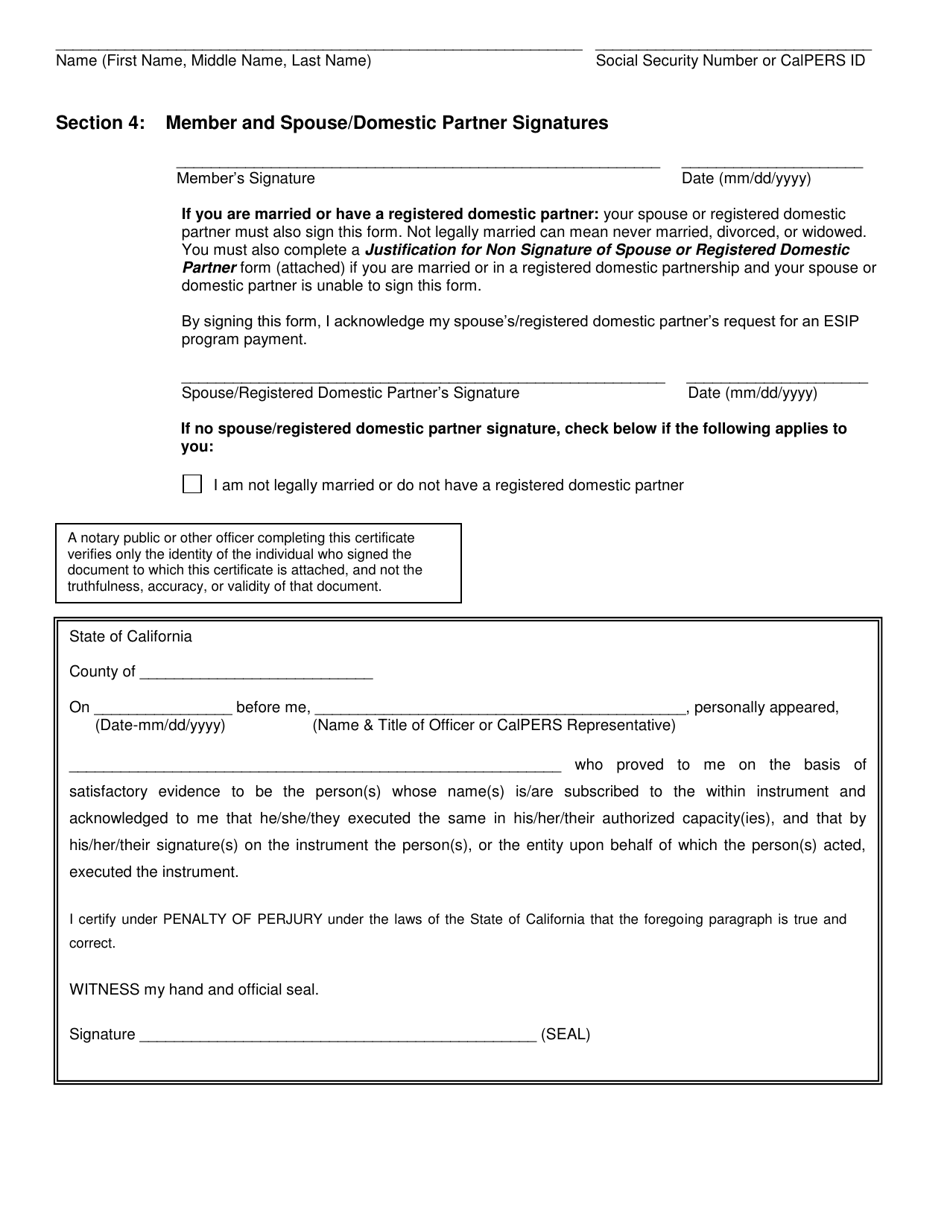

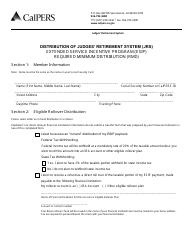

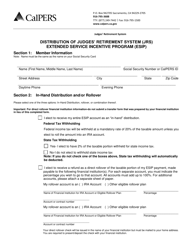

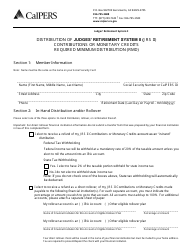

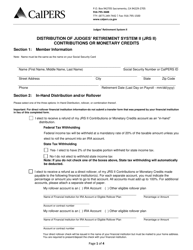

Distribution of Judges' Retirement System (Jrs) Extended Service Incentive Program (Esip) Required Minimum Distribution (Rmd) - California

Distribution of Judges' Retirement System (Jrs) Extended Service Required Minimum Distribution (Rmd) is a legal document that was released by the California Public Employees' Retirement System - a government authority operating within California.

FAQ

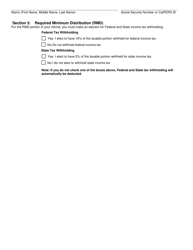

Q: What is the Judges' Retirement System (JRS) Extended Service Incentive Program (ESIP)?

A: JRS-ESIP is a program that allows judges to extend their service beyond normal retirement age.

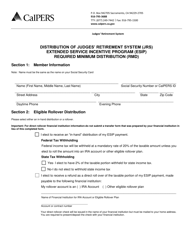

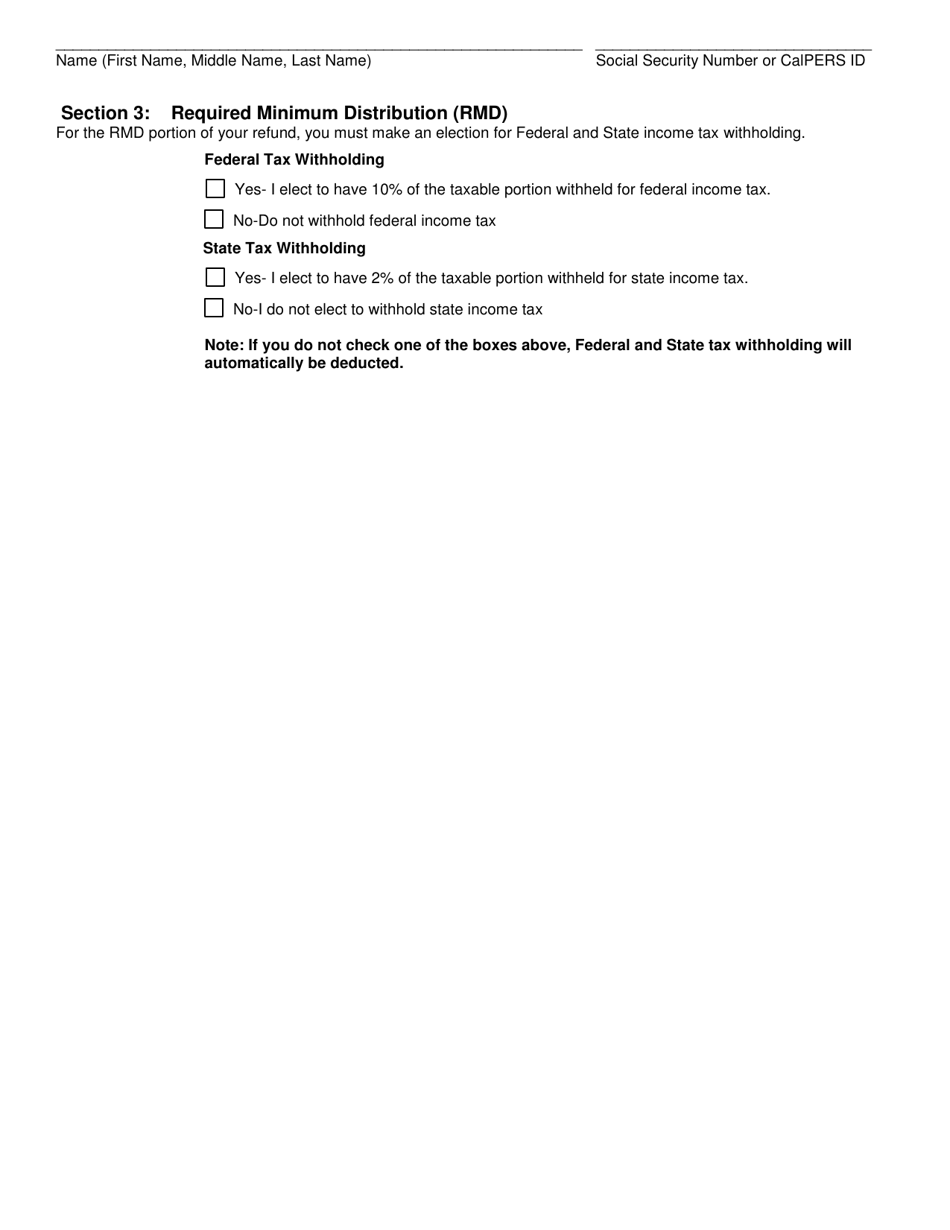

Q: What is the Required Minimum Distribution (RMD)?

A: RMD is the minimum amount that must be withdrawn from retirement accounts, including JRS, each year after reaching a certain age.

Q: Is the JRS-ESIP program available in California?

A: Yes, the JRS-ESIP program is available for judges in California.

Q: What is the purpose of the JRS-ESIP program?

A: The program aims to incentivize experienced judges to continue their service, addressing potential shortage and maintaining continuity in the judicial system.

Q: Do judges have to participate in the JRS-ESIP program?

A: Participation in the JRS-ESIP program is voluntary for eligible judges.

Q: Is the Required Minimum Distribution applicable to the JRS retirement accounts?

A: Yes, JRS retirement accounts are subject to the Required Minimum Distribution rules.

Q: Are there any penalties for not taking the Required Minimum Distribution from JRS accounts?

A: Yes, failure to take the required distribution may result in penalties imposed by the IRS.

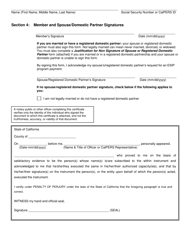

Q: How can judges apply for the JRS-ESIP program?

A: Judges can contact their respective JRS administration to inquire about eligibility and application process for the ESIP program.

Form Details:

- The latest edition currently provided by the California Public Employees' Retirement System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.