This version of the form is not currently in use and is provided for reference only. Download this version of

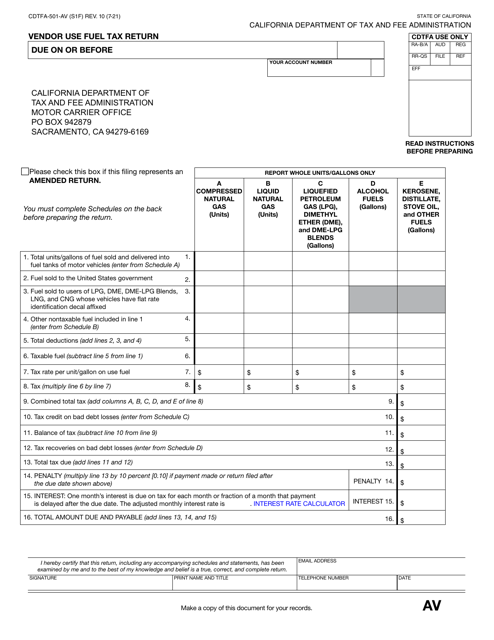

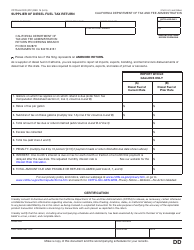

Form CDTFA-501-AV

for the current year.

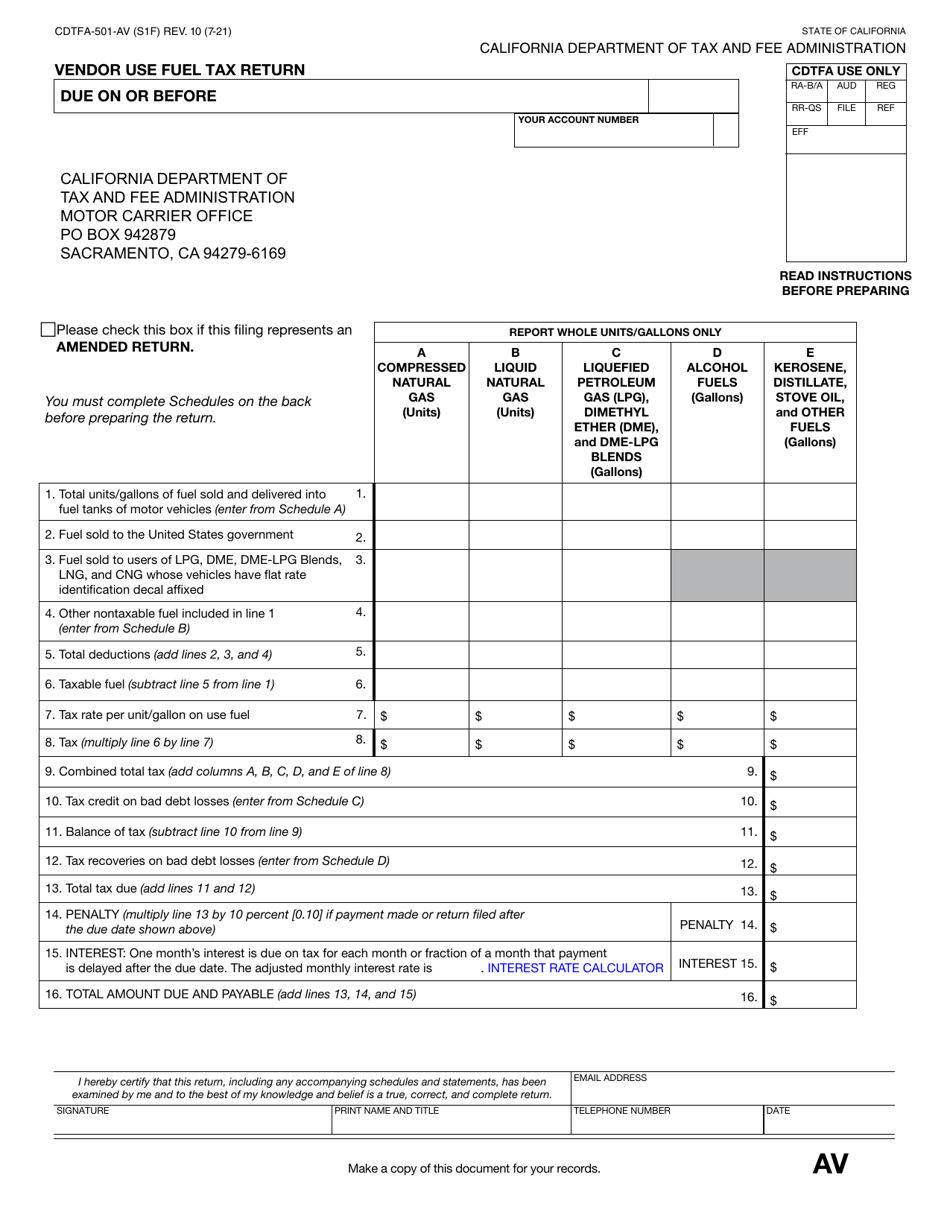

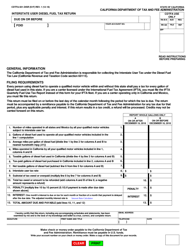

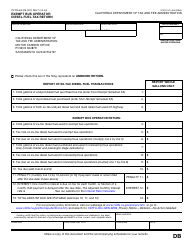

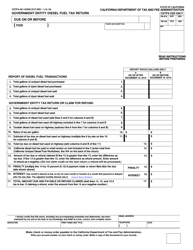

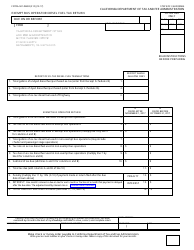

Form CDTFA-501-AV Vendor Use Fuel Tax Return - California

What Is Form CDTFA-501-AV?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CDTFA-501-AV?

A: Form CDTFA-501-AV is the Vendor Use Fuel Tax Return specific to the state of California.

Q: Who needs to file form CDTFA-501-AV?

A: Vendors who sell or use motor vehicle fuel or diesel fuel for their own use in California need to file form CDTFA-501-AV.

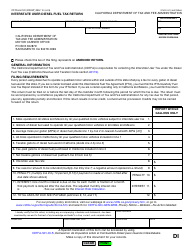

Q: What is vendor use fuel?

A: Vendor use fuel refers to motor vehicle fuel or diesel fuel that is purchased tax-free for a specific purpose, such as operating construction equipment or power generators.

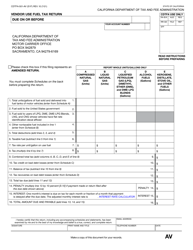

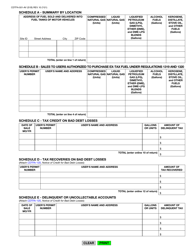

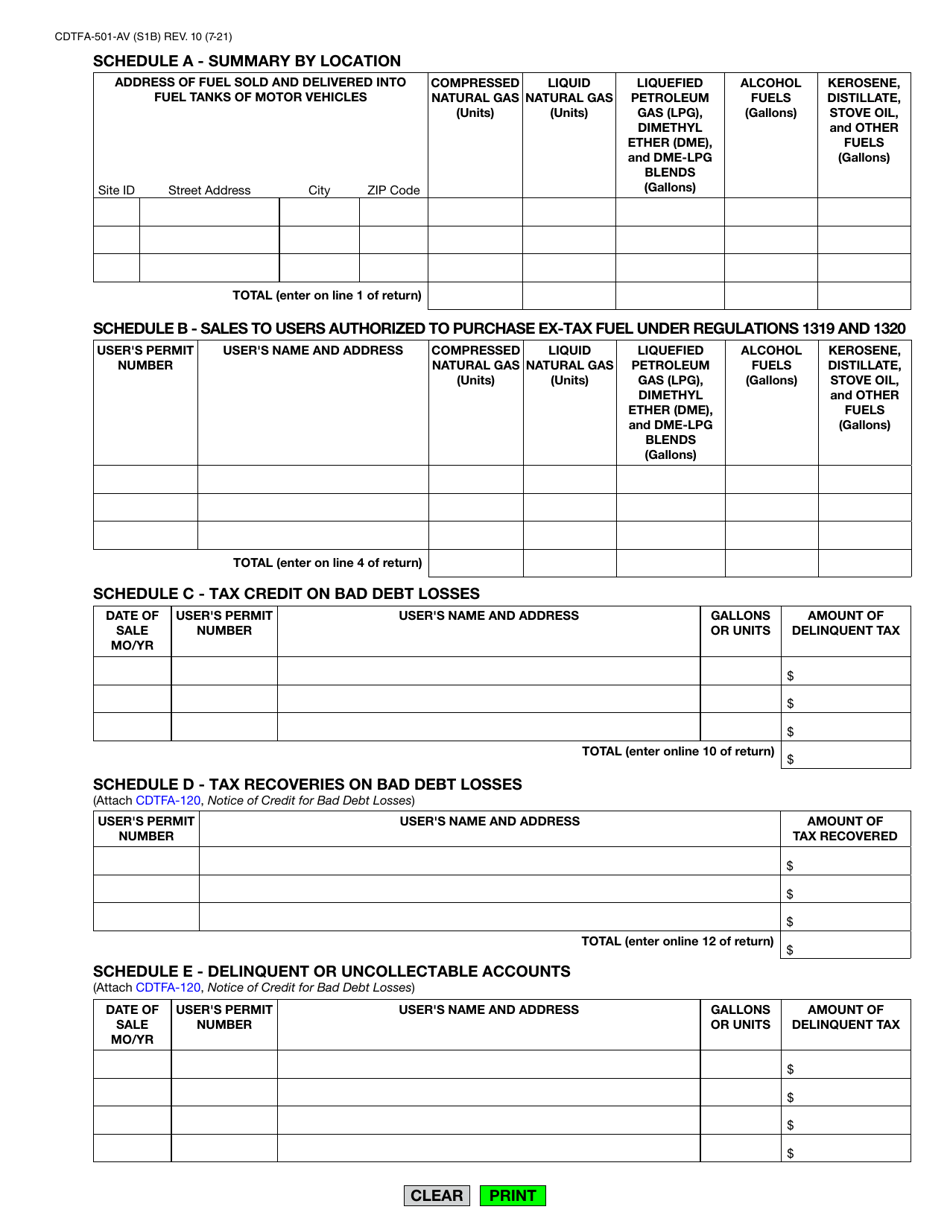

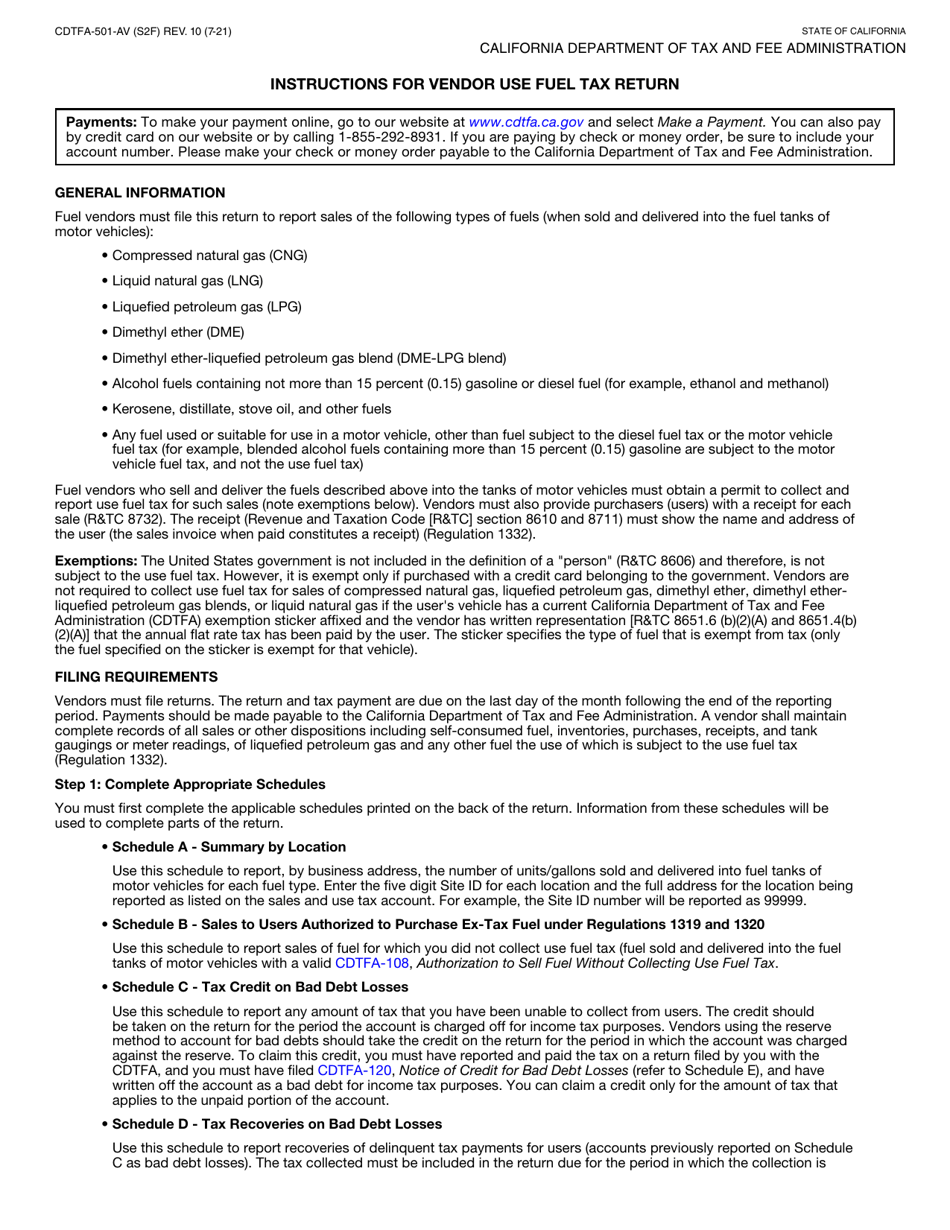

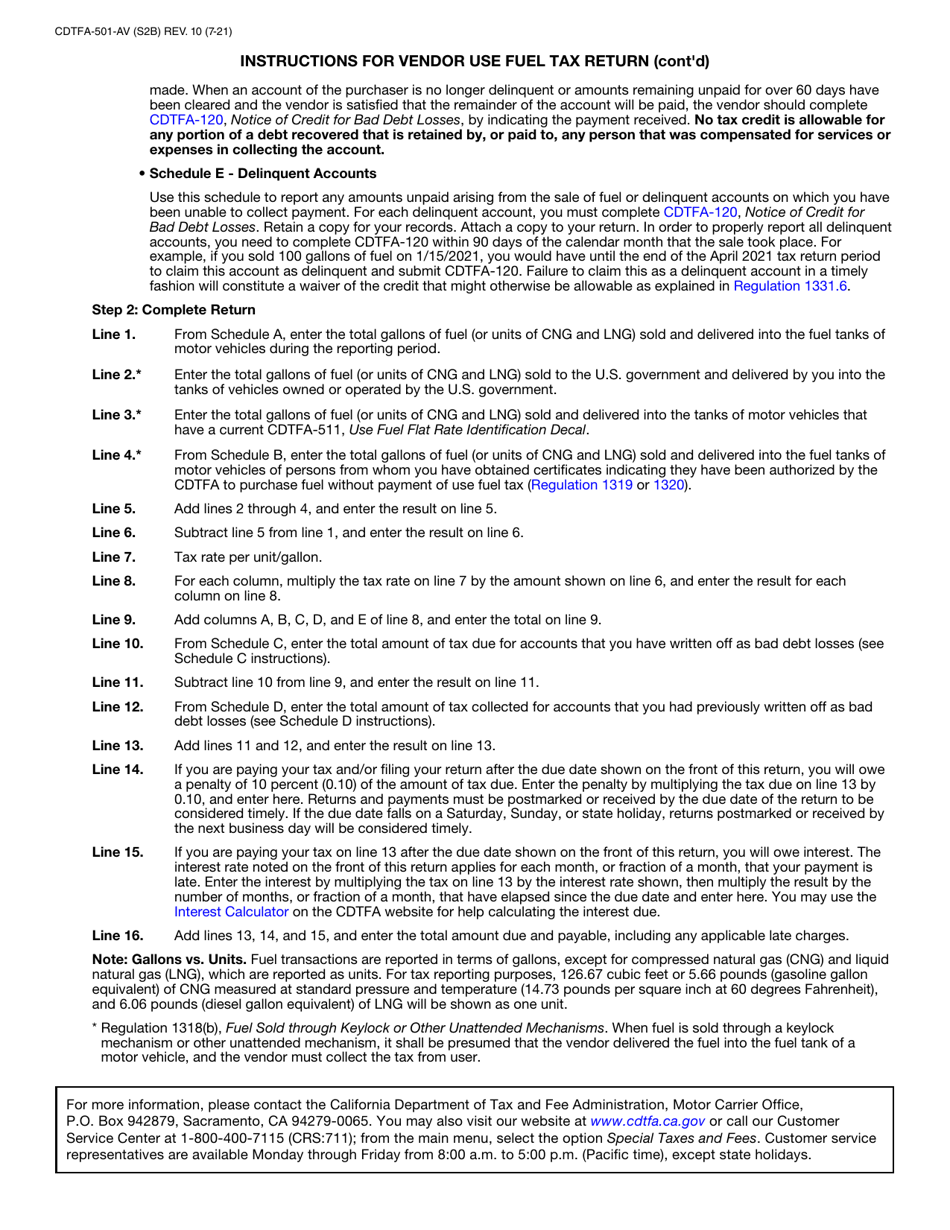

Q: What type of information is required on form CDTFA-501-AV?

A: Form CDTFA-501-AV requires vendors to provide information such as the total gallons of motor vehicle fuel or diesel fuel used or sold, the tax due, and any credits or refunds claimed.

Q: When is form CDTFA-501-AV due?

A: Form CDTFA-501-AV is due on a quarterly basis, with the due dates being the last day of the month following the end of the quarter (e.g., April 30th for the first quarter).

Q: Are there any penalties for late filing of form CDTFA-501-AV?

A: Yes, penalties may apply for late filing or underpayment of tax. It is important to file the return and pay any tax due on time to avoid penalties.

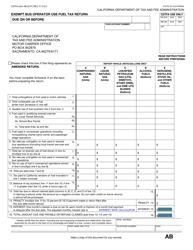

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

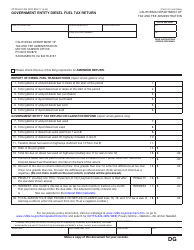

Download a fillable version of Form CDTFA-501-AV by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.