This version of the form is not currently in use and is provided for reference only. Download this version of

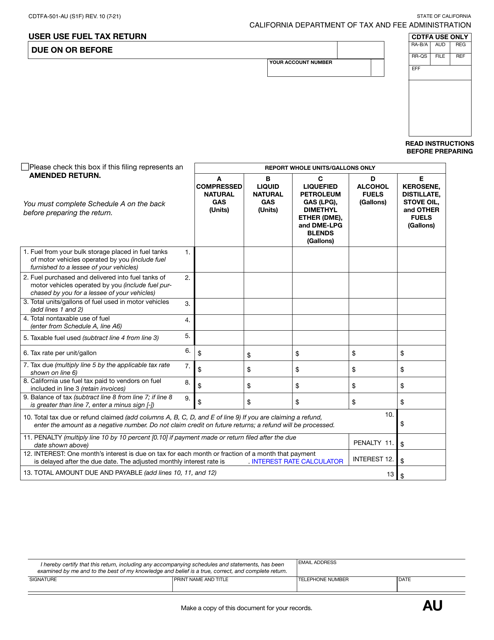

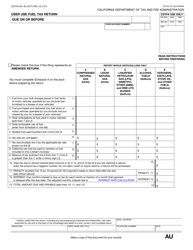

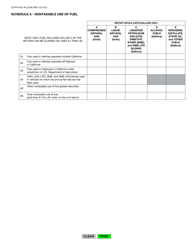

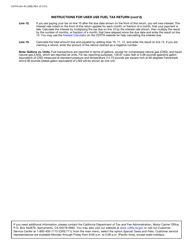

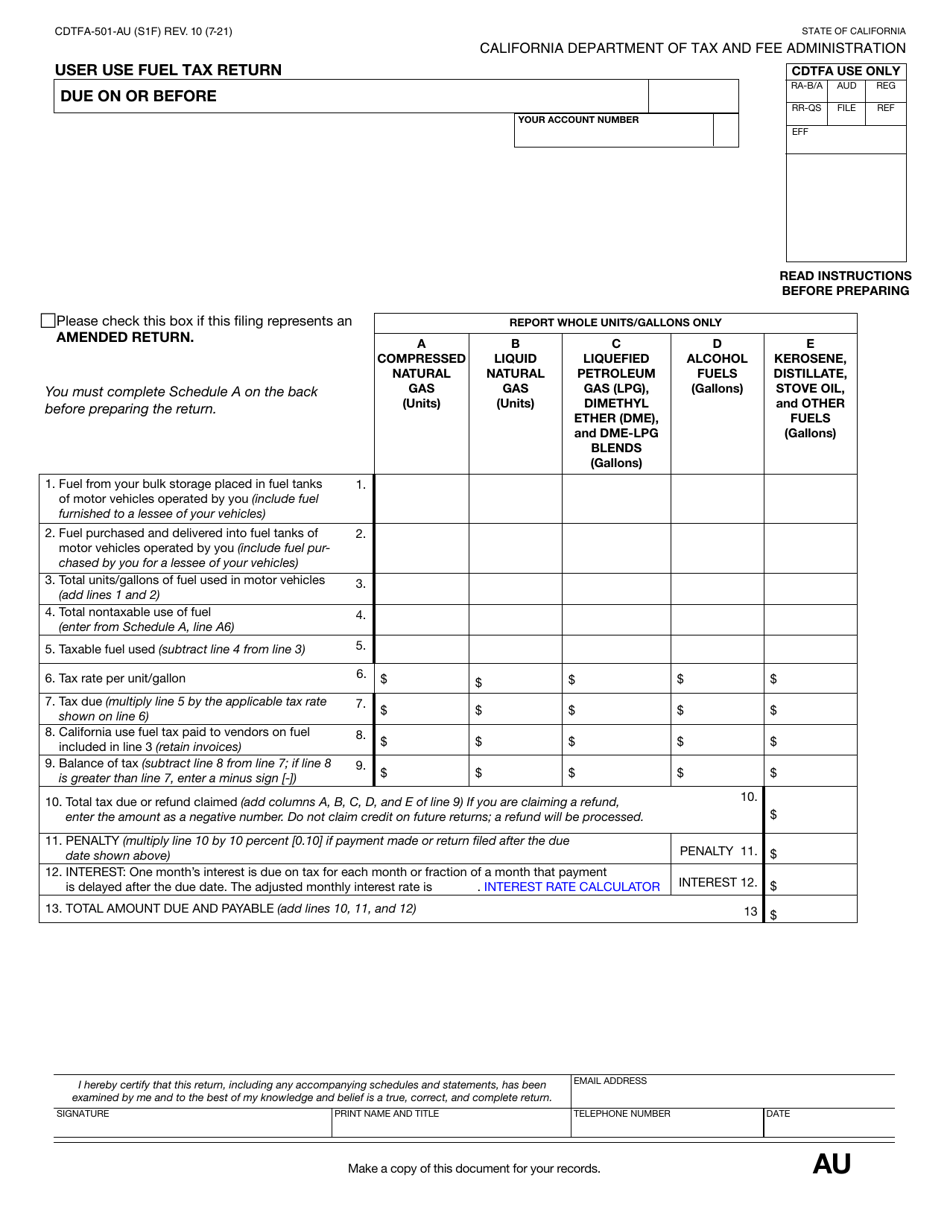

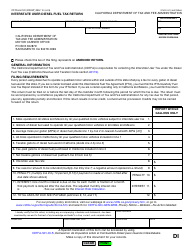

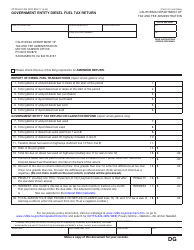

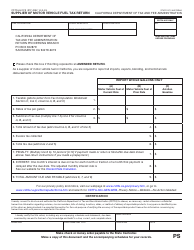

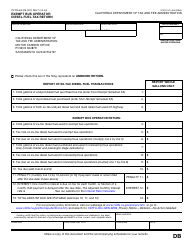

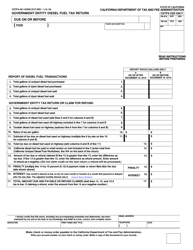

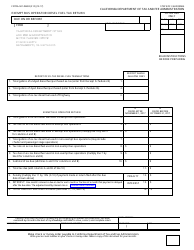

Form CDTFA-501-AU

for the current year.

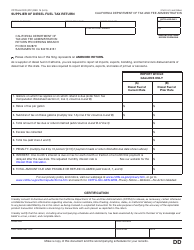

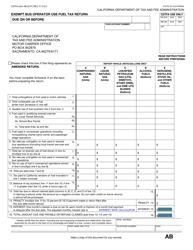

Form CDTFA-501-AU User Use Fuel Tax Return - California

What Is Form CDTFA-501-AU?

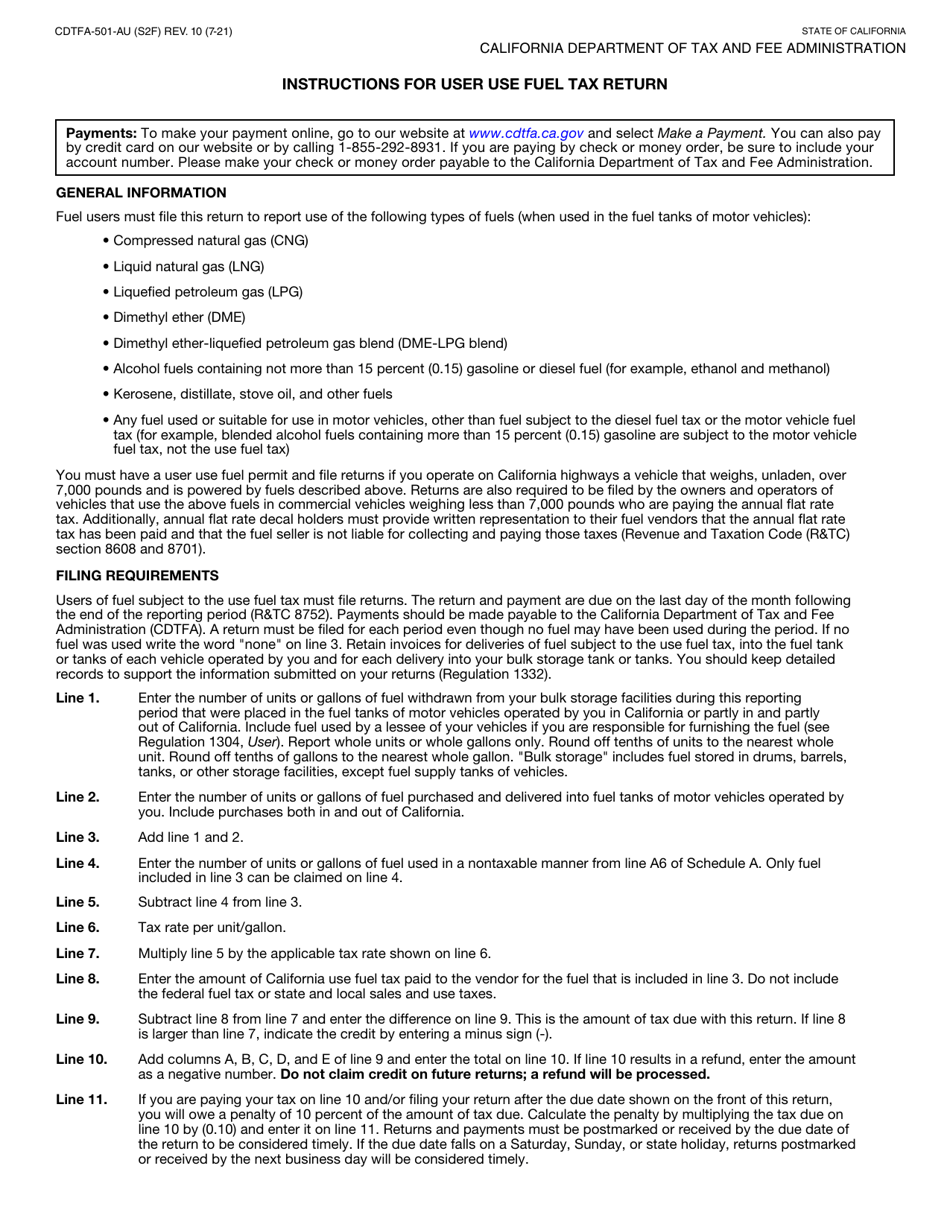

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

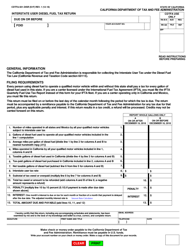

Q: What is Form CDTFA-501-AU?

A: Form CDTFA-501-AU is the User Use Fuel Tax Return in California.

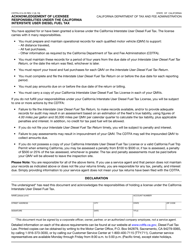

Q: Who needs to file Form CDTFA-501-AU?

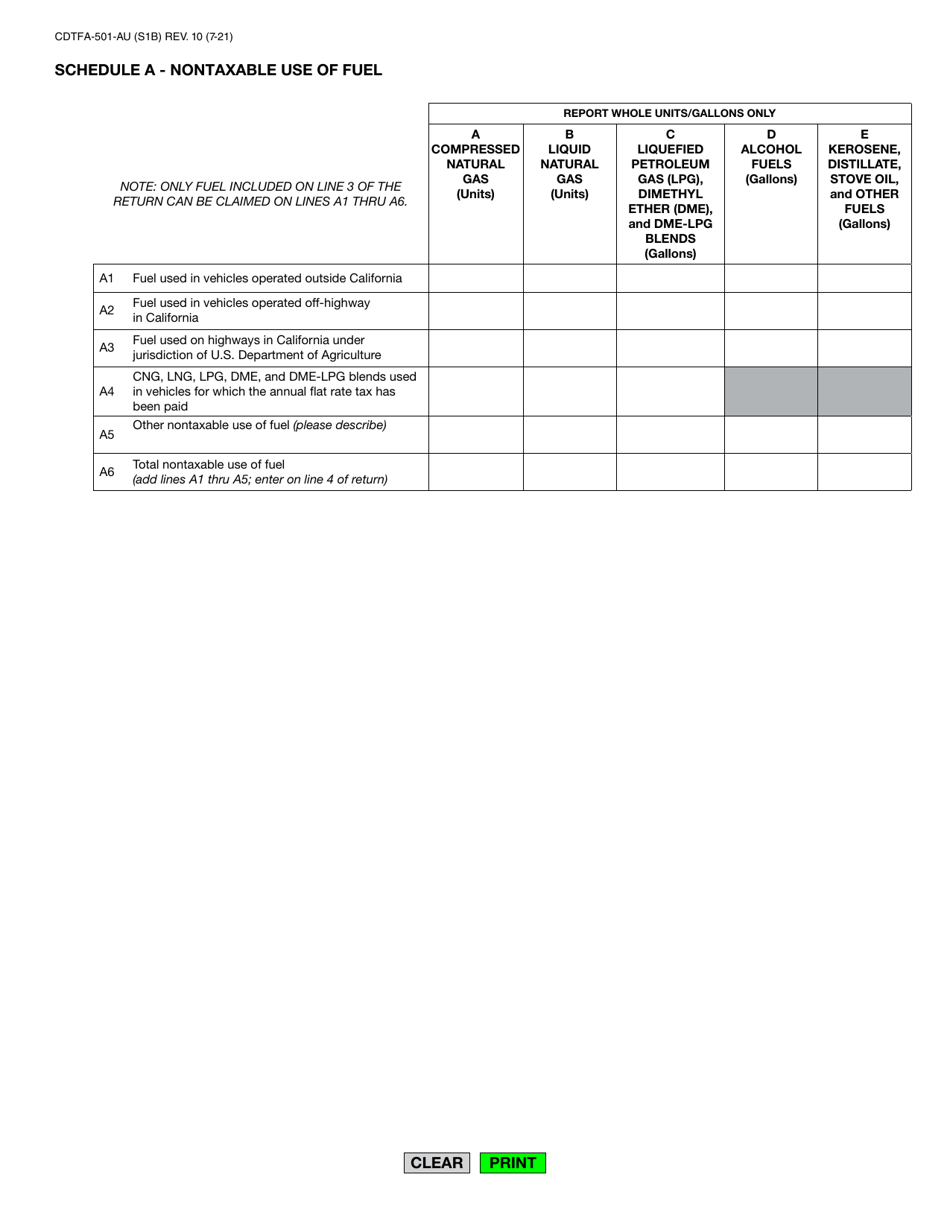

A: Any individual or business that uses tax-paid fuel for a nontaxable use in California needs to file Form CDTFA-501-AU.

Q: What is the purpose of Form CDTFA-501-AU?

A: Form CDTFA-501-AU is used to report and pay the User Use Fuel tax in California.

Q: When is Form CDTFA-501-AU due?

A: Form CDTFA-501-AU is due on a quarterly basis, with the due date falling on the last day of the month following the end of each quarter.

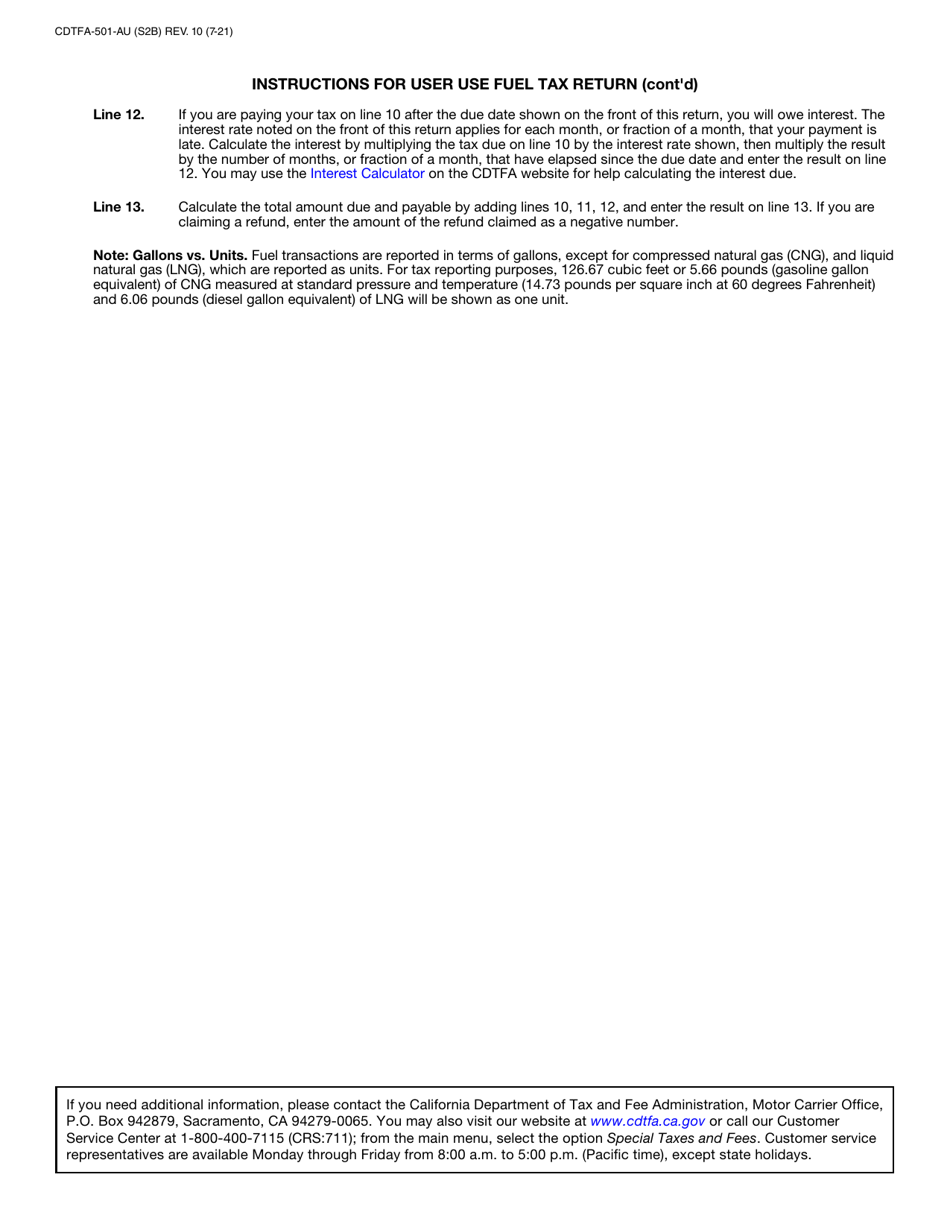

Q: Are there any penalties for not filing Form CDTFA-501-AU?

A: Yes, there are penalties for not filing Form CDTFA-501-AU, including late filing penalties and interest on unpaid taxes.

Q: Do I need to include payment with Form CDTFA-501-AU?

A: Yes, you need to include payment for any taxes due with Form CDTFA-501-AU.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-AU by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.