This version of the form is not currently in use and is provided for reference only. Download this version of

SBA Form 3512

for the current year.

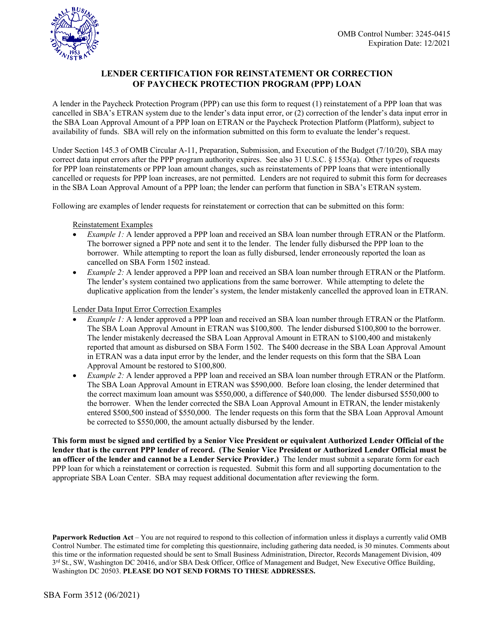

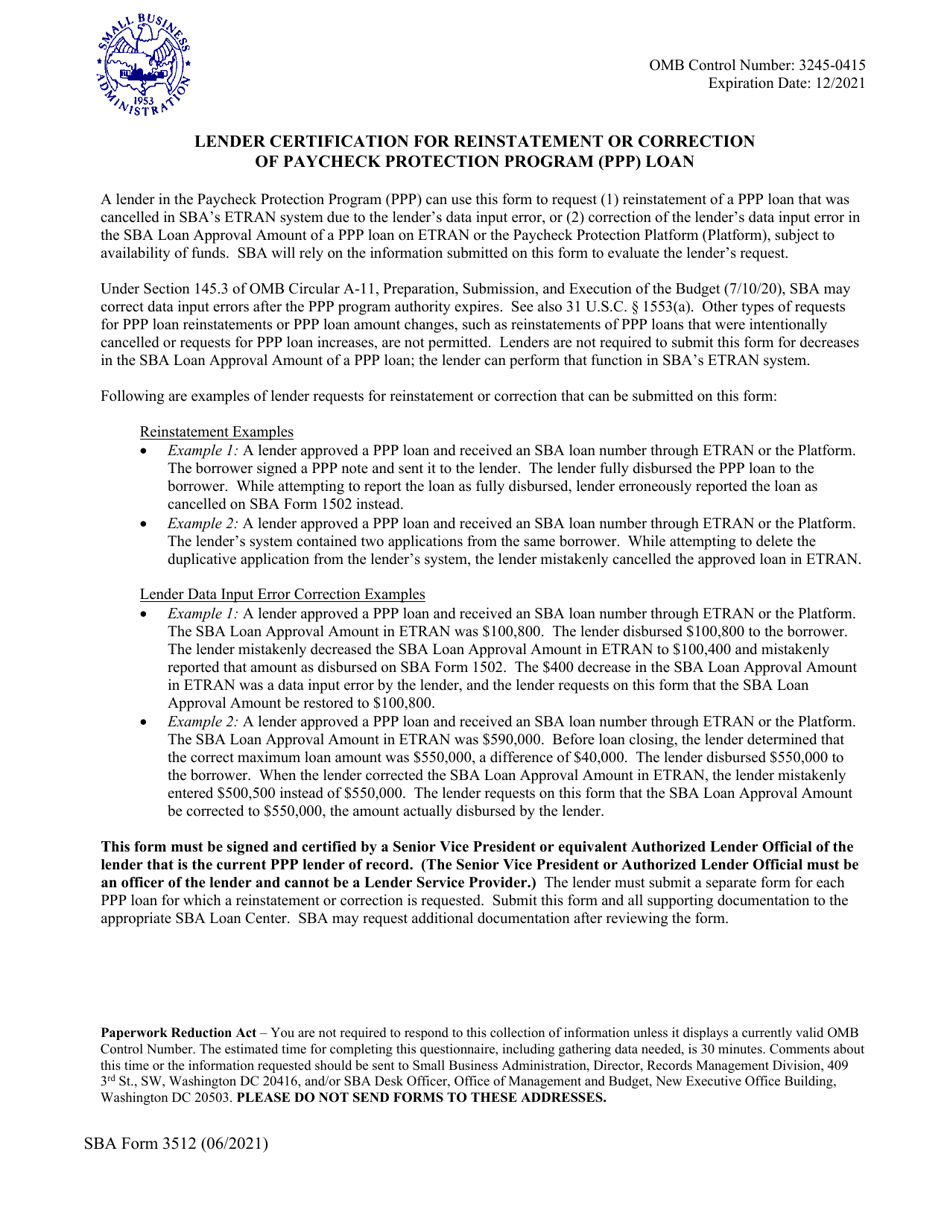

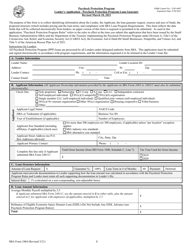

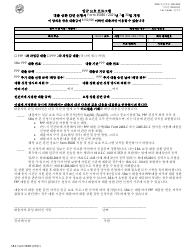

SBA Form 3512 Lender Certification for Reinstatement or Correction of Paycheck Protection Program (PPP) Loan

What Is SBA Form 3512?

This is a legal form that was released by the U.S. Small Business Administration on June 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 3512?

A: SBA Form 3512 is the Lender Certification for Reinstatement or Correction of Paycheck Protection Program (PPP) Loan.

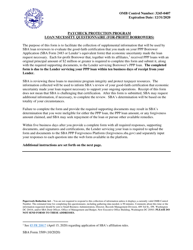

Q: What is the purpose of SBA Form 3512?

A: The purpose of SBA Form 3512 is to certify and request the reinstatement or correction of a PPP loan.

Q: Who can use SBA Form 3512?

A: Lenders can use SBA Form 3512 to request the reinstatement or correction of a PPP loan.

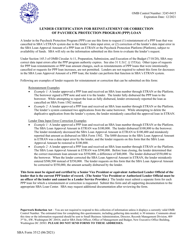

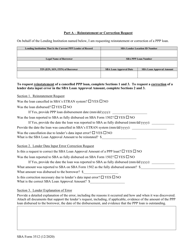

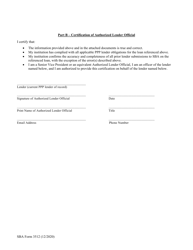

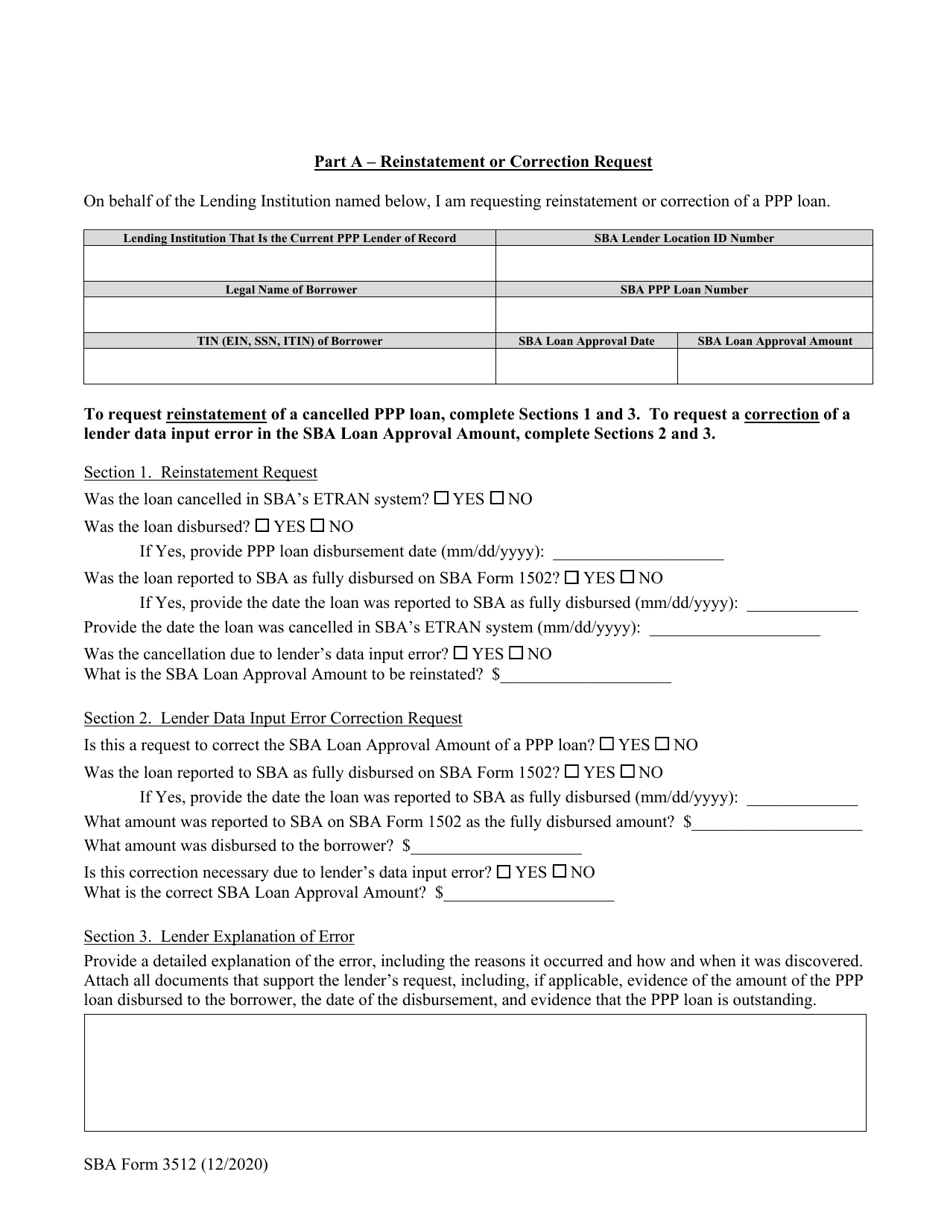

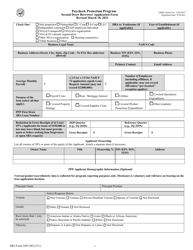

Q: What information is required in SBA Form 3512?

A: SBA Form 3512 requires information such as the lender's name, contact information, PPP loan number, and the reason for the reinstatement or correction.

Q: Is there a deadline for submitting SBA Form 3512?

A: There may be a specific deadline for submitting SBA Form 3512, so it is important to check with your lender or refer to the SBA's guidelines.

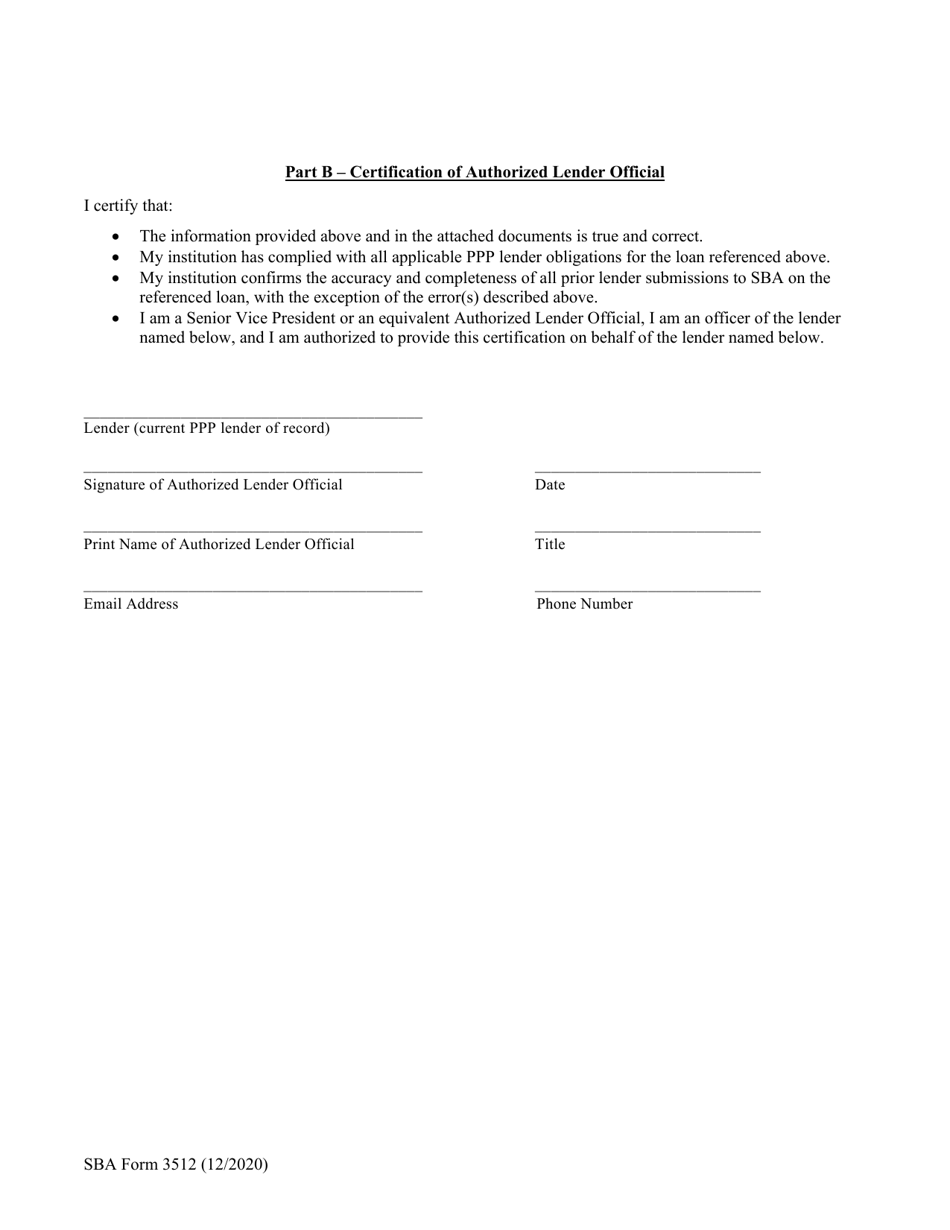

Q: What happens after submitting SBA Form 3512?

A: After submitting SBA Form 3512, the lender will review the request and take appropriate actions to reinstate or correct the PPP loan as necessary.

Q: Are there any fees associated with SBA Form 3512?

A: There are no fees associated with completing or submitting SBA Form 3512.

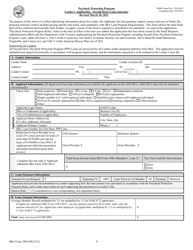

Q: Can I make changes to my PPP loan using SBA Form 3512?

A: Yes, you can request corrections or changes to your PPP loan using SBA Form 3512.

Q: Who should I contact if I have questions about SBA Form 3512?

A: If you have questions about SBA Form 3512, you should reach out to your lender or the U.S. Small Business Administration (SBA) for assistance.

Form Details:

- Released on June 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 3512 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.