This version of the form is not currently in use and is provided for reference only. Download this version of

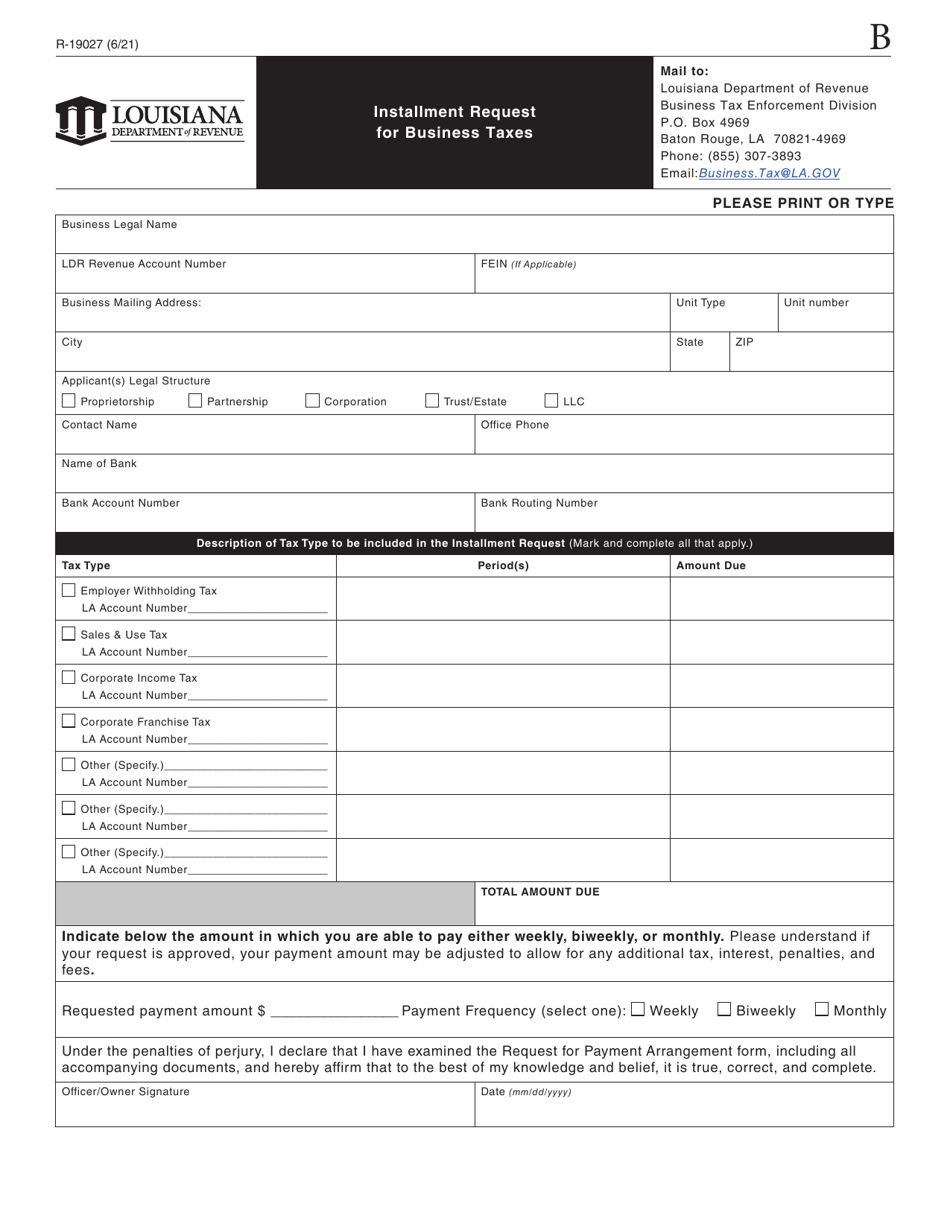

Form R-19027

for the current year.

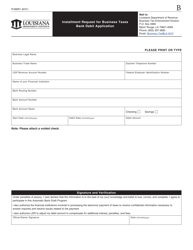

Form R-19027 Installment Request for Business Taxes - Louisiana

What Is Form R-19027?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-19027?

A: Form R-19027 is the Installment Request for Business Taxes in Louisiana.

Q: Who needs to use Form R-19027?

A: Businesses in Louisiana who are unable to pay their taxes in full by the due date can use Form R-19027 to request an installment payment plan.

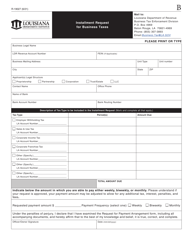

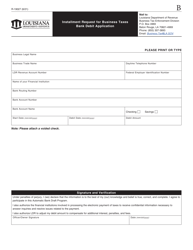

Q: What information do I need to provide on Form R-19027?

A: You will need to provide your business name, address, tax identification number, and the amount of tax owed.

Q: Is there a fee to use the installment payment plan?

A: Yes, there is a non-refundable $50 fee to apply for an installment payment plan.

Q: What is the deadline to submit Form R-19027?

A: Form R-19027 must be submitted by the due date of your tax return or within 90 days after you receive a bill from the Louisiana Department of Revenue.

Q: How long is the installment payment plan?

A: The length of the installment payment plan depends on the amount of tax owed. Contact the Louisiana Department of Revenue for more information.

Q: What happens if I miss a payment?

A: If you miss a payment, the Louisiana Department of Revenue may cancel your installment agreement and pursue collections action.

Q: Can I pay off my balance early?

A: Yes, you can pay off your balance early without any additional penalties or fees.

Q: What if I can't afford the monthly installment amount?

A: If you cannot afford the monthly installment amount, contact the Louisiana Department of Revenue to discuss other options.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-19027 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.