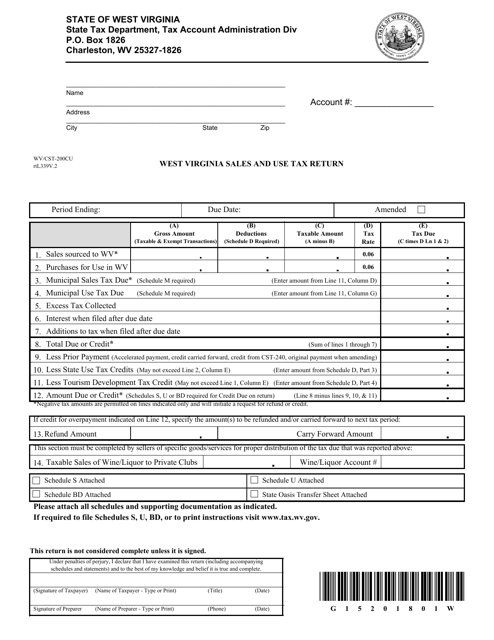

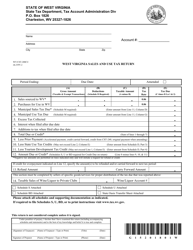

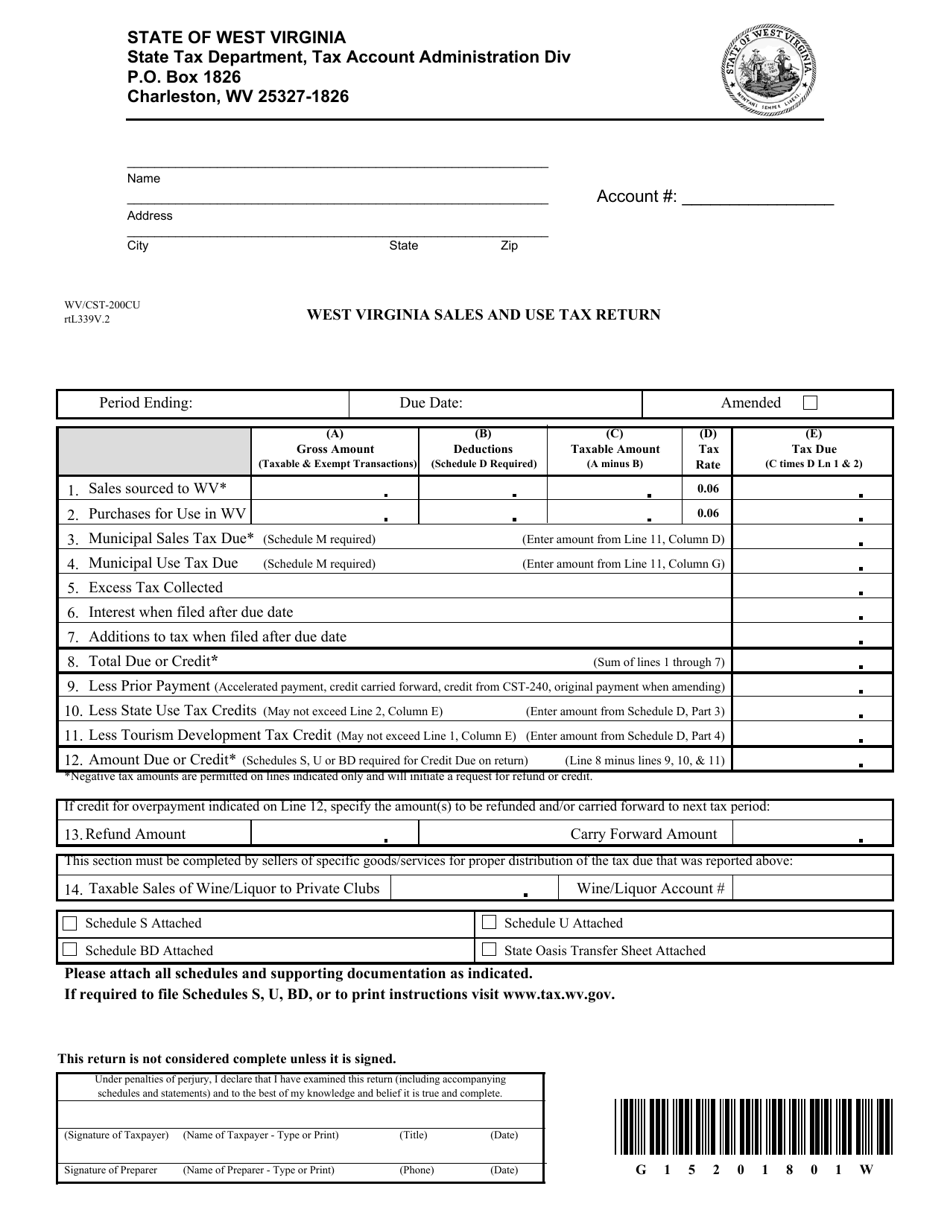

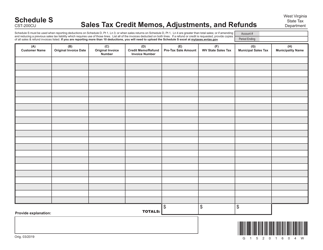

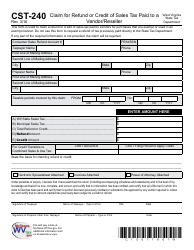

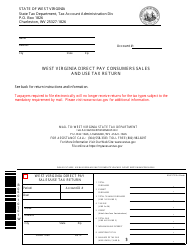

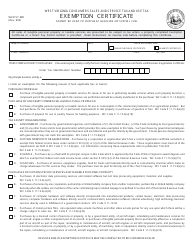

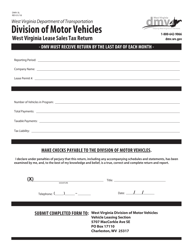

Form WV / CST-200CU West Virginia Sales and Use Tax Return - West Virginia

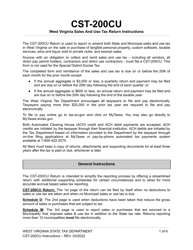

What Is Form WV/CST-200CU?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form WV/CST-200CU?

A: Form WV/CST-200CU is the West Virginia Sales and Use Tax Return.

Q: What is the purpose of Form WV/CST-200CU?

A: Form WV/CST-200CU is used to report and remit sales and use tax owed to the state of West Virginia.

Q: Who needs to file Form WV/CST-200CU?

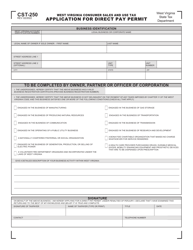

A: Any individual or business that has made retail sales in West Virginia or owes use tax on purchases made from out-of-state vendors must file Form WV/CST-200CU.

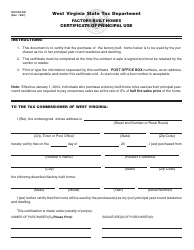

Q: What information is required to complete Form WV/CST-200CU?

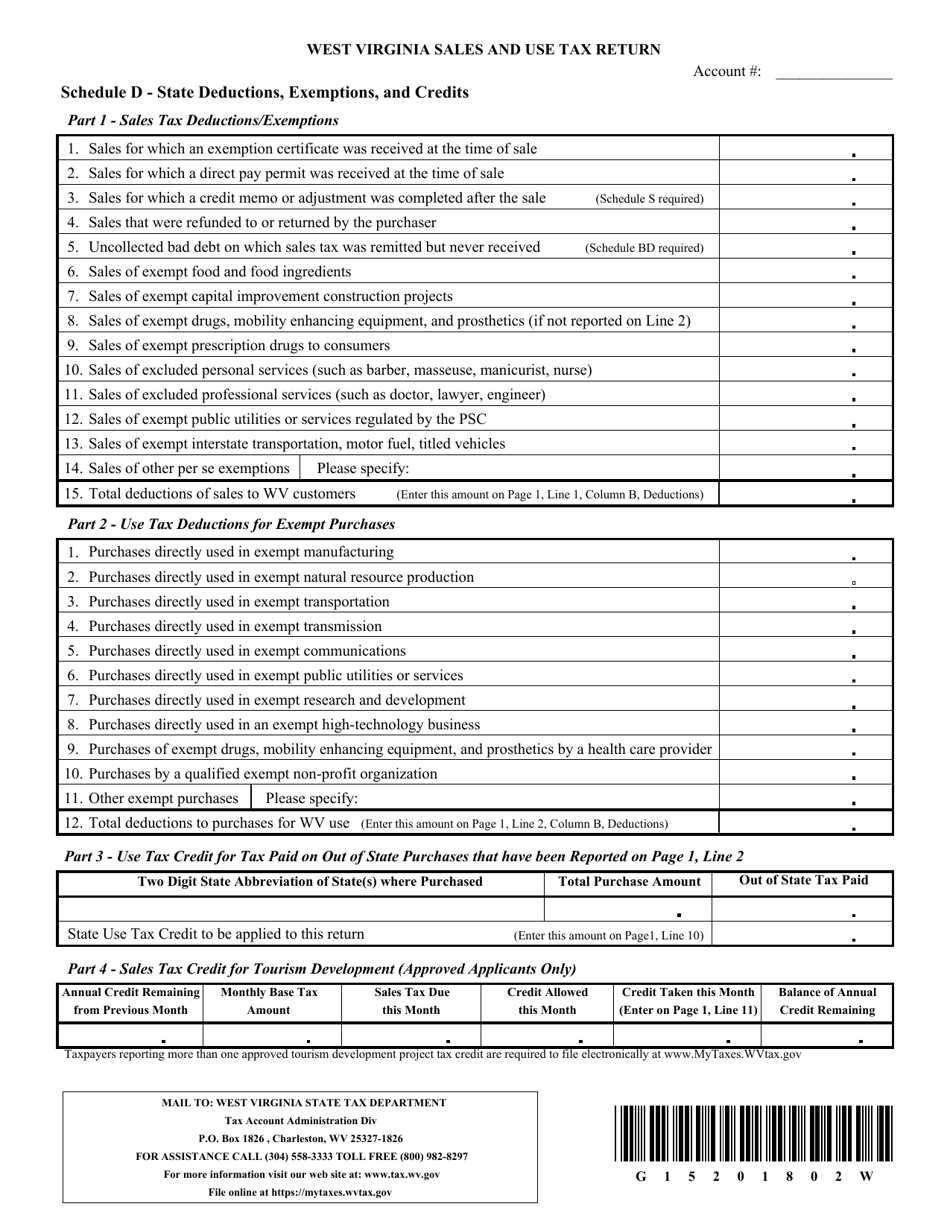

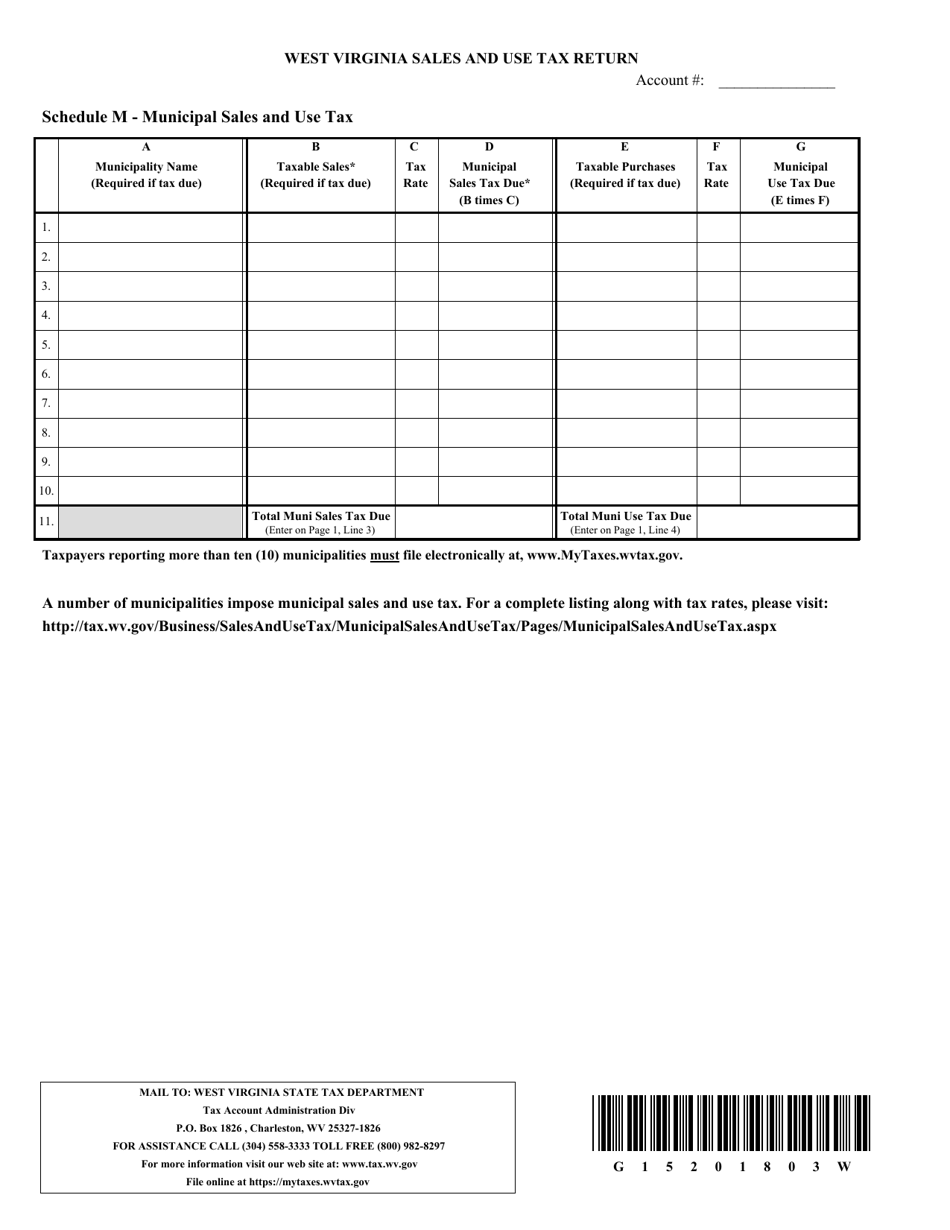

A: You will need to provide information about your sales and purchases, including the gross sales amounts, taxable sales amounts, and any exemptions or deductions.

Q: When is Form WV/CST-200CU due?

A: Form WV/CST-200CU is due by the 20th day of the month following the end of the reporting period.

Q: Is Form WV/CST-200CU subject to any penalties for late filing or payment?

A: Yes, failure to file or pay the tax owed on time may result in penalties and interest charges.

Q: Can Form WV/CST-200CU be filed electronically?

A: Yes, electronic filing is available for Form WV/CST-200CU.

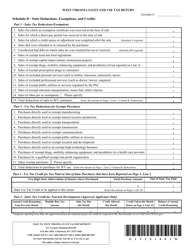

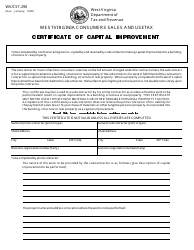

Q: Are there any exemptions or deductions available on Form WV/CST-200CU?

A: Yes, there are certain exemptions and deductions available on Form WV/CST-200CU. You should consult the instructions for the form or contact the West Virginia State Tax Department for more information.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CST-200CU by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.