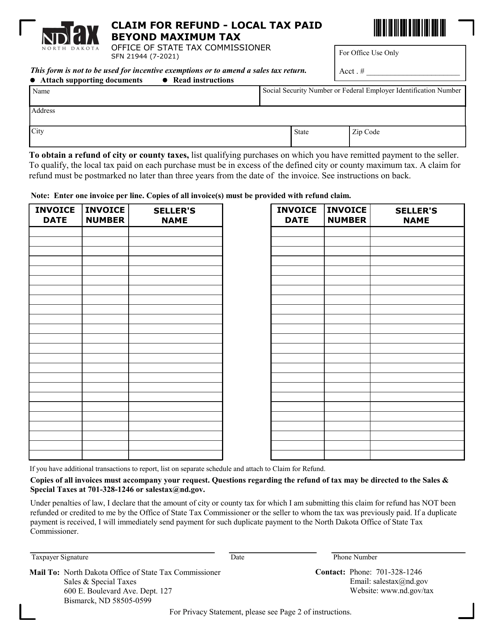

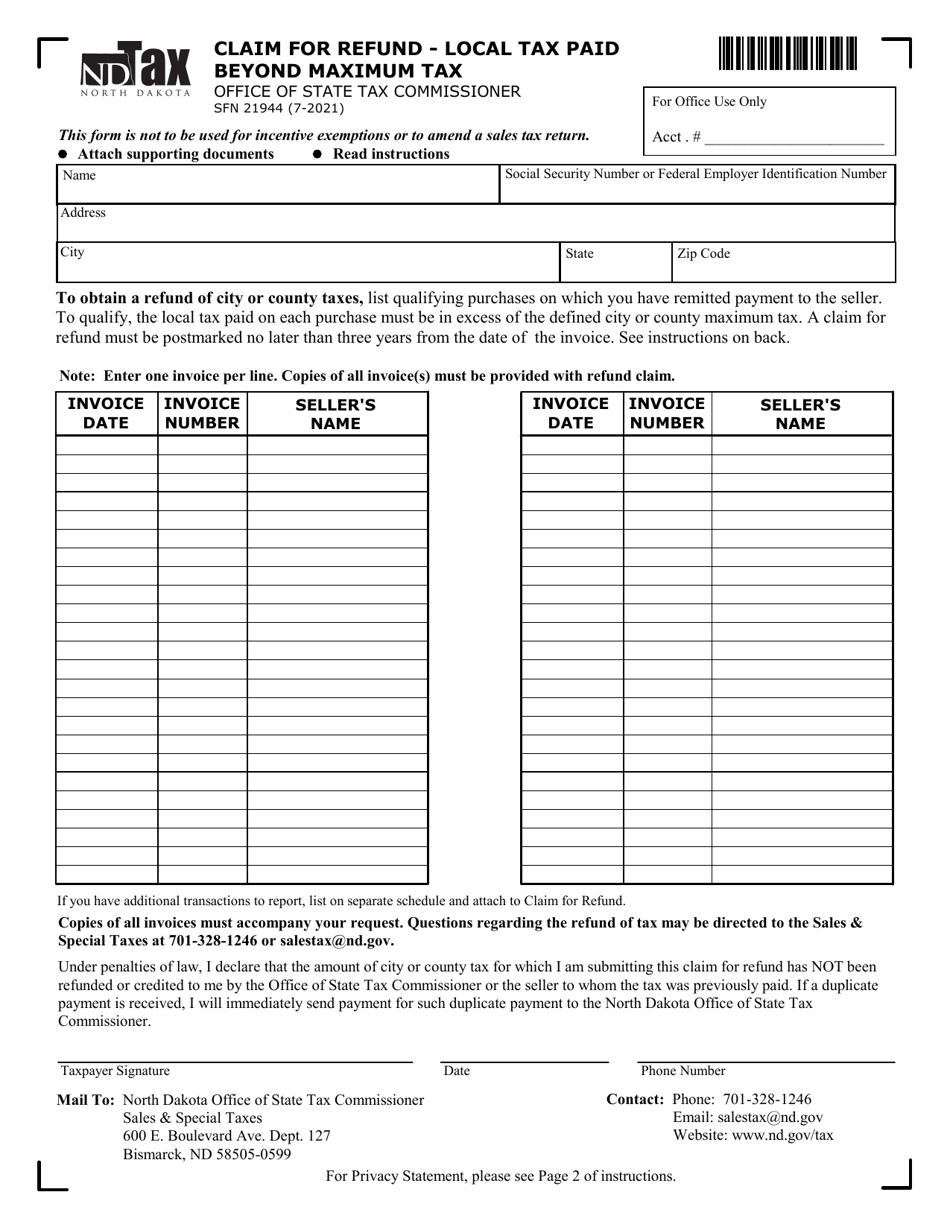

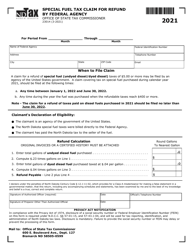

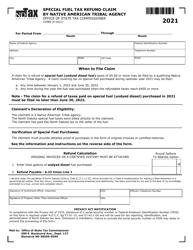

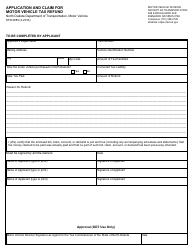

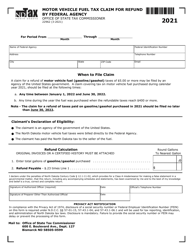

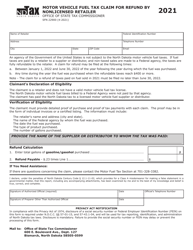

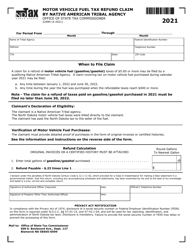

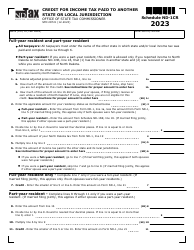

Form SFN21944 Claim for Refund - Local Tax Paid Beyond Maximum Tax - North Dakota

What Is Form SFN21944?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN21944?

A: Form SFN21944 is a Claim for Refund form.

Q: What is the purpose of Form SFN21944?

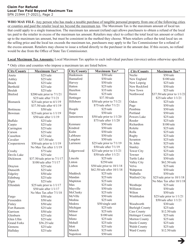

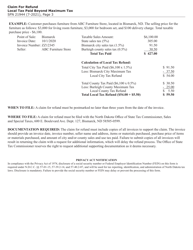

A: The purpose of Form SFN21944 is to claim a refund for local tax paid beyond the maximum tax in North Dakota.

Q: Who can use Form SFN21944?

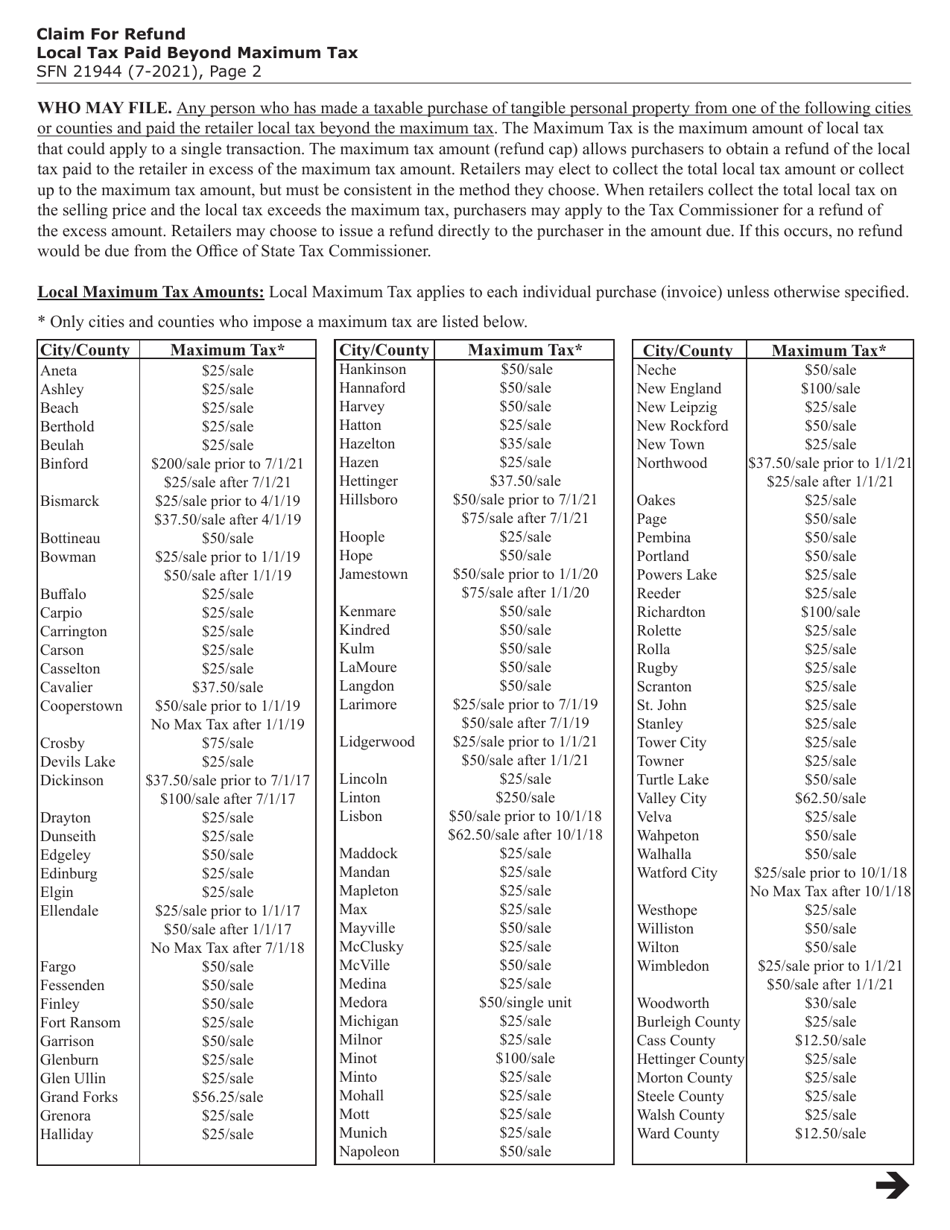

A: Any individual or business that has paid local tax beyond the maximum tax in North Dakota can use Form SFN21944.

Q: What information do I need to fill out Form SFN21944?

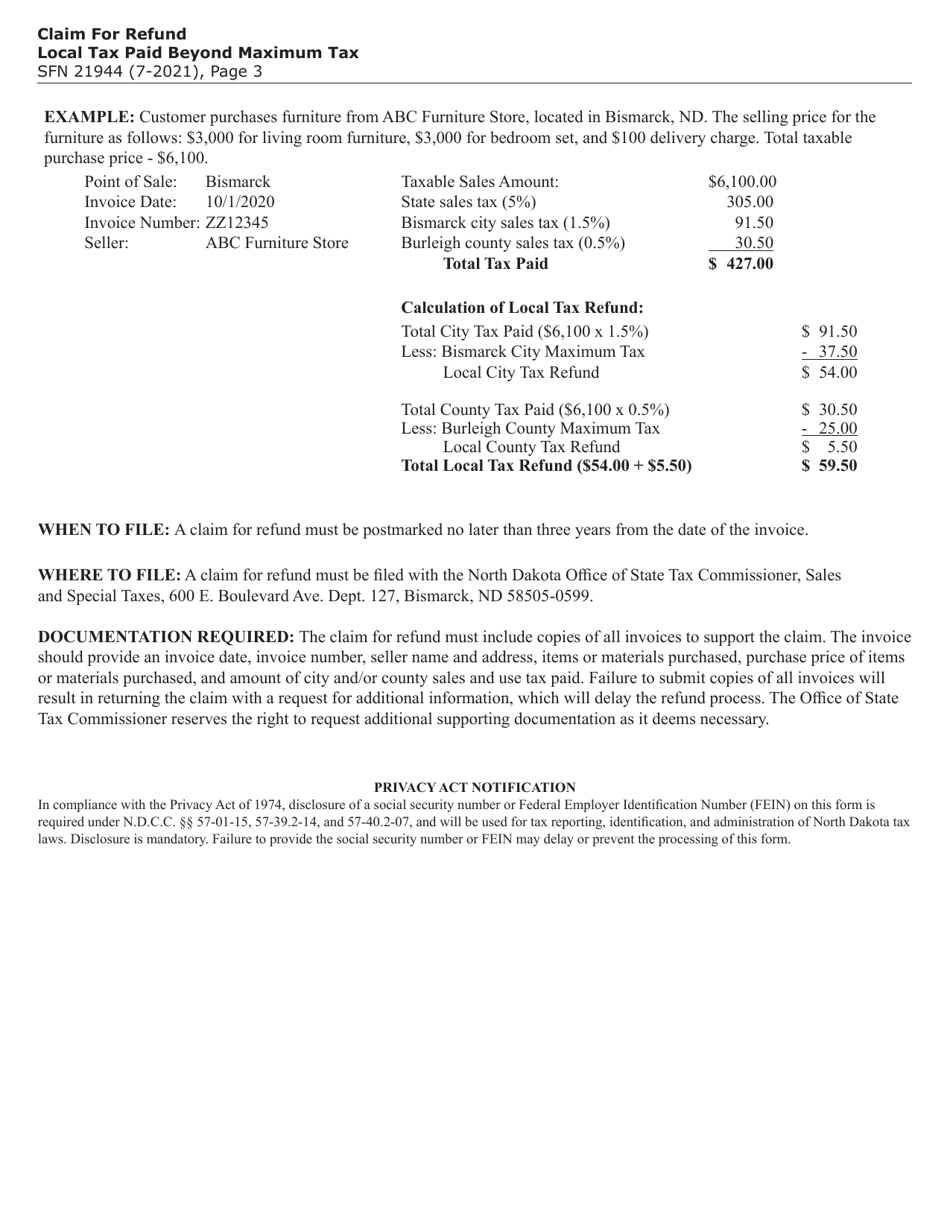

A: You will need to provide information about the local tax paid, the maximum tax allowed, and any supporting documentation.

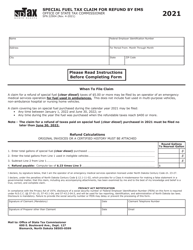

Q: Is there a deadline for filing Form SFN21944?

A: Yes, Form SFN21944 must be filed within three years from the due date of the tax return or within three years from the date the tax was paid, whichever is later.

Q: How long does it take to receive a refund after filing Form SFN21944?

A: The processing time for Form SFN21944 varies, but it typically takes around eight weeks to receive a refund.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SFN21944 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.