This version of the form is not currently in use and is provided for reference only. Download this version of

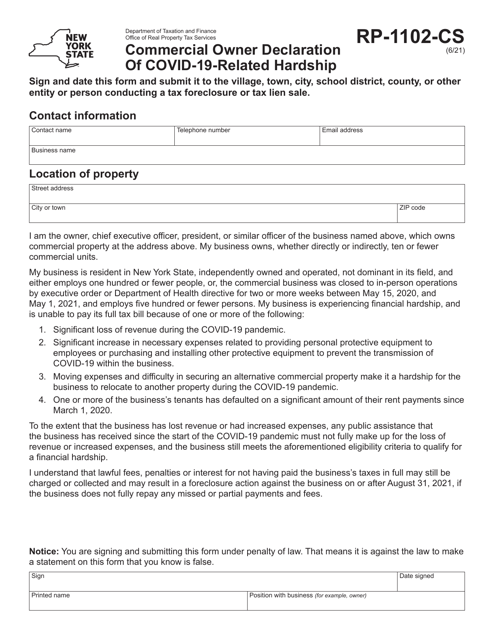

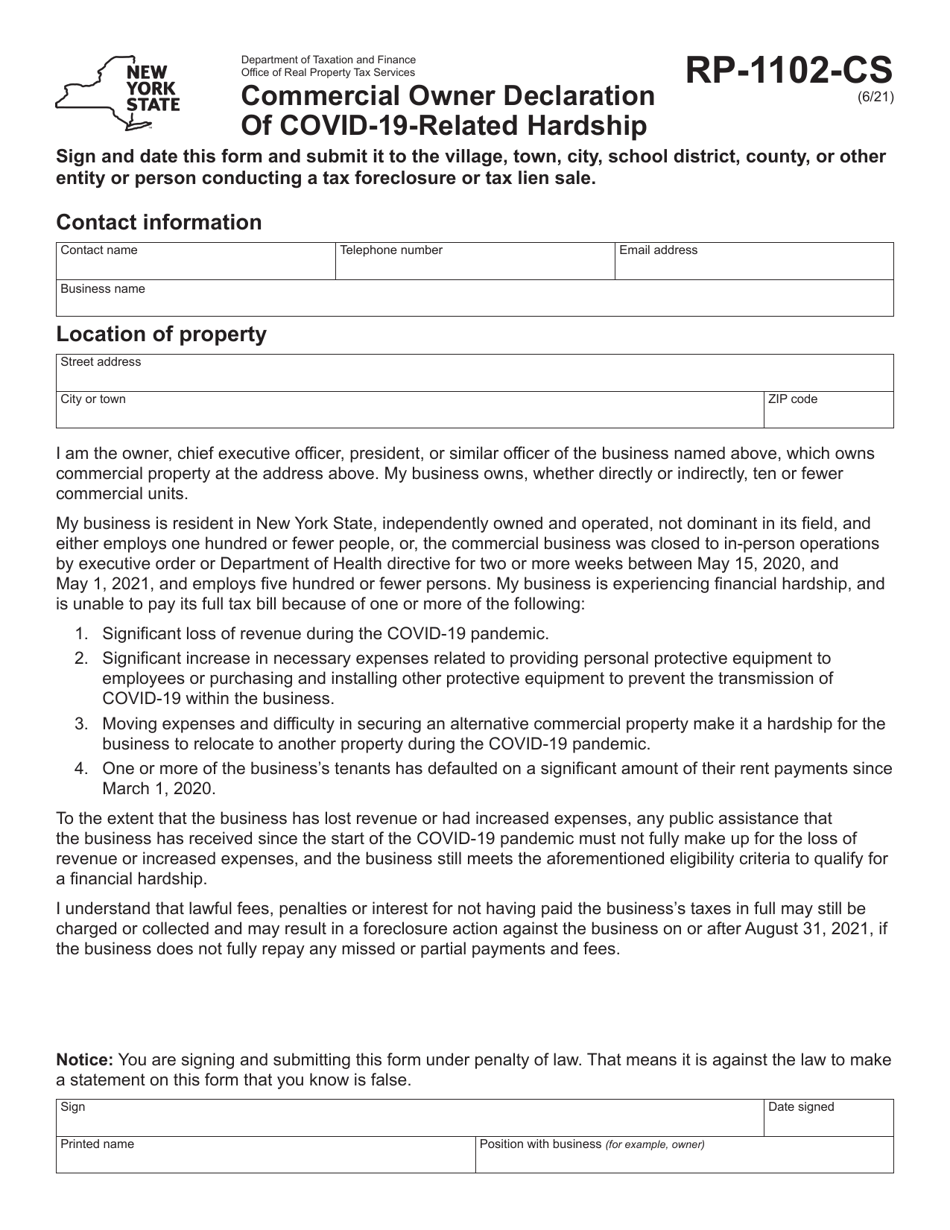

Form RP-1102-CS

for the current year.

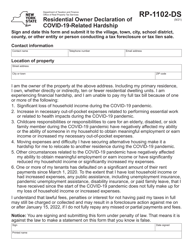

Form RP-1102-CS Commercial Owner Declaration of Covid-19-related Hardship - New York

What Is Form RP-1102-CS?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-1102-CS?

A: Form RP-1102-CS is the Commercial Owner Declaration of Covid-19-related Hardship form.

Q: Who needs to fill out Form RP-1102-CS?

A: Commercial property owners in New York who have experienced financial hardship due to Covid-19 need to fill out this form.

Q: What is the purpose of Form RP-1102-CS?

A: The purpose of Form RP-1102-CS is for commercial property owners to declare their Covid-19-related financial hardship and request relief.

Q: What information is required on Form RP-1102-CS?

A: Form RP-1102-CS requires the property owner's contact information, property details, Covid-19 impact details, and a statement of financial hardship.

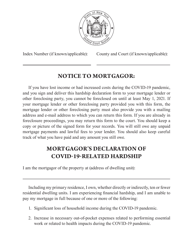

Q: Are there any deadlines for submitting Form RP-1102-CS?

A: The deadlines for submitting Form RP-1102-CS vary by locality. It is important to check with your local assessor's office for specific deadlines.

Q: What happens after submitting Form RP-1102-CS?

A: After submitting Form RP-1102-CS, the local assessor's office will review the application and determine if the property owner is eligible for relief.

Q: Is there any cost associated with submitting Form RP-1102-CS?

A: There is no cost associated with submitting Form RP-1102-CS.

Q: Can I submit Form RP-1102-CS electronically?

A: Yes, in most cases, Form RP-1102-CS can be submitted electronically. Check with your local assessor's office for specific submission instructions.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-1102-CS by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.