This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941-SS

for the current year.

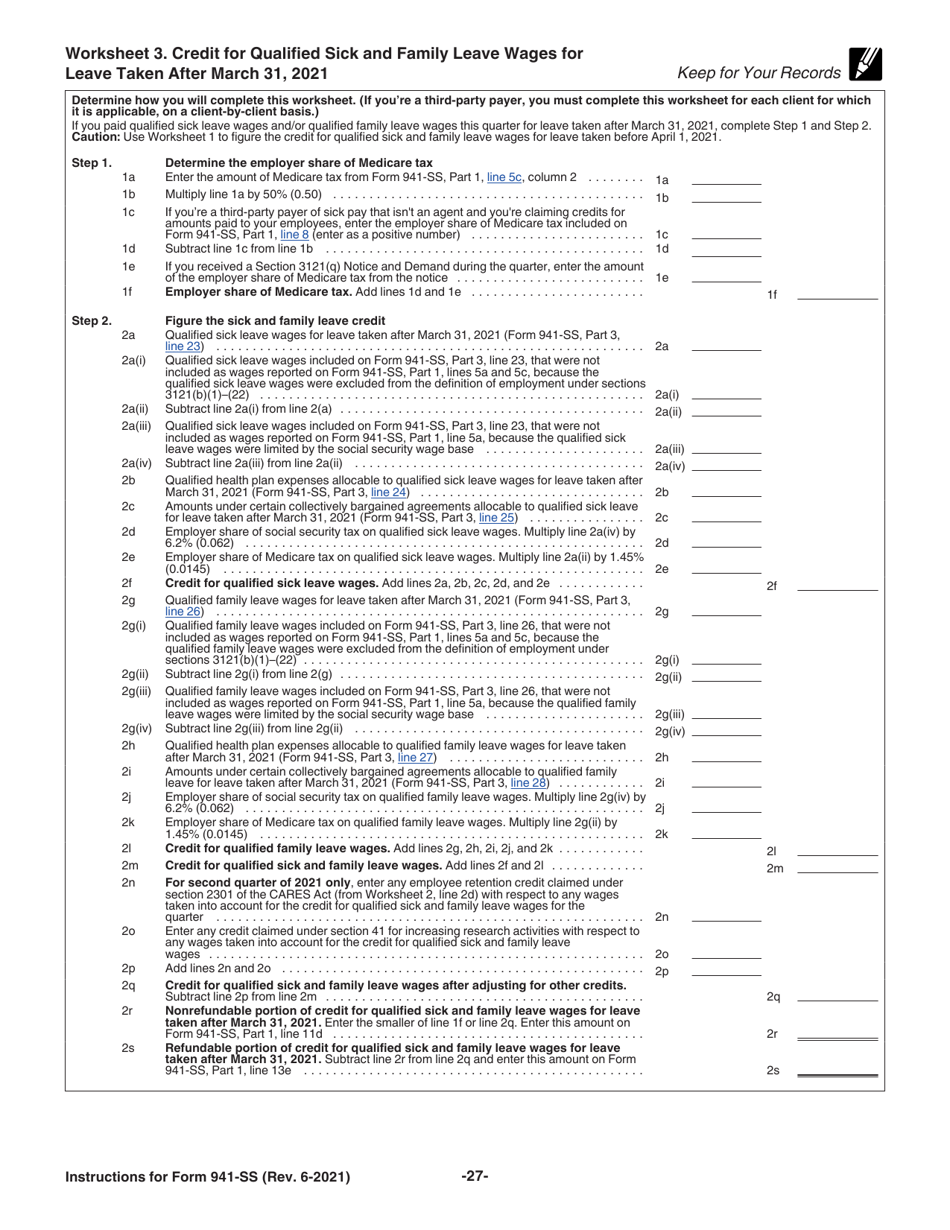

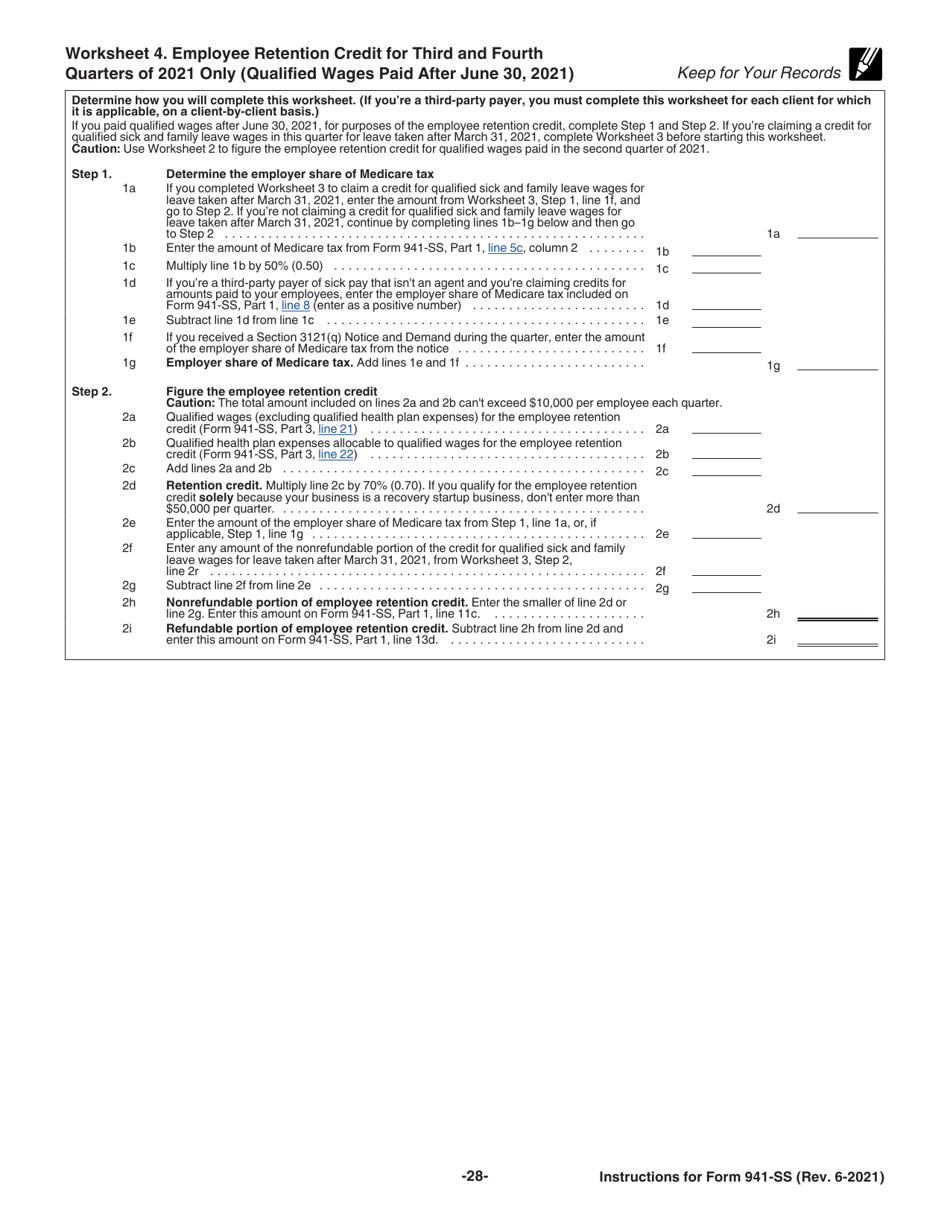

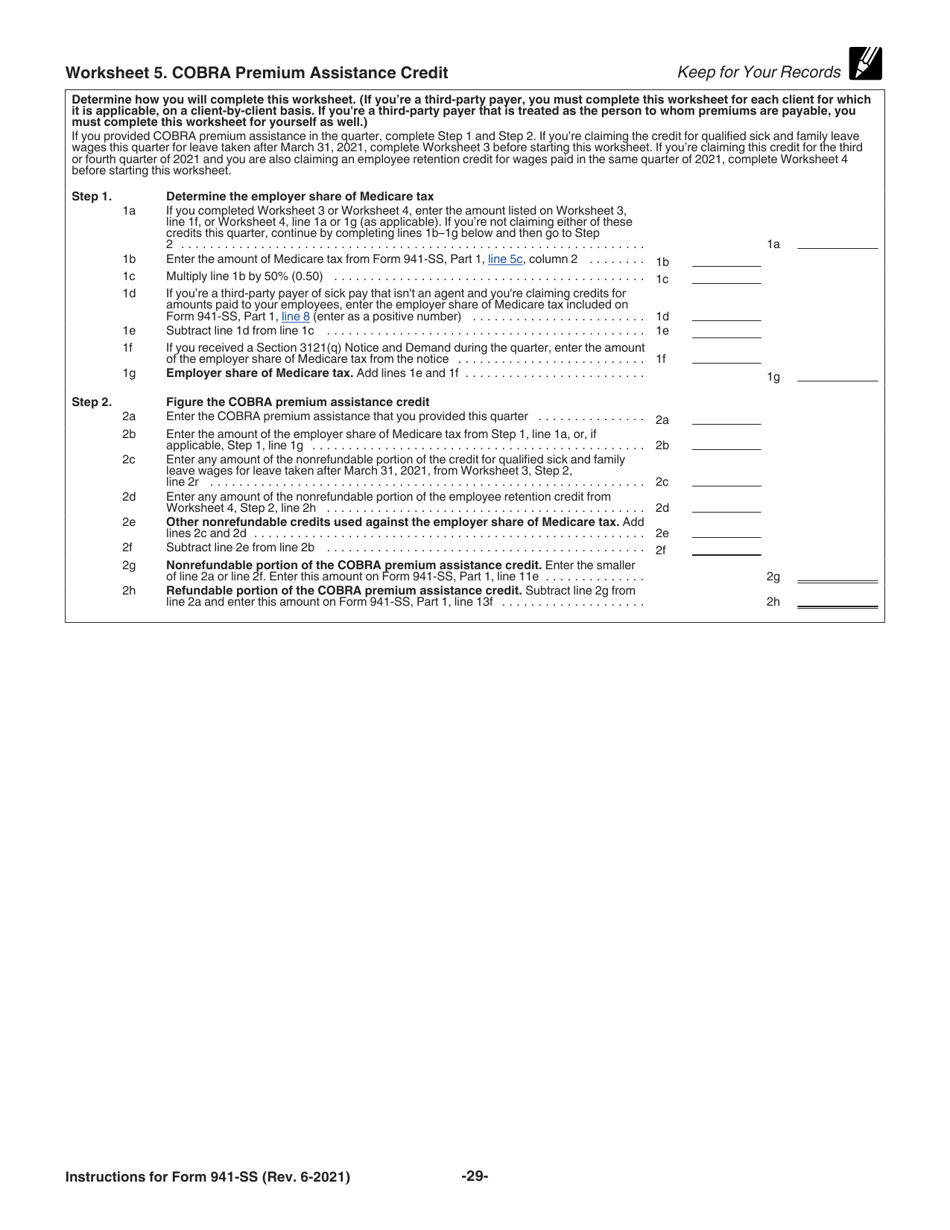

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who needs to file IRS Form 941-SS?

A: If you are an employer in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, or the U.S. Virgin Islands, you need to file IRS Form 941-SS.

Q: What information is required for IRS Form 941-SS?

A: IRS Form 941-SS requires information about wages paid to employees, withheld taxes, and any adjustments or credits.

Q: How often do I need to file IRS Form 941-SS?

A: IRS Form 941-SS is a quarterly return, so it needs to be filed four times a year by the end of each quarter.

Instruction Details:

- This 29-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.