This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941 Schedule B

for the current year.

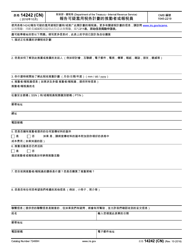

Instructions for IRS Form 941 Schedule B Report of Tax Liability for Semiweekly Schedule Depositors

This document contains official instructions for IRS Form 941 Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 941 Schedule B is available for download through this link.

FAQ

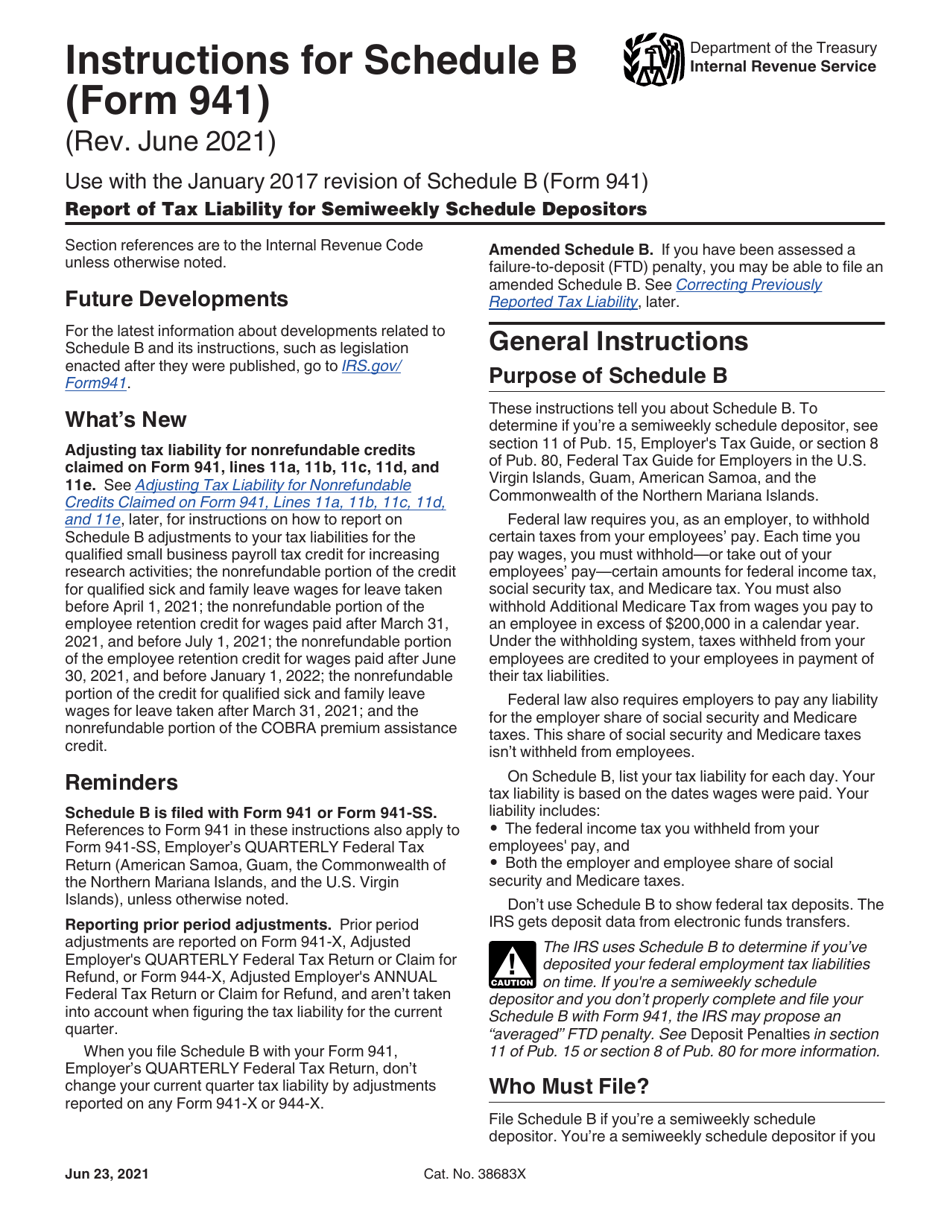

Q: What is IRS Form 941 Schedule B?

A: IRS Form 941 Schedule B is a report of tax liability for semiweekly schedule depositors.

Q: Who needs to file IRS Form 941 Schedule B?

A: Semiweekly schedule depositors who file Form 941 need to also file Schedule B.

Q: What is the purpose of IRS Form 941 Schedule B?

A: The purpose of Schedule B is to report the tax liability for each semiweekly deposit period.

Q: How often do semiweekly schedule depositors need to file Form 941 Schedule B?

A: Semiweekly schedule depositors need to file Schedule B with each Form 941 they submit.

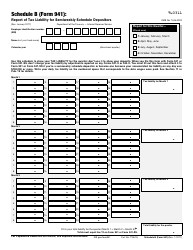

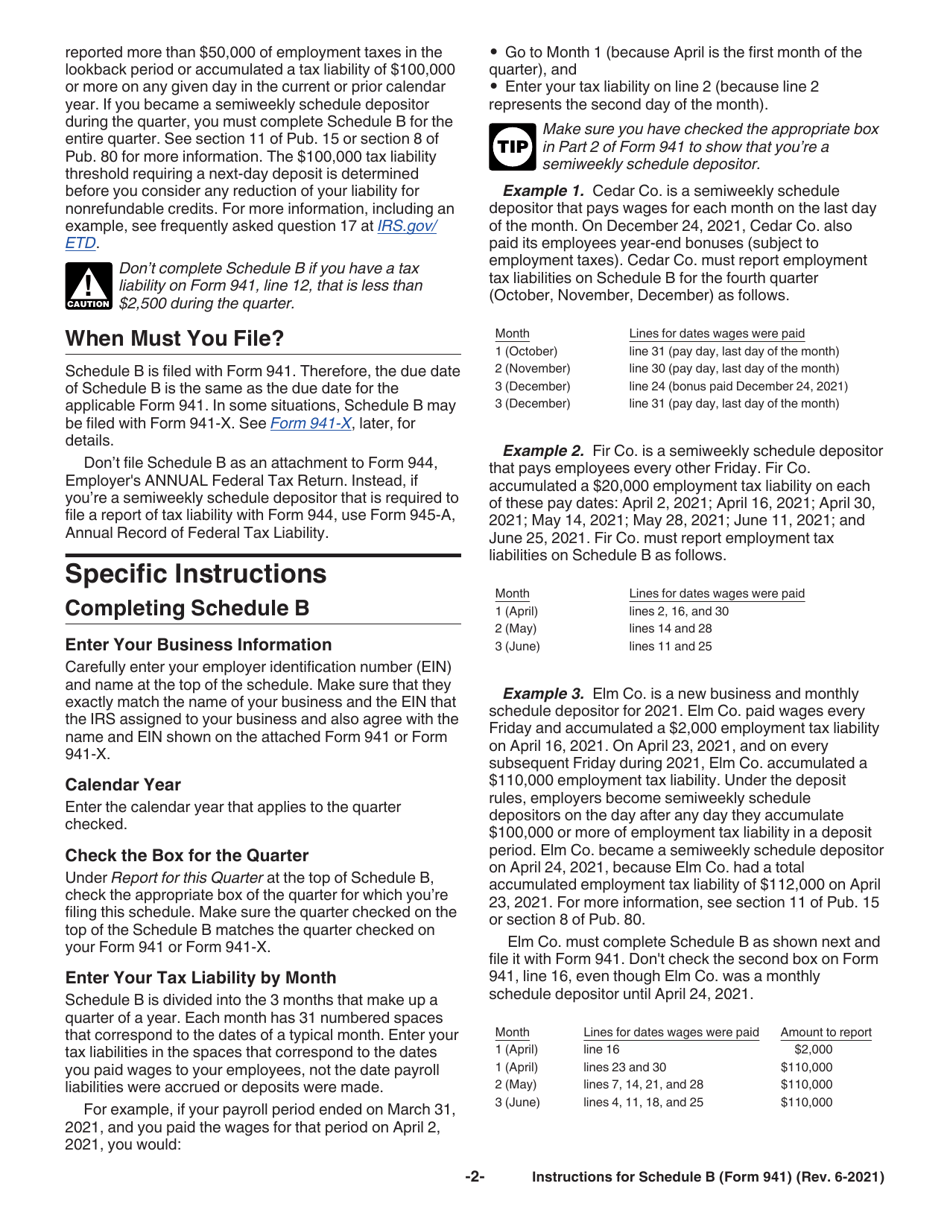

Q: What information is required on IRS Form 941 Schedule B?

A: Schedule B requires you to report the amounts of payroll tax liability for each semiweekly period.

Q: Are there any penalties for not filing IRS Form 941 Schedule B?

A: Yes, there may be penalties for not filing Schedule B or for filing it late.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.