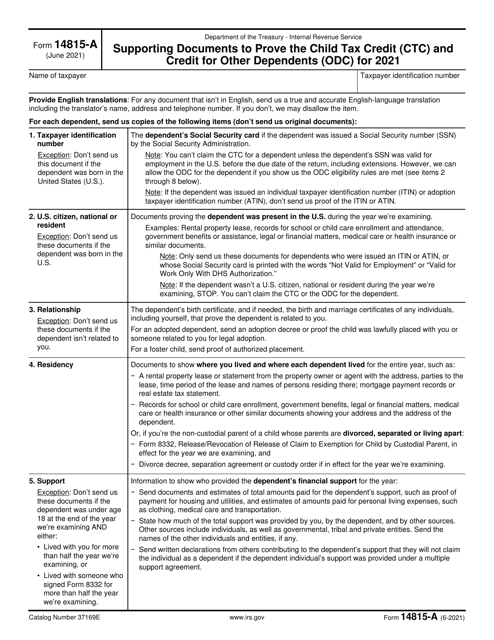

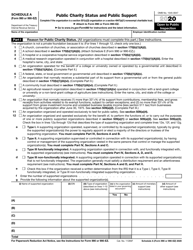

IRS Form 14815-A Supporting Documents to Prove the Child Tax Credit (Ctc) and Credit for Other Dependents (Odc)

What Is IRS Form 14815-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14815-A?

A: IRS Form 14815-A is a form used to provide supporting documents to prove the Child Tax Credit (CTC) and Credit for Other Dependents (ODC).

Q: What is the Child Tax Credit (CTC)?

A: The Child Tax Credit (CTC) is a tax credit that provides financial support to taxpayers who have dependent children under the age of 17.

Q: What is the Credit for Other Dependents (ODC)?

A: The Credit for Other Dependents (ODC) is a tax credit that provides financial support to taxpayers who have dependents other than qualifying children, such as elderly parents or disabled relatives.

Q: When do I need to submit IRS Form 14815-A?

A: You need to submit IRS Form 14815-A when requested by the IRS to provide supporting documents for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC).

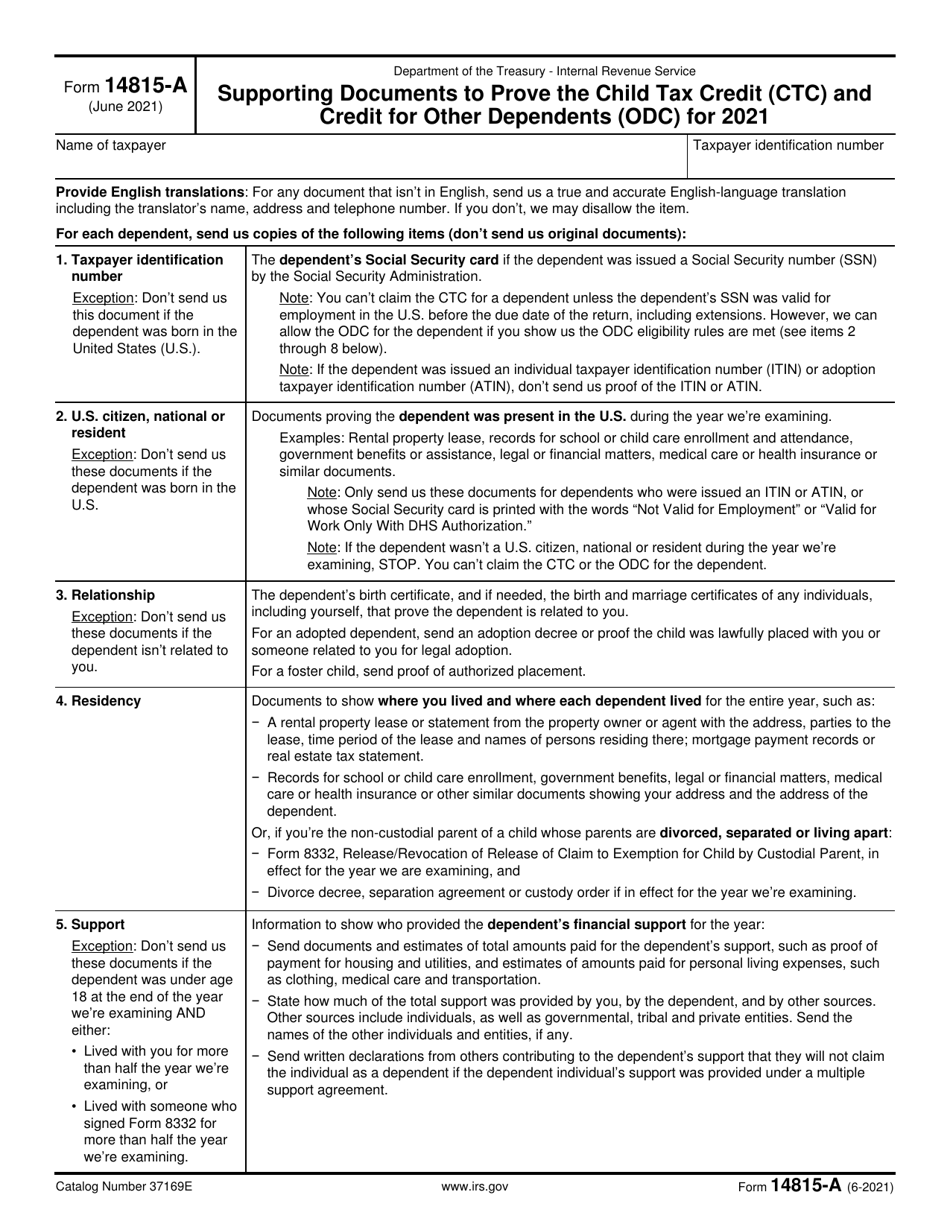

Q: What kind of supporting documents do I need to provide with IRS Form 14815-A?

A: You need to provide documents such as birth certificates, social security cards, and other proof of dependency for the qualifying child or other dependent.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14815-A through the link below or browse more documents in our library of IRS Forms.