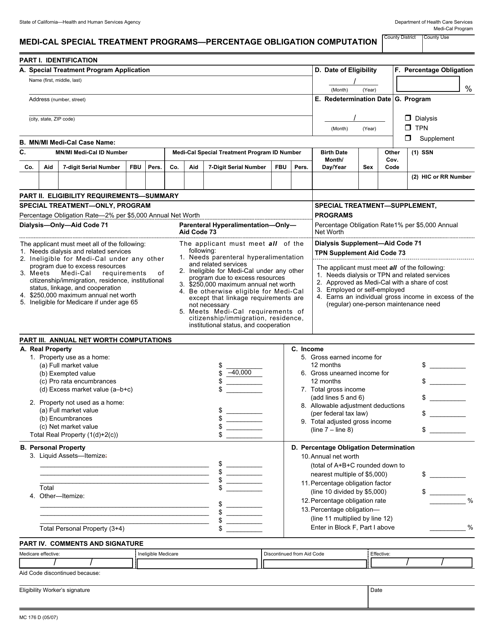

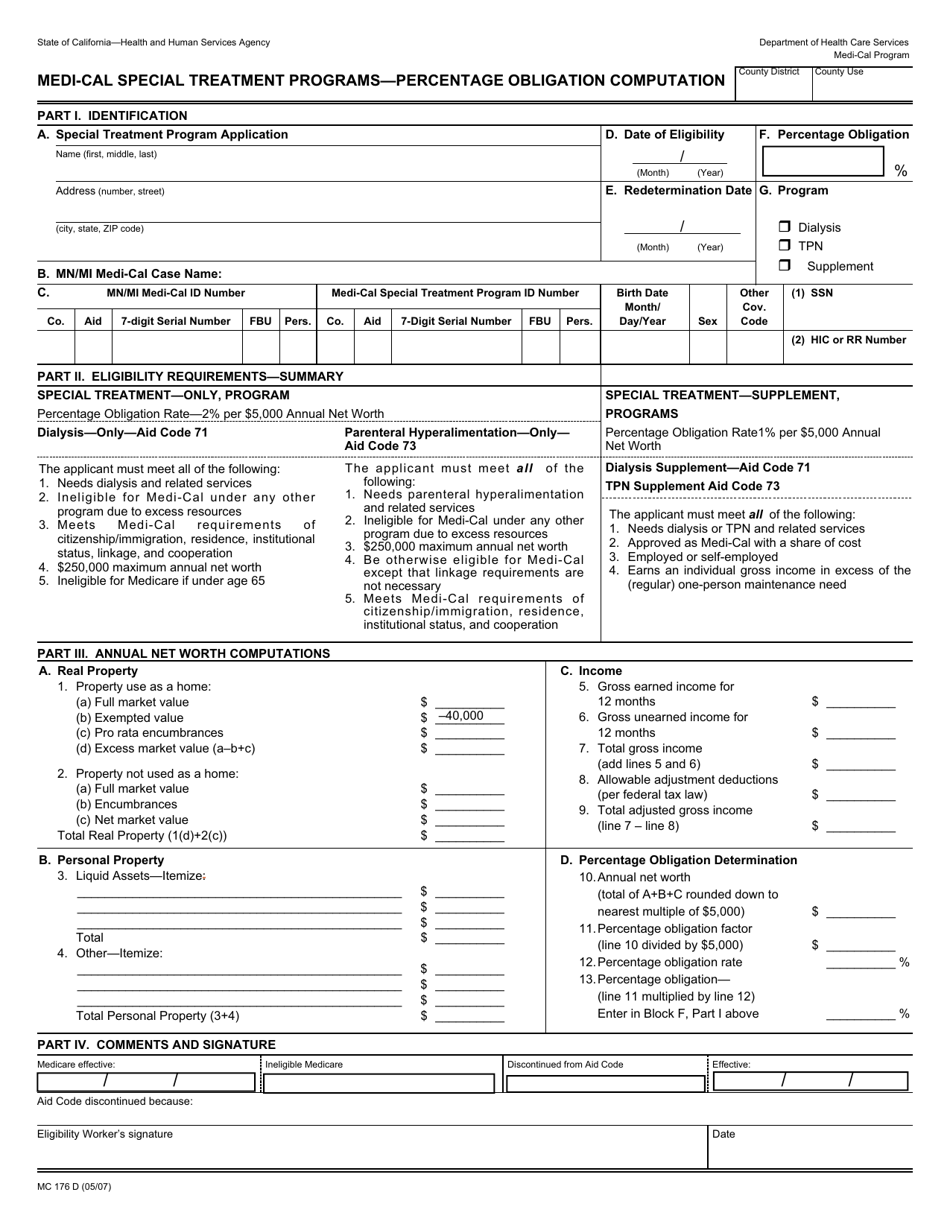

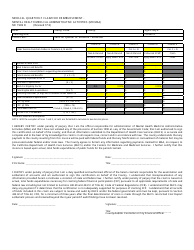

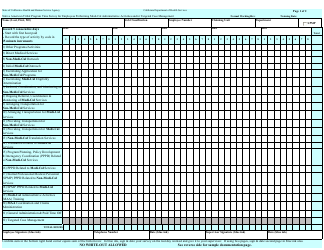

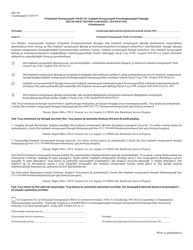

Form MC176 D Medi-Cal Special Treatment Programs - Percentage Obligation Computation - California

What Is Form MC176 D?

This is a legal form that was released by the California Department of Health Care Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MC176 D?

A: Form MC176 D is a document used in California for computing the percentage obligation for Medi-Cal Special Treatment Programs.

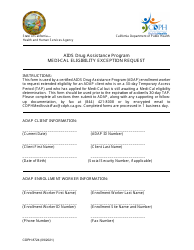

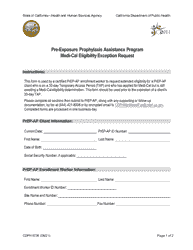

Q: What is Medi-Cal?

A: Medi-Cal is California's Medicaid program, which provides healthcare coverage to low-income individuals and families.

Q: What are Special Treatment Programs?

A: Special Treatment Programs refer to specific healthcare services and programs available to Medi-Cal beneficiaries.

Q: What is the Percentage Obligation Computation?

A: Percentage Obligation Computation is a calculation used to determine the cost share or percentage of healthcare expenses that a Medi-Cal beneficiary is responsible for.

Q: Who uses Form MC176 D?

A: Form MC176 D is used by individuals and families applying for or enrolled in Medi-Cal Special Treatment Programs.

Q: What information is required on Form MC176 D?

A: Form MC176 D requires information such as personal details, income, assets, and expenses to determine the percentage obligation.

Q: Is completing Form MC176 D mandatory for Medi-Cal beneficiaries?

A: Yes, completing Form MC176 D is mandatory for Medi-Cal beneficiaries applying for or enrolled in Special Treatment Programs.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the California Department of Health Care Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC176 D by clicking the link below or browse more documents and templates provided by the California Department of Health Care Services.