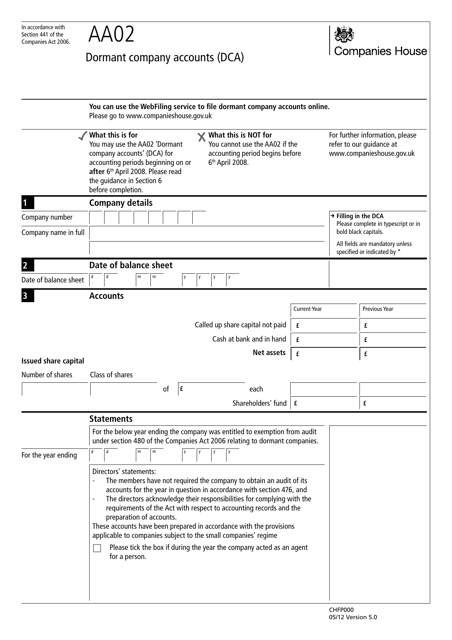

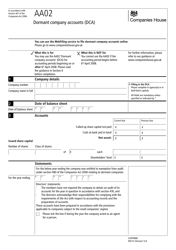

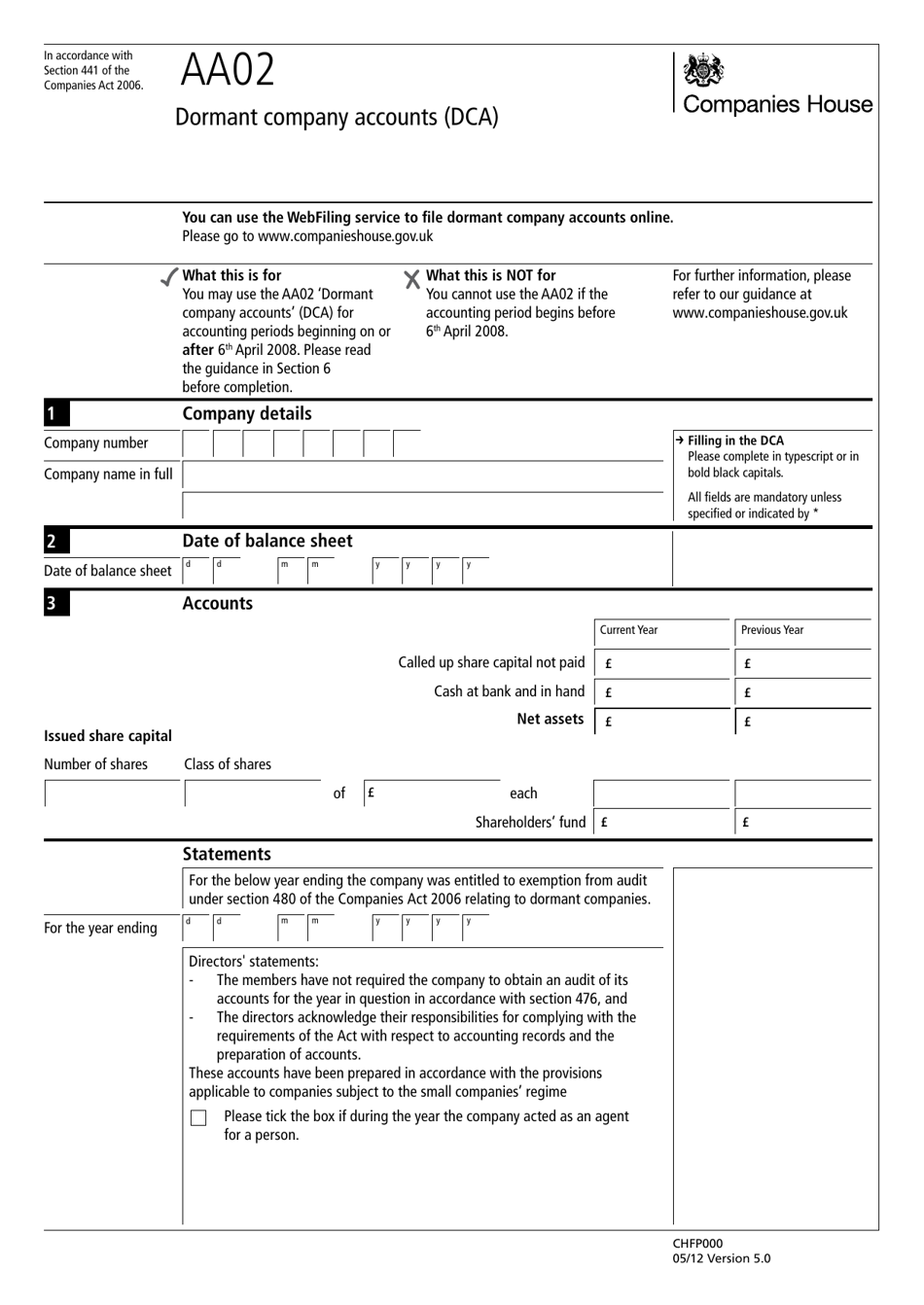

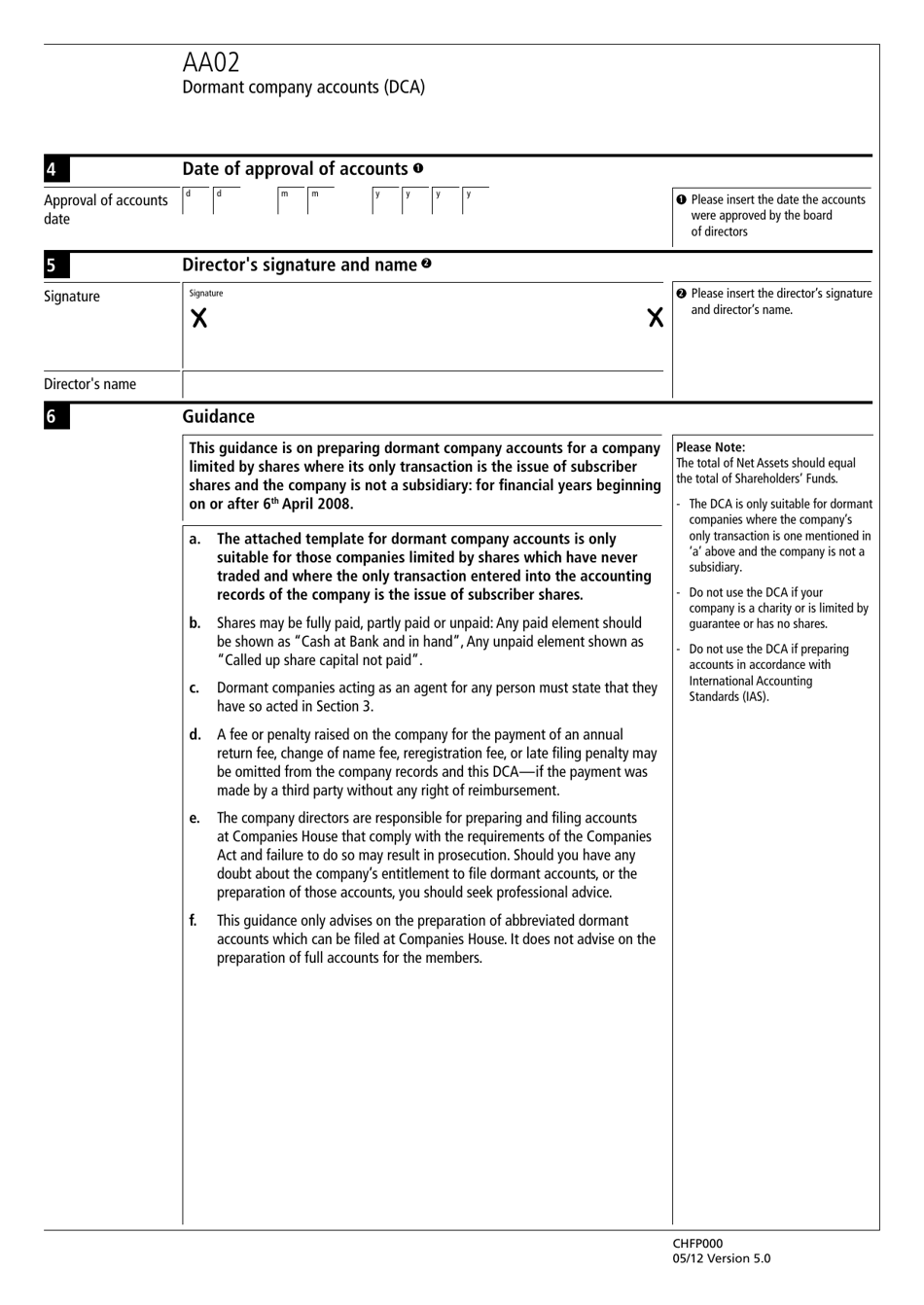

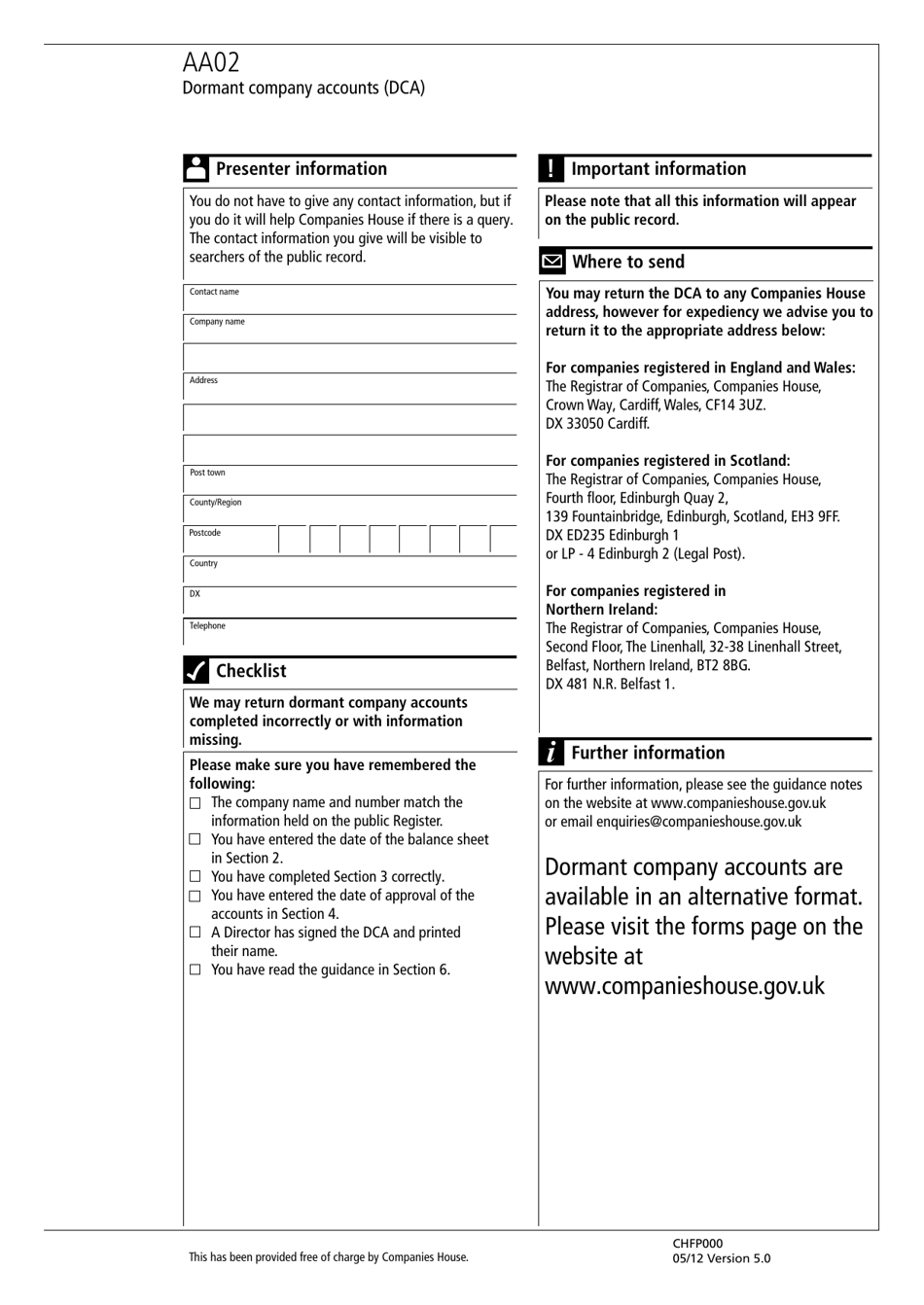

Form AA02 Dormant Company Accounts (Dca) - United Kingdom

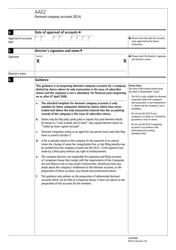

Form AA02 Dormant Company Accounts (Dca) in the United Kingdom is used for filing the dormant company accounts for companies that are not actively trading or generating any significant financial activity.

The form AA02 Dormant Company Accounts (Dca) in the United Kingdom is filed by companies that have not been active during a specified period.

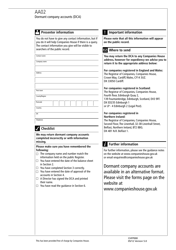

FAQ

Q: What is Form AA02?

A: Form AA02 is a form for filing dormant company accounts in the United Kingdom.

Q: What are dormant company accounts?

A: Dormant company accounts are financial statements filed by a company that has had no significant accounting transactions during a specific period.

Q: Who needs to file Form AA02?

A: Any company in the United Kingdom that is classified as dormant and wants to file its dormant company accounts must complete and file Form AA02.

Q: When should Form AA02 be filed?

A: Form AA02 must be filed within certain time limits, usually within 9 months of the end of the company's financial year.

Q: What information is required in Form AA02?

A: Form AA02 requires information such as the company's registered name, registration number, financial year-end date, details of the director(s), and a statement of assurance.

Q: What happens if Form AA02 is filed late?

A: If Form AA02 is filed late, the company could face financial penalties, and the directors may be held personally liable.

Q: Are there any exemptions from filing Form AA02?

A: Yes, certain small companies, charitable companies, and subsidiary companies can be exempt from filing dormant company accounts using Form AA02. However, they may still need to file alternative forms or declarations.